Next Big Nevada Gold Discovery Play w/ American Eagle Gold’s CEO Tony Moreau & Chair Stephen Stewart

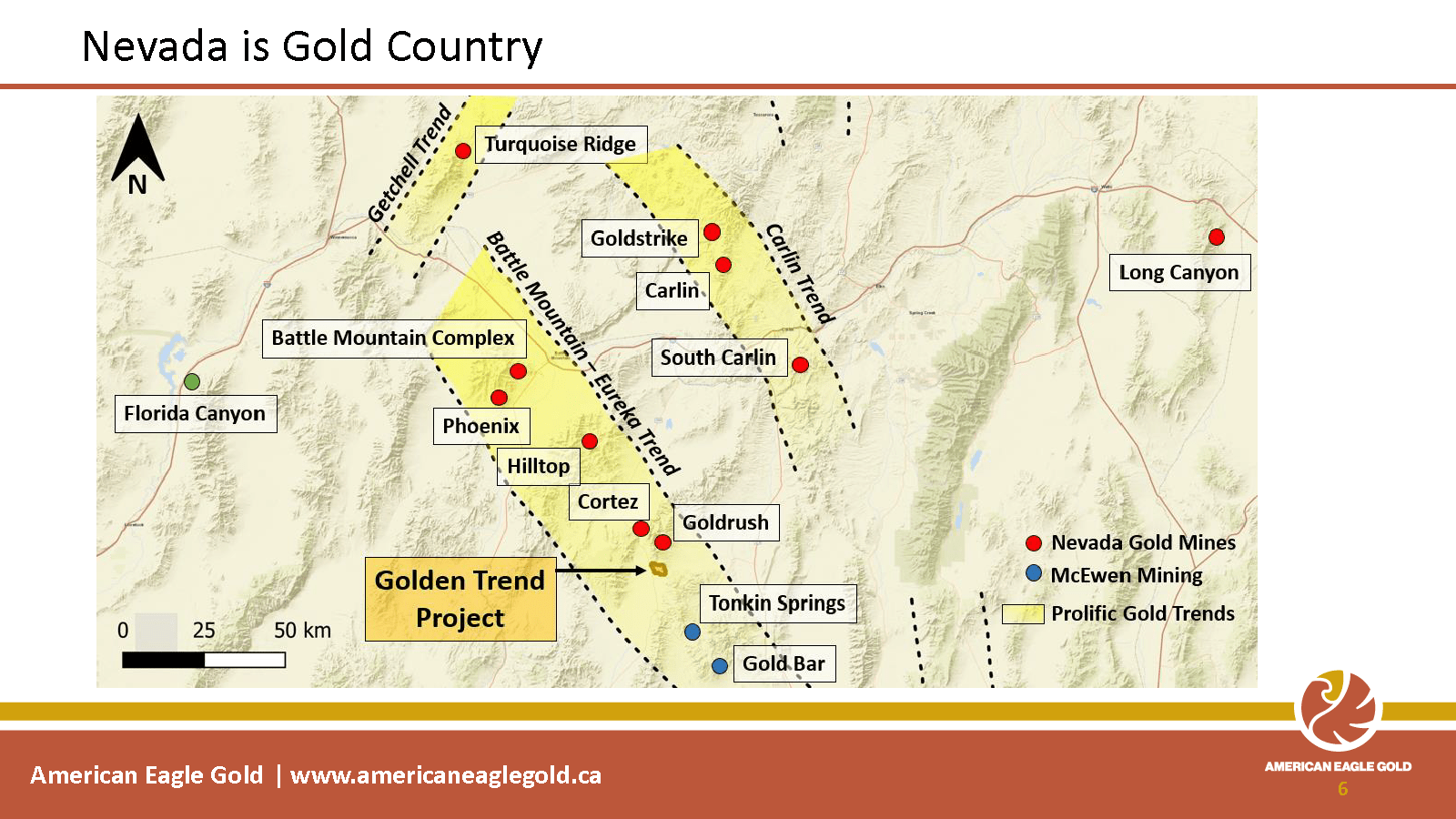

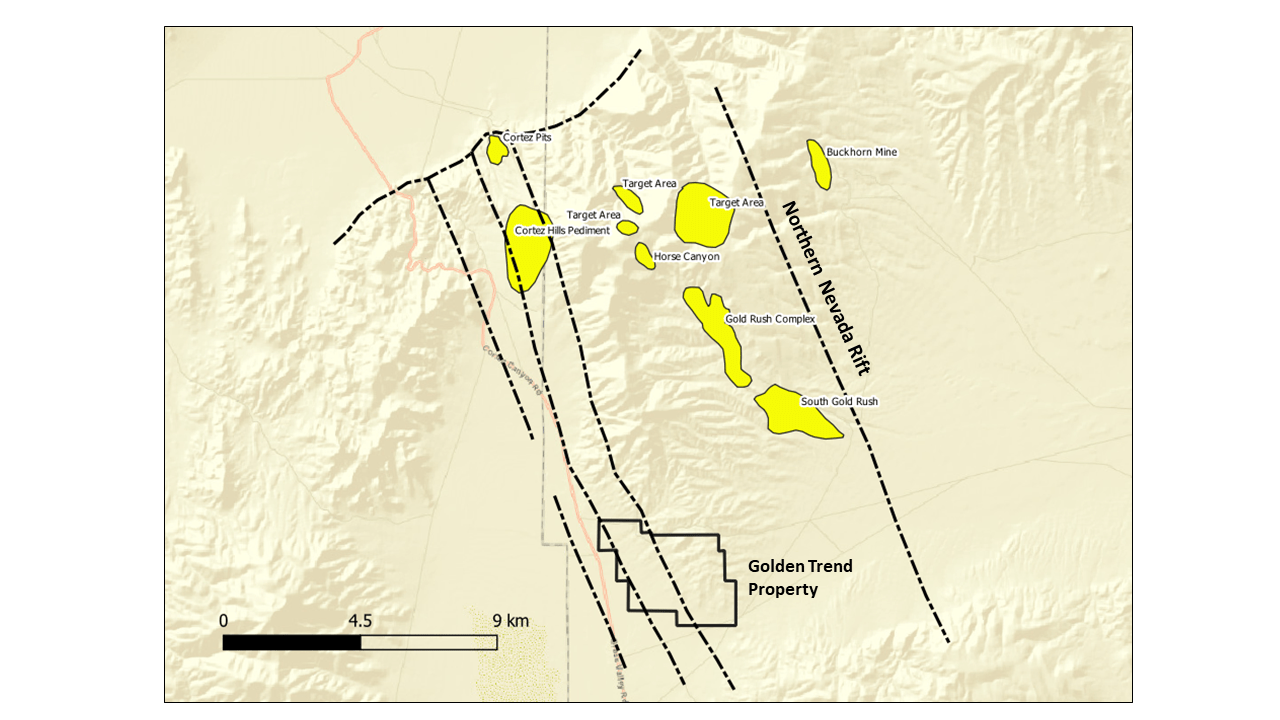

American Eagle Gold (AEG) is focused on exploring for a world-class gold deposit on its flagship property, Golden Trend. The property is located on the Cortez Trend, next door to Barrick Gold and Newmont Mining’s Gold Rush and Cortez Mine, which host over 27 million ounces of gold. The company plans to drill and advance its relatively unexplored property and continue to focus on acquiring and advancing gold projects in the area. American Eagle Gold’s pre-IPO financing is scheduled to close February 8th and the company aims for a March 2021 IPO. Drills are expected to be turning on the flagship Golden Trend project in H2 2021. In this interview Chair Stephen Stewart and CEO Tony Moreau describe AEG’s investment value proposition, upcoming milestones and plans for growth.

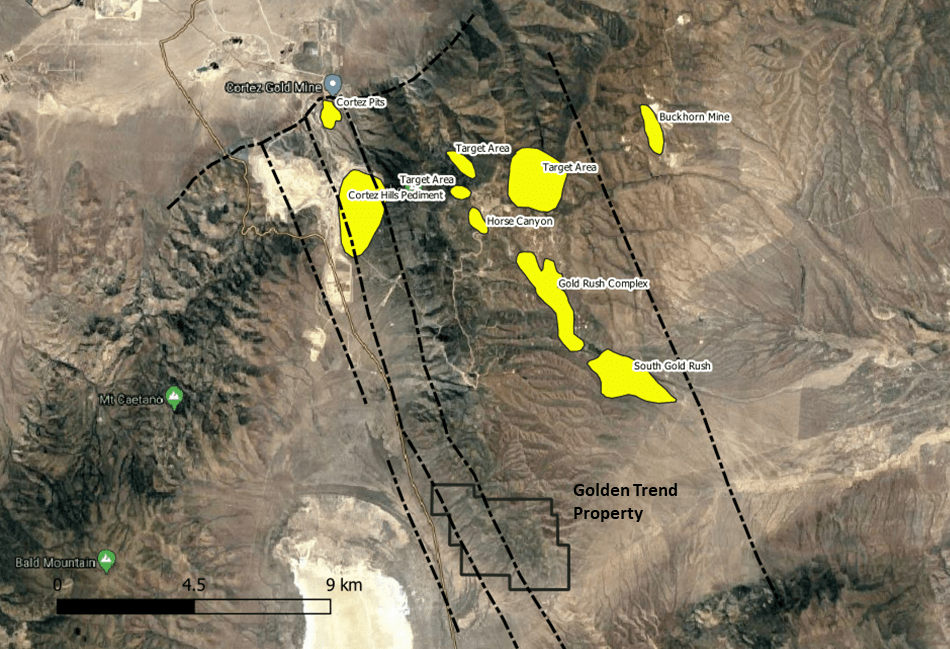

American Eagle Gold CEO Tony Moreau stated, “Where our property is, it’s right next to the Goldrush deposit. What’s the Goldrush deposit? It’s coming to production in 2021…it has 15 million ounces of gold in the ground, averaging 10 grams per ton. It’s the biggest and best new gold property that’s coming online in the world right now. So where better to be than five miles next door to this property? If you look right now, there’s seven of the largest 30 mining properties in the world are located either in the Cortez or Carlin camp. Three of those properties located in the Cortez camp, and Pipeline, Cortez, and Goldrush. We’re right next door. We’re on the same fault system as Cortez. So people say finding gold is very tricky. Well, at least we’re taking our chances of finding it a lot better. We’re right in elephant country, and I believe that we’re going to find it.”

0:00 Introduction

1:17 Overview & why Tony was brought on as CEO

4:55 Pre-IPO financings & company structuring

6:05 Tony’s vision for AEG & investment value proposition

10:57 How soon will the drills be turning?

12:40 AEG plans for growth

13:36 Treasury & share structure

14:50 What differentiates AEG from other Nevada gold explorers?

17:05 Stephen’s final thoughts

TRANSCRIPT:

Bill Powers: In today’s show, you’re going to be getting an overview of a new exploration company, Nevada focused, in the States. This is part of the Ore Group, which is a sponsor of Mining Stock Education. And I will be participating in the IPO financing upcoming that you’re going to hear about. The company’s name is American Eagle Gold. The website is AmericanEagleGold.ca. And I also will be dividend some shares of this company as Orefinders…we featured that company in the past, and I’m a shareholder. Orefinders owns a significant stake of this private company soon to IPO. So joining me today is Stephen Stewart, who is in charge of the Ore Group, as well as Tony Moreau, who is going to be the new CEO. So, Stephen, I like to start with you please. Gentlemen, welcome onto the show. Give us a high level overview of this potential investment. And Tony is your friend. You brought him on as the CEO. Why is Tony qualified for this position?

Stephen Stewart: Well, good morning. Thanks Bill. And I’m very pleased to be here to talk about American Eagle Gold and, of course, introduce Tony, who’s going to be running the show on this. American Eagle Gold is a private company, of which Orefinders is a major shareholder. We own 10 million shares, which is about a little over 30% of the company. And as you mentioned, as part of American Eagle’s going public transaction, we’re using the exact same model we used with QC Copper, which like American Eagle Gold, Orefinders was a shareholder. And so how we will be going public, it’s a very cheap and efficient way of doing it. We sort of pioneered this model where we dividend out, or Orefinders will dividend out it’s American Eagle Gold shares directly to Orefinder shareholders, and that creates our 200 person board lot distribution, which is part of the going public process.

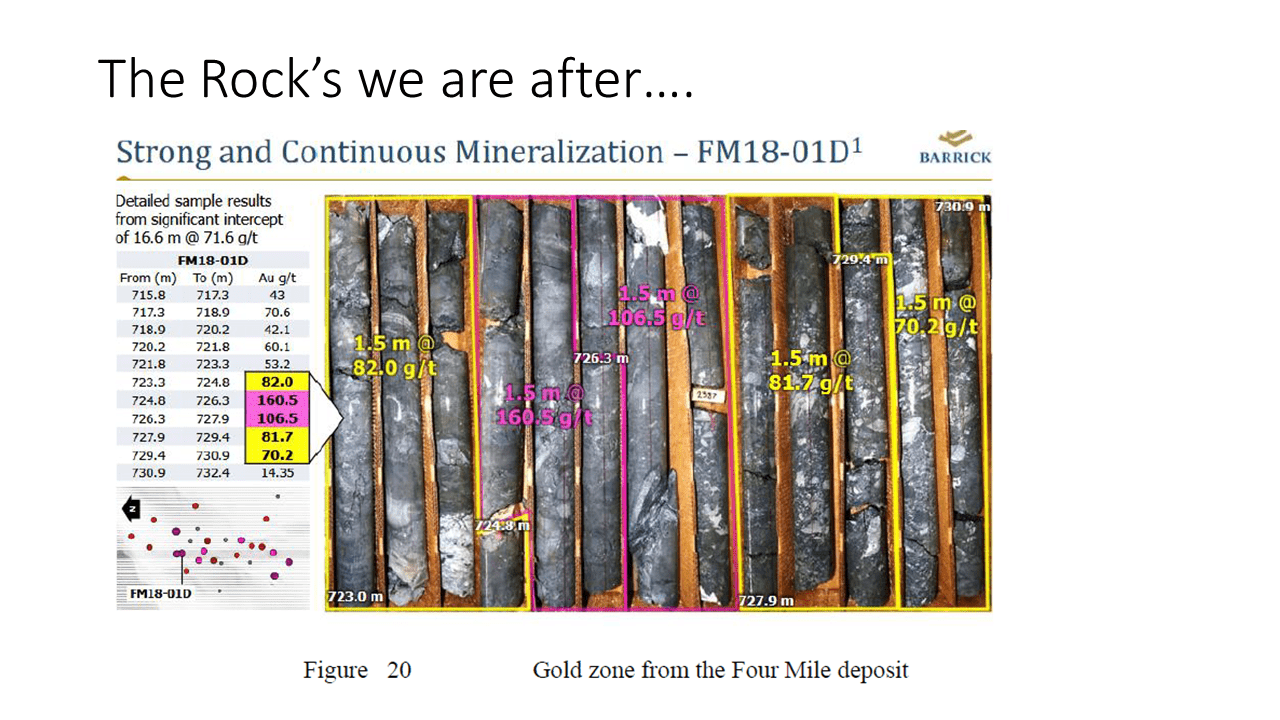

And we jump through a couple other hoops, close the financing, and then we have our listing on the Toronto Venture Exchange. There’s no shells. There’s no CPCs, there’s no full prospectus. It’s very friendly from Orefinder shareholders’ perspective, who it’s very rare for a junior to be giving a dividend, and it’s cheap from American Eagle’s perspective. And so that’s a little bit about the process and what we’re doing in the first two months of 2021. The company itself is the latest incarnation of us trying to create value for shareholders, this time, doing it exclusively in the Great Basin, more specifically in Nevada, which is fantastic jurisdiction. And even more so specifically, we’re in the Cortez Trend, our flagship projects with the Golden Trend, which is adjacent to a Barrick-Newmont’s Goldrush deposit, which is a 15 million ounce, 10 gram deposit. We’re in those rocks. That’s what we’re looking for: high risk, high reward on this type of exploration.

And as you mentioned, I brought in a gentleman by the name of Tony Moreau, who’s here today, of course. And I’ve known Tony for five years. He was most recently in business development for IAMGOLD. He was introduced to me by Steve Letwin, who is the outgoing CEO of IAMGOLD. Tony was sort of his protege, and Steve nominated him for the Peter Munk award a number of years ago, which is for the best mining entrepreneur in the industry. And that brought Tony to my attention. And he and I became, as a result of that, fast friends. And since then, he and I have been instrumental, were two of the key people behind growing Young Mining Professionals, most specifically it’s scholarship and charity, which gave away $300,000 in 2020. And so I’ve developed that trust with Tony.

This American Eagle Gold is sort of using the Baselode Energy model where I find a great project, and most importantly, great people, And I put them in there, and I get the Ore Group behind them, and we back, them finance them, and we manage everything. And we go, and we look to find deposits with Tony at the helm and Dave Shadrack as our VP Exploration. I think American Eagle’s in a really good position for 2021.

Bill: Stephen, one more question before we hear from Tony. As we talked about in our previous interviews, I like for my audience to know what went on in terms of share structure and how you obtained your shares prior to the IPO. Because as you agree with me, there’s a lot of funny business in the mining sector where management can put together a team in order to take advantage of unsuspecting potential shareholders, but that’s not your goal here. So could you go over a little bit about how you put together the company before this IPO?

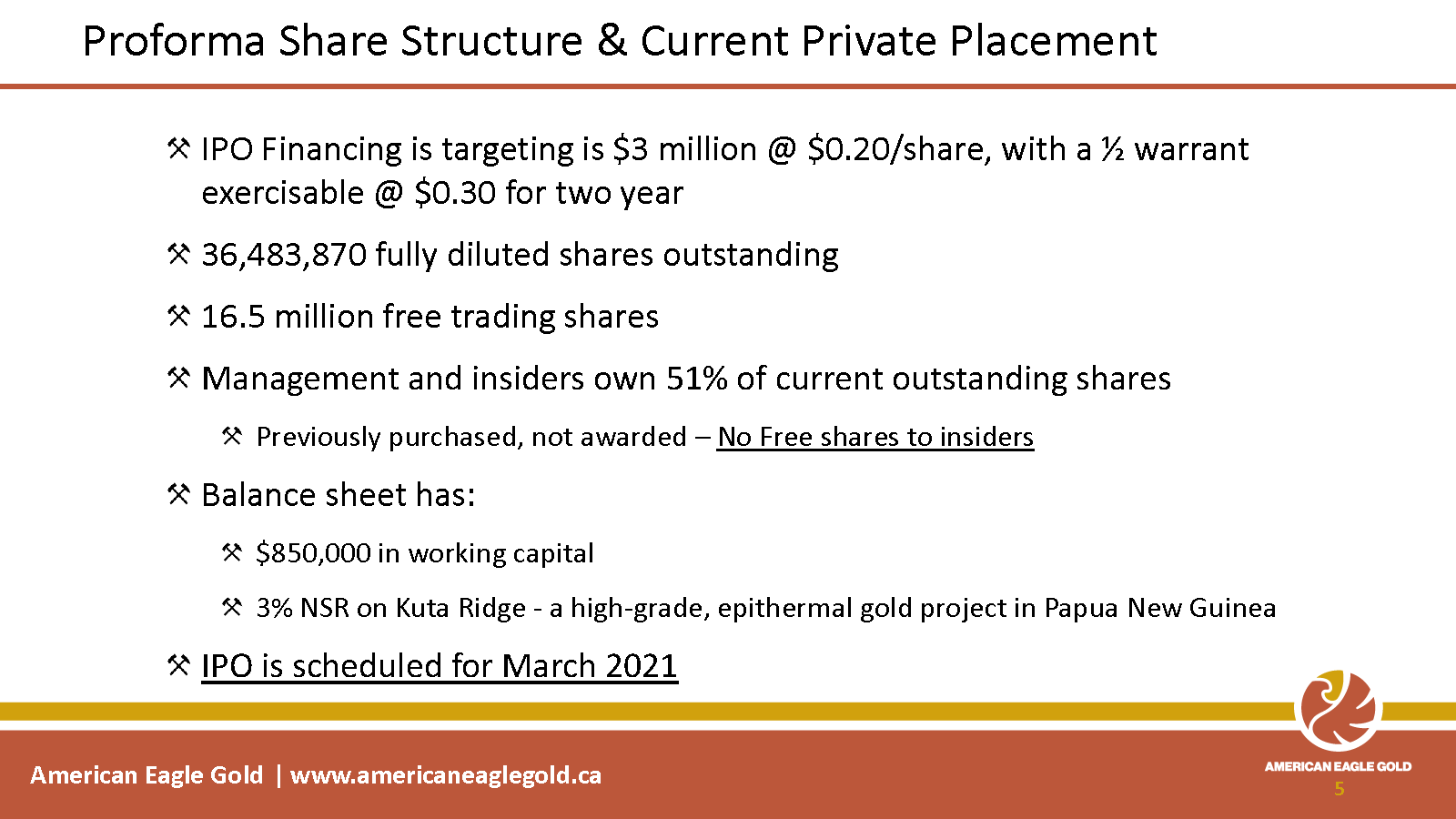

Stephen: There are absolutely no free shares that have gone to anybody in American Eagle Gold, period, full stop. There have been two financings. The first one was in 2019, was at 5 cents. I participated in that round. There was a second round at 10 cents completed earlier in 2020. I participated in that round. And then we’ve got this IPO round, which is live and closing in the near term. We’re doing it at 20 cents with a half warrant at 30 cents for two years. So that is its capital structure. There are no free shares whatsoever, and I participated in every step of the way.

Bill: Tony, welcome onto the show for the first time. How about you start by giving us your vision for American Eagle Gold and how you plan to advance this company?

Tony Moreau: Well, first of all, Bill, thank you very much for having me on the show. I spent close to 10 years with IAMGOLD. It was an amazing company, amazing people. I learned a lot, but I really thought that I needed an opportunity to spread my wings, advance my leadership, and really make some people a lot of money, make myself some money, and find a world-class deposit. So where better to find a deposit that elephant country in Nevada? Nevada produces 80% of the United States gold. Approximately 5% of the world’s gold production is located in Nevada. And predominantly, most of this production comes directly in the area where property is. So we’re looking for gold. I think gold is going to go up in 2021. You look at the last five years, gold’s averaged about 13% return. For the last 15 years, it’s average 11% return. 2020, it averaged close to 25%. 2019, it averaged 20%.

I see nothing but gold going up. I want to be involved in a gold company, and who better to be involved with than Steven Stewart and his team. Steve’s team has a great track record. They have a great team behind them. Even though different people handle different companies, It’s all hands on deck. And what I like best about the company was their cost approach. They’re very frugal with their money. We put maximum amount of money into the ground. I give this example a lot, and let me give it to you really quick. Look at the average junior mining company. You might have a CFO. How much does that CFO make? Let’s say $140,000. Now that goes to the bottom line. That costs money for the company. Now let’s be honest, that’s not a full-time job. You can actually spread that cost across different companies.

So what the Ore Group does, it does a cost sharing approach. And we put that philosophy, and we look after our shareholder money, and we try and get maximum return. And maximum return right now is just putting drills in the ground and hopefully finding a deposit. Where our property is, it’s right next to the Goldrush deposit. What’s the Goldrush deposit? It’s coming to production in 2021. As Steve mentioned, it has 15 million ounces of gold in the ground, averaging 10 grams per ton. It’s the biggest and best new gold property that’s coming online in the world right now. So where better to be than five miles next door to this property? If you look right now, there’s seven of the largest 30 mining properties in the world are located either in the Cortez or Carlin camp. Three of those properties located in the Cortez camp, and Pipeline, Cortez, and Goldrush.

We’re right next door. We’re on the same fault system as Cortez. So people say finding gold is very tricky. Well, at least we’re taking our chances of finding it a lot better. We’re right in elephant country, and I believe that we’re going to find it. What interests me about this property more than anything, now think about it, we have 925 hectares of land. What is that in relative term? Hectare to me doesn’t mean anything. What does it mean to the average person? I love football. That’s 1,725 football fields. Now, if you look at that property, that’s roughly three kilometers by three kilometers. Do you know how many times, Bill, that land has been drilled by core deep?

Bill: A few, right, about 30 years ago if I remember from the presentation?

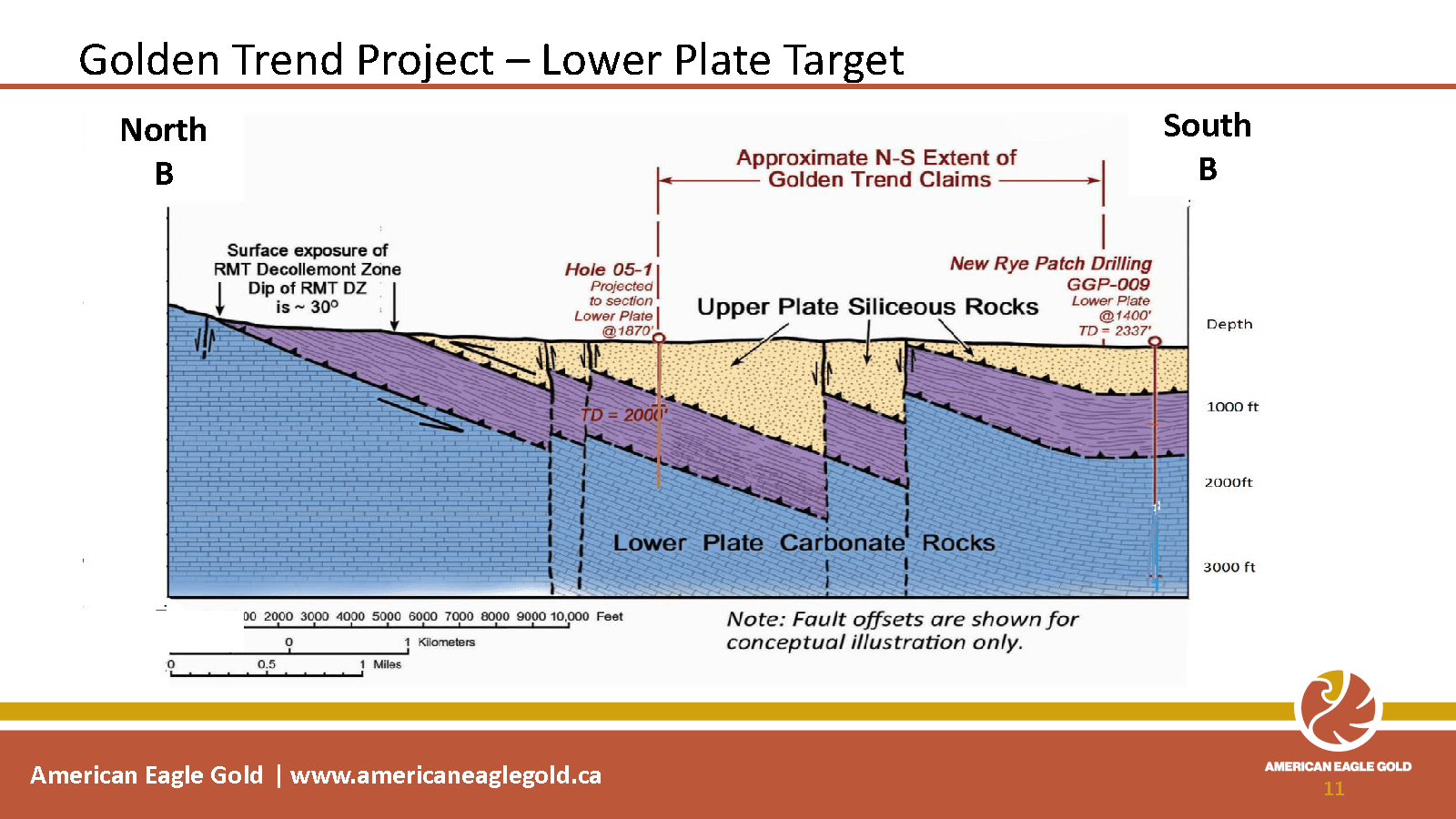

Tony: So it’s been drilled a few times. Most of it was RC drilling, very shallow holes. Now there’s been three deep holes drilled. Two of them were core holes. One of them was an RC hole. The two core holes that were drilled by Kinross, who owned the project for only 17 months from late 2016 to late 2017, one of those holes actually got confiscated by Barrick. It went onto their property. So we never knew what that was. Their other holes are RC holes. So it actually doesn’t allow you to analyze the geology. The only core hole that’s ever been drilled there was drilled in 2004, 16 years ago.

So right now, we’re in elephant country with exactly one hole drilled at depth. So we have a huge amount of land. And our full focus right now is to find the lower plate rocks, analyze the geology, and then drill more holes to hopefully find a world-class discovery. Now 1,700 football fields, that is bigger than any of the mines in the area. So I believe we have a good size of deposit. And I believe once we go public, we can focus on hopefully expanding our land package and finding other good mines or properties in the area.

Bill: You’re on a prolific trend. And your presentation also indicates that you’ve done work at surface and also a gravity survey. So talk to us about how soon you’ll be able to develop specific drill targets. And when should investors expect the drills to be turning?

Tony: What’s really interesting about this property, look, there’s a lot of companies out there, and people claim they have many, many geologists at the company. What we have is one geologist. His name’s Dave Shaddrick. He’s one of the main reasons why I decided to join the company. Now, David is head of the Nevada Mineral Exploration Coalition in Nevada. He’s a mining man. He’s from Nevada. He understands land. He’s owned this land since 1993. He’s staked it. He’s understood it. He’s been leasing it back and forth to different companies, which, may I remind you, there’s only been one drill hole actually drilled there. Dave knows this land better than anyone, and guess what he’s been doing for the last 27 years? He’s been finding the best places to drill. And now that gold’s at a price where it is economically drilling into the lower plates, he’s identified some very good drill holes. I’ve spoken to him. So right now, we need to get through the permitting process, which takes approximately 30 days. And then we’ll drill a couple of initial holes, hopefully get to the lower plates and analyze the geology.

Bill: So in the first half of 2021, we could expect to see the drills turning. Would that be fair to say?

Tony: That’s fair to say, correct.

Bill: Okay. And the IPO is February 8th…

Tony: Sorry to interrupt you, Bill. So in March, we’re planning to raise the money by February.

Bill: February, we have to raise the money. IPO in March. Thank you for that clarification. So you’re have one flagship project. Is this going to be the majority of the focus for 2021, or do you have anything else in the works?

Tony: Well right now, in order to go public, to make it feel painless as possible, we have an asset of going concern. Now this is an asset that we’re obviously still going to focus on, but once we are public, once we have money in the treasury, we will obviously be looking at other locations. We obviously want to focus in the Great Basin, Idaho, Arizona, and Nevada, and hopefully expand our land package as well. But until we’re public, we were going to focus on the Golden Trend. And I promise we will be drilling some holes there. And I hope to find a gold discovery there. We’re not here for a 10% return here, a derivative on the price of gold. And our plan is made everyone a lot of money and hope they have a 5x, 10x return.

Bill: When the financing closes on February 8th, how capitalized will the company be? And can you talk to us also about the amount of shares out? What can investors that are looking to buy in the open market expect?

Tony: So let me get back to our balance sheet. So right now we have approximately $125,000 of cash. We also have 5 million shares of Orefinders’ stock. Orefinders is creating at the 15 cents. So we have 850,000 in our working capital on our balance sheet, which is pretty good for a pre-IPO company. In addition, we have a 3% NSR of Kuta Ridge property that’s located in Papa New Guinea. I believe that also has some value. We’re not sure what we’re going to do with it, but just wanted to give you the quick highlight of what our working capital currently looks like. Currently, right now, we have 36.4 million shares outstanding. No shares have been given away for free. And we were planning to raise $3 million at 20 cents a share with a half warrant available for two years. So at $3 million at 20 cents a share, we’ll be issuing 15 million more shares. So we’ll have 51 million and change shares outstanding once the IPO happens.

Bill: Tony, I know that this trend that you’re on is amazing. I was actually there last year on top of a mountain, 9,000 feet, looking down at Cortez Hills. So I know that a mineralization event occurred in this area however many years ago. But when I was looking down upon this project, another newsletter writer was with me, and he said, “This is a amazing neighborhood. However, it’s still like finding a needle in a haystack.” So why would an investor with this perspective and there’s truth in what they’re saying, go with American Eagle Gold versus another Nevada explorer?

Tony: Well, our land package is directly adjacent to Barrick’s land package. We are attached to them. We are as close as it gets to world-class mines. A needle in a haystack, that’s the same case for pretty much any junior exploration mining company. What we can tell investors is that our junior exploration company is located in the best jurisdiction in the world. The jurisdiction next to Witwatersrand in South Africa has produced the world most gold. So I think that it’s a really great opportunity for investors. And like I said before, it’s a derivative on the price of gold. Now, if you look at the history of gold in Nevada, one of the largest immigrations in the United States actually was the 200,000 people that walked in the mid 1800’s across Nevada to get to California during the 49ers Gold Rush.

And guess what They walked over? They walked over Cortez. They walked over Goldrush. They walked over Pipeline. So this gold discovery wasn’t discovered until 1961 by Newmont’s John Livermore, took over a 100 years. For the rest of the mines in the area to be profitable, it wasn’t until the 1980s. So look, if 200,000 people can walk over the biggest gold deposit in the world, I’m guessing that a few companies can maybe overlook the Golden Trend opportunity. But again, we’re not going to put all of our eggs in one basket. We’re going to explore, do our proper due diligence. But like we said, we want to expand our land package; we want to diversify, hopefully look for other opportunities.

Bill: Thank you, Tony. Stephen, you’ve been listening to this discussion. Anything you want to add in light of what we’ve been chatting about?

Stephen: Oh, well, I think Tony did a great job, and I’m excited for his leadership, and he’s going to have our support. I think the only thing I’ll add is that I hope that our shareholders in AEG, well, they can expect accretive transactions outside of exploration. We’ve done all sorts of interesting acquisitions this year in our portfolio, and they can expect us to do the same sort of work that we’ve done in the other, such as Baselode and QC Copper into AEG. So 2021 is really the year of the drill bit. We spent 2020 putting ourselves together, raising capital. We’re going to put steel into the ground, across the portfolio, and absolutely in Nevada. And we’re going to see what happens, but I’m excited.