Technology & Energy Sectors Are Hot – Are You Missing Out?

We have seen some really big moves in various S&P sectors over the past 60+ days and these trends look like they may continue for a while. Near the end of 2020, in October and November, the markets seemed to stall a bit before the US elections, but they have really started to trend much higher over the past 60+ days. Technology and Energy seem to be leading the charge in some respects. The most important thing for traders is to find decent breakout trends in stocks and sectors that have a real potential for strong continued trending. When we find these types of longer-term trends, we can scale in and out of the typical up/down price trends, over time, to generate some incredible returns.

Technology Heating Up Again

The move in the IXN Global Technology ETF charted below, looks like it is starting to accelerate higher. It has already moved +17% over the past 60+ days, but there is a real potential that global investors are starting to pile back into technology ahead of the Q4:2020 earnings reports. This may prove to be one of the hottest sectors in 2021 – so keep an eye on this new breakout rally.

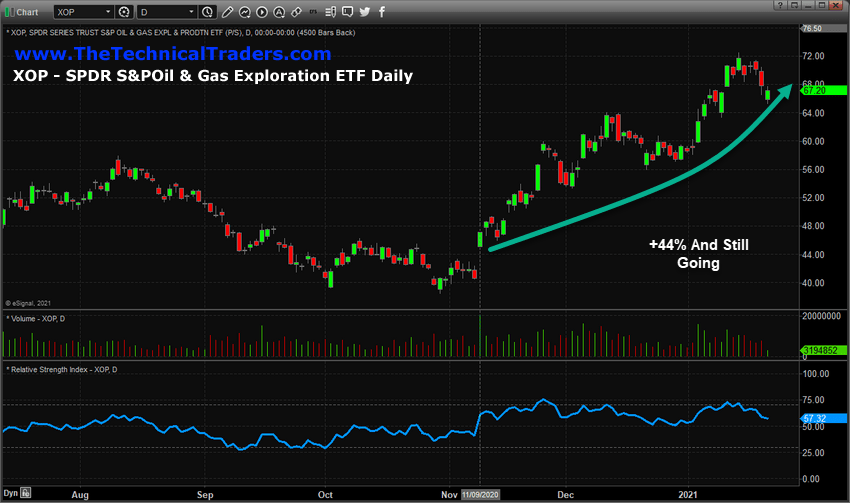

Energy and Exploration Setting Up For Another Move Higher

One of the biggest movers over the past few months has been the recovery of the Oil/Gas/Energy sector after quite a bit of sideways/lower price trending. You can see from this XOP chart, below, a 44% upside price rally has taken place since early November, and XOP has recently rotated moderately downward – setting up another potential trade setup if this rally continues. Traders know, the trend if your friend. Another upside price swing in the XOP, above $72, would suggest this rally mode is continuing.

Recently, we published a research article suggesting a lower US Dollar would prompt major sector rotations in the US and global markets where we highlighted the fact that the Materials, Industrials, Technology, and Discretionary sectors had been the hottest sectors of the past 180 days, but the Energy, Financials, Materials, and Industrials had shown the best strength over the past 90 days.

Technology, Healthcare, Financials, Energy, Consumer Products/Services, Foreign Markets have all been hot over the past 4+ months, but what is trending right now? We believe the best performing sectors are likely to be sub-sectors of the SPY and QQQ. My research team and I believe Technology and Energy still have lots of room to run. Financials could be a big winner too if the recent upside trend continues. We rely on the BAN Hotlist to rank the “Best Assets Now” and tell us when new trade entry triggers are generated.

In short, 2021 is going to be an incredible year for BAN Trader subscribers because of the big trends, high volatility, stimulus, and policies with the Biden administration. The time is now to learn and trade the Best Assets Now Hotlist using our proven sector rotation strategy. Our BAN Trader Pro strategy is proving to be an incredible advancement that allows us to dominate and generate Alpha. We urge you to take advantage of the BAN Trader Pro technology and prepare for the big trends that we expect to continue throughout all of 2021 and into 2022 and beyond.

I am teaching my BAN trading strategy in a 1-hour FREE webinar. The webinar is 100% educational and you will get everything you need to trade my powerful strategy on your own, with no proprietary trading tools or indicators, and with no strings attached. Learn this strategy now and join me in my webinar at https://joinnow.live/s/EPdGTI.

Enjoy the rest of the weekend!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com