Silver May Rally Above $39 On Range Breakout

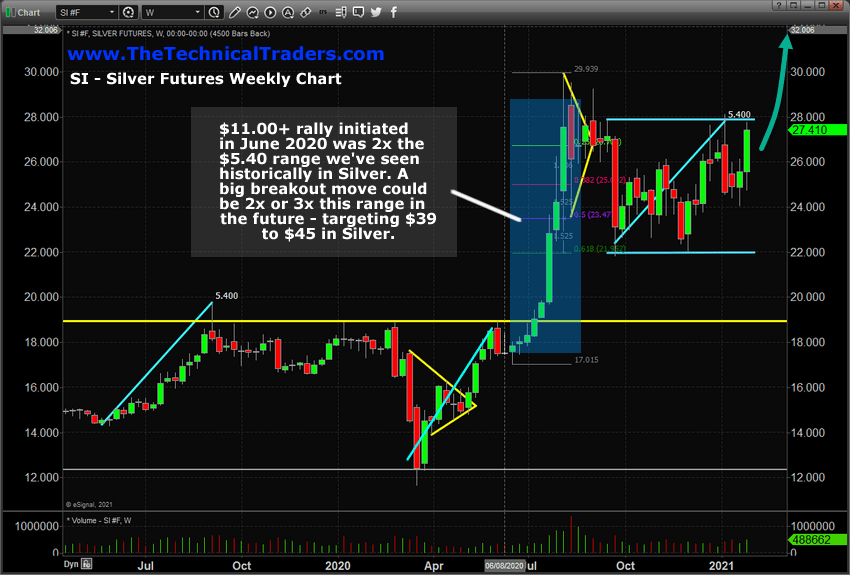

Nearly 6+ months ago, our research team highlighted a unique price range that appears to be repeating itself in Silver. This price range consists of a $5.40 bullish or bearish price phase. Using our 100% measured move techniques, we’ve seen silver move higher and lower by this range over the past 10+ months and, quite interestingly, the current sideways price range in Silver is almost exactly a $5.40 range. After a bit of research related to the explosive upside price move in June 2020, where Silver rallied from $17.75 to levels over $28.75 – an $11 Candle Body Range (nearly 2x the $5.40 range), our researcher team believes the next breakout move in Silver may be another 2x or 3x rally – ranging from an $11+ rally to a $16.50+ rally. This suggests a potential upside price target in Silver near $39 to $45 if our research is correct.

Potential Silver Blastoff Once Price Clears $30

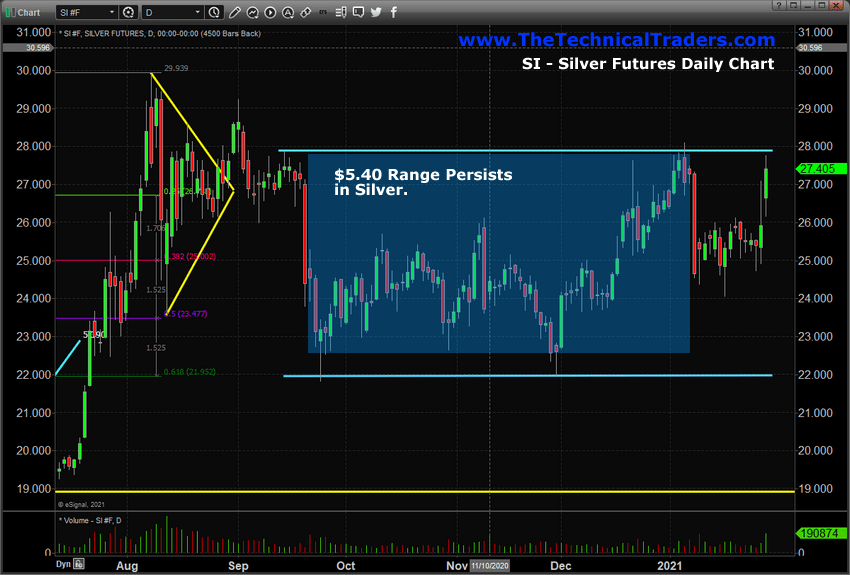

This Daily Silver Futures chart highlights the continued $5.40 range that has “bound” silver over the past 4+ months. The peak in price, near $30 represents the high price level that would have to be breached if any breakout attempt is confirmed. Initially, we expect to see the $28 (upper channel) level breached, then we need to see the $30 breached as the breakout move continues/confirms.

The news that the Reddit group is targeting Silver, as one of the most heavily shorted markets on the planet, suggests we may see a very explosive move higher in the near future if enough pressure is put on the shorts to present a real short-squeeze. The other interesting facet of this setup is that Silver has already initiated a bullish price phase while the global markets appear to be in a Depreciation phase. My team and I have written about this in a previous research article entitled Long Term Gold/US Dollar Cycles Show Big Trends For Metals – Part II.

If our research is accurate and correct, the combination of the Reddit targeting, extreme short positions, longer-term Depreciation cycle phases and the current Bullish Silver price phase may prompt a very big and explosive breakout move once Silver prices clear $30.

Reddit Focuses Attention On Silver – What Next?

The interesting component to all of this is the renewed focus on extremely heavily shorted symbols because of the Reddit group. Silver was trading near the middle of the $5.40 price range and price was stalling/declining price to the sudden shift by the Reddit group. Maybe this renewed focus in the Silver short positions focused the broader market into the unique setup that has continued in Silver over the past 12+ months – a rallying market in a Depreciation phase with a very heavy short interest. It has all the makings of a potentially very big upside break move.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Recently, if you’ve been following my research, I have been expecting a shorter-term downward price trend in Silver – with a longer-term outlook still Bullish. After reaching the peak of the channel in late December 2020, I expected Silver to move a bit lower before building enough momentum to attempt a breakout move. Now that a renewed focus on Silver has taken over, there is a very real potential that a breakout above $28~$30 is in the works – possibly initiating a very explosive upside trend.

The last explosive upside move in Silver, from June 2020 to August 2020, only about 90 days, prompted an $11.50 to $12.50 rally (about 2x the $5.40 range). This next upside breakout trend may see a similar, or larger, scale of a price advance – targeting $39 to $45 (or higher).

In short, any breakout above $28 to $30 may prompt a very big upside price advance. Any failure of this breakout attempt will likely prompt a downside price move to levels near $24 to $25.50 (again). This renewed attention into Silver, one of the most heavily shorted commodities on the planet, may prove to be an incredible opportunity for traders – possibly pushing miners and other precious metals much higher over time.

As a reminder, this increased volatility and price range will create some opportunity for euphoric enthusiasm by many traders. Please don’t get caught up in all of the hype. This may be a once in a blue-moon setup in precious metals because of the renewed focus on Silver. It may also prompt a big pullback move after any rally attempt. Play this smart – don’t get caught up in the hype.

2021 is going to be full of these types of trend rotations and new market setups. Quite literally, hundreds of these setups and trades will be generated over the next 3 to 6 months using my BAN strategy. You can learn how to find and trade the hottest sectors right now in my FREE one-hour BAN tutorial. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

Don’t miss the opportunities in the broad market sectors over the next 6+ months. For those who believe in the power of relative strength, cycles and momentum then the BAN Trader Pro newsletter service does all the work for you in determining what to buy, when to buy, and when to take profits. You will be kept fully informed of the market with my short pre-market report every morning along with the BAN Hotlist for those looking for more trades.

Have a great weekend!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com