American Salars Site Visit for Environmental Assessment at Pocitos Lithium Brine Project in Argentina

|

|||||||||

|

|

|

|

|

|||||

Vancouver, BC – November 29th, 2024 – TheNewswire – American Salars Lithium Inc. (“American Salars” or the “Company”) (CSE:USLI) (OTC:USLIF) (FRANKFURT:Z3P) announces that company technical team members will be on site conducting an environmental monitoring assessment as part of the ongoing environmental study. The ongoing study is a key component in preparation for follow on production well drilling and moving towards feasibility studies, pilot production and follow-on commercial production at the Pocitos 1 Lithium Brine Project (“Pocitos 1”) in Salta, Argentina.

Figure 1. Previous Drilling at Pocitos 1

It was previously announced on May 28th, 2024 that the vendor had completed its environmental baseline assessment report that will be used for a production EIA. The report is titled “Environmental and Social Baseline report for the Pocitos 1 and 2 concession on the Pocitos Salt Flats.” The report was the culmination of four months work by E & C Asociados, a specialist environmental consulting group. The company further announces it has made the Cannon payments required by the Argentinian mining authorities.

The project has a December 2023 prepared NI 43-101 Mineral Resource Estimate (“MRE”) consisting of an inferred 760,000 tonne lithium carbonate equivalent (“LCE”). The Mineral resource is contained on the Pocitos 1 block (800 Ha) in combination with the neighbouring Pocitos 2 (532 Ha) block. American Salars does not own the neighboring Pocitos 2 ground which comprises 40% of the gross land package that makes up the resource however it is notable that all drilling to date has been completed on American Salars’ Pocitos 1 block. The Mineral Resource Estimate was prepared by WSP Australia Pty Ltd (“WSP”). WSP has relevant lithium resource expertise and experience working on many of the major lithium resources around the Globe. The resource model will have to be updated to reflect the proportional number of resources on Pocitos 1 concession as the aforementioned resource was shared with Pocitos 2. Additional work on porosity and permeability will also enhance the MRE estimate.

R. Nick Horsley, CEO & Director states, “In the past 120 days we have seen close to $9.0 Billion announced lithium industry M&A and Strategic Funding with the majority focused on Argentina and the Lithium Triangle. We are excited to be moving the Pocitos 1 Project forward with the ongoing environmental assessments required by Argentina’s mining authority in preparation for production well drilling, feasibility studies with the company’s ultimate goal of moving the Pocitos project towards a pilot plant and commercial production.”

About the Pocitos Lithium Brine Project

The Pocitos 1 Project is located approximately 10km from the township of Pocitos where there is gas, electricity, and accommodation. Pocitos 1 is approximately 800 hectares (1,977 acres) and is accessible by road. Collective exploration since 2017 totals over US$2.0 million developing the project, including surface sampling, trenching, TEM and MT geophysics and drilling three wells that had outstanding brine flow results. Locations for immediate follow up drilling have already been designed and identified for upcoming exploration.

Lithium values of 169 ppm from drill hole PCT22-03 packer test assayed from laboratory analysis conducted by Alex Stewart were recorded during the project’s December 2022 drill campaigns. A double packer sampling system in HQ Diamond drill holes were drilled to a depth of up to 409 metres. The flow of brine was observed to continue for more than five hours. All holes had exceptional brine flow rates. A NI 43-101 report has been released on the Pocitos 1 project.

Ekosolve Ltd a DLE technology company was able to produce 99.8% purity lithium carbonate, where extraction was above 94% of the contained lithium in the brine i.e. 158.86ppm of lithium would have been recovered from 169ppm.

WSP Australia completed an update of the NI 43-101 report initially written by Phillip Thomas QP in June 2023 and estimated on an inferred basis using a block model with 6% and 14% porosity for the clay and sand lithologies respectively and a MRE of 760,000 tonnes of LCE on the combined Pocitos 1 (800 Ha) and neighbouring Pocitos 2 block (532 Ha).

Click Image To View Full Size

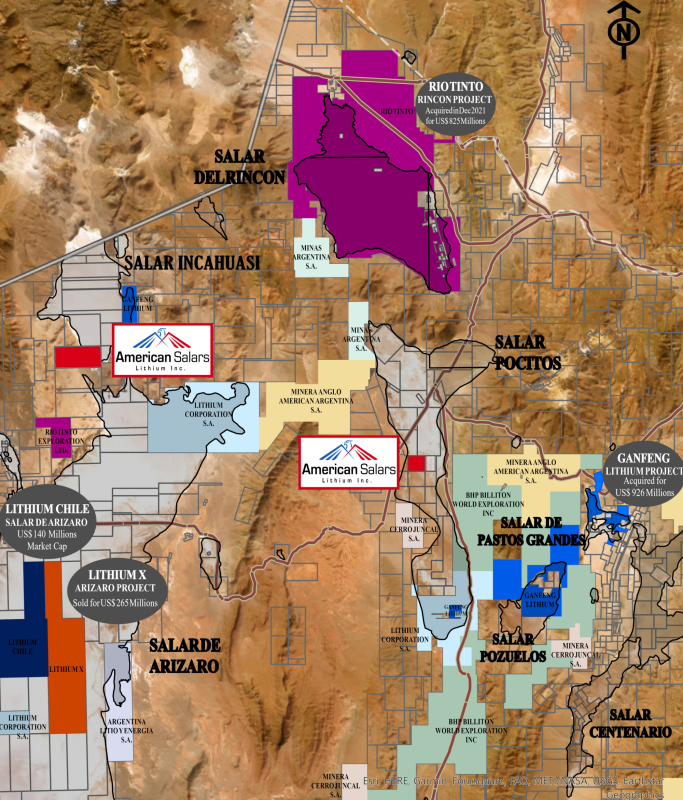

Figure 2. American Salars Project Map – Pocitos 1 & Candela 2

The highlights of the NI 43-101 were as follows:

-

Highest Lithium value tested using packer sampling system was 169ppm Lithium at a depth 363m.

-

The MT geophysics survey has discovered a large area to the west with a resistivity of 0.4Ω.m and a depth of more than 1km.

-

Ekosolve

DLE technology pilot plant test work at University of Melbourne achieved 94.9% extraction efficiency with brines at an average lithium concentration of 86 ppm lithium of which 80.76 ppm was recovered.

DLE technology pilot plant test work at University of Melbourne achieved 94.9% extraction efficiency with brines at an average lithium concentration of 86 ppm lithium of which 80.76 ppm was recovered.

-

Significant brine flow was recorded in 2018 wells PO1 and PO2 and brine and gas in PO3 drilled in November 2022.

-

The company will start a new drill/production well program when the permits are issued by the Salta Mines Department.

Qualified Person

Phillip Thomas, BSc Geol, MBusM, FAusIMM, MAIG, MAIMVA, (CMV), a Qualified Person as defined under NI 43-101 regulations, has reviewed the technical information that forms the basis for portions of this news release, and has approved the disclosure herein.

Stock Options

The Company announces that it has granted a total of 1,925,000 stock options (“Options”) to purchase common shares of the Company to certain officers, employees and consultants pursuant to the Company’s Stock Option Plan. Such Options are exercisable into common shares of the Company at an exercise price of $0.12 per common share for a period of twelve months from the date of grant.

Pocitos 1 Closing

As previously announced American Salars entered into an agreement with Recharge Resources (the “Vendor”) whereby American Salars is acquiring a 100% interest in the Pocitos 1 Lithium Brine Project by issuing to the Vendor 5,000,000 common shares subject to a 24-month escrow and assuming an outstanding tax liability of the original seller (the “Seller”) estimated to be no more than USD $250,000. The company has been updated that the Seller has placed a lien on the project. Additionally, the Vendor notified the Company that the Vendor has yet to receive substantial evidence to suggest that the USD $250,0000 in taxes was in fact paid by the Seller. The Company does not expect that this will impact closing and moving the project forward. It should be noted that The Company is in contact the Seller and will look to negotiate a fair settlement and will defend its position if necessary.

About American Salars Lithium Inc.

American Salars Lithium is an exploration company focused on exploring and developing high-value battery metals projects to meet the demands of the advancing electric vehicle market. The company’s Pocitos 1 and the Candela II lithium salar projects in Argentina both feature a NI 43-101 inferred resource.

All Stakeholders are encouraged to follow the Company on its social media profiles on LinkedIn, Twitter, TikTok, Facebook and Instagram.

On Behalf of the Board of Directors,

“R. Nick Horsley”

R. Nick Horsley, CEO

For further information, please contact:

American Salars Lithium Inc.

Phone: 604.740.7492

E-Mail: [email protected]

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

Certain statements in this release are forward-looking statements, which reflect the expectations of management regarding American Salar’s intention to continue to identify potential transactions and make certain corporate changes and applications. Forward looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance, or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits American Salars will obtain from them. These forward-looking statements reflect managements’ current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect. A number of risks and uncertainties could cause actual results to differ materially from those expressed or implied by the forward-looking statements, including American Salars results of exploration or review of properties that American Salars does acquire. These forward-looking statements are made as of the date of this news release and American Salars assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements, except in accordance with applicable securities laws.

Copyright (c) 2024 TheNewswire – All rights reserved.