Osino Resources Discovers More Gold with CEO Heye Daun

Osino Resources’ (TSXV:OSI – OTC:OSIIF – FSE:R2R1) CEO Heye Daun explains that the new gold discovery at the Clouds target has the potential to dramatically increase the Twin Hills Central deposit size. The Clouds target is located about 1.5km away from the deposit at Twin Hills Central. Thus if Osino can demonstrate the mineralization is continuous between Twin Hills Central and the gold discovered at Clouds, then the known strike length would about double. Osino will be drilling between Twin Hills Central and Clouds over the next few months to hopefully confirm mineralization. Heye also addresses the recent share price action, the potential valuation of Twin Hills Central, the company’s current treasury and 2021 burn rate.

0:00 Introduction

1:22 Twin Hill Central recent drill results

3:20 Twin Hills Central current footprint

5:18 High-grade gold shoots within bulk-tonnage deposit

6:28 Clouds target gold discovery (1.5km away from THC)

8:14 2021 drill program

9:45 Commentary on OSI share price action

10:53 Treasury and incoming warrant money

12:15 Potential valuation of Twin Hills Central

14:45 Navachab mine: update on potential purchase

Press Releases discussed in this interview:

TRANSCRIPT:

Bill Powers: Heye, welcome back onto Mining Stock Education. Osino Resources has truly hit many milestones over the past 18 months since we initially featured your company. Its been impressive to watch. You put out two press releases, so I’m excited to pick your brain and provide a platform for you to share with the market. Let’s start talking about the Twin Hills update. This is your core discovery that you’ve been working on for some time. Been working on this in a preliminary way, even before you went public. Talk to us about these drill results that you announced on November 12th. What’s the significance here?

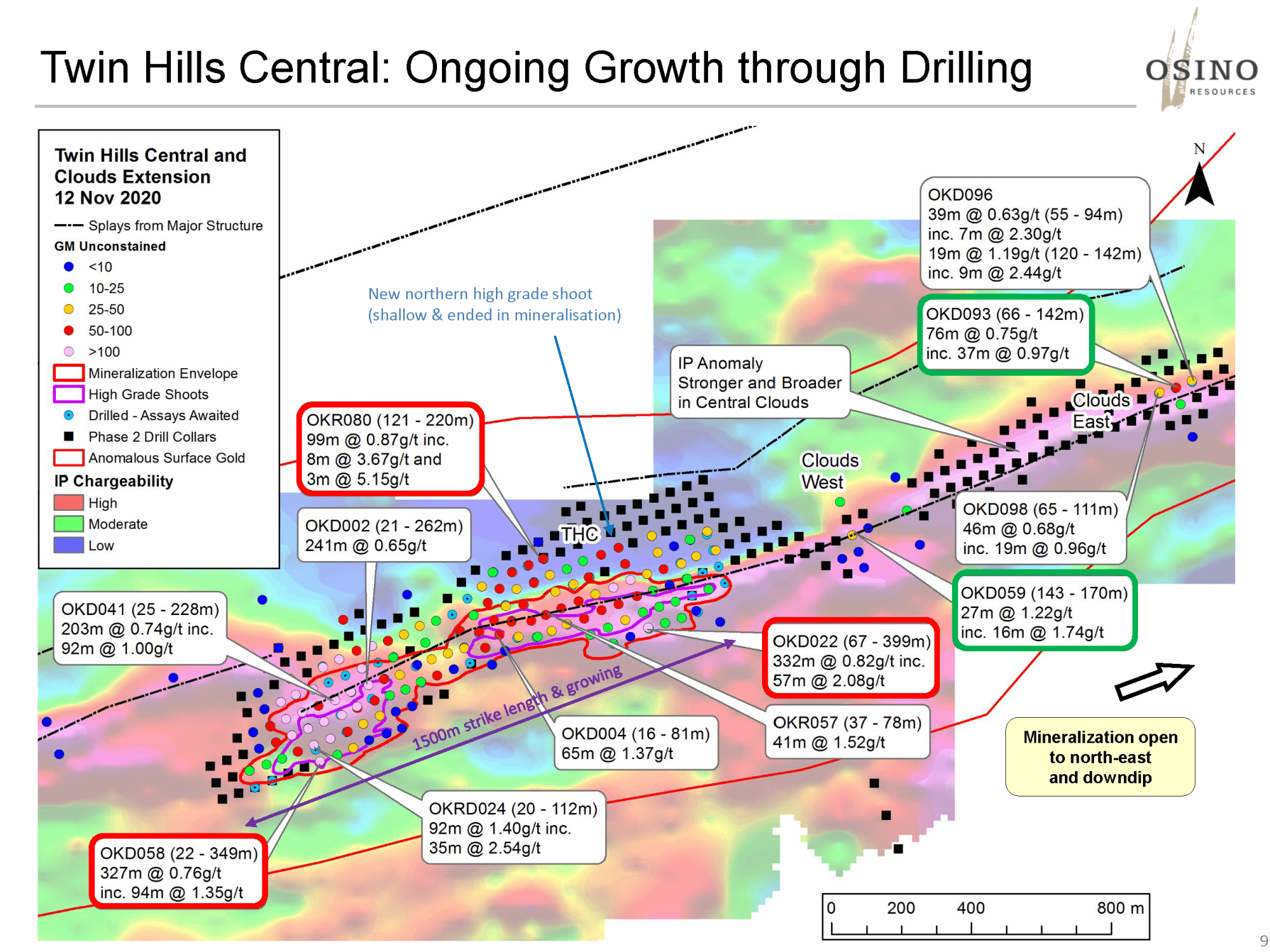

Heye Daun: Okay. Well Bill, thank you. It’s great to be back on the show and thank you for always providing this platform. So the drilling is very exciting to us. As you saw, it’s a lot of holes. We spent basically the end of the lockdown and the last couple of months drilling very intensively with eight rigs. We had some issues with sample turnaround time, like across the world the labs are backed up. So it took a little bit longer to get the results out, but finally we put them out. And the significance really is that it shows that Twin Hills is what we always thought it would become, namely a major gold deposit that still has very substantial legs. So this drilling, if you looked at the press release, there was a diagram in there that shows the real sort of detailed drilling, 50 by 50 meter spacing that we’re doing, to prove the continuity and the size and the extent of the deposit. So the drilling has shown that.

So the drilling has been good and has been more of the same plus good stuff, good grades in there. So we’re very, very happy with that. That was the first question is that was the bulk, the Twin Hill Central drilling. And then the second press release, you might not have asked for it or you would have asked about it, was the exploration update where we announced some very big step outs. We stepped out by one and a half kilometers in an area called Clouds, which is on the strike extent, where we had some quite substantial intercepts. Much more than just smoke. And that opens the window, that opens up the possibility of us actually doubling on strike length, which would be very significant because that indicates the real growth potential off of Twin Hills. So yes, we’re very happy, but we’re already at it again. We got eight rigs and we just keep going. We just keep drilling.

Bill: So Heye you’re an engineer, that’s your background. Obviously you’re an entrepreneur, but from an engineer’s viewpoint, when you see these Twin Hills Central drill results come back, talk to us about the footprint. Your analog project is Otjikoto, how does the footprint currently compared to Otjikoto? And is there any preliminary thoughts that you can share about strip rate and things like this?

Heye Daun: Yeah. Thank you. That’s obviously a key question. Otjikoto is one of the important comparative spots because it’s in Namibia and I was so intimately involved with it. So, but there are other comps and I’ll share some of them. So the one obvious measure is size. So the current footprint of Twin Hill Central is more or less the same as the Otjikoto main pitch, which B2Gold developed. They subsequently drove out a high grade, additional satellite pitch to the North, which we don’t have that yet. We might find something like that, but to the current footprint of Otjikoto, I would say is broadly similar, a little bit smaller than Twin Hills as compared to Otjikoto, but size is only one thing. The other important question of course is grade. And if you look at our intercepts, and you can see a lot of them are in the 0.8, 0.91 even high up to one and a half grams.

But you must remember this is quite technical, but it’s very important point you make, is that those large intercepts, the way we report them is they are unconstrained. It means that a big intercept of 200 meters like this, all the layers of waste that are in between are in there, so it’s an average. Now, when you mine that intercept, those layers of waste will be separated out. And therefore the average grade of the resulting material that goes into the plant will be higher. So this is standard practice, Otjikoto does this, other mines do this. And that’s why these grades, which Twin Hill Central currently represents, are not a lot lower than the Otjikoto average grades. So therefore we’re very satisfied. These are definitely economic grades. We are highly confident that Twin Hills is going to become another mine.

Bill: So the model that you’ve laid out here is a bulk tonnage with high grade shoots. With the high grade shoots that you even announced in this recent press release, did that meet your expectations or exceed your expectations?

Heye Daun: I think it meets our expectations. I mean, they’re not that big yet. You can see, I think it was like eight meters at three or four grams, five meters at… Or three meters at five grams. That hole, by the way, ended in mineralization, ended at five grams. So we’re going to deepen that hole. It will extend, but the way this deposit works is, and I’ve said this before, I’ll say it again. It’s a thick package of sedimentary rock, like layered sedimentary rock, with these higher grade shoots going through it. And so as we drill more, we’re going to continue to intercept more of them, both at a larger level, but also at a tiny centimeter scale.

So we are very happy. Basically the drilling in general has exceeded our expectations. The thickness of the package is probably double of we expected, but at the grades out there, we’re very happy with the grades. We haven’t found a real big high grade zone like B2Gold has yet, but even with the grades that we have now, we are definitely going to be quite profitable and quite economic. So we’re very, very happy and very satisfied with the results so far.

Bill: Twin Hills is situated in between Otjikoto on one end and bookend on the other is Navachab, which we’ve talked about. That’s a 6 to 8 million ounce deposit, but I understand that that’s a bunch of satellite deposits. So you’ve discovered a satellite deposit, well are shown mineralization at least, separated apart from Twin Hills Central at this Clouds discovery. Talk to us about this discovery and what this means for the future economics potentially of this project.

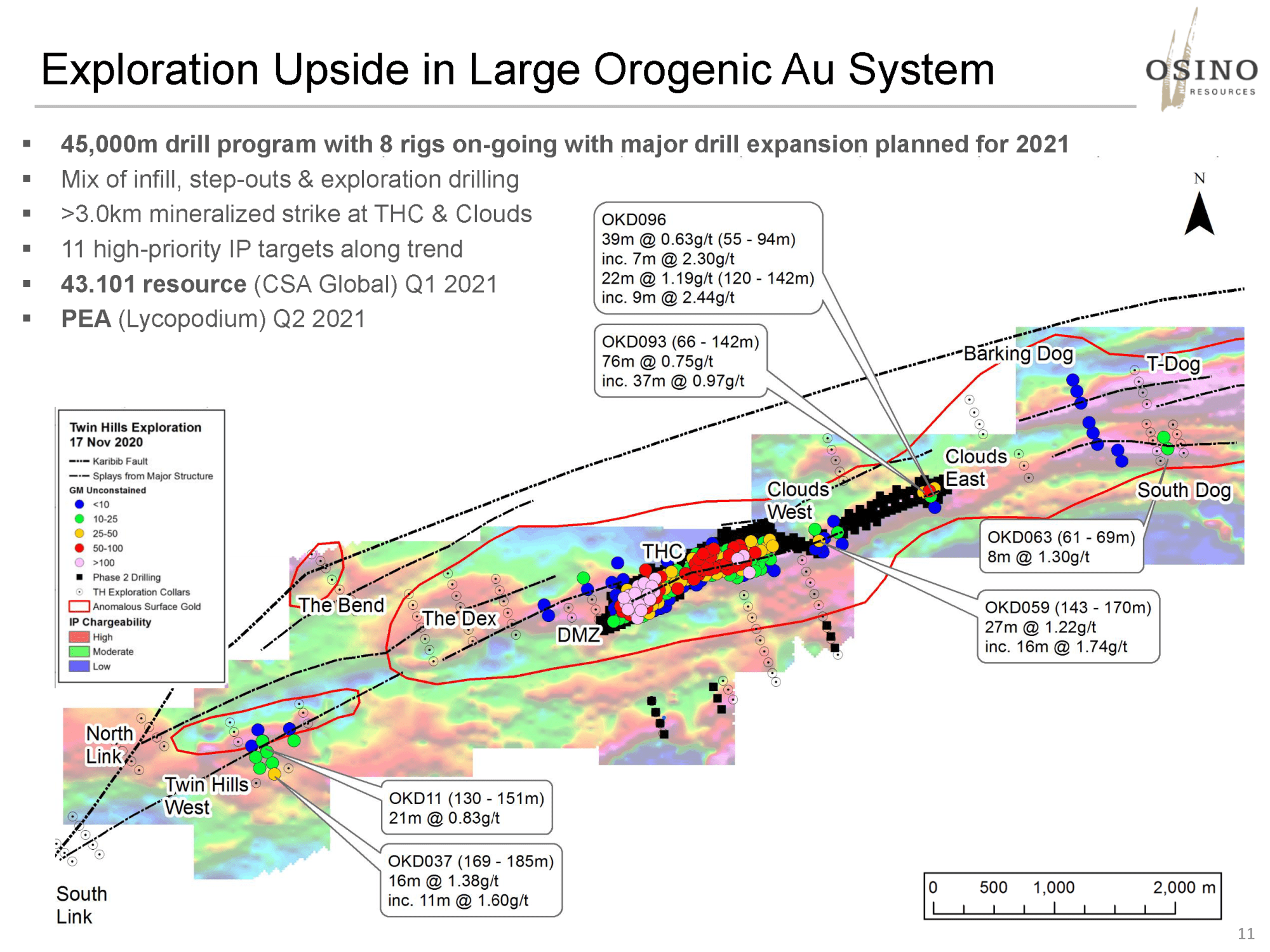

Heye Daun: Yeah. Clouds is very, very significant. I would say for two main reasons. One is it’s one it’s one and a half kilometers away. What Clouds is actually it’s a bunch of satellites, sort of mag and IP anomalies, which are on strike from Twin Hill Central. So Clouds promises to be one continuous zone of mineralization all the way up to Twin Hill Central. Now if we can prove that, and if that comes true, and we’ll know that in the next two or three months because we’ve actually got two drill rigs on there right now. But if that comes true, then the Twin Hills footprint doubles from one and a half kilometer strike to three kilometer strike. And the Otjikoto strike length currently is about one and a half kilometers. So it basically, it would make us substantially bigger than Otjikoto. Of course, it takes time to drill those answers out, et cetera, so I don’t want to be too flippant with the comparisons here.

But so that’s the one significance of Clouds. The other significance is that it validates what we’ve always said, which is that the greater Twin Hills area has very substantial exploration potential. And there are many, many similar IP and other high priority targets, similar to Clouds, which we haven’t drilled yet because we’ve been so focused on resource drilling in the last six months. But in the next couple of months, we’re going to get to it now that we have so many rigs operating. So we’ve got high hopes that we will make additional such discoveries, which will result in the overall Twin Hills resource endowment to continue to grow.

Bill: So for 2021, when investors look at what you have going, will it be more expansion discovery drilling, or will it be more infill? What’s the ratio here?

Heye Daun: I think it’s going to be probably about two thirds, one third, or maybe a half.. well two thirds, one third, because Twin Hills Central-

Bill: Two-thirds discovery-focused?

Heye Daun: No, I would say the other way around. And I know that a lot of, especially the retail investors, don’t like to hear this, but I’ve got to be real in that the real value lies in the project and that project will get bigger and bigger and the faster we can get it to the production stage, the faster we can actually add true shareholder value. Of course, exploration is important because exploration enables us to make the project bigger. But in order for us to get to the production stage, we need to do feasibility work and that requires drilling to the indicated level of detail. At the moment, the resource we’re going to put out in February will be an inferred resource. In order to get it to the indicated stage, indicated and measured, we need to drill another 50,000 meters, the same amount of drilling we’ve done this year, and we’re going to do that in 2021.

But on top of that, we’re going to add hopefully another 25,000 to 30,000 meters of exploration drilling, which is enough to test all those targets that I was talking to you about. Because you know, the one thing about exploration is it’s an iterative process. You can’t just blow your brains out. You’ve got to drill a bit to get the results, interpret them, come back. We’re not going to do stupid drilling, but on the resource side, we can just carpet bomb that thing now with resource drilling, which is what we will do. So it’s going to be a blend of exploration, step outs, and ongoing infill drilling.

Bill: As I mentioned in my introduction, you truly have been hitting milestones and producing the goods for investors, yet the share price after these two good news releases in the last week, it basically sold off a little and trended sideways. Any commentary here you could provide?

Heye Daun: Yeah. I saw that. You know, we can’t win against the market. And as you know, with companies, especially smaller companies, they’re… half of valuation is fundamentals and the other half is the market or the sentiment. Now I think the market sentiment at the moment is a little soft. You know, the US election, everybody thought the US election would provide new guidance. It has to some extent, but I think everyone is a little bewildered where things will be going.

So I’m not concerned about it because with the two financings we did this year, we’re so well cashed up that we are actually independent of our share price at the moment. Which doesn’t mean I take it lightly, share price is important to me, but the share price will correct itself with ongoing delivery. So yeah, I think we’ve just got to keep doing what we’re doing, keep delivering and the share price will follow. So I have no doubt about that. Unfortunately, having such great results into arguably a little weaker market is unfortunate, but that’s how it goes sometimes.

Bill: On that note, remind us, what is your treasury? And also, what can you expect to bring in, in terms of warrant money being exercised?

Heye Daun: Yeah, so the treasury is very good. We’ve got $24 million in cash right now. We’ve spent, or we will have spent $13 million more or less by the end of this year. So we’ll end the year with about 22. And our budget for next year probably will be in the 15, $17 million range, plus maybe some additional for surface rights acquisition, and some once offs. So we are financed for throughout next year comfortably just with the cash that we have on the balance sheet right now. Then the warrants, half of which are in the money, and the other half gets in the money at a dollar fifty. So we expect to accelerate these warrants, post PA and maiden resource announcements. So probably in the second quarter next year, we might accelerate those. We’re not in a hurry. And if they’re all in the money at that stage, that will bring in another just over $20 million. So I think we are quite comfortably financed, possibly all the way to construction. So it’s a great situation to be in.

So we are definitely not going to do a financing anytime soon. I saw some chatter on CEO.ca and elsewhere where people said, “Oh, these guys are marketing big results. Maybe there’s financing coming.” People speculated that that might be related to the sort of little sell off. But that is certainly not the case. We are not planning to do a financing anytime soon.

Bill: Heye, just in Namibia in terms of buyout price, is there any price per ounce in the ground in United States dollars? Like what is the metric that investors can look to here when we think about what this project might go for?

Heye Daun: Go for, mean stock selling?

Bill: If you don’t develop it.

Heye Daun: Yes. No, the project will go for the highest price possible, that’s the short answer. But the real answer, the honest answer, it’s like valuation metrics at exploration stage, you can look at a dollar per ounce metric, and I can give you some numbers. But as you move into project development, you increasingly move towards price per NAV. That’s what the brokers use. Now, of course, for investors, there’s no NAV number out yet because we haven’t put out a PA. That’s why we’re rushing this PA because we’re very bullish on the economic numbers.

So I have my model and I’m happy to share my numbers. So on realistic assumptions, like 90 to 95% recovery, 5% discount rate, and let’s say consensus gold price forecasts around $1,700 or so roughly, we will easily with current resource only, not bringing in the exploration growth, et cetera… we will easily be able to show 400 to 500 million US dollar DCF. Now, of course, companies like ours never get valued at the full DCF, there’s usually a discount. And unfortunately for the whole junior space, the price per NAV multiple has been coming down.

So I think for companies like ours, it’s reasonable to be sort of point 0.6, 0.7, even 0.8, 0.9, like Montage, and some other companies I saw in their own presentation. They use 0.9, I think it may be a bit aggressive, but whatever. If you apply that factor to that discount rate and you then apply the share price fully diluted at 133 million shares, you get to a valuation of the Twin Hills project on a per share basis, quite easily, of $3. This is Canadian dollars, I’ve worked it back. So call it $2.50 or whatever, $2.50 US, $3… in that range. It all depends on how aggressive you want to be. But these numbers are just gave you a quite conservative.

So there is lots and lots of upside left, and that upside is going to be expressed in the share price in the next year as we deliver. Especially I think the maiden resource which is out in February, and the PA which should come out in April, is going to put a lot of these numbers on the table. And I think it will change people’s views of the company. Hopefully with a supportive market our share price should reflect that.

Bill: And before you go…Navachab, we’ve talked about the possibility of that coming into the market. I know if you’re working on something behind the scenes, you can’t disclose, but is there anything you can publicly disclose with a potential advancement here?

Heye Daun: I mean, I can just tell you what most people know, which is the owners do want to divest at some stage. They’re busy with operational turnaround themselves. They’re doing a really good job turning the company around and they’re quite profitable at the moment. We’re quite close to them and we like them. And if that sale comes, we’ll be very interested. We haven’t heard anything lately. I don’t think anything is going to happen soon, maybe next year sometime. But yeah, we’re close to it, but we’re heavily focused on our own projects at the moment, but we’ll be there when it happens.