The Harsh Realities Of Caving Into Emotional Trading

Wow, what an emotional trading day and week thus far. What John said Wednesday in the member’s comments could not be more accurate for most people. “Only thing scarier than shark week is FED week!”

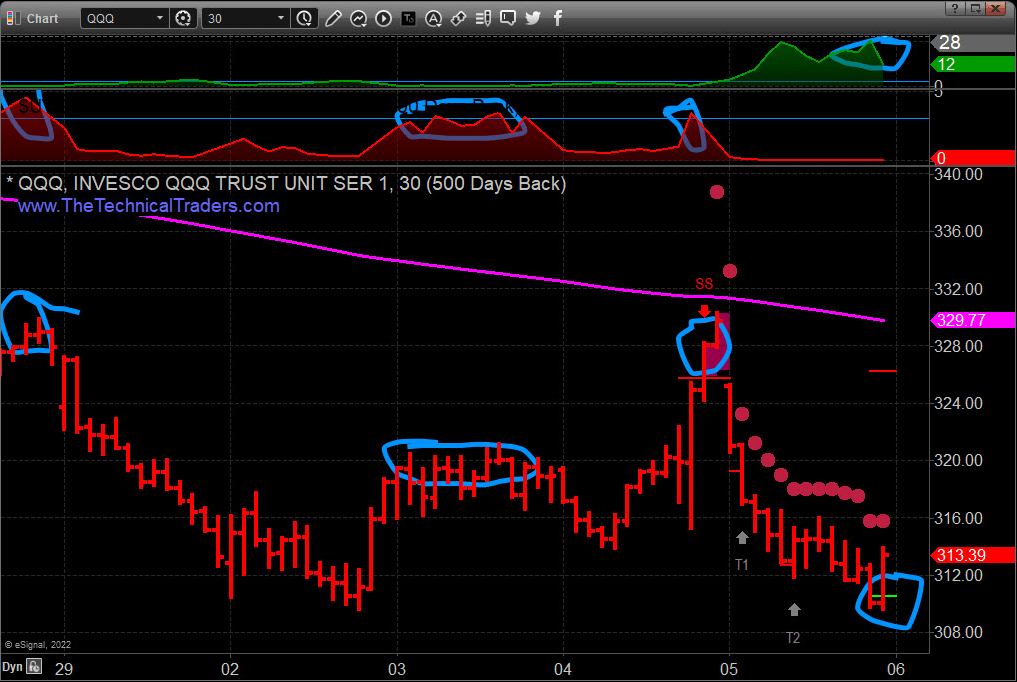

Luckily we safely navigated the turmoil and FOMO brought on by FED announcements on Wednesday, May 4th.

- We knew it would be choppy and that trades should only last hours to a day, and you must actively manage positions.

- Earlier this week, I mentioned the only things I liked were UUP, UNG, and SVXY. So far, UUP is flat; given the recent market sell-off, that’s a win. UNG is up 15%, and SVXY rallied 7.2% in the last 24 hours. These were not official trades, but I gave trading tips and updated you each day and how to handle them if you were to trade them. Get in, make money, get out.

- Wednesday’s Fed rally sparked FOMO buying, indexes hit resistance, became overbought, and had a cycle high. Today investors bumped shares with the panic volume indicator on the downside, spiking over 31 yesterday afternoon. Temporarily.

Overall not much safety during panic selling like this, and it’s the reason why I don’t believe in holding stocks in a downtrend or bear market. I get pushback all the time about holding cash, but the answer as to why I do is simple.

Why You Want To hold cash vs Own Stocks

All I have to do is ask:

Would you rather own stocks because you like owning stocks and lose 25-60% of your money if we enter a bear market?

OR

Would you rather have a ton of cash waiting for you to buy your favorite stocks at a much lower price, earn more dividends, and make bigger returns at some time in the near future?

Simple answer….or is it?

That last part, “make bigger returns at some time in the near future”, may throw a kink into some of your answers. It’s like that test they do with kids where they offer one cookie now or wait five minutes, and we will give you four. Most people take one cookie, unfortunately, and it defies my question and logic = frustrating!

This leads to the most frustrating part of what I do. I have watched trader after trader make the same mistakes for the past 20 years. They go through the cycle of thinking the markets are amazing, to having a big winning stock trade that hooked them, to emotional FOMO-based trading, to the eventual closing of their trading account. They get crushed both financially and mentally. No matter what I do to help, most are driven by their emotions, which by the way, is the most powerful decision-making force we as humans struggle to control.

The reality is most traders would rather trade and hold stocks no matter what direction the stock market is going, and here’s why:

- They think they should (lack understanding of risk and position management).

- FOMO, they fear missing out on potential gains and don’t want to be left behind.

- They crave the risk/excitement (the rush of trading is like gambling, it is addicting).

- They cannot contain their emotions and struggle with exiting both winning and losing Trades.

How do I know these things?

Simple, I used to think and trade that way. And it was days like WEDNESDAY when I blew up one of my trading accounts trading ES mini futures. In one day, I lost everything I had!

Facing the Reality of emotional trading

Yesterday afternoon I relayed this story to my subscribers so that they might fully understand why I spend so much time educating people about cash being a wise position when the markets are in the state they are in right now.

The day I blew up my trading account I was down so much money I could not sell, so I just kept averaging down, waiting for the intraday bounce. Well, it never came, and the only thing that did come was the closing bell and margin call that broke my account, my confidence, and my dreams.

I never did tell my then-girlfriend and now-wife about that one. I felt like a total loser, my confidence crushed, and I got depressed for a little while. That was the defining moment in my trading career.

To give up, or to trade like it’s a business and do all the proper things that I hated to do like: sell losing trades and live to trade another day, smaller positions, fewer trades, stop trading leverage (futures and 2x 3x ETFs) because they made me too emotional, and to wait for trades to form vs. finding trades that may not be real setups, etc. I say all of this in hopes that it connects with some of you in the same situation.

You either had a very stressful day and lost a lot of money, or your thought Thursday was incredible to watch and/or trade because you understand market movements, risks, how to trade it, and know there will be a lot more time and price action to earn consistent oversized returns later in a favorable market condition.

I share my analysis, thoughts, and experience with you to help prepare you mentally and emotionally with your portfolio for days like this.

And for the record none of the price action, this week, was anything out of the norm. Wild, sure, but this is typical price action in a bear market.

how we CAN HELP YOU live to trade another day

At TheTechnicalTraders.com, my team and I can do these things:

- We reduce your FOMO and manage your emotions.

- We have proven trading strategies for bull and bear markets.

- We provide quality trades you can trust.

- We tell you when to take profits and exit trades.

- We save you time with our research.

- We provide above-average returns/growth over the long run.

- We have consistent growth with low volatility/risks.

- We make trading and investing safer, more profitable, and educational.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

Learn how we use specific tools to help us understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, we expect very large price swings in the US stock market and other asset classes across the globe. We believe the markets have begun to transition away from the continued central bank support rally phase and have started a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern begin to drive traders/investors into Metals and other safe-havens.

We invite you to join our group of active traders and investors to learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition by clicking on the following link: www.TheTechnicalTraders.com

Chris Vermeulen

Chief Market Strategist

Founder of TheTechnicalTraders.com

The post The Harsh Realities Of Caving Into Emotional Trading appeared first on Technical Traders Ltd..