Long Term Gold/US Dollar Cycles Show Big Trends For Metals – Part I

Over the past few months, my research team and I have published a number of articles suggesting a broader market depreciation cycle has set up in the US/global markets that may propel precious metals much higher over the next 5+ years. If you have missed these, then check out Gold And Silver Follow Up & Future Predictions For 2020 & 2021 – Part I and Part II, as well as my recent Kitco News interview with David Lin.

Today, we are going to explore the possibility of a continued US Dollar decline, targeting levels just above 80. Gold has continued to contract just above a key Fibonacci Price Amplitude Arc, which may further prompt a big rally in precious metals in the coming months. Let’s take a look at some charts…

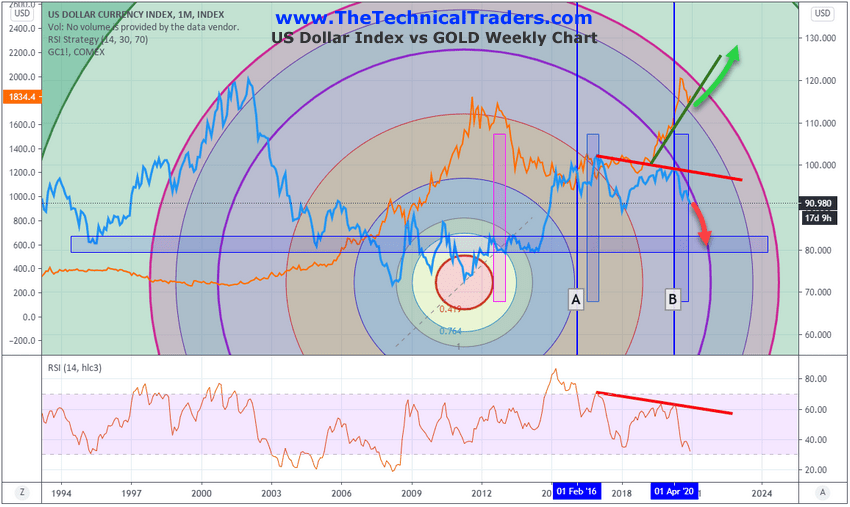

US Dollar Index vs. Gold Comparison Chart

The Monthly US Dollar Index vs. Gold Weekly chart, below, presents the US Dollar Index (in LIGHT BLUE) and Gold (in GOLD) and shows a key Fibonacci Price Amplitude Arc anchored at the 2011 bottom in the US Dollar Index. This is a key date because it was also near the peak in the Gold price rally after the 2008-09 Credit Crisis event.

This first chart highlights two key factors relating to Gold and the US Dollar:

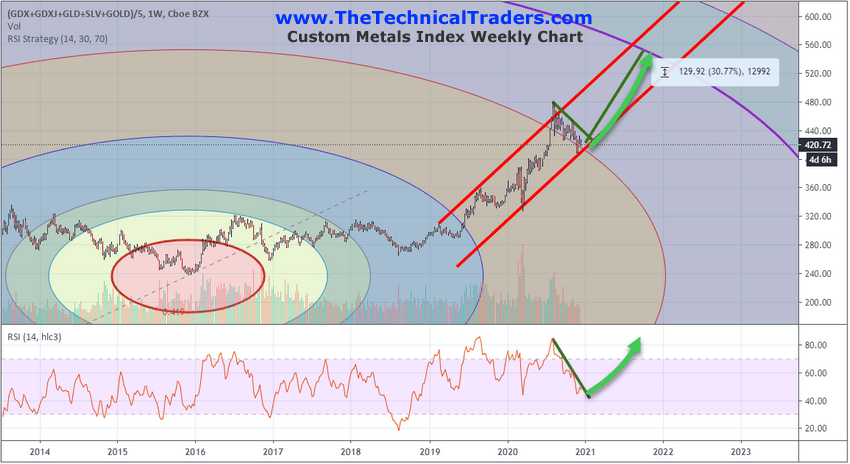

- The US Dollar Index has weakened dramatically since the March 2020 peak and has continued to decline along the heavy dark purple Fibonacci Price Amplitude Arc. As long as this trend continues, we believe the US Dollar Index will decline to historical support levels just above 80 over quite some time (6 to 12+ months). Conversely, Gold has rallied substantially over the past 24+ months and has recently contracted over -15% from recent highs. You will see, near the end of this article, our Custom Metals Index chart that highlights why this recent low price level in Gold is so important.

- The recent decline in Gold prices took place while the US Dollar Index was also declining. Historically, this is somewhat unusual and only takes place when a new RISK ON event in equities sets up. For example, From 1990 to 1992, the US Dollar Index declined from 104 to 81 while Gold declined from $423 to $325. Additionally, nearly all of 2017 represented another period where the US Dollar Index declined, from levels near 103 to 89 while Gold declined and traded sideways, from $1300 to $1130. Both periods we’ve highlighted, 1990 to 1992, and 2017 were fairly recent and represented a strong upside price rally in the US stock market (RISK ON). Our researchers found this fact rather interesting overall.

With two moderately clear examples of downward sloping US Dollar and Gold price levels to compare from, what happened to both price levels after these correlative price trends ended? Well, after 1992, the SPX500 rallied 277% to reach a peak in March 2000 while Gold continued to decline to eventually bottom near $256. Once that March 2000 peak was reached in the SPX500, Gold also bottomed at that time and started a historic rally targeting the September 2011 $1923 highs.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

After the 2017 correlative price decline in the US Dollar and Gold, Gold established a new momentum base in 2018, near $1167 and has rallied to levels near $2089. We believe the RISK ON event taking place in the US Stock market right now is acting to diminish the luster of this setup in the US Dollar and a Gold. In other words, the contraction in precious metals is likely because of increased focus on the US stock market right now while ignoring the broader market trends. This “shifted focus” will end at some point in the future and we believe precious metals will begin to rally higher as the US Dollar continued to slip lower – targeting the 80 level.

Longer-term US Dollar Index Trends – What They Suggest

Researching the previous major peaks in the US stock market over the past 20+ years, the 2000 peak setup when the US Dollar was also trading near all-time highs. The US Dollar was trading above 117 at that time and the US Stock market peaked and began to decline in late December 2010 while the US Dollar continued to stay above 116 until it finally broke down in July 2002. This event suggests the US stock market can lead a US Dollar decline under the right circumstances (remember, 9/11 happened over that span of time as well).

The 2008-09 US stock market peak happened while the US Dollar was nearing a major bottom – the exact opposite of the 2000 peak. At this time, Gold had already been climbing from the 1999 lows (near $257) and peaked in 2011 – spanning an 11+ year rally. We published a research article about these longer-term 9 to 10 year phases of market cycles in November 2020 entitled How To Spot The End Of An Excess Phase – Part II if you want to learn more.

From the 2010~2011 peak in gold prices to 2018~2019, we believe the US stock market entered an appreciation phase which likely ended about 12 to 16 months ago. The new depreciation phase would likely align with the 2000 to 2010 market cycles where the US Dollar declined and precious metals rallied. My research team and I believe we are experiencing the end “Excess Phase” rally in the US stock market which will likely prompt a declining US Dollar trend to continue for many months or years.

The Fibonacci Price Amplitude Arc on the US Dollar Index chart below is anchored to the 2011 lows. The reason we’ve drawn it at this location is because this period of time represents the most recent Excess Phase peak in Gold and aligns almost perfectly with the lows in the US Dollar Index. The secondary peak in the US Dollar Index (near the “B” vertical line) aligns very well with the heavy purple Fibonacci Price Amplitude Arc and we believe the downside trending in the US Dollar Index may just be starting.

In Part II of this article, we’ll go into more detail highlighting the major market cycles and how the US Dollar may continue to collapse for years to come as we have just entered a new “major market phase” that could push Gold above $5000 per ounce. The next 5+ years are certainly going to be a skilled technical traders dream – with big trends in various sectors and assets. Take the time to learn how to profit from these huge trends now – before they end.

We publish this free research to help you stay ahead of broad market trends and to illustrate how we apply our technical analysis skills in helping you find and trade the best performing assets – trying to help you beat the S&P500. Are you ready for what is unfolding before us and do you know how to find the best performing asset/sectors for your trading? Follow our research and learn more about our trading systems and pre-market morning video analysis at www.TheTechnicalTraders.com.

Have a great week!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for readers to take any action regarding this research. We are not registered financial advisors and provide our research for educational and informational purposes only. Read our FULL DISCLAIMER here.