Natural Gas Price Drives Crude-SPY Trends When USD Is Appreciating

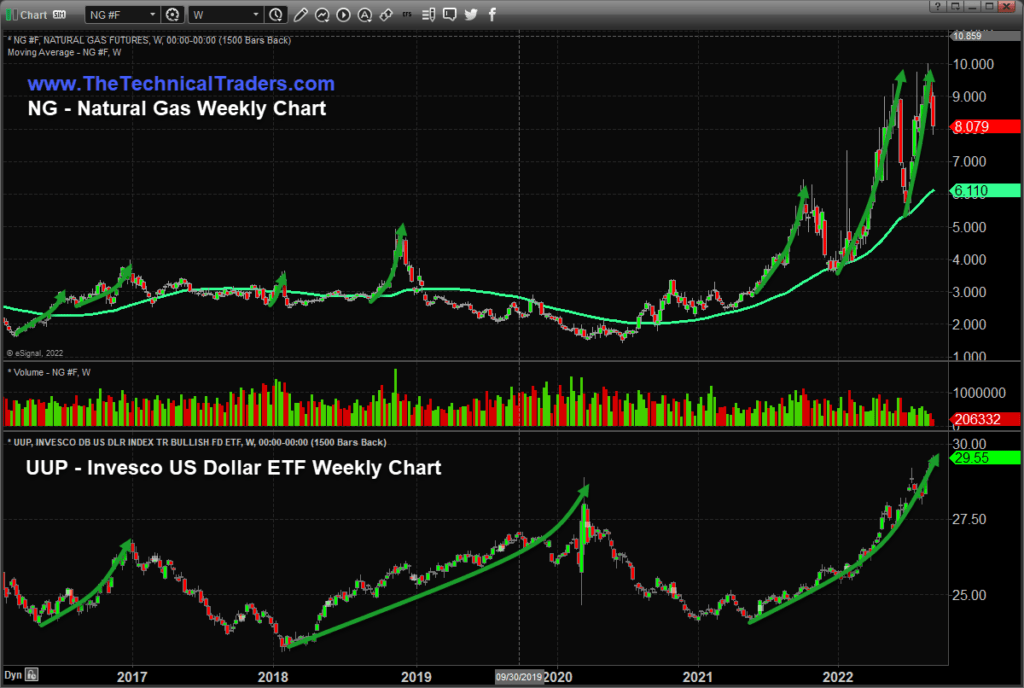

When the US Dollar is appreciating in value and trending upward, Natural Gas price trends upward as well to put moderately extreme pressures on the SPY & Crude Oil. As most energy transactions are conducted in US Dollars, this makes sense. Yet, with the recent agreement signed by Russia & China to conduct future energy transactions in Rubles & Yuan (Source: Nikkei Asia), will it result in more muted price trends in the future?

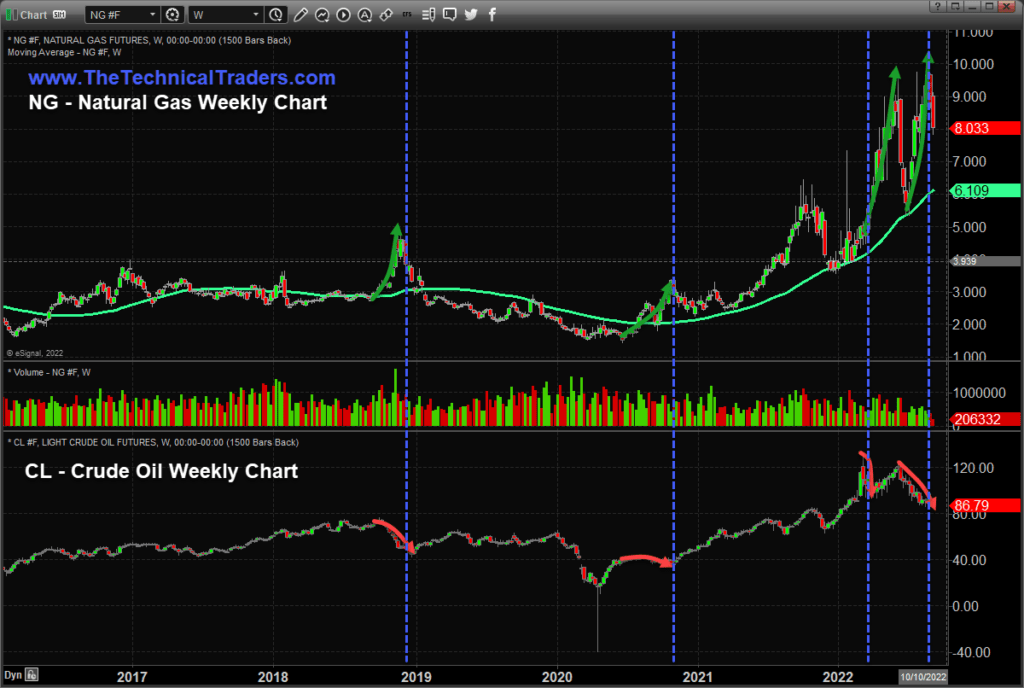

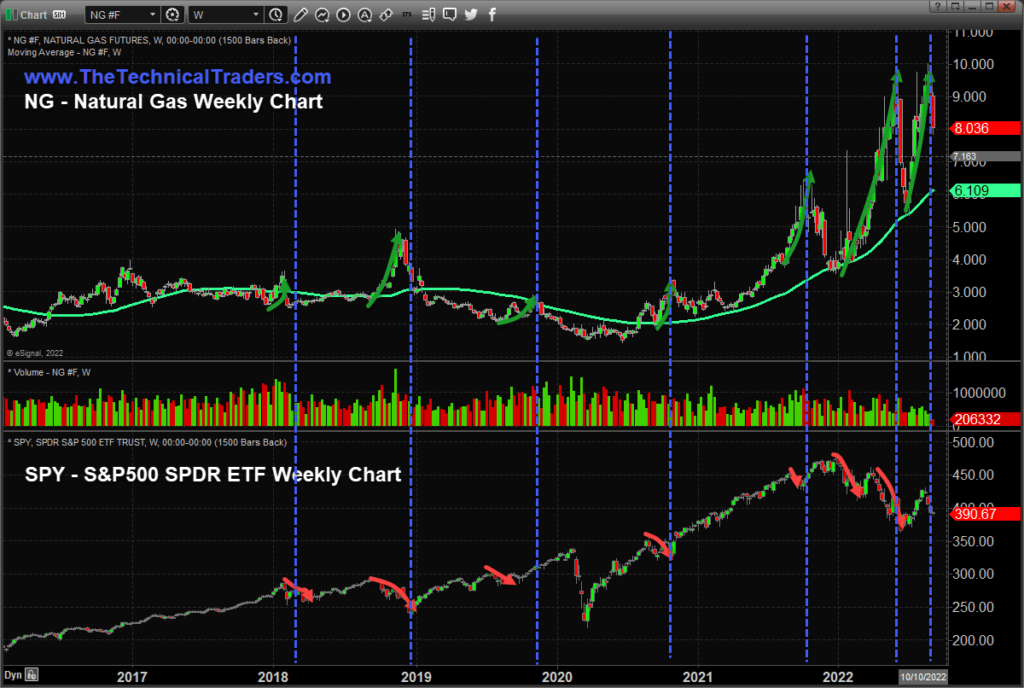

When the US Dollar rises, Natural Gas bullish price spikes seem to inflict greater disruption events in Crude Oil and the SPY. It appears that when Natural Gas spikes excessively, global nations are trapped in a US Dollar based economic crisis to supply electricity, heat, and other economic essentials to their communities.

US Dollar Strength May Disrupt Energy & Currency Valuations As Recession Looms

This disruption in economic stability translates into greater risks for consumers, manufacturers, governments, and others. The shock of rising Natural Gas prices while the US Dollar is strengthening presents a real problem for many foreign nations dependent on importing energy.

This is likely why the recent Natural Gas price spikes have helped drive the SPY lower over the past 6+ months. The concern that rising energy costs could work to break economic function in certain nations becomes very real when Natural Gas moves to $3.50. It becomes even more critical when Natural Gas rises above $6~7.

My research suggests energy will continue to play a significant role in driving future trends in the global markets that conduct business transactions in various currency forms. It will simply push buyers & sellers to hedge foreign currency risks related to US Dollar strength or weakness. In short, the energy transactions will still be executed in a US Dollar base valuation – although they will be executed in foreign currency denominations.

Read our recent Crude Oil research article: Crude Oil Prices – Will They Hold Above Key Support Level Or Begin To Unwind? (thetechnicaltraders.com)

There is one aspect of the deal between Russia & China that we’ll have to watch over the next 10+ years. Will this deal strengthen the Ruble & Yuan, or will it isolate these currencies and work to peg the Ruble/Yuan toward similar valuation levels? In a way, this is a bold move by Russia & China attempting to move their currencies into position to battle the US Dollar. But at the same time, if it fails to support the Ruble & Yuan, then it may work to devalue them in tandem.

The currency alliance between Russia & China may act as an anchor between the two currencies where any future broad global trends may drive both the Ruble & Yuan in a similar direction. The result could be an Oil/Energy based Ruble/Yuan correlation to the US Dollar or British Pound.

If Natural Gas begins to slide downward over the next 6+ months and breaks below $5.50, then I believe we may see a resurgent upswing in US stocks and other assets. Until then, I think the continued economic and global energy crisis will hang over the US markets headed into Winter 2022.

There is a chance that US markets may start a Christmas Rally over the next 30+ days and attempt to move into some type of end-of-year rally phase. But the global risks related to energy prices, inflation, and the US Fed may continue to disrupt rally attempts closing out Q4:2022. In short, we may not see any real relief from energy/inflation pressures until Q1 or Q2 2023.

Don’t try to be a hero with these market trends. Learn to protect your assets and target your trading style toward the best opportunities for profits.

On another note, if you are holding stocks and bonds in your portfolio, I highly advise you to watch this video I did with Craig. Bonds could fall another 20-30% from here and will send most baby boomers back to work, killing their retirement plans if you are not proactive.

LEARN FROM OUR TEAM OF SEASONED TRADERS

In today’s market environment, it’s imperative to assess our trading plans, portfolio holdings, and cash reserves. As professional technical traders, we always follow the price. At first glance, this seems very straightforward and simple. But emotions can interfere with a trader’s success when they buck the trend (price). Remember, our ego aside, protecting our hard-earned capital is essential to our survival and success.

Successfully managing our drawdowns ensures our trading success. The larger the loss, the more difficult it will be to make up. Consider the following:

- A loss of 10% requires an 11% gain to recover.

- A 50% loss requires a 100% gain to recover.

- A 60% loss requires an even more daunting 150% gain to simply break even.

Recovery time also varies significantly depending upon the magnitude of the drawdown:

- A 10% drawdown can typically be recovered in weeks to a few months.

- A 50% drawdown may take many years to recover.

Depending on a trader’s age, they may not have the time to wait nor the patience for a market recovery. Successful traders know it’s critical to keep drawdowns with reason, as most have learned this principle the hard way.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition. Click on the following link to learn how: www.TheTechnicalTraders.com.

Chris Vermeulen

Founder & Chief Market Strategist

The post Natural Gas Price Drives Crude-SPY Trends When USD Is Appreciating appeared first on Technical Traders Ltd..