Four Stocks To Own In Leading Sectors – Part II

In this second part of our revisit of the stock picks we made on October 23, 2020, I want to focus your attention on the broad sector trends that have set up and continued since just before the November 2, 2020 elections. We have seen broad sector rotation over the past 2 to 3 months that suggests the markets are shifting capital away from previously hot sectors and into sectors that are poised for growth in 2021.

On October 23, 2020, my team and I picked four stocks from various sectors as “Four Stocks To Own Before The Elections” in an attempt to illustrate how optimism related to the election outcome could prompt strong trends in various sectors. The four stocks we selected were:

| AAL | American Airlines | Travel/Leisure |

| ACB | Aurora Cannabis | Cannabis |

| GE | General Electric | Industrial/Specialty Industry |

| SILJ | Junior Silver Miners ETF | Precious Metals Miners |

We believed each of these markets sectors presented a very strong opportunity for upside trend strength whereas each of these stocks had been forming a deep, extended bottom setup prior to the election. Our intent was to identify opportunities for traders to profit from identifying broad sectoral rotation opportunities early.

Obviously, Travel and Leisure, Cannabis, and Industrial sectors are contingent on a number of factors for growth. Each of these sectors was selected for various reasons by our research team. My team felt very strongly that in 3 to 6+ months renewed optimism would prompt a moderately strong rally in these stocks while the Junior Silver Miners position would act as a hedge against moderate risk.

Travel and Leisure require consumers to engage in business or vacation travel in the midst of the COVID-19 outbreak. Our thinking was that the holidays and the pending vaccines would generate renewed optimism related to travel. Additionally, we expected early 2021 to be a year where people attempted to forget about the problems of 2020 and start the new year with optimism.

Cannabis requires the legislature to open up new markets and engage new consumers. The November elections did just that in multiple US states. This new opportunity suggests that a 20%+ increase in the US market is just starting to engage in the Cannabis sector.

Industrial components are essential to all types of infrastructure and building. That is why we selected this sector as we expected policy to engage in new infrastructure and repair of existing infrastructure as part of the stimulus package. Even a moderate increase in this sector would allow for 15% to 25% growth in certain stocks related to this sector. Let’s take a look at what has happened with Aurora, GE, and SILJ.

In each of these examples, we selected two target levels that were related to recent price ranges on the Weekly Charts. Target #1 (the MAGENTA line) was identified as a near-term target where we would pull 33% of our position. Target #2 (the RED line) was identified as a broader-range target where we would pull another 33% of our position (if this level was reached). After these two targets, we would leave the remaining 33% as a “runner” with a trailing stop level.

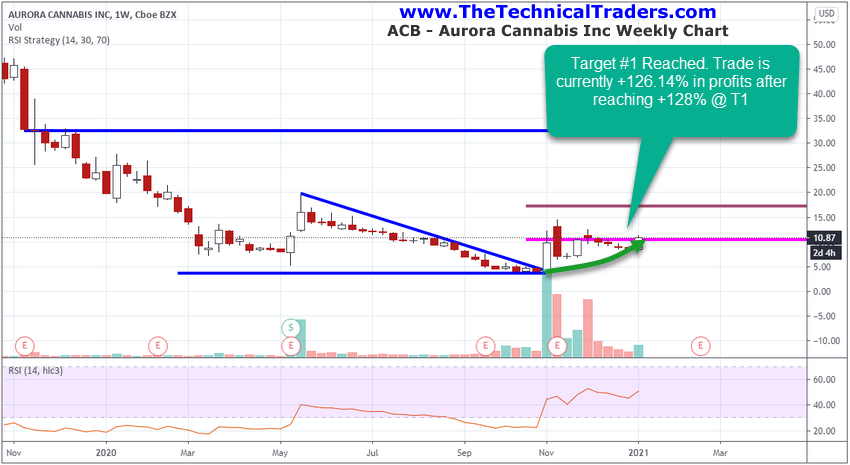

ACB – Aurora Cannabis

Aurora Cannabis rallied from the entry price level to nearly $15 very quickly after we made our initial entry. Traders would have had to deploy limit orders to secure the Target #1 exit as the BID/ASK spread for ACB was quite large as trends exploded upward. Still, it was easy for most traders to navigate the first target because ACB spent quite a bit of time above this level and continues to provide opportunities to “take profits” at a 110% to 125% range from our entry price.

Be sure to sign up for my FREE webinar that will teach you how to

find and trade my BEST ASSET NOW strategy on your own!

Even if traders decided not to wait for Target #2 – this has been an excellent short term trade given the speed and opportunities for traders to take that 100%+ initial target.

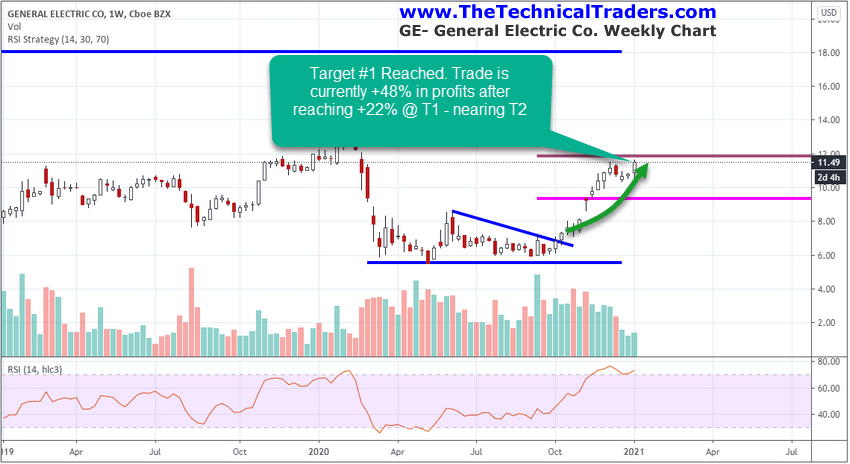

GE – General Electric

GE has continued to trend higher since our entry trigger. We expected the FLAG formation to prompt a moderate upside price trend and the rally that initiated after the elections prompted a very solid upward trend. Currently, Target #1 has been reached for a +22.77% gain and the remainder of the trade is nearing Target #2. Overall, this has been a very solid entry trigger and upside price trend for traders.

SILJ – Junior Silver Miners

Junior Silver Miners struggled for a while after the COVID-19 vaccine was announced. Price did hold our support levels and eventually rallied up to our first price target of 9.5% gain at which point we sold a portion of the position and moved our protective stop up to breakeven. SILJ recently sold off and trigger our protective stop as it fell to our entry price. While we wanted larger gains, we were only able to lock in 9.5% before closing the rest of the position for breakeven.

Remember, these types of sector trends happen all the time in various sector ETFs. Our BAN trading strategy (Best Asset Now) Hotlist helps us to identify these setups for traders/members. The strength behind the BAN Hotlist is that it allows us to not only see and trade these setups/triggers but also RANKS the sectors based on trend strength and momentum. This allows us to take trades in the best-performing assets all the time as new BAN triggers are generated.

Here is a recent example of a BAN trigger on a Daily and 10 Minute chart. This BAN Hotlist trigger was generated in a sector ETF in early January 2021 (see “NEW Trigger”). Since that trigger was generated, the ETF has rallied over 11% in just three days. Also, pay attention to the Previous Signal on the Daily chart. This is the previous BAN trade setup that prompted a 25.36% gain over a 30-day span of time. This is just one sector ETF with two trades over the past 45+ days totaling over 36% in gains.

2021 is going to be full of these types of trends and setups. Quite literally, hundreds of these setups and trades will be generated over the next 3 to 6 months using the BAN Hotlist. Don’t miss the opportunities in the broad market sectors over the next 6+ months. Sign up below this post for my FREE webinar that teaches you how to trade my BAN strategy yourself, or let my BAN Trader Pro service deliver the best trade setups to you along with my daily pre-market analysis by visiting www.TheTechnicalTraders.com/BAN.

Happy Trading!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com