Will 2022~23 Require A Different Strategy For Traders/Investors?

Is The Lazy-Bull Strategy Worth Considering? – Part I

Many traders struggled in 2021 with the extended price volatility and sideways price trends. Recently, news that Bridgewater’s 2021 results were saved by December’s +7.8% gain (Source: Yahoo! Finance) leads me to believe a number of independent funds and investors are going to have a tough end-of-year return for 2021.

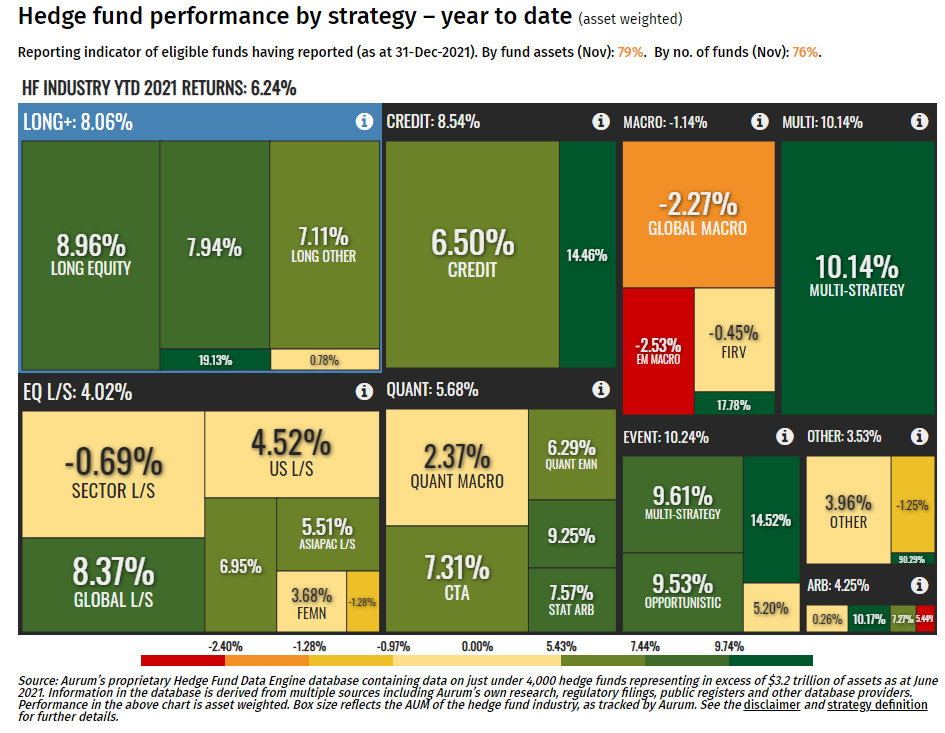

Average Hedge Fund Returns Less Than 25% Of The 2021 S&P500 Gains

The volatility in the US and global markets throughout most of 2021 took a toll on traditional trading strategies. With the VIX trading above 12 on average throughout almost all of 2021, traditional trading strategies may not have been able to adjust to this increased volatility in the US markets – getting chewed up along the way. I wrote an article series about how computerized trading strategies can fail when volatility levels increase beyond traditional boundaries a few weeks ago. You can read the first of the three part series, US Federal Reserve Actions 1999 to Present – What’s Next?, and then link to the other two.

(source: Aurum.com)

Many of the best Hedge Funds could barely squeeze out a profit in 2021. While the S&P500 rallied more than 27% in 2021, you can see from the graphic above that the average returns for Hedge Funds in 2021 were a paltry +6.24%.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

I expect that the US and global markets will continue to stay in extended price volatility ranges throughout all of 2022 and into 2023 as broad global market transitioning continues to take place. This expectation leads me to conclude that the “Lazy-Bull” strategy may be better suited for traders/investors over the next 24+ months than more active trading strategies.

What Is The “Lazy-Bull” Strategy?

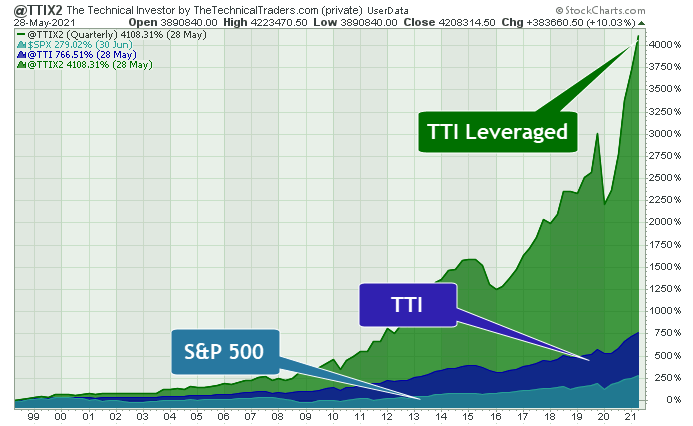

The Lazy-Bull strategy is a term I use for my proprietary strategies – The Technical Investor and the Technical Index & Bond Trader. I call it the Lazy-Bull strategy because it is straightforward and only generates about 3 to 10 trades per year (on average). Many traders dislike this type of strategy because it it does not require many trades and does not provide the rush/roller coaster ride that many think they should feel while trading, which is not how it should be. Having said that, overall, this strategy has consistently produced positive annual results (average 15% – 33% depending on ETF leverage) – beating the SPY almost every year. If you traded with the 2x ETFs then you would have crushed the market, and experienced that positive rush feeling.

My trading style is a bit different than most other traders. My objectives consist of three very important concepts:

- Protect Capital At All Times

- Trade Only When Strategically Opportunistic (probabilities are favorable)

- Trade Efficiently Using Bonds As Trade When Fear Rises among traders and investors.

In short, I don’t care about trading every day or trying to catch the hottest symbols from social media. I care about catching and riding the biggest trends in the US major indexes ETFs, and the Treasury Bond ETF, to take advantage of the most opportunistic sentiment trends in the USA.

Through the Technical Investor and Technical Index and Bond Trading strategies, I help people learn how trading more efficiently using the Lazy-Bull strategies are for generating mind blowing compounded returns as shown in the SP500 chart below.

I’ll go further into detail regarding my strategies as we continue this multi-part article.

Reading Into Q1:2022 – What To Expect?

Right now, the world is waiting on Q4:2021 earnings and economic data. The first Quarter of 2022 should be very exciting for US traders as the year-end momentum of 2021 may carry forward into Q1:2022 with solid revenues and earnings. After that, we move into Q2:2022, which may be much more volatile overall.

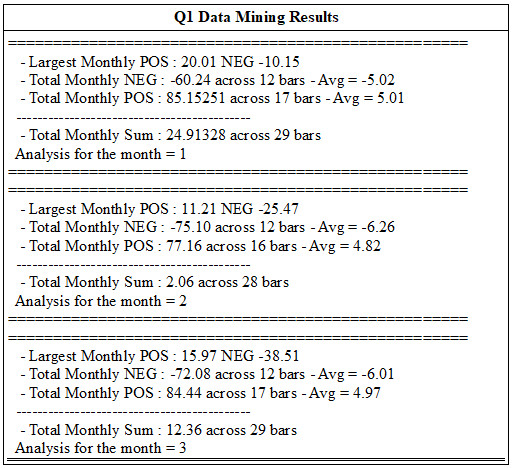

Let’s look at our proprietary data mining utility to see what we might expect from the markets in the first Quarter of 2022.

January 2022 has more than a 1.41:1 probability ratio of staying positive based on the past 29 years of historical data. Ideally, the average positive and negative monthly ranges are about equal – nearly .00. The accumulated monthly data shows that January is usually overall positive by at least .50 to .00.

February 2022 has a much higher chance of extreme volatility. February 2022 shows a much greater positive to negative ratio while the possibility of a bullish February drops to a 1.33:1 probability ratio. Overall, I would suspect larger price volatility in mid to late February 2022 as the markets attempt to transition into late Q1 expectations.

March 2022 has the same 1.41:1 probability ratio as January, yet the overall likelihood of extended downside price trends is about 20% greater than January.

My analysis of this data suggests January and March of 2022 may surprise traders with a potential for a significant upward price move headed into Q2:2022. I believe Q4:2021 will also surprise traders as US consumers continue to engage and spend. This will lead to higher expectations for Q1:2022, which may set up a bit of a rally ahead of April/May 2022.

Q1 and Q2, historically, seem to be strong in terms of traditional market growth and expectations. Yes, there have been instances when unexpected volatility disrupts the more customary types of trends – and 2022 may be one of those years. Our research shows the US Fed may make early efforts to move away from extreme easy money policies – which may shock the markets.

Our research suggests the possibility of a 7% to 10% rally in the SPY in the First Quarter of 2022. If our extended research is accurate, our predictive modeling suggests more extreme price volatility may also play a significant role in how price trends/moves in 2022.

Is The Lazy-Bull Strategy Worth Considering?

In Part II of this article, we’ll review the entire year of 2022 Quarterly Data Mining results and present more evidence that 2022 and 2023 may be years where a shift in strategy plays an important role for traders/investors. With the VIX trading above 15 more consistently, many strategies will get chewed up and spit out as the markets roll 9% – 15% up and down while attempting to transition away from the post-COVID stimulus.

Get ready; 2022 will be an excellent year for traders with significant trends and bigger volatility. We just have to stay ahead of these trends to protect our capital and allow it to grow more efficiently. The risks of more traditionally moderate volatility systems getting chewed up in this extreme environment will continue. So be prepared to move towards a more protective trading style to survive the next 12 to 24 months.

Want To Learn More About The Technical Investor and The Technical Index & Bond Trading Strategies?

Learn how I use specific tools to help me understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may start a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.

I invite you to take a few minutes to visit the Technical Traders website to learn about our Technical Investor and Technical Index and Bond Trading strategies and how they can help you protect and grow your wealth.

Have a great day!

Chris Vermeulen

Chief Market Strategist

The post Will 2022~23 Require A Different Strategy For Traders/Investors? appeared first on Technical Traders Ltd..