Russell 2000 ETF Initiates New Rally Trend

Last week my team and I alerted our readers to the current trends and shifting sectors that are getting hotter every day. Technology, Energy, Financials, Industrials and others are experiencing bullish trends we haven’t seen in years. The Russell 2000 ETF, URTY, is starting a new breakout uptrend just after our BAN Trader Pro system suggested the SPY may initiate a new bullish rally. You can read relevant research posts here: RECENT TRIGGERS IN THESE SECTORS SUGGEST US STOCK MARKETS MAY ENTER A RALLY PHASE and TECHNICAL TRADERS ARE USING THE BAN HOTLIST TRIGGERS WITH HUGE SUCCESS USING REGULAR ETFS, LEVERAGE ETFS, AND OPTIONS.

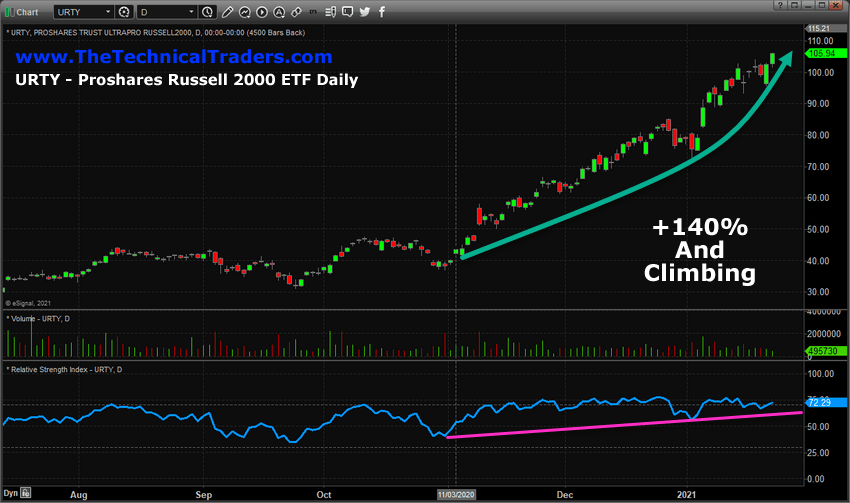

As we can see in the chart below, the Russell 2000 has been one of the top performers since just after the November 2020 elections. Originating a breakout trigger on November 3, near $43.46, and confirming a “New High Breakout” on November 9, near $51.37, the Russell 200 sector has been rallying very strongly over the past 60+ days. The current “New Price High” breakout suggests this rally may continue. Fibonacci price extensions show a peak may target levels near $125~$130 – nearly 20%+ higher than current prices.

These sector trends that initiated in early November 2020 are a result of capital being deployed in sectors that are expected to benefit from new policies, Q4:2020 earnings, and renewed investor interest in 2021. Billions in capital have been redeployed into the markets with very high expectations. This will result in big trends, increased volatility and even more opportunities for efficient traders. My Best Asset Now strategy that I teach to you for free helps you find these hot sectors and ride them out for explosive gains.

The strength of this uptrend in URTY, breaking above the January 2020 highs, suggests any continued rally from this point may be reflective of the incredible -$80.34 collapse that took place as a result of COVID-19. Using this range as a basis for future upside price expansion, Fibonacci Price Theory suggests a $130 to $141 upside target level. If these levels are accurate, we may see another 25%+ upside move in the Russell 2000 ETF, URTY.

With so much opportunity in ETFs and other stocks/sectors, it is important for traders to be able to identify the best setups, triggers and trends. Our BAN Trader Pro newsletter service is designed to help you accomplish that with our easy to follow trade alerts and my daily pre-market report. The daily BAN Hotlist, also included in the BAN Trader Pro newsletter service, provides a very clear ranking and trigger system that shows you to trade the very best trend setups given their relative strength and momentum for more active traders who want to enhance their own strategies.

One of our members recently wrote us this email:

Hello –

I want to share a success story but do not want my real name shared (you can use my first name – “Dave”)

I signed up in late December and have taken 7 trades using the BAN system. I did get into HAIL and SILJ not on a new system signals but as part of the “pre-launch” of the actual BAN system that started in January. All 7 trades I exited in profit. I’ve been using the signals to go in and out of swing trades as “New” alerts are added. I’m looking forward to the market turning over and entering into 3 trades at the top of the lisr (sic).

…

I signed up for the quarterly plan at $250 per quarter, that means I have already gotten a 2,189% ROI on my initial investment. I’ve more than paid for my subscription for the whole year 5x over in 1 month.

Chris – Thank you very much for setting up this system. It is easy to use, easy to understand and frankly gives you great entry signals. I very much like quick in and out trades in addition to the longer horizon trades that you teach. Just waiting for the market to turn over to get into those trades and use your system but in the meantime, your signals are giving great entry points.

Dave, sent by email on January 21, 2021. Dave’s public review can be found at The Technical Traders – Verified Reviews.

I publish these articles and research posts to teach our readers the importance of using efficient trading strategies to grow their wealth, achieve financial goals, and have more free time. 2021 is going to be full of great trading opportunities for those who know how to take advantage of sector rotations, relative strength and momentum. Quite literally, hundreds of these setups and trades will be generated over the next 3 to 6 months for those subscribers using BAN strategy. Sign up now and I will teach you how to create and trade your own hotlist in my FREE (less than) one-hour tutorial on the Best Asset Now.

For those that don’t have the time to research and create their own BAN Hotlist, you can get my Hotlist, research, and trade alerts delivered to you with the BAN Trader Pro newsletter service. Subscribers of BAN Trader Pro will also receive my daily pre-market video where I walk through the charts of all the major asset classes, my BAN Hotlist, and other trade setups and things to watch out for in the markets. You owe it to yourself to see how simple it is to only trade the Best Assets Now to generate incredible results.

Happy Trading!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com