Four Stocks To Own Before The US Elections – A Follow Up

On October 24, my research team and I highlighted four stock symbols we thought would do really well after the US elections. Today, we’re going to follow up on these calls/predictions and see how these four stocks are doing.

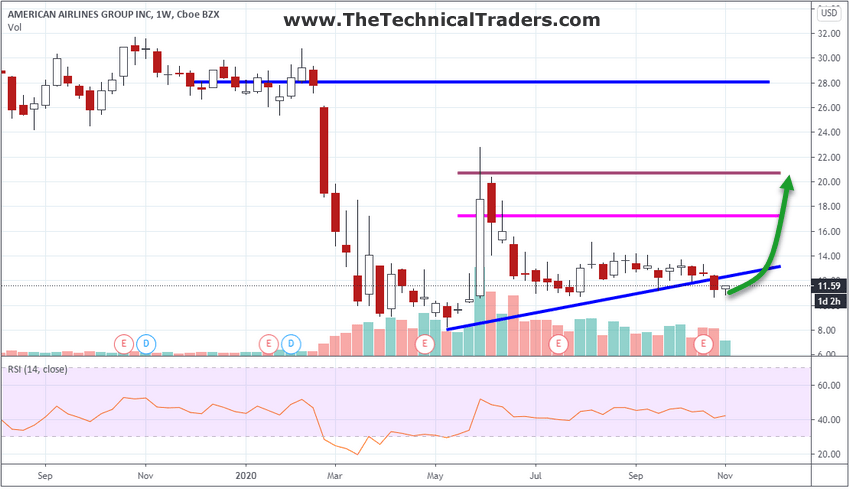

The first stock symbol we suggested had a good opportunity to rally in the weeks and months after the US election was American Airlines (NASDAQ: AAL). We believed a new stimulus package would help to boost Airline price levels and sustainability. With the current post-election chaos, we still believe the US congress will focus on attempting to pass a stimulus package supporting consumers and essential services (like airlines). It seems very likely that AAL will rally to levels above $15.00 over the next few weeks and months with our targets near $17.25 & $20.65. Currently, AAL is just 8.5% below our trigger level (executing a “washout-low” price rotation).

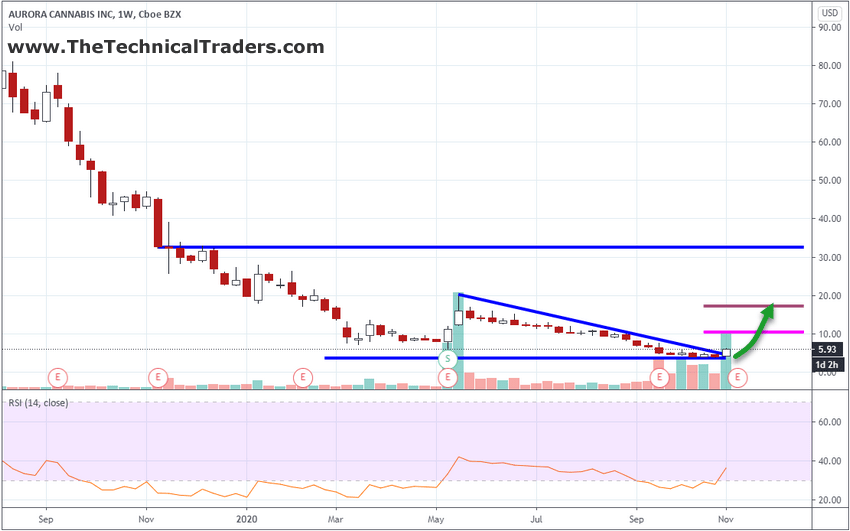

The second stock we suggested had some real opportunity was Aurora Cannabis (ACB). We believed the elections would prompt a new wave of acceptance for recreational cannabis use within the US. This change in acceptance would likely produce new interest in the bigger cannabis companies (Aurora being one of them). Aurora was also very close to an Earnings announcement and has, in the past, skyrocketed higher near earnings data.

Currently, ACB is trading just above $6.00 while our trigger price was $4.69. This current rally represents a 30%+ increase in share price (and we expect it to continue to rally higher). The earnings date for ACB is November 9. The rally in ACB may continue for a few days after this earnings date – so be prepared to exit the trade quickly once it breaks above $10.40. This one call/prediction looks like it is setting up beautifully for skilled traders.

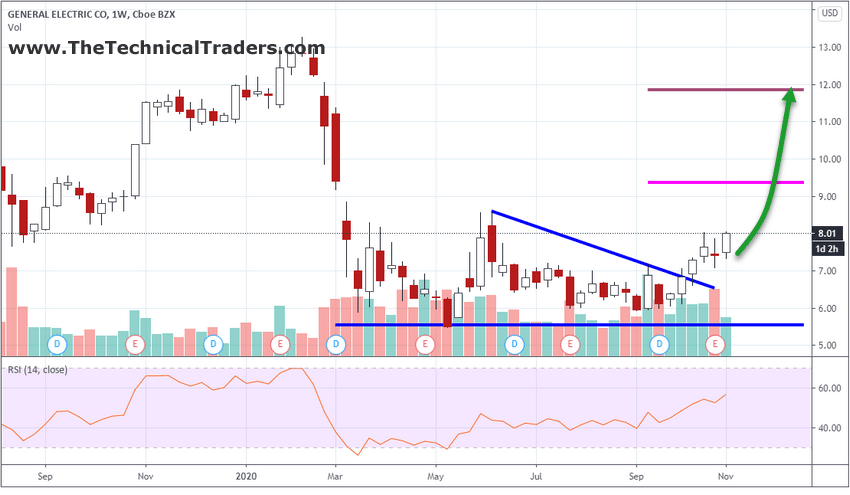

The next symbol we suggested was General Electric (GE). We believed GE would continue to recover and would have a strong opportunity to be a part of any infrastructure, chemical, or industrial resurgence prompted by any stimulus/economic recovery efforts. Our trigger price for GE was $7.61 and GE is currently trading near $8.00. This represents a +4.9% profit – and it looks like this trend is just getting started.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Our initial target level for GE is $9.35. Once GE reaches this level, traders should start trailing a protective stop exit level as price continues to advance to the second target, near $11.80.

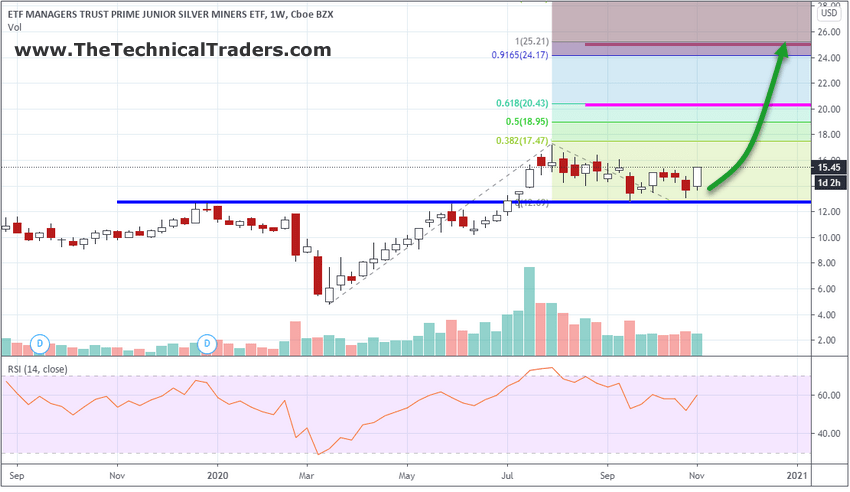

Lastly, our “hedge trade” was in the Silver Junior Miners sector (SILJ). Balancing our portfolio/trades with a “hedging instrument” allows us to protect against some unexpected downside price risk. Imagine that two or three of our trades collapsed downward – resulting in losses. The plan to execute a “hedge trade”, like our SILJ trade, was to allocate some capital into a sector that should rally is weakness or risks became excessive in the markets – thus acting as a protection trade against unknowns.

Well, after a bit of sideways/downside price rotation, precious metals and miners have really started to rally higher. SILJ is up over 11% yesterday – which is exactly what we wanted to see happen.

Our targets for SILJ are $20.25 and $25.00. These are bigger target levels considering the recent price rotation – so be prepared to start protecting profits when SILJ gets above $18.00. In our opinion, if the current post-election chaos continues throughout the end of 2020, precious metals and miners should continue to rally as fear and uncertainty become very real issues for investors and traders.

So, to summarize this update of our “Four Stocks To Own Before The Election” article follow-up. Here is how we currently stand with these trades..

| SYMBOL | DIRECTION | TRIGGER PRICE | NET P/L % |

| AAL | LONG | $12.60 | -8.50% |

| ACB | LONG | $4.68 | 30.00% |

| GE | LONG | $7.63 | 4.90% |

| SILJ | LONG | $14.68 | 7.00% |

Initially, we wanted to see all of these trades move into profits (as all traders desire), but the reality of the markets are that the post-election chaos will continue to present very real volatility in various sectors. Sometimes, this can be a bonus if we are holding long trades in sectors that skyrocket higher. Other times, this volatility can result in deep and painful losses. Remember to use your skills to identify stop/exit levels and remember to try to target gains when they happen. The objective of trading is to “take profits” – not “let profits turn into losses”.

So far, it looks like these trades may do pretty well over the next few weeks. Obviously, we want to see more upside price activity in AAL and GE while it appears ACB and SILJ are already starting parabolic upside price moves. There is still an opportunity for traders to take advantage of our predictions if you time your entry trades.

Want to learn more about how we time and execute great trades and how our Best Asset Now (BAN) technology calls out the strongest symbols/sectors for our members? Visit www.TheTechnicalTraders.com to learn more about how we can help you find profits in these crazy markets.

Have a great weekend!!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only and is not intended to be acted upon. Please see your financial advisor before making any trading or investment decisions. Read our FULL DISCLAIMER here.