Global Markets Start The Week Very Volatile – Metals & Oil Collapse, Part II

In this, the second part of our Market Volatility research article, we’ll take a look at how Precious Metals, the US Dollar, and the US major markets have moved into a sideways price trend which supports a pending future volatility event. The big “mini flash-crash” in precious metals on Monday, August 9, may have been an early warning that the markets are shifting away from past expectations and moving towards a new post Q2:2021 reality. Let’s continue exploring these trends.

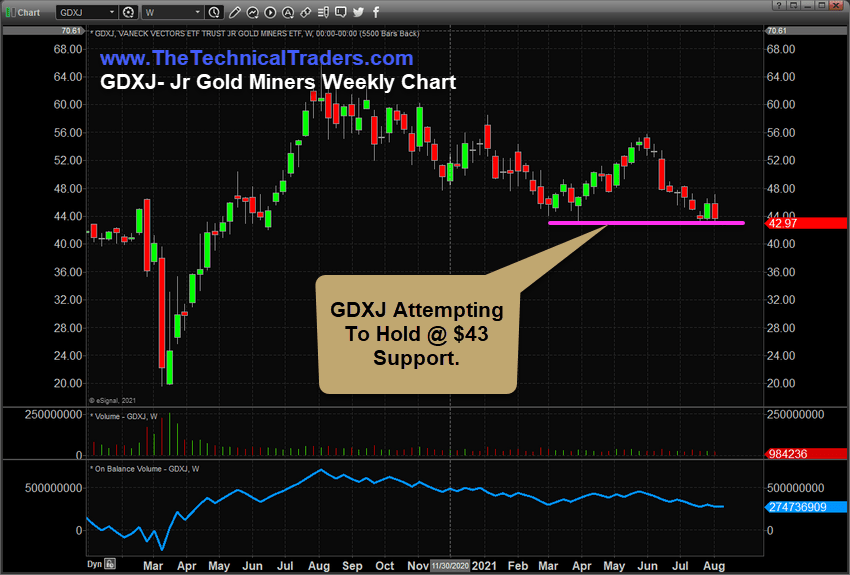

Jr Gold Miners Need To Hold Support Near $43

The big selling that took place in Gold and Silver on Monday, August 9, will likely put pressure on GDXJ, the Jr Gold Miners ETF, which is already trading very close to the $43 support level. If this level is broken/breached to the downside, traders need to watch if the price trend of GDXJ continues to push lower or if the $43 price level re-establishes itself with a fairly quick price recovery.

Precious metals, and the miner ETFs, react to extreme fear in the markets usually by selling off quite aggressively in volatility events. Usually, Metals and Miners recover within 30 to 60 days of these volatility events and continue to trend higher as the fear of any market event drives traders into metals as a safe haven.

Sign up for my free trading newsletter so you don’t miss the next opportunity to learn more!

The current Double Bottom near $43 in GDXJ may prove to be a critical price level in the near future if our expectation of a global market volatility event actually unfolds over the next 10 to 20+ days. The post Q2:2021 earnings and growth expectations have passed as earnings data has continued to hit the news wires recently. Now, after the earnings news settles, the market must decide what is the most likely outcome of price for the next Q3 reporting period – a 65 to 95 day span of time.

Do traders believe another 15% to 20% rally phase is the path of least resistance at this stage of the recovery rally, or do they believe the markets have already reflected the post-COVID recovery rally attempt and have peaked in the near-term with Q2:2021 expectations? That is the big question.

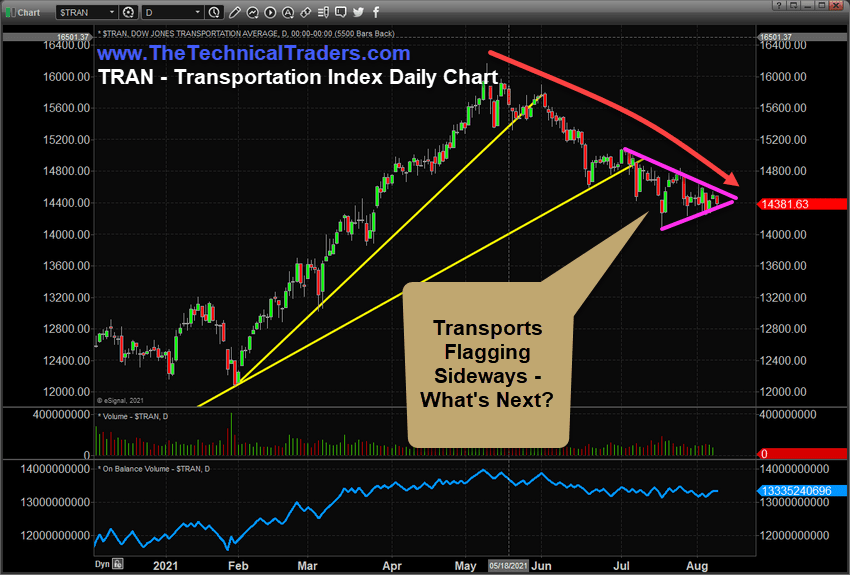

Transportation Index Continues To Weaken & Setup A Pennant/Flag Pattern

In a fairly similar move to Precious Metals, the Transportation Index has continued to move downward, breaking multiple upward sloping support channels, over the past 85+ days as an indicator that traders believe the rally in the economy has already peaked. The Transportation Index acts as a forward expectation of the US overall economic activity/engagement – often leading the markets by 2 to 4+ months. When the Transportation Index changes direction and starts to trend higher or lower, traders should start to pay attention to this because the new major trend is likely to become a major issue for the US major markets in about 90 to 180+ days.

The peak in the Transportation Index in early May, just after the Q1:2021 earnings release, is suggesting the late 2020 and Q1:2021 rally in the US major markets was a true reflation trade rally which may have ended in April/May 2021. The downward price slide that we can see on this Transportation Index chart suggests the US economy is sliding into a consolidation/downtrend and is weakening overall after Q1:2021.

Currently, the Transportation Index is setting up in a Pennant/Flag formation (highlighted in MAGENTA on this chart). We found it interesting that throughout the Q2:2021 earnings announcements, which continued to stay rather strong compared to seeing broad earnings/revenue misses, prompted a sideways price trend and more volatility in the US major indexes. It also prompted a downward price trend in the Transportation Index which has shifted into this new Pennant/Flag pattern setup.

Obviously, if traders really believed the Q2:2021 earnings data translated into increased growth and revenue opportunities to continue into Q3 and Q4 2021, we would have expected to see the US major indexes rally on these strong data points and expectations – but that didn’t happen. What did happen is the markets shifted into a sideways price trend where any attempt to rally to new highs was met with almost immediate consolidation/rotation.

As we move closer to the Apex of the Pennant/Flag price setup, traders need to prepare for a breakout/breakdown volatility event taking place. If the Transportation Index breaks below $14,000, traders should expect the second half of 2021 to become a bigger rotational price trend. If the Transportation Index holds above $14,000 and starts a new rally, then the second half of 2021 will likely continue to push higher and higher – extending the reflation rally into the Christmas rally for 2021.

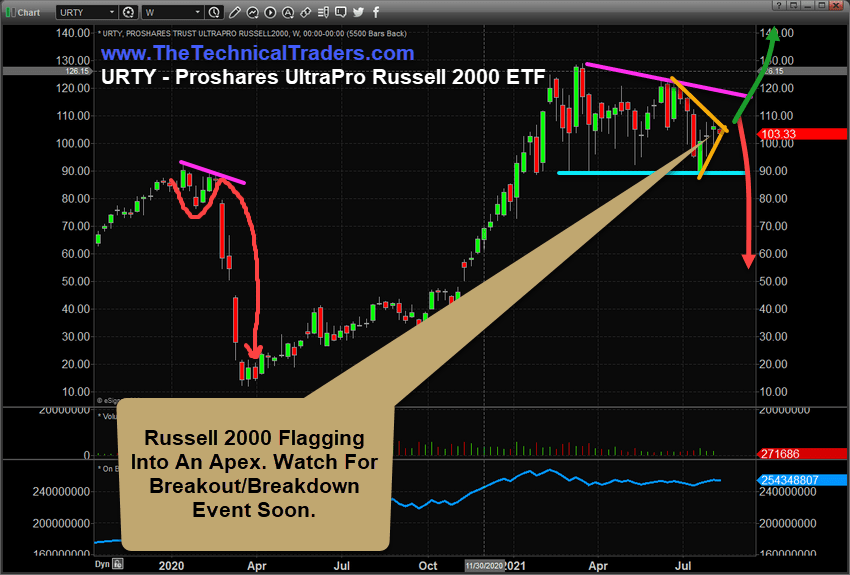

Russell 2000 Flagging In A Broad Range Channel – Suggesting A Very Big Volatility Event Is Pending

This URTY Weekly chart highlights one of the most important aspects of the US major markets over the past 12+ months. You should be able to clearly see the big reflation rally that took place after the November 2020 elections on this chart where URTY rallied from $40 to $140. Then, after March 2021 (Q1:2021), URTY setup a very broad range peak and began to trade sideways in a broad range price flag. Support near $90 is still confirming as a critical support level for URTY while the upper range has been sliding lower over the past 3+ months.

More recently, as we’ve highlighted in GOLD, URTY has broken downward in a very broad Pennant/Flag price formation that is very near the Apex level. This suggests a very volatile breakout or breakdown price event is setting up and this event is likely to take place within the next 2 to 4 weeks. The $90 support level will be key to understanding if the US major markets are about to attempt a bigger downside price move while the $117 level will be key to understanding if the US major markets are about to enter a new rally phase.

The mini flash-crash that took place in Gold, Silver, and Crude Oil on Monday, August 9, may have been a very clear “shot over the bow” for traders and investors to pay attention to the risks that are setting up in the global markets right now. These Apex Flag patterns are going to prompt a new trend – as they usually do. The lack of real upward momentum in the US major markets over the past 30+ days while the Transportation Index and Russell 2000 show very clear signs of weakness may suggest the rally is running out of momentum.

Yet, we still have to be patient and wait for the breakout/breakdown event to unfold (and confirm) before we can attempt to accurately identify which side is more likely to prevail. One thing is certain, though, Gold, Silver, Crude Oil, and the US major markets are clearly suggesting a big volatility event is about to unload/unfold. This could be the start of a very big Q3 & Q4 global price trend – so get ready.

More than ever, right now, traders need to move away from risk functions and start using common sense. There will still be endless opportunities for profits from these extended price rotations, but the volatility and leverage factors will increase risk levels for traders that are not prepared or don’t have solid strategies. Don’t let yourself get caught in these next cycle phases unprepared.

Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

As something entirely new, check out my initiative URLYstart to learn more about the youth entrepreneurship program I am developing. This is an online program of gamified entrepreneurship designed to introduce and inspire kids to start their own businesses. Click-by-click, each student will be guided from their initial idea, through the startup process all the way to their first sale and beyond. Along the way, our students will learn life lessons such as communication, perseverance, goal setting, teamwork, and more. My team and I are passionate about this project and want to reach as many kids as possible!

Have a great day!

Chris Vermeulen

Chief Market Strategist