Breakout Or Breakdown – What Does The Next Big Trend Look Like?

Just in case you missed this recent research article, we wanted to put it back on top of your reading list for the long Memorial Day weekend. As the markets continue to slide into this “Start of Summer” holiday, we’re still seeing big trends setting up over the next few weeks and months. The way certain assets and sectors are reacting right now may lead many investors to believe a breakout trend is setting up (which could be the case). But, behind the scenes, sectors are starting to show signs of a broader Excess Phase Peak pattern that may surprise those that are not paying attention.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

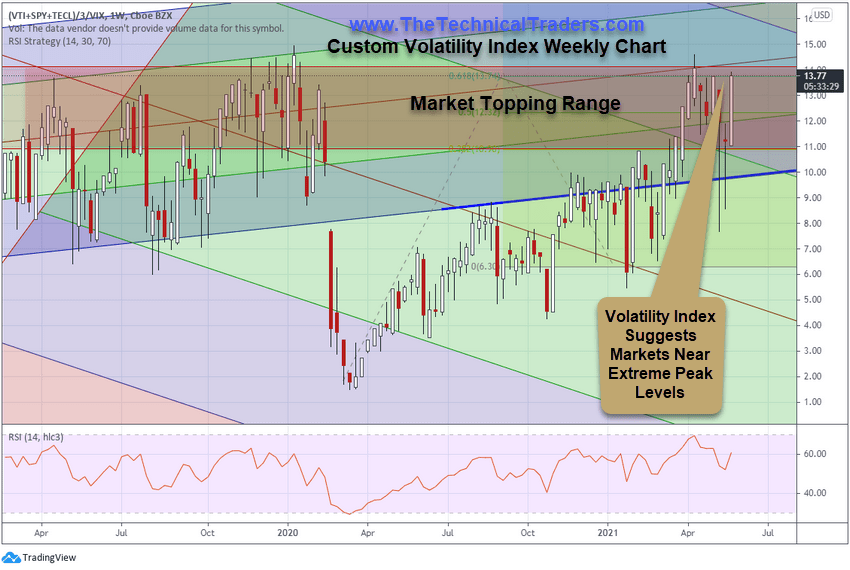

Our Custom Volatility Index, shown below, suggests the markets have now rallied into extreme overbought levels which have historically resulted in a moderate price pullback after reaching levels above 13~14. We may start out seeing some type of bigger price trending/rotation after the long Memorial Day Holiday should this indicator prove accurate.

Please take a minute to read the research article mentioned above regarding how various asset classes and market sectors have already moved into phase #2 or phase #3 of the Excess Phase Peak price pattern to prepare for any type of trending price activity over the next few weeks.

The markets are likely to enter a very volatile period of price rotation fairly quickly and turn into a true traders market. Best get ready for it now.

For those of you who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily pre-market reports, proprietary research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers. Sign up today!

Have a great Memorial Day Weekend!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com