Surprising Consumer Activity May Suggest A Deeper Shift In The Markets, Part III

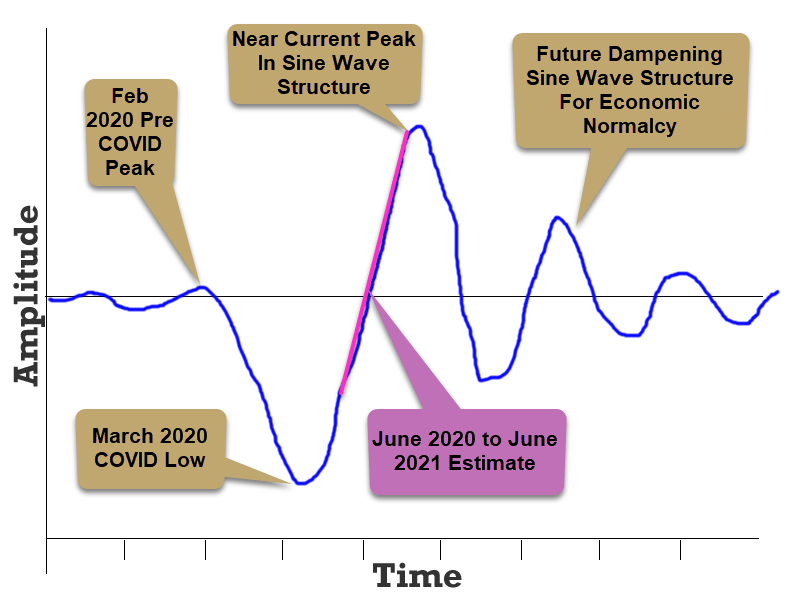

As I dive deeper into the shifting economic trends, driven by both the post-COVID-19 recovery event and the US and global economic actions and policies, we are going to focus on two key aspects of the recent market recovery in this third installment of our research article. Ideally, we are going to focus on price action in various market sectors and how that price action may align with our Dampening Sine Wave process which we pushed to your attention in Part I of this research article.

Global Markets May Start To Roll Over As We Shift Away From Recovery/Reflation

In Part II of this research article, we highlighted how consumers and consumer activity make up more than 70% of the US GDP output. We also suggested that it is common for consumers to react to extreme economic and price functions in a natural form; either optimism for profits, or fear of excessive-high price trends. We’ve seen this happen over and over again throughout history. Over the past few months, we’ve authored numerous articles warning about this type of Excess Phase Peak setup. Here are just a few for you to review:

- June 23, 2021: ARE THE US MAJOR INDEXES ROLLING OVER IN AN EXCESS PHASE PEAK SETUP?

- July 27, 2021: ARE WE GOING TO SEE BIG PRICE ROTATION BEFORE THE END OF 2021, OR IN 2022?

- August 3, 2021: US MARKETS STALL NEAR END OF JULY AS GLOBAL MARKETS RETREAT – ARE WE READY FOR AN AUGUST SURPRISE?

Now, it appears we start a process of watching the US economic activity roll over past the June/July 2021 peak levels on this example of the Dampening Sine Wave pattern – pushing forward weaker and more normalized economic data throughout the end of 2021 and possibly into 2022. If our research is correct, the current Consumer Sentiment data, falling -13% from the previous Month’s levels, is an early indication that consumers have already pulled away from economic activity over the past 60+ days.

Sign up for my free trading newsletter so you don’t miss the next opportunity to learn more!

This aligns with a couple of key extreme price highs in the US/Global markets; first Housing Prices have skyrocketed higher over the past 90+ days; next, used car prices have skyrocketed higher over the past 90+ days; lastly, energy costs have skyrocketed higher over the past 90+ days. Additionally, general inflation across a number of consumer items have pushed incredibly higher over the past 6+ months and that is leaving the consumer to react to these pricing pressures the only way they know how – stop buying these items when they are not critical for survival. The answer at times like this is “Toothpaste, Toilet paper, and Top Ramen” – people buy only what is essential and forego almost everything else until price falls back to more reasonable levels.

If the markets follow this example of the Dampening Sine Wave process and we are already past the June/July peak level, then we may have already started the slide downward towards a moderate bottom/support level. We will likely continue to see weaker data related to consumer activity; which includes sales, manufacturing, Real Estate purchases and Auto/Other purchase activities. The consumer has been blindsided by an incredible inflationary trap that has unfolded over the past 5+ months. Everything seems to cost more and more money, while the economy is still limping into recovery and consumers are just trying to make it work.

How The Markets May React To Extended Contracting Economic Trends

As we’ve attempted to illustrate, the markets may be processing a price setup very similar to the Dampening Sine Wave process we’re showing near the top of this article. If this is the case, then the last 9+ months of market trending are excessive in structure and more related to expectations propagated from the extreme deep COVID-19 market contraction and really less about at 40% to 60% increase in economic activity and real earnings.

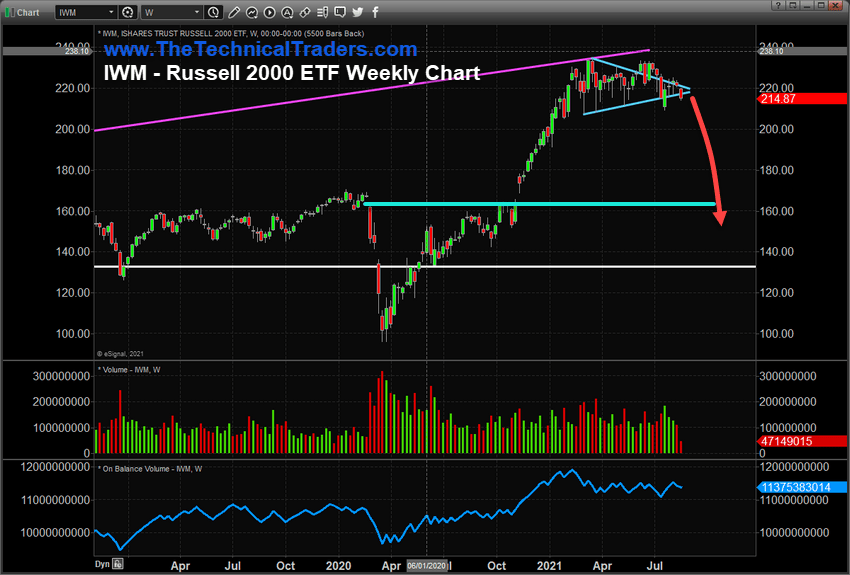

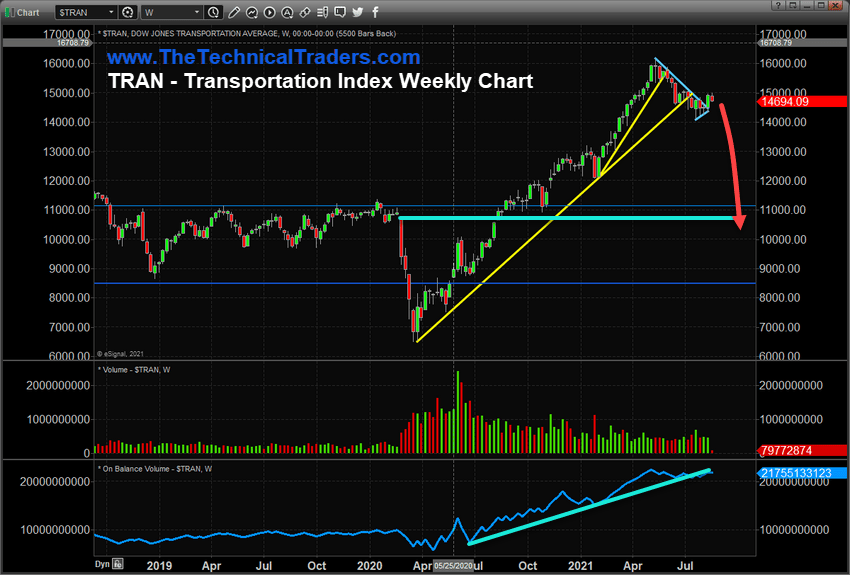

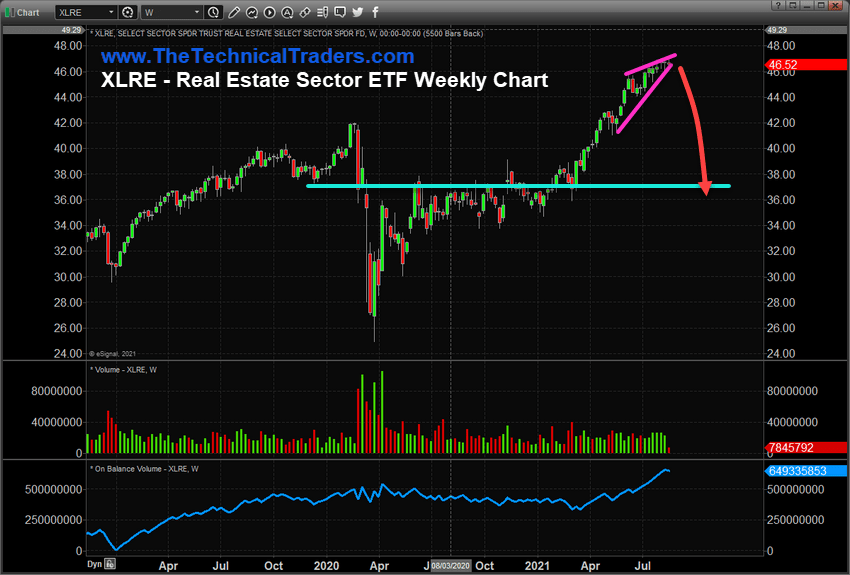

If that is the case and the market price levels are currently extremely overbought, then a moderate price correction/reversion is very likely. We believe the levels near the November 2020 US elections are likely “fair market value” for the current capabilities of the US/Global economies based on a number of factors (earnings, consumer participation, inflation, global issues/policies). If we are correct, we may see an extended price contraction/reversion event targeting the CYAN support levels we’ve drawn on these charts.

IWM May Fall 24% Before Finding Key Support Near $163.40

Ideally, the key support level near $163.40 appears to be a very solid basing/bottoming price level on this IWM Weekly price chart. Obviously, we may have found some other support levels to pick out on this chart, but the extreme rally phase that started after the November 2020 elections prompted a big upside price gap that aligned with the breakdown gap near the start of the COVID-19 collapse. I believe these gaps may become key targets for any reversion event in the IWM if we continue to see the Dampening Sine Wave process unfold.

TRAN May Target $10,725 If The Market Continue To Contract After Excess Peak

Similar to the IWM, the Transportation Index Weekly Chart below shows a very clear breakdown in price trend as well as an APEXed Flag/Pennant formation. If we understand the Dampening Sine Wave process and why it is important to understand in relationship to future price activity, we can assume any further breakdown in price below the $14,000 level on the TRAN may prompt a move to recent support. I believe that support level exists between $10,725 and $11,400.

Real Estate May See Some Extreme Volatility If Our Research Is Correct

There are two things we want you to understand about the Real Estate sector; first, recent US policy has created a temporary block of foreclosures and evictions over the past 12+ months. This means we don’t really have any understanding of how many homes and other building are distressed or how many borrowers are 90+ days delinquent on their loans. What we do know is that after September 2021, all of these moratoriums are likely to end and the flood-gates will open for banks to begin processing foreclosures and evictions.

I believe the buildup of distressed homes and other buildings could crush the current high price levels of the housing market by as much as 20% to 25%. There has never been a time like this where the entire US housing market has been protected from foreclosures and evictions for more than 12+ months while extreme pricing and inflationary pressures have continued to put a strain on consumers. Because of how these multiple waves of costs have seemed to overcome earning capabilities for consumers, I believe we could see a massive wave of over 1.5+ million homes flood into the market near the end of 2021 and crush the recent rally in Real Estate valuations.

If my research is accurate, a -20% to -21% price decrease in XLRE is possible before support is found near $37.

In Part IV, the final part of this research article, we’ll take a look at some recent economic data to try to pinpoint where we are in the Dampening Sine Wave Process. Stay tuned into the markets and please try to understand that my research is predicated on the process that the post COVID recovery in market price levels functions very similar to the laws of nature and fluid dynamics. We’ll see how this plays out in the long run, but so far it appears my Dampening Sine Wave process may be driving price trends for a while.

Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

For those of you who are interested in Options Trading, our resident specialist Neil Szczepanski will be hosting a LIVE two-part Intermediate Course beginning on Wednesday, August 25, 2021. Neil will dive deep into the different strategies and outline what are the best trade setups and what to avoid – helping you to become a more knowledgable, confident, and advanced options trader. To learn more, or to register for the course, kindly click on the following link: INTERMEDIATE OPTIONS MENTORING COURSE.

As something entirely new, check out my initiative URLYstart to learn more about the youth entrepreneurship program I am developing. This is an online program of gamified entrepreneurship designed to introduce and inspire youth to start their own businesses. Click-by-click, each student will be guided from their initial idea, through the startup process all the way to their first sale and beyond. Along the way, our students will learn life lessons such as communication, perseverance, goal setting, teamwork, and more. My team and I are passionate about this project and want to reach as many people as possible!

Have a great day!

Chris Vermeulen

Chief Market Strategist