High-Grade Gold and Copper on the Pathway to Production with Doré Copper Mining CEO Ernest Mast

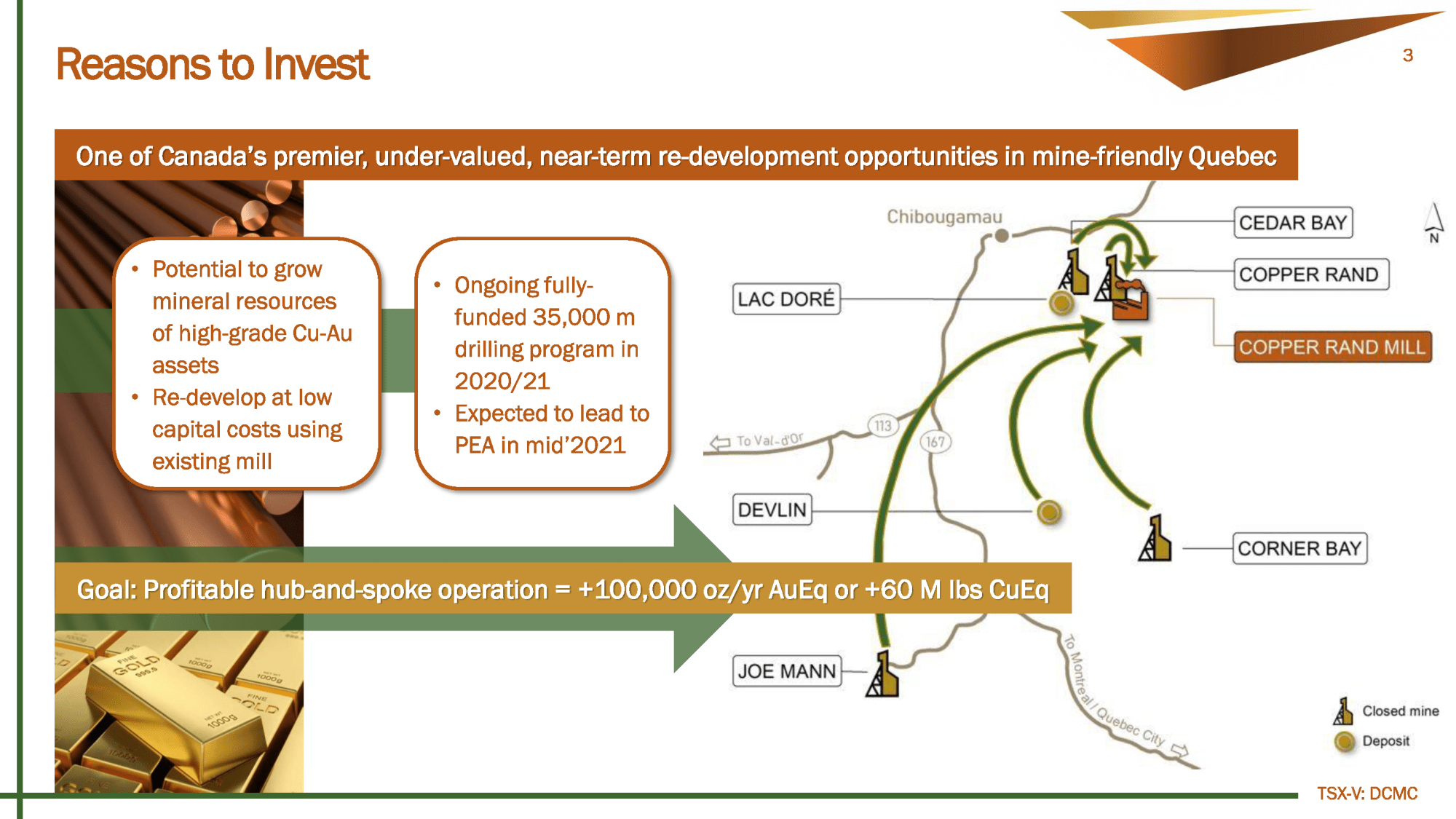

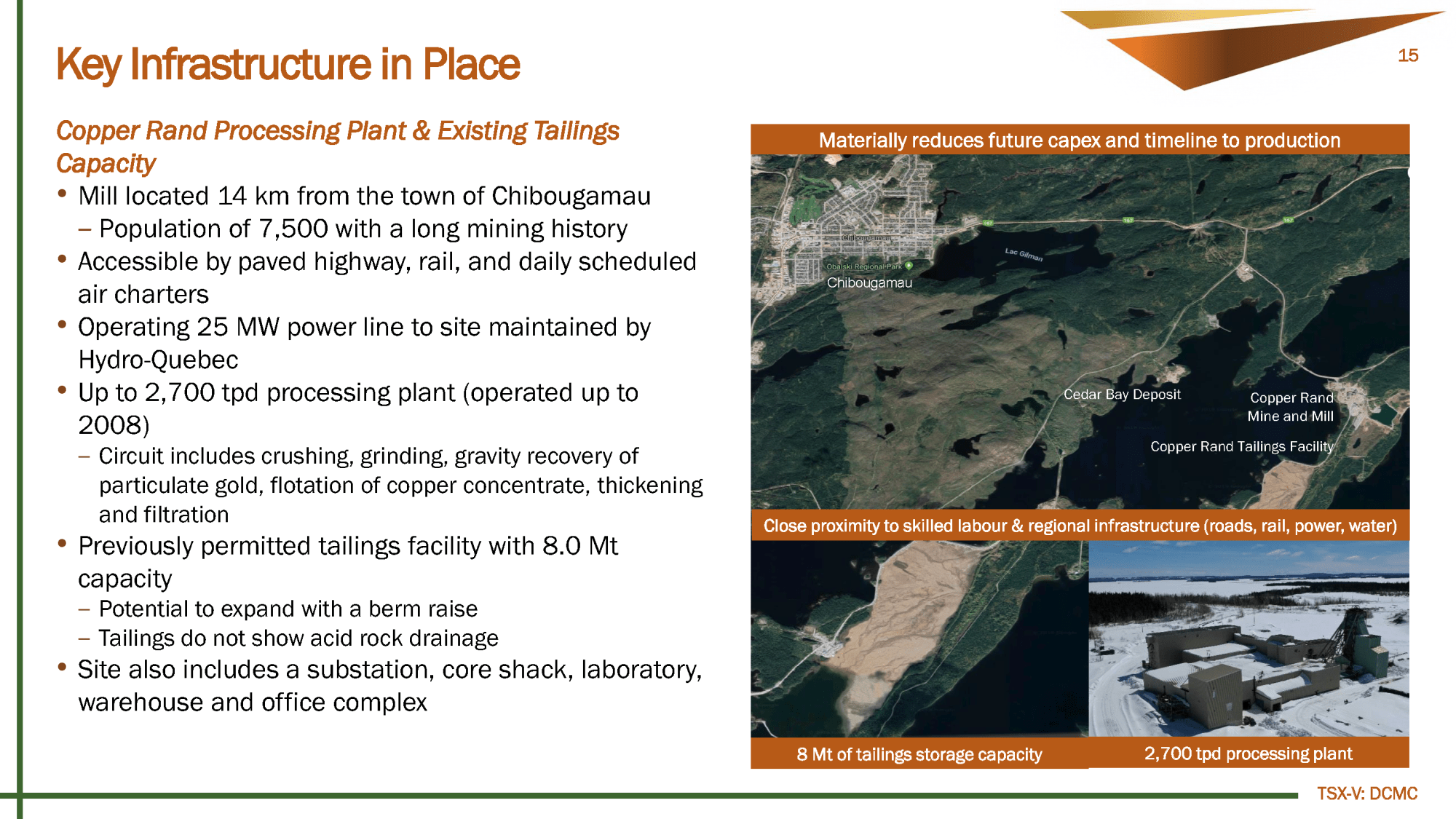

Doré Copper Mining’s (TSXV: DCMC – OTCQB:DRCMF) assets contain some of the highest-grade undeveloped copper and gold deposits in North America. The company’s projects are located just 14 km from the town of Chibougamau in mine-friendly Quebec and are one of Canada’s premier near-term redevelopment opportunities. Doré Copper is debt-free and owns a 2,700 tpd mill with a 8.0Mt tailings facility. There is already power to site and it is accessible by paved highway and rail. The goal is to produce a profitable hub-and-spoke operation of +100,000 oz/yr AuEq or +60 M lbs CuEq by 2023/2024. Because of the existing infrastructure and location, a low capex is anticipated to recommence production. In this interview, Doré Copper Mining’s president and CEO Ernest Mast provides an overview of the company’s investment value proposition, describes why the company is undervalued and explains the plans for 2021.

0:00 Introduction

1:18 History of Dore Copper Mining

3:11 Hub-and-spoke high-grade gold and copper redevelopment opportunity

4:29 Current historic and NI43-101 gold and copper resource

5:35 Any fatal flaws or legacy issues with projects?

6:18 Any royalties or financial encumbrances on projects?

7:11 Capex needed to restart Copper Rand mill

8:30 Tailings facility has 8.0 Mt capacity left

9:28 Capex need to recommence production

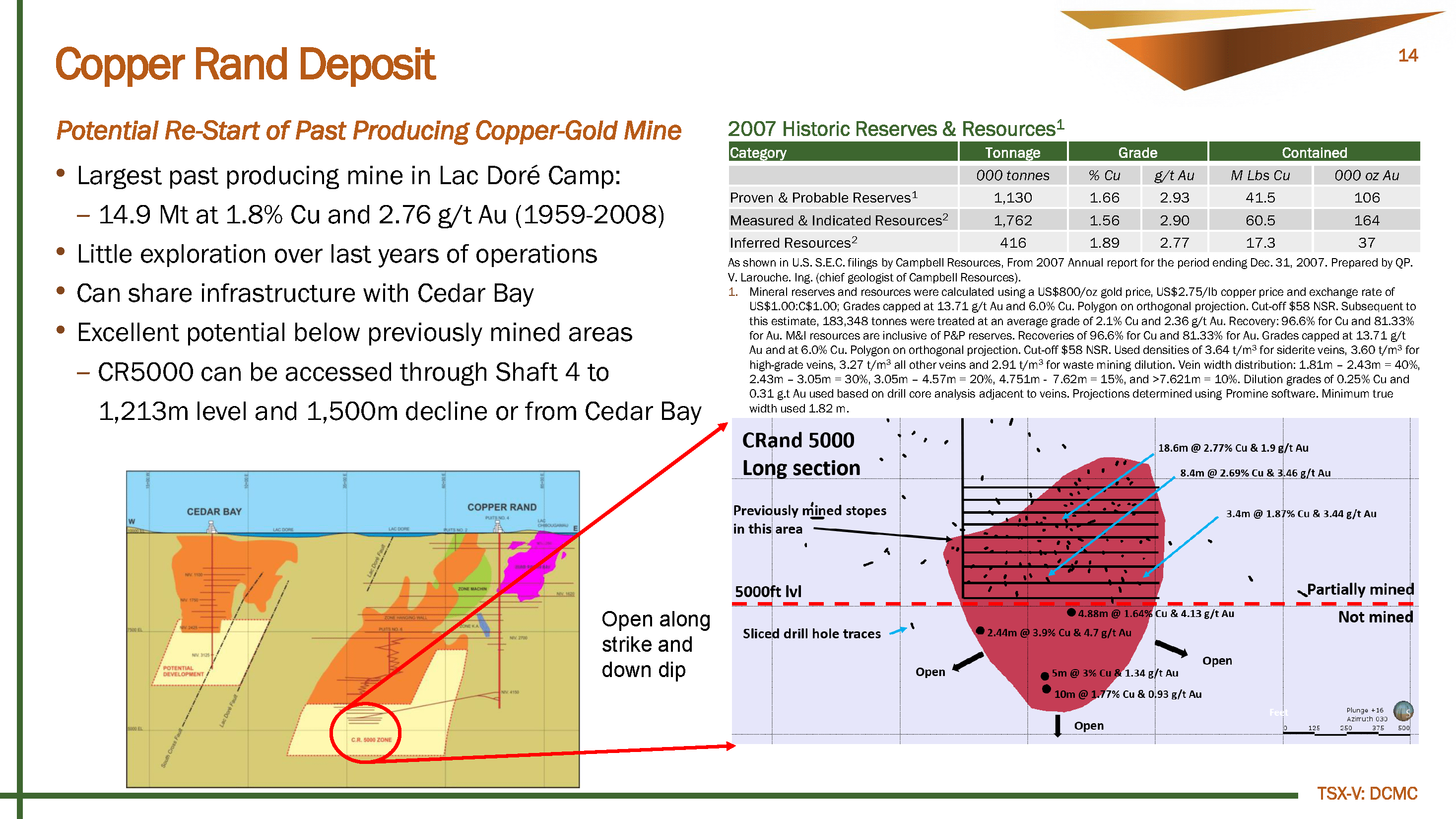

11:02 Copper Rand Deposit

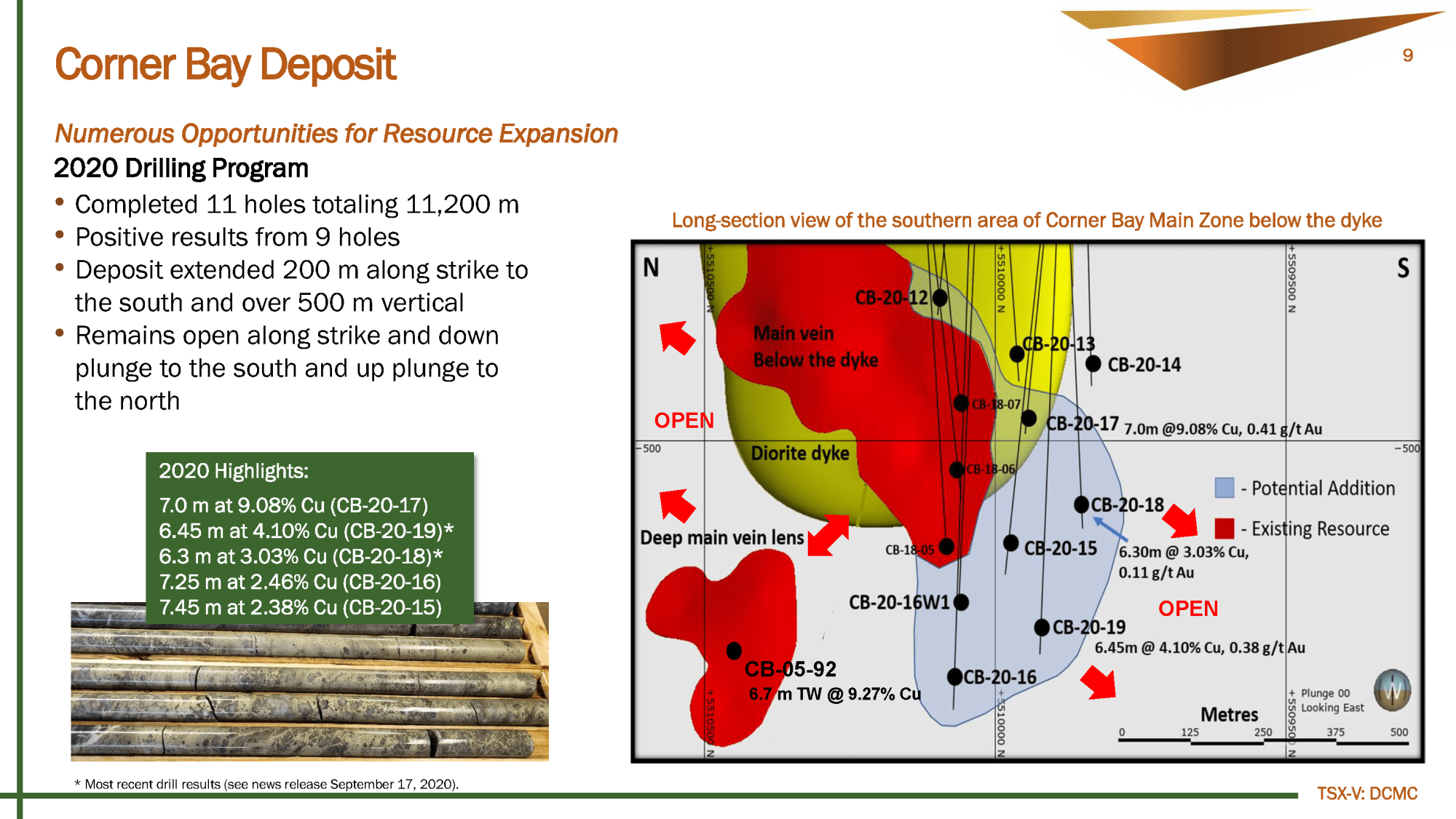

11:44 Corner Bay Deposit

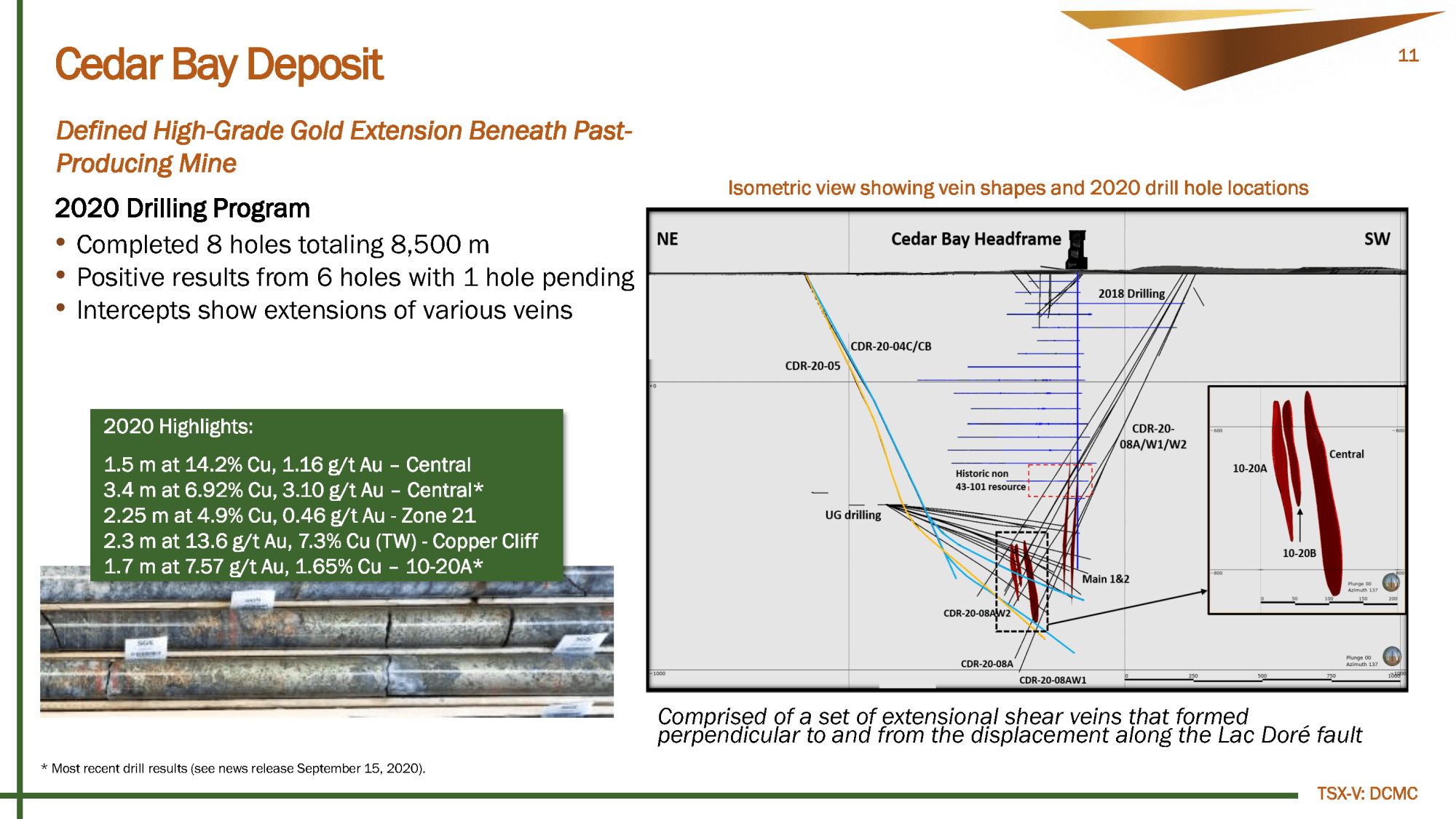

13:11 Cedar Bay Deposit

15:40 Low-cost drilling year-round

16:38 Joe Mann Deposit

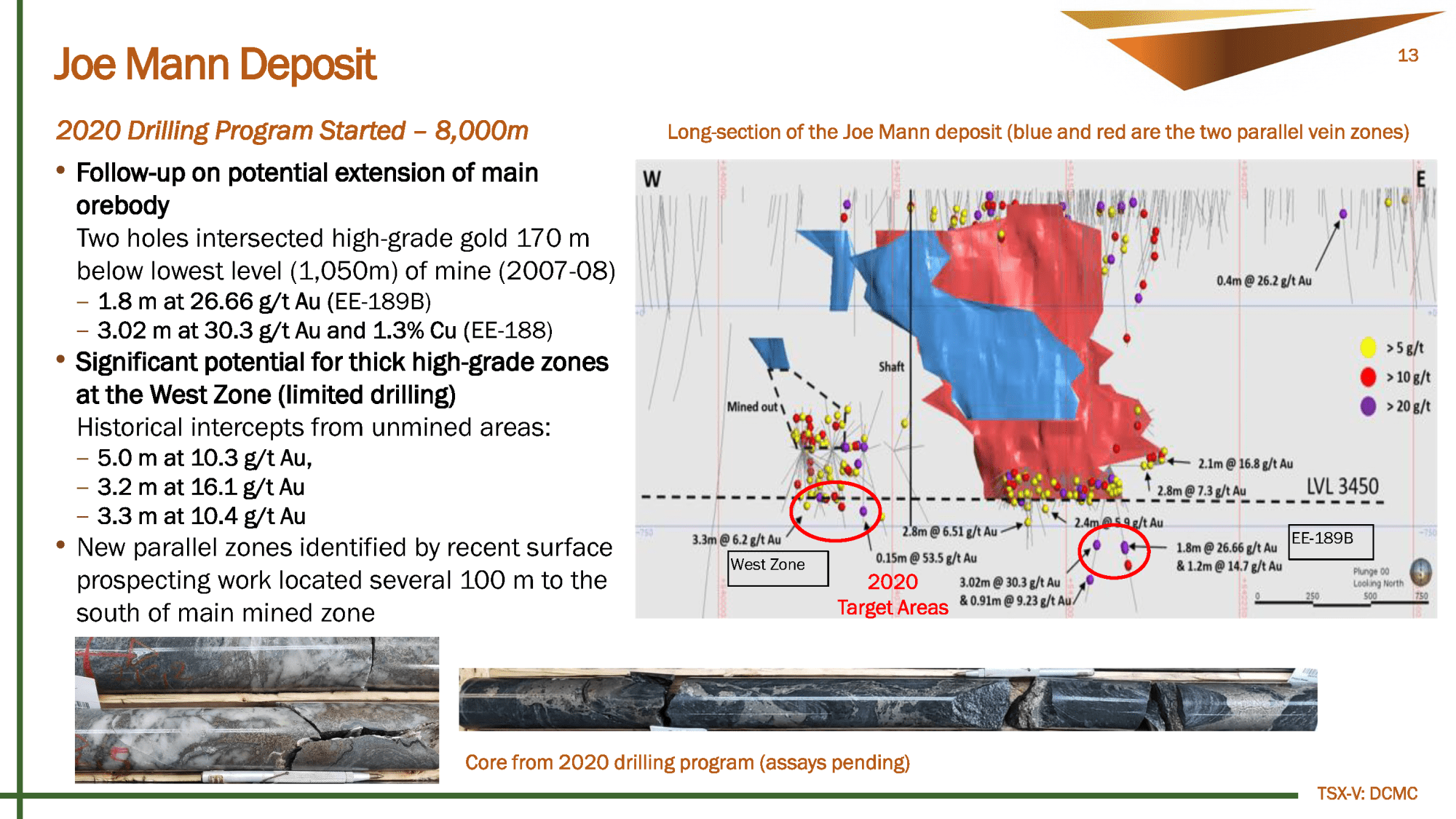

19:14 Current drill program and catalysts

20:28 Possible expedited PFS and FS

21:07 Production goal 2023/2024

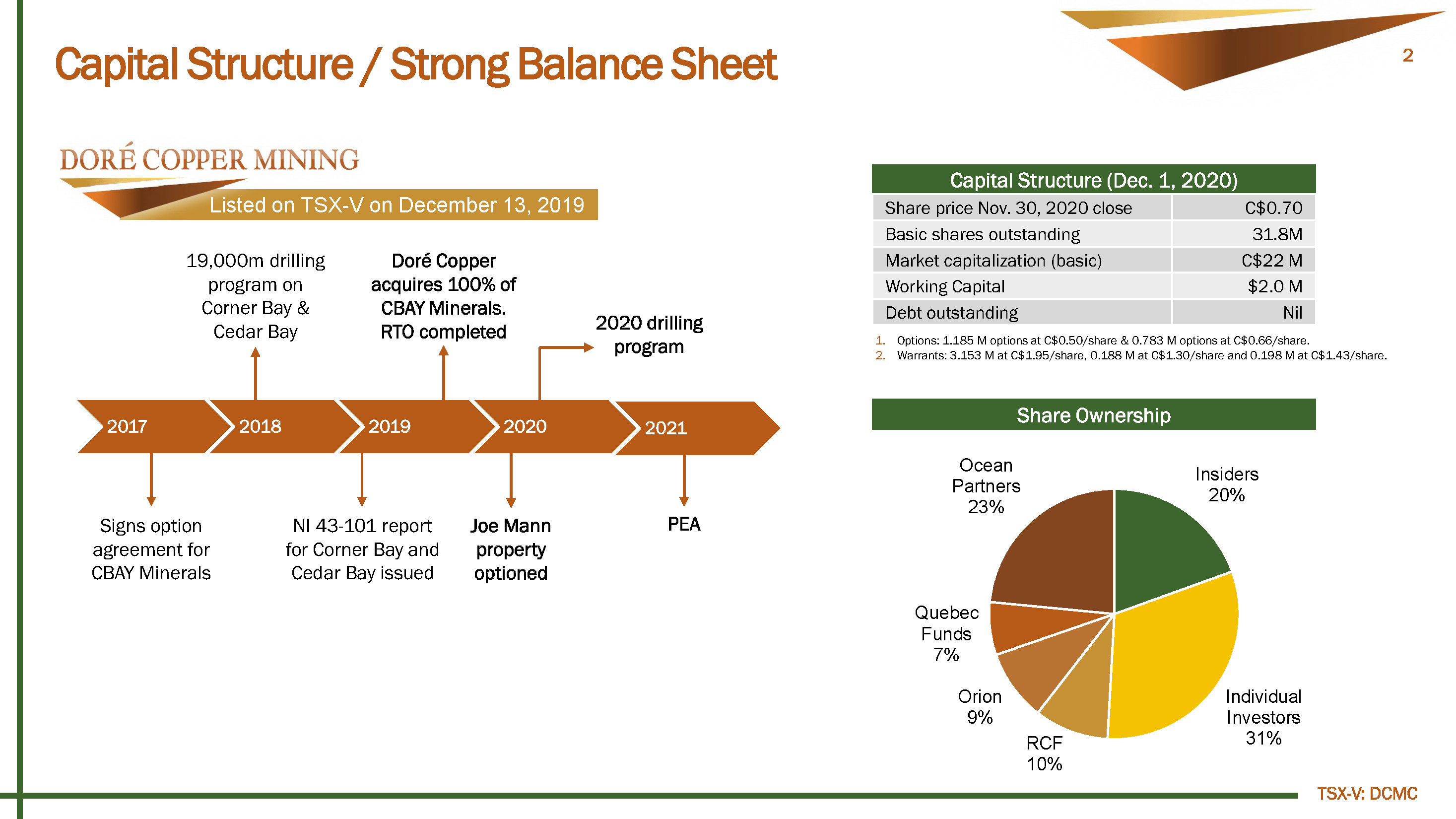

21:33 Share structure and key investors

23:23 Key investors might provide needed capex

23:52 Treasury, burn rate and financing

Most-recent Doré Copper presentation

Paradigm Capital’s Report with a C$1.60 12-month price target for Doré Copper Mining

TRANSCRIPT:

Bill: Ernest Mast is the president and CEO of Doré Copper Mining and he joins me today. Ernest, please give us a background of the history of Doré Copper Mining which went public about a year ago.

Ernest: There’s actually quite interesting history of this camp that we’re working in, which is called the Lac Doré Chibougamau mining camp. It was an operation for nearly 50 years and closed down at the financial crisis of 2008. The assets were then held privately and myself along with some other experienced mining executives were able to sign a contract to acquire an option on the assets in 2017. This is a period of prolonged lower prices of gold and copper. So as a private company, we did some exploration work and we proved to ourselves that there’s tremendous upside in the camp and including the tremendous amount of assets that were already there. So we then consummated the option agreement and acquired the assets and went public in December 2019.

Bill: So you’re in the Chibougamau camp in Quebec, you’re developing a hub and spoke redevelopment story for high grade copper and gold. Give us a thumbnail overview and some of the key highlights that investors should initially know.

Bill: So you’re in the Chibougamau camp in Quebec, you’re developing a hub and spoke redevelopment story for high grade copper and gold. Give us a thumbnail overview and some of the key highlights that investors should initially know.

Ernest: Very important is the fact that we’re in copper and gold, those are two great commodities. They’ve seen very strong prices very recently. Now, as we’re speaking today, gold is going retracing a bit, but copper is as strong as ever. So it shows you, we almost have a natural hedge with these two great commodities. We have a series of mines and they can all be considered high grade, whether they’re gold/copper or copper/gold. And we’re looking to put these mines into production in a sequential manner that makes sense. We have the assets in place, and we also have the infrastructure in place regarding a mill, a tailings facility, and so we’d look to put the sequence into production. And then as upside we could hit over a 100,000 ounces a year of gold equivalent ounces, or over 60 million pounds a year of copper equivalent production as we have a few of these mines in operation.

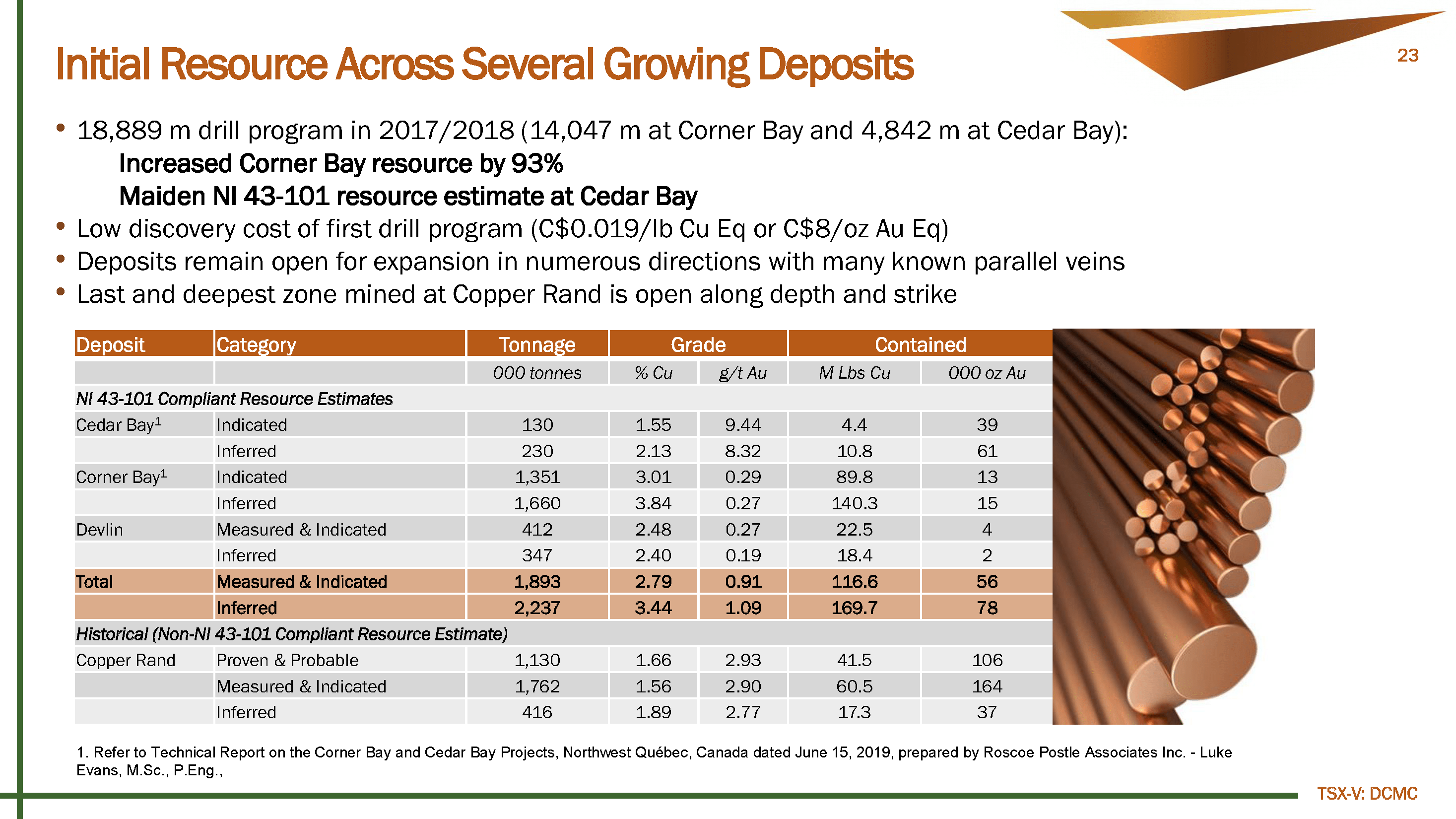

Bill: Okay, so for your existing gold in copper resource, you have a historic resource but also you’ve done some drilling even before you went public to have an NI 43-101 compliant resource. Talk to us about your total resource both historic and NI 43-101.

Bill: Okay, so for your existing gold in copper resource, you have a historic resource but also you’ve done some drilling even before you went public to have an NI 43-101 compliant resource. Talk to us about your total resource both historic and NI 43-101.

Ernest: So the total NI 43-101 resources approximately four million tons and then historic resources approximately two million tons. This historic resource actually was SEC compliant in 2007. So it’s a very reliable estimate, so that gives us a total of six million tons of resource. The resource, the average grades would be a little under 3% copper and a little over on average one and a half to two grams per ton gold. But the components of those resources vary quite a bit between over three and a half percent copper, in some cases in over eight grams per ton gold and other cases. So it’s a very nice blend of high copper, high gold and deposits in between.

Bill: So you have a 2,700 ton per day mill, that would be the hub and then the spokes are going to be four key projects. Before we delve into the specifics of these key projects, are there any fatal flaws or legacy issues that investors should know about these projects?

Bill: So you have a 2,700 ton per day mill, that would be the hub and then the spokes are going to be four key projects. Before we delve into the specifics of these key projects, are there any fatal flaws or legacy issues that investors should know about these projects?

Ernest: Not really, the operation as was for 50 years, and during that time they kept the site compliant with all environmental regulations. So for instance, when you see behind me now is actually our tailings facility at copper end, the water is beautifully clear. We sample the water on a weekly basis and essentially it’s lake quality water. So we really don’t have any environmental legacies.

Bill: Are there any royalties or any other financial encumbrances on the projects?

Ernest: There is a royalty on the option Joe Mann property of 2%, which we optioned it in the beginning of 2020. And there’s a small royalty net profit interest on the Devlin property, but other than that, there are no royalties on the major properties.

Bill: So the hub is this mill and your market cap, as we speak, is only about 22 million dollars Canadian. Yet, you have this mill, you have hundreds of millions of dollars of work that’s already been done in terms of infrastructure with railways, with all the power that’s there. You’re only 14 km from the town of Chibougamau. You have a workforce right there. So you have all this in place, you have this resource, but your market cap is only 22 million dollars Canadian. Let’s zero in now on the mill. What is this mill capable of and what type of CapEx would you need to get this up and running again?

Ernest: So the mill has a capacity of 2,700 tons a day, the mill last operated in 2008. And when it closed, the operators emptied out the mills, they raised the ball mills on jacks, so that you’d take the weight off the trunnions or the bearings, the flotation cells, and the thickeners were emptied as well. And so it’s being essentially in that position. When we come in, we feel we should put in a new control room or a new control system, upgrade some of the electrical components, and a little bit of mechanical repairs. For an estimate, I don’t have a hard number, we’ve estimated approximately $12 million Canadian to get the mill into operation. Because of the size of the mill compared to the likely size of the mines when we start, we probably don’t have to commission the entire mill.

So a couple of the ball mills won’t have to be restarted at that time. And then later, as we had more mines into the plan, we could restart 100% of the mill. The tailings facility has eight million tons of capacity left in it, and so that’s definitely more than adequate to start up. And we’d probably use tailings for backfill, so that eight million tons capacity could last a long time. The mill is 14 kilometers from the town of Chibougamau, so it’s a nice 15-minute drive. The advantage of that is workers get to go home every night and we should have a very good relationship with the town of Chibougamau which the previous mine, when it was in operation, did have. The infrastructure is in place, there’s a 25-megawatt power line to the site. In addition to office buildings, warehouse, core shack, laboratory at the site as well. So it’s really a lot of value that’s already in place when you consider the market cap of the company as you pointed out.

Bill: You haven’t done an economic study yet that’s on the horizon for next year, but could you give us maybe a back of the napkin calculation if you were to bring these deposits back in production with the mill operating, are we talking $100 million to bring this back into production?

Bill: You haven’t done an economic study yet that’s on the horizon for next year, but could you give us maybe a back of the napkin calculation if you were to bring these deposits back in production with the mill operating, are we talking $100 million to bring this back into production?

Ernest: Yeah, we’re talking approximately $100 million to put it into production. A big amount of that amount will be how much underground development that we plan on doing before we start up officially in commercial production. And in fact that underground work will probably be the major component of our capital. And so those are the details we have to work out as you know an underground mining, there’s many different ways of approaching it. My preference is to make sure that you have a sufficient number of stopes ready in hand as you start commercial production, because once you fall behind it’s quite difficult to catch up.

So our point of view is let’s start from really a position of strength when we restart these mines, which is why we’re doing exploration now in building up the resources. We do have enough resources to fast track and restart immediately, especially now with copper prices at about over $3.30. But we think the investment community would like to see a really solid 10-year mine plan before we get started. And therefore with that we’ll come more drilling now and development as we restart.

Bill: So the first of the four key projects is Copper Rand, where your mill is, what is the overview of the Copper Rand deposit? And what’s the advancement plan here?

Ernest: So the Copper Rand deposit was the last mine that was operated in the camp in 2008, and there’s two million tons of historical resources there. Actually, our plans with Copper Rand is it would probably be the last of the four to enter operation because of potential synergies it has with one of the other mines. It does have resources at the depth they were mining at when they closed in 2008. However, there’s also resources in an upper part of the mine that we would probably access first.

Bill: And the Corner Bay deposit is your next deposit.

Ernest: Correct. So the Corner Bay deposit is our biggest deposit with NI 43-101 of three million tons. We have been drilling the deposit earlier this year, you can find those drill results on our webpage and our various press releases over the year. But that drilling campaign has been very, very successful, and we’re very confident that we’ll see a significant increase in the size of Corner Bay. That mine was built in 2008, the project was stopped during the financial crisis.

And therefore, we can come in to this project, with a call it a 90% built mine, two kilometers of development, three levels access. And the deposit starts at surface and essentially goes down to a thousand meters. We initially plan on ramping and creating new levels in the mine in order to get it restarted. So Corner Bay is going to be probably our biggest mine and provide most of the feed to the mill. It’s principally a copper mine, it has a grade of over 3% copper and about 0.28 grams per ton gold. I should mention the copper mineral is extremely clean as will be the concentrate, so we would have very low levels of impurities in the concentrate and this makes it a very attractive product for different smelters.

Bill: Thank you for that overview of Corner Bay, which is high grade copper, but I understand that Cedar Bay is a past producing high grade gold mine that you’re going to begin to redevelop.

Ernest: Correct, Bill. The current resource that Cedar Bay is 8.7 grams per ton gold, 1.9% copper. It operated from the 1950s to 1990 and produced 3.9 million tons of ore and it was mine to the 670 meter level. The current resource sits at about the thousand meter level, which is the level of the shaft. The gold grades in the current resource are considerably higher than they were in the past, but even previously at current prices the gold value would have been greater than the copper value. The drilling that we did on the deposit earlier this year confirmed that three of the major structures in the mine are open at depth, and these are called the 10-20A and 10-20B and the Central vein.

Bill: What are your goals for your future drill programs at Cedar Bay? What type of resource would you like to see there before you bring it back into production?

Ernest: Because of the high grades at Cedar Bay, really, if we’re able to establish a resource of about half a million tons, it should be able to be put into operation. Keep in mind that this is the type of ore body that is best drilled from underground, so one of the things that we’re doing very shortly is we’re going to be taking water samples down the shaft, down underground. And we will determine the water quality and determine what type of water treatment we would need to do in order to de-water the mine and commenced drilling from underground. We think once we’re underground, the drilling will be much more effective than drilling from surface. And at that point, we can really delineate the ore body. If you consider though that the ore body produced 3.9 million tons on surface to 670 meters, the chances of us, of finding another million tons of depth is pretty reasonable.

Bill: And what would that be translated into gold ounces?

Ernest: The gold ounces if the ore body would have say a grade of about eight grams per ton, you’re looking upwards of 200,000-300,000 ounces of gold in that one deposit.

Bill: And all of these deposits drilling year-round is capable here?

Ernest: Correct. Although the winters are relatively cold, we do get temperatures in Celsius of approximately -20 to -30. Those are hardy northern temperatures, but we can drill all year round. It’s not a problem, many mining operations in the district operate all year round without a problem.

Bill: And I understand your cost of drilling is quite low.

Ernest: Yes, we’re using a local contractor and they’re very efficient, and therefore, again, we don’t have this remote camp type of setup where you have to fly people in, house them, feed them, fly them back. Essentially everything is done as a commuter base. And the local contractor has his workshops and his drill machines in the town.

Bill: So Doré Copper has no debt but your Joe Mann property is one that you don’t yet own 100% outright. Before we talk about the geology here, what’s the financial arrangement with this Joe Mann property?

Ernest: So the Joe Mann property remaining to acquire the property is $3.25 million Canadian, which are due up until January 2nd, 2023, most of the payments are back ended. In addition, we have to do $2.5 million of work on the property.

Bill: And that payment is in shares, I understand.

Ernest: It’s combination of cash and shares.

Bill: So with Joe Mann, what is the potential here? This also is a high grade potential gold mine, right?

Ernest: Correct. So Joe Mann actually produced 1.2 million ounces at 8.26 grams per ton gold over its life and it closed in 2007, essentially it closed because the operators at the time were in a low gold price environment and did not do a lot of exploration below the lowest levels. And they had other focuses, they are focused on other commodities at the time, so they closed down this mine. A couple of drill holes drilled below the lowest working after the mine had closed, identified some very high grade intercepts of about an ounce per ton and we’re essentially following up on those intercepts.

And again, similar to Cedar Bay, if 1.2 million ounces of gold were produced over the first thousand meters of the mine, over the next few hundred meters of the mine, we should be able to identify a few hundred thousand ounces. In addition, we’re doing exploration along strike, close to surface in an area which had previously been drilled. But we don’t think the operators fully understood the geological model of that area, and so we’re doing some up there as well.

Bill: So would part of your success be in doing a geological re-interpretation of some of these projects?

Ernest: That’s correct, yeah. Especially on the area, which is a long strike at Joe Mann on the main vein at depth, essentially we’re following the same structure that the previous operator used. And it’s quite a simple model, essentially you’re following a vein, which is in a certain geology and it’s well-known, well-understood. And essentially we’re following up on that to verify, in fact, that the two previous historical drill holes, whether we can expand the resource around that.

Bill: Ernest, you’ve been in the midst of a large drill campaign, my listeners that are just being introduced to the story aren’t familiar with that. So could you bring us up to speed on the current drill campaign? When should we expect results and what are some of the near-term catalyst that we should look for?

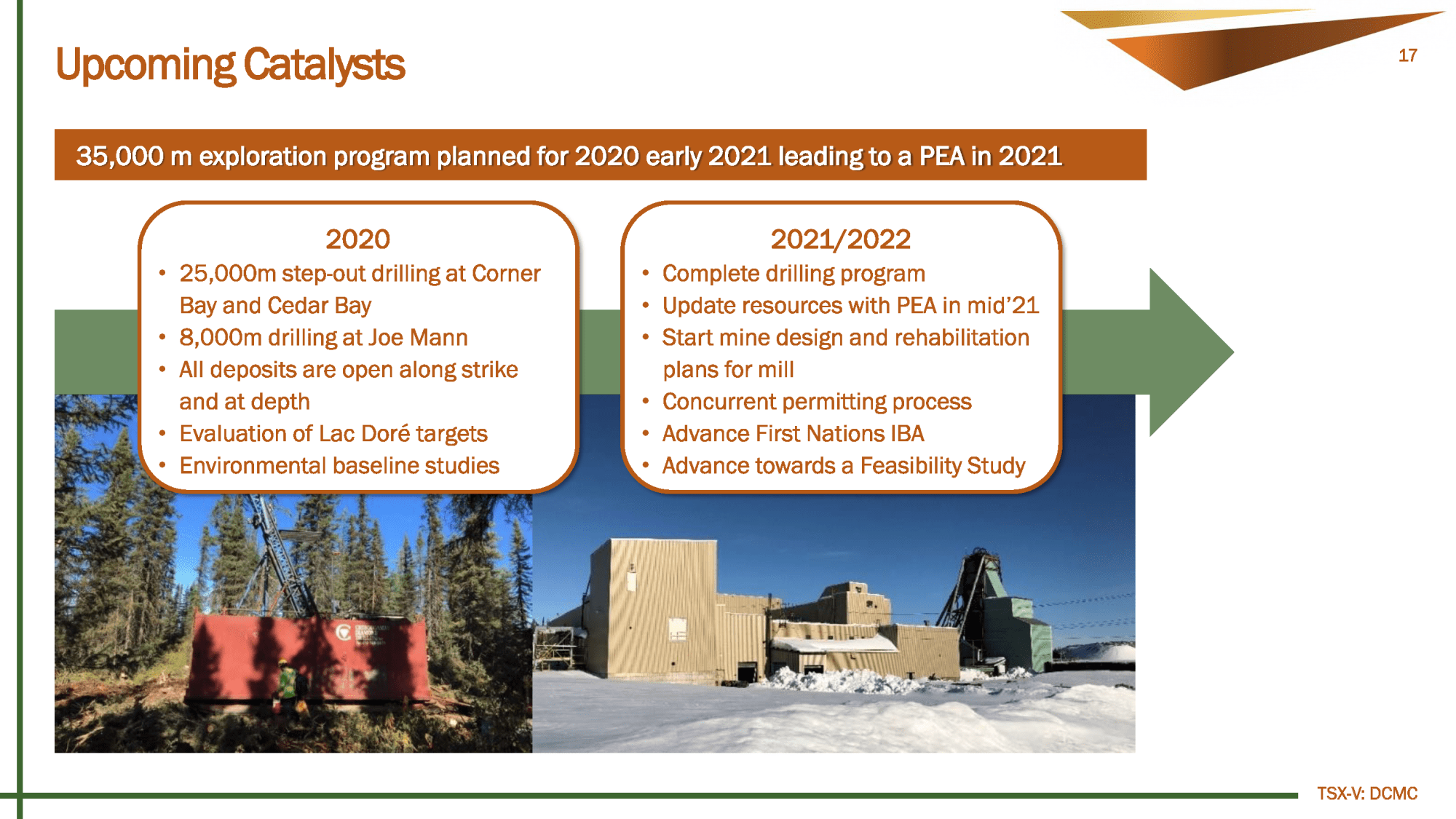

Ernest: Okay, yeah, we started the drill campaign actually in January and we started drilling the Corner Bay property and the Cedar Bay property, we had very good results from both of those drill campaigns. Currently, we’re drilling the Joe Mann property and we should see drill results before the end of the year and early next year on that program. In addition, early next year, we’ll probably return to Corner Bay and continue the drill program there as they were a couple of areas of the deposit that were still open up plunge and along strike. And it makes sense that we finish off the program following up on areas that are open like that. And so then what we can look forward to is the update of the resources at the deposits. And then based on that, we would look to do a PEA towards the middle of next year with the results coming out in the second half.

Bill: Because we’re talking about a lower CapEx here and you already have the mill in the infrastructure, is it correct to expect perhaps an expedited pre-feasibility and then feasibility study?

Ernest: That’s correct, yeah. Based on the results of the PEA, based on what the market is looking at in the financing that we can obtain, we would look to fast track the pre-feasibility or bankable study in order to get into production. Another tack that we can take is do another round of exploration to grow the resources even more, so that we could even put together a more robust bankable study or pre-feasibility study.

Bill: In a best-case scenario, if everything lines up, how soon could you be in production?

Ernest: I would say 2023, 2024, we could be in production. We could really fast-track things and be in production for sure, and maybe even a little earlier, however, we think it’s prudent to put together the most robust project possible before committing to production.

Bill: Let’s talk share structure and some of your key investors. One of the things that I liked when I initially looked at the presentation is I recognized some key quality shareholders. Could you talk to us a little bit about this?

Ernest: Yeah. So our major shareholders of group called Ocean Partners, and they’re a metals trading firm and they’re actually the firm whom we acquired the assets from and they’re very supportive, they really want to see the mines enter production. The main reason being is their business is the sales of copper concentrates and zinc concentrates and other metals. We will be producing a very clean copper product, and they have the marketing rights of that. So they’re very supportive, a very savvy investor, as well as a supportive shareholder.

We have two US-based private equity funds, RCF and Orion who are also are a little less than 10% shareholders. They first became investors when we launched the company privately and they were seed investors for us. And in addition, we have a couple of funds from the province of Quebec as investors. And going forward, we expect what we call Quebec Inc. To be a significant funder of the project in the game that just improves the certainty for us to go deeper into this project.

Bill: And your share structure, I think it’s like 31 million shares outstanding right now?

Ernest: That’s correct. So we’ve kept the share count quite low, and really what we’re doing now is we’re doing quite a big push in order to increase the volume of shares and attract more retail investors into the company. We recently obtained our OTC listing and so we’d like to see American shareholders as well.

Bill: Because you do have some of these quality shareholders with access to capital. Would it be fair to assume that, that could be a source of potential CapEx since we’re only looking at about CAD$100 million here?

Ernest: Yeah, it’s very, very possible, especially given the mix of major shareholders that we do have, that’s definitely an advantage we have as we look to finance eventually in the future, the return to operation, we see a lot of support there.

Bill: Let’s talk treasury and burn rate. What do you have in the bank and how fast are you going through it?

Ernest: So, currently we have at this point about little over $2 million in treasury while we’re drilling the burn rates about half a million a month. But we do expect to finish drilling, say early next year which means we’ll probably look to the market for some additional funds, not for additional drilling, but in order for corporate purposes and to arrive at the PEA relatively early next year.

Bill: And you often raised with flow-through funds, is that correct?

Ernest: That’s correct, yes. It’s a great advantage for Canadian and Quebec based companies, the flow-through funding is readily available. Flow-through though can only be used for technical advancement of the project, and drilling and doing studies falls into that category.

Bill: Ernest, as we conclude here, what more would you like to share with the investors that are listening to us?

Ernest: I’d say the investors do their due diligence but I would say look for copper projects that are high grade in good jurisdictions, that have infrastructure in place with experienced management teams. And I don’t think you’ll find too many names. Those are some of the attractive features our company has.