Ashley Gold samples up to 5.8 g/t Au at new Tabor-Sakoose Claims and announces Financing

|

|||||||||

|

|

|

|

||||||

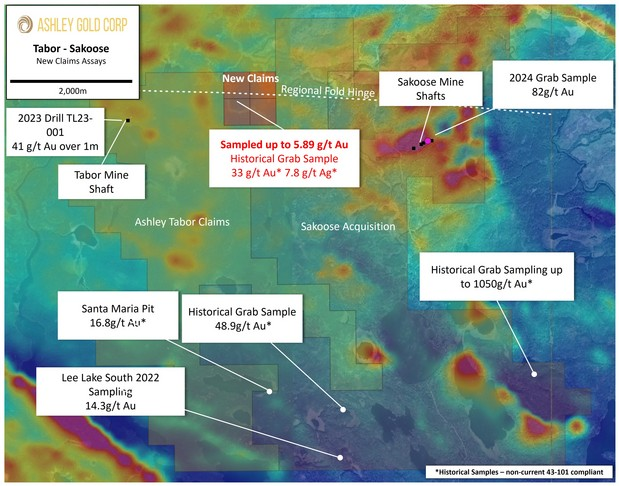

CALGARY, ALBERTA – TheNewswire – October 23, 2024 – Ashley Gold Corp. (CSE: “ASHL”) (“Ashley” or the “Company”) announces assay results for the additional Tabor-Sakoose claims acquired June 19, 2024. New assays confirm historical indications of gold mineralization with elevated gold in all three samples up to 5.8g/t Au. Three historical channel cuts were resampled including a 1m sample over a quartz vein and two 1.5m shoulder samples in the wall rock either side of the vein. These claims have never been drilled.

Highlights

-

Historical sampling grading 5.8g/t Au over a 1m chip sample

-

Wall-rock is bleached and silicified with the presence of gold

-

On trend with Tabor deposit with 2023 drill program hitting 5g/t Au over 8m including 41 g/t over 1m

Figure 1. Location of New Sakoose Option Claims

Darcy Christian, CEO of Ashley comments “We are happy to see that gold mineralization over the new claims is not just limited to the high-grade veins. Alteration and mineralization within the wall-rock shows that this under explored area has the potential to provide gold grades and widths needed for economic deposits. This sample is located almost 2km from our 2023 drill program and adds additional indications for a sizeable strike-length to the Tabor system.”

Claim History and Sampling

The additional claims are located just east of the Tabor Lease and contain the Star Apple occurrence sampled in 1980 by Sulpetro Metals. It is described in historical reports as a quartz vein in a quartz feldspar porphyry (QFP) and a single sample was taken as chips across 25cm. The historic sample graded 33 g/t Au* and 8.7 g/t Ag* (1.18 oz/t Au* and 0.31 oz/t Ag*).

Three samples were taken across the mineralized zone at Star Apple earlier this summer. The central sample was taken across the 1m vein (#340249) utilizing a historical channel likely from Sulpetro. Either side of the vein sample 1.5m (#340248 and #340250) wall rock samples were taken using the same methodology for a total of 4m. The wall rock is defined as a light-green quartz QFP with disseminated pyrite identical to the Tabor mine mineralization over 2km away. Table 1 outlines the results.

|

Sample # |

Au g/t |

Sample Width (m) |

Description |

|

340248 |

0.10 |

1.5 |

Quartz stringer and light green QFP |

|

340249 |

5.89 |

1.0 |

Quartz Vein |

|

340250 |

0.49 |

1.5 |

Light green QFP with pyrite |

Table 1. Assay Results

Assays were performed by Activation Laboratories in Dryden, Ontario using their Fire Assay methodology FA-GRA.

Figure 2. Sample Location Star Apple Occurrence

Financing Terms and Use of Proceeds

The Company announces a non-brokered private placement financing (the “Offering”) for aggregate proceeds of up to $300,000 (CDN) to advance exploration on Ashley’s Ontario gold properties.

The Offering includes a flow-through component (the “Flow-Through Component”) and a non-flow through component (“Non-Flow Through Component”). The Offering consists of a combination of flow-through units (the “Flow-Through Units”) and non-flow through units (the “Non-Flow Through Units”), at a price of $0.05 per Flow-Through Unit and $0.04 per Non-Flow Through Unit, for gross proceeds of up to $300,000. Each Flow-Through Unit is comprised of one flow-through common share and one-half of one non-flow through share purchase warrant. Each full warrant is exercisable for one non-flow through common share, at an exercise price of $0.075 for a term of 24 months after the closing (“Closing Date”). The Non-Flow Through Unit is comprised one common share and one warrant, with each warrant exercisable for one common share at an exercise price of $0.075 for a term of 24 months after the Closing Date. Management of the Company reserves the right to amend the final allocation of the Flow-Through Component and the Non-Flow Through Component under the Offering. The Company may close in one or more tranches.

In connection with the issue and sale of the Flow-Through Units and Non-Flow Through Units under the Offering, the Company may pay finder fees and finder warrants to eligible finders at the discretion of the board of directors.

The gross proceeds from the sale of the Flow-Through Shares will be used to incur eligible Canadian Exploration Expenses (“CEE”) for the Company’s Howie and Burnthut Projects. More details will be released shortly regarding the planned program. The Company will renounce CEE effective on or before December 31, 2024. The proceeds raised from the Non-Flow Through Units will also be used for exploration work and for general working capital purposes.

The Existing Shareholder Exemption and Investment Dealer Exemption

The Offering will be made available to existing shareholders of the Company who, as of the close of business on October 23, 2024, held common shares of the Company (and who continue to hold such common shares as of the closing date), pursuant to the prospectus exemption set out in B.C. Instrument 45-534 — Exemption From Prospectus Requirement for Certain Trades to Existing Security Holders and in similar instruments in other jurisdictions in Canada. The existing shareholder exemption limits a shareholder to a maximum investment of $15,000 in a 12-month period unless the shareholder has obtained advice regarding the suitability of the investment and, if the shareholder is resident in a jurisdiction of Canada, that advice has been obtained from a person that is registered as an investment dealer in the jurisdiction. If the Company receives subscriptions from investors relying on the existing shareholder exemption exceeding the maximum amount of the financing, the Company intends to adjust the subscriptions received on a pro rata basis.

The Company has also made the Offering available to certain subscribers pursuant to B.C. Instrument 45-536 – Exemption Form Prospectus Requirement for Certain Distributions Through an Investment Dealer. In accordance with the requirements of the investment dealer exemption, the Company confirms that there is no material fact or material change about the Company that has not been generally disclosed.

The Offering is subject to all necessary regulatory approvals including acceptance from the Canadian Securities Exchange. All securities issued in connection with the Offering will be subject to a four-month hold period from the closing date under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada.

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Darcy Christian, P.Geo., President of Ashley, who is a Qualified Person as defined by NI 43-101.

Samples in this news release denoted with an Asterix (*) are historical in nature and are not 43-101 compliant.

About Ashley Gold

Ashley Gold is focused on creating substantive, long-term value for its shareholders through the discovery and development of world class gold deposits. Ashley has acquired, 100% of the Tabor Lake Lease subject to a 1.5% royalty, 100% of the Santa Maria Project subject to a 1.75% royalty, 100% interest in the Howie Lake Project subject to a 0.5% royalty, 100% interest in the Alto-Gardnar Project subject to a 0.5% royalty, 100% interest in the Burnthut Property subject to a 1.5% NSR, and an option to earn 100% of the Sakoose claims subject to a 1.5% NSR.

Ashley Gold Corp. is an early-stage natural resource company engaged primarily in the acquisition, exploration, and development of mineral projects. The Corporation’s objective is to conduct efficient and economical exploration on its growing portfolio of high-quality gold projects as well as moving the Sahara Uranium-Vanadium project towards near-term production.

The responsibility of this release lies with Mr. Darcy Christian, President and CEO • +1 (587) 777-9072 • [email protected] , may be contacted for further information. www.ashleygoldcorp.com

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

DISCLAIMER & FORWARD-LOOKING STATEMENTS

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management’s expectations. Factors which cause results to differ materially are set out in the Company’s documents filed on SEDAR. Undue reliance should not be placed on “forward looking statements”.

Copyright (c) 2024 TheNewswire – All rights reserved.