Our Custom Index Charts Suggest Downside Flagging Is Setting Up In The US Stock Market

As much as I would like to be able to suggest “all is well – just buy into this rally and forget about it”, our charts are suggesting a broader Flagging formation is currently setting up in the US stock market. This suggests the previous upside price rally has lost momentum and is poised for a sideways flagging set up ahead of the US Presidential election and the Q3 earnings numbers. Eventually, this flagging setup will break upward or downward as a new trend originates – likely just before or after the 2020 elections.

For those of you that have not been following our research, we suggest reading some of our earlier research posts for context:

August 31, 2020: IS THE BULL TRAP COMPLETE? ARE WE FLAGGING OUT INTO A CORRECTION?

August 19, 2020: SPECIAL ALERT: MASSIVE DUAL HEAD-AND-SHOULDERS SETUP

As you can see, we have been urging skilled technical traders to stay very cautious as the new all-time highs were reached because we interpreted the recent rally as an Excess Phase driven by speculation and the US Fed. Within an Excess Phase, price tends to chase a bullish trend as traders pile into the “have no fear” trending. When the Excess Phase breaks, it typically shocks the market and reset the price exploration phase – resulting in a broad market reset where traders and investors attempt to identify “fair market value” given economic expectations.

EXCESS PHASE TRENDING – STAY CAUTIOUS

I have seen this type of activity many times before. In 1999~2000, the Excess Phase drove speculative investors to pile into technology stocks thinking “I can’t lose”. In 2005~2007, we saw a similar type of Excess Phase in the US stock market and US Real Estate market. Now, we believe the actions of the US Fed and the hyper-reactive recovery process after the COVID-19 virus event has resulted in another Excess Phase where speculative traders and investors jumped into the rally thinking “what could go wrong with the Fed driving this rally higher”.

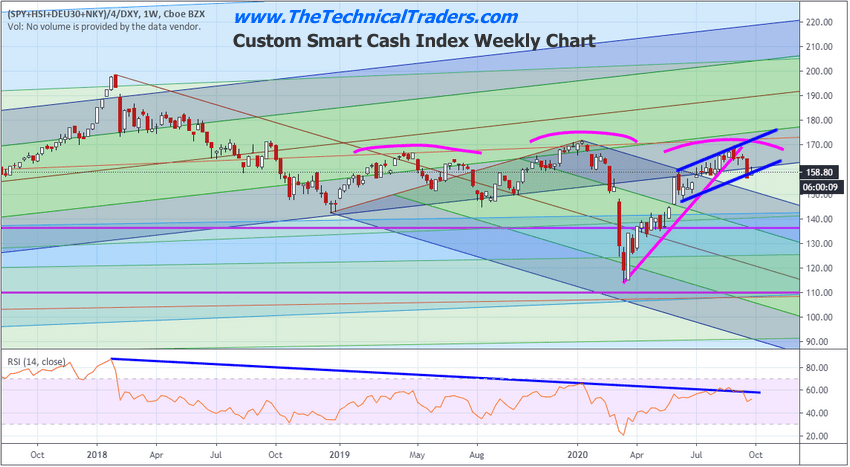

The biggest warning we’ve been highlighting for the past 60+ days originates from our Custom Smart Cash Index chart. The peak in price on this chart aligned with the January 2018 peak in the markets. We are calling this the “true market top” because we believe this peak in price resulted from the organic growth expectations after the 2016 elections. The entire downside price move on this Custom Index Chart after that 2018 peak suggests the markets were driven higher by speculation in certain sectors (technology and others) while the real organic economic growth was waning.

Looking at the Custom Smart Cash Index Chart below, we can see a very clear Head-and-Shoulders pattern that is Flagging Out (see the BLUE LINES). We believe the Head-And-Shoulders pattern presents a very clear resistance level near $174 on this chart – which would act as a trigger level for a new upside bullish price trend. If price is able to rally above that $174 level, then we believe the broader US stock market may be capable of entering a longer-term bullish price trend. If not, then we need to prepare for more sideways price flagging or a potential breakdown in the US markets.

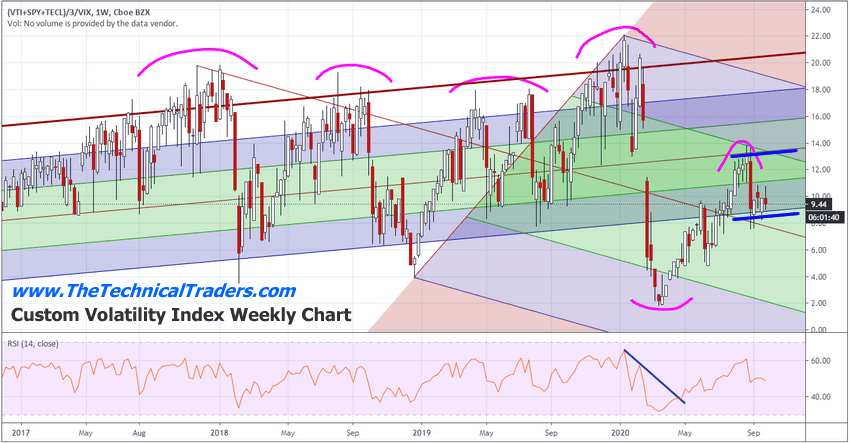

Our Custom Volatility Index chart, below, shows a slightly different perspective of the US markets. First, notice the ultimate peak on this chart setup in late 2019 and early 2020. This is because this Volatility Index is more aligned with price levels and VIX levels than the Smart Cash Index. But it still paints a very clear picture – the COVID-19 event BROKE the previous trending from 2017~2020. Now, we have entered a correction phase where downside trending appears to be dominant.

You can see the downward-sloping Standard Deviation channel on this chart and the recent peak in the Custom Volatility Index that aligns with the upper GREEN range of the Standard Deviation range. Our researchers believe the current downside price rotation in this Index suggests the upper Standard Deviation Range has confirmed. The current FLAGGING setup on this chart suggests the markets are likely to trade sideways a bit before breaking higher or lower eventually.

Ideally, we would watch for any upside move above the 16 level on this chart as a sign that price has broken away from the downside Std Dev channel and resumed the previous upside Std Dev channel cycle. Unless this happens, there is a very strong likelihood that the Custom Volatility Index will fall below the lower BLUE FLAG line and enter a new bearish trend. Until then, it will continue to FLAG OUT sideways.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

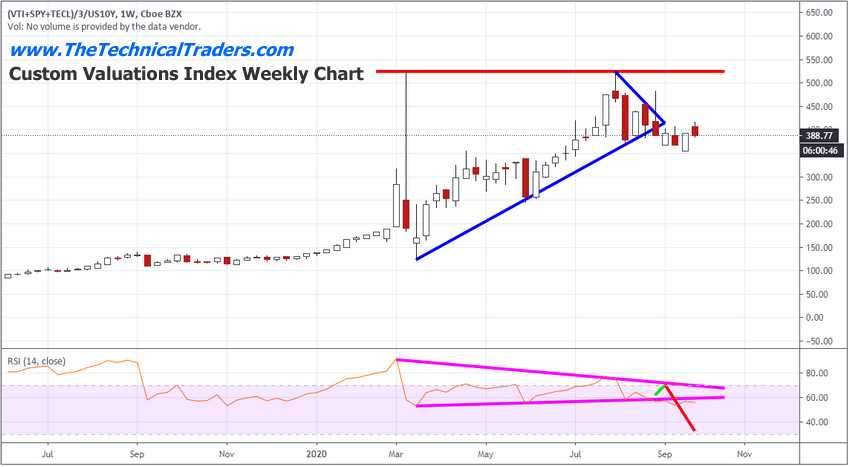

Lastly, we will take a look at the following Custom Valuations Index Weekly chart. The Custom Valuations Index is a representation of price valuation compared to Bond Yields in this chart. This chart very clearly shows the Pennant/Flag formation that recently set up and how the price levels moved a bit lower, then stalled into the current setup. You can also see the Pennant/Flag formation in the lower RSI indicator near the bottom of this chart. As price declines and yields stay flat, the Custom Valuation Index will decline in value. As price stays flat and yields increase, the Custom Valuations Index will also decline. So, deciphering this Custom Valuations Index needs to be done in the context of what the other two Custom Index charts present in order to have a broad understanding of the market technical dynamics.

Our interpretation is that the Smart Cash Index is flagging sideways near a Head-And-Shoulders setup – likely to break lower if the Head-And-Shoulders pattern stays solid. The Custom Volatility Index is also flagging out and suggests a breakdown is likely – breaking away from recent support and potentially entering a new bearish price trend. Thus, the interpretation of the Custom Valuations Index is that price is likely to break lower while yields stay rather flat and that will prompt a downside price move in the Custom Valuations Index. We believe this downside price move will act as “true price exploration” in an attempt to identify new “fair market value” (or a new price level for a momentum base/bottom)

A breakdown in price is very likely at this moment and over the next 30+ days. A breakdown in price will likely prompt new price exploration to establish a base/bottom in the future. Any potential upside price move would have to breach the Head-And-Shoulders pattern high to develop any sustainable momentum. If that happens, we should expect to see broad market bullish participation – otherwise we may be entering another speculative phase driving price higher.

Skilled traders should stay very cautious right now and trade very small positions within their portfolio. The volatility levels are quite high from historical levels – so there is money to be made with short term trading. But be very aware of the risks related to this extreme volatility and the overall setup within the markets. The Flagging patterns will eventually break – one way or another. Our research team believes the downside price break is more likely at this time.

This market, the future setups described above, and the profits lying therein are fantastic opportunities for skilled technical traders to capitalize on. Isn’t it time you learned how I can help you find and execute better trades? My incredible technical analysis team and our proprietary tools have just shown you what to expect 6+ months into the future. Do you want to learn how to profit from these huge moves? Sign up for my Active ETF Swing Trade Signals today! If you have a buy-and-hold account and are looking for long-term technical signals for when to buy and sell equities, bonds, or cash, be sure to subscribe to my Passive Long-Term ETF Investing Signals.

Stay healthy and rest easy at night by staying informed of market trends with The Technical Traders!

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only – read our FULL DISCLAIMER here. Visit www.thetechnicaltraders.com to learn how to take advantage of our members-only research and trading signals.