Lido Minerals Executes LOI to Acquire Hercules Silver Property, Idaho

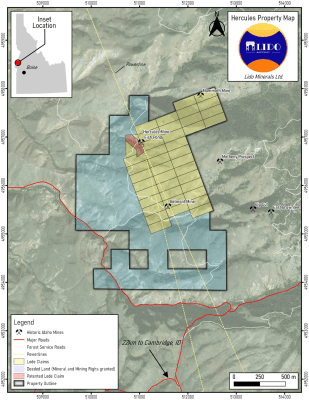

Vancouver, British Columbia – TheNewswire – September 21, 2020 – Lido Minerals Ltd. (“Lido” or the “Company”) (CSE:LIDO) (CNSX:LIDO.CN) is pleased to announce it has executed a non-binding letter of intent (“LOI”) to acquire 100% of the Hercules Silver Property (“Hercules” or the “Property”) by purchasing all of the issued and outstanding shares of private company 1218530 B.C. Ltd. (“1218530”) from 1218530’s sole shareholder, an arm’s length party (the “Transaction”). Hercules is located in Washington County, Idaho, USA and is prospective for silver mineralization. The Project comprises 42 unpatented lode claims, one patented lode claim, and 11 lots of deeded lands covering approximately 1,490 acres (603 hectares), which are registered in the name of Anglo Bomarc U.S., Inc., a wholly-owned subsidiary of 1218530 (Figure 1).

The transaction contemplated by the LOI will provide the Company with the option to acquire 100% of the Property by making aggregate cash payments of $175,000 and by issuing an aggregate of 700,000 common shares of Lido to 1218530 as follows:

-

(1)on the date of execution of a binding definitive agreement respecting the transaction (the “Execution Date”), by making a cash payment of $75,000 and by issuing 250,000 Lido common shares; and

-

(2)on or before the first anniversary of the Execution Date, by making an additional cash payment of $100,000 and by issuing an additional 450,000 Lido common shares.

In addition, Lido shall be required to pay an additional $1,000,000 bonus payment to 1218530 upon the commencement of commercial production on the Property. Lido shall also grant to 1218530 a 2.0% Net Smelter Returns royalty (“NSR”) on the Property. Lido shall have the right to repurchase one-half of the NSR (1.0%) from 1218530 for a purchase price of $1,000,000 payable to 1218530 at any time before the commencement of commercial production on the Property.

The issuance of Lido common shares under the Transaction shall be subject to applicable securities laws, any securities regulatory authority having jurisdiction, and the policies of the Canadian Securities Exchange (“CSE”), and the Lido common shares shall be subject to a four-month hold period in accordance with applicable securities laws and the policies of the CSE.

Completion and execution of a definitive agreement is subject to Lido completing detailed due diligence of the Hercules Project and 1218530.

Figure 1: Location Map for the Hercules Silver Property, Idaho, USA

Project Highlights

-

– Historical drilling results from 28 core drill holes, 43 underground percussion drill holes, and 236 reverse circulation (RC) drill holes (307 drill holes in total) completed on the Property between 1965 and 1988 including drilling intersections with average silver grades between 15 to 20 oz/ton Ag (468 to 625 g/t Ag) near the Hercules Adit1,2

– A historical drill hole completed in 1978 returned 22.5 oz/t Ag (703 g/t Ag), 1.36% Pb, and 0.20% Zn over 50 feet (15.2 m – true width unknown) at a hole depth of 145-195 feet (approx. 44-59.4 m), demonstrating the potential for high grade silver mineralization on the Property1,2

– The Hercules Adit (also known as the Hercules Mine) has in the past allowed underground access for core and percussion drilling, and metallurgical testing, and would need to be rehabilitated in order to continue underground exploration and development activities. Underground activity ceased in 1976 after the completion of a 790-foot drift and several crosscuts1,2

– The Property comprises a Jurassic-aged ash flow rhyolite unit (300-400 feet thick) that hosts the high-grade silver occurrences in the region and is known as the Hercules rhyolite. Six mineralized areas or prospects have been identified within the Property including the Belmont, Haystack Ridge, Fishpond, Hercules Adit, Hercules Ridge, and Grade Creek prospects1. The majority of historical exploration and development work has been within the Hercules Adit prospect followed by the Fish Creek prospect with the remaining part of the Property receiving minimal work

1Source of technical information: The technical information disclosed in this news release including historical drilling results on the Hercules Property are referenced from “NI 43-101 Technical Report on the Hercules Silver Property Washington County, Idaho for First Idaho Resources Inc. and Anglo-Bomarc Mines Ltd.” by T.W. Muraro, P.Eng. with a SEDAR filing date of April 3, 2013 (Muraro, 2013).

2Data Verification Statement: A Qualified Person has not fully verified the historical drilling results disclosed above including any sampling, analytical, and test results underlying this information, other than reviewing the results from the Muraro (2013) technical report on the Property referenced above and any available public information. The Company and a Qualified Person plan to review and verify the available scientific and technical information on the Property during its extensive due diligence efforts over the next several weeks.

Lido CEO Paul Teniere commented, “the Company is actively looking at property acquisitions in the State of Idaho, a mining-friendly state with a rich history of precious and base metal mining. The Hercules Property is highly prospective for silver yet has been underexplored over the past several decades. We look forward to learning more about this potentially high-grade silver property over the next few weeks as we complete our extensive due diligence efforts.”

Hercules Property Overview

The Hercules Property is approximately 1,490 acres (603 hectares) in size and comprised of mineral claims (patented and unpatented) and accessible private lots between 3,000 and 5,500 feet above sea level on the northwestern shoulder of Cuddy Mountain, 193 km northwest of Boise, Idaho and 32 km northwest of Cambridge, Idaho on Highway 71 (Figure 1). The Property extends northeast of Highway 71, between Camp Creek and Grade Creek and is comprised of steep to moderate, open grassy slopes marked by strips and patches of mainly coniferous trees. More than half of the mineral claims and the private lots which make up the western three quarters of the property lie within the Cecil D. Andrus Wildlife Management Area which is managed by the Idaho Fish and Game Department.

Cuddy Mountain is an uplifted and tilted fault block of accreted terrane approximately 19 km in size, surrounded by rocks of the Columbia River Basalt Group. Flat-lying erosional remnants of the basalt cover half of the mountain top, six to seven thousand feet above sea level. The core of the mountain is a Triassic to Jurassic sequence of volcanic rocks, volcaniclastics, and marine sediments. These basement rocks are best exposed on the northwest and western flanks of the mountain and in faulted and unconformable contact with the Miocene Columbia River Group. The Cuddy Mountain Fault is exposed along the southwest and south flanks of the mountain and the older, east-verging Connors Creek Fault is exposed on the northwest flank of Cuddy Mountain.

The Property is comprised of a Jurassic-aged ash flow rhyolite unit approximately 300 to 400 feet (91 to 122 metres) thick that hosts the high-grade silver occurrences in the region. This rhyolitic unit has been the focus of silver exploration since the 1880’s. Between 1965 and 1988 work by previous operators resulted in 13 drilling programs and approximately 1,045 feet (318 metres) of lateral underground workings accessed via the “Hercules Adit”. The historical drilling programs produced 28 core drill holes, 43 underground percussion drill holes, and 236 reverse circulation drill holes. Underground access has not been possible for several decades and would require rehabilitation to commence underground exploration and development including drilling.

Qualified Person Statement

All scientific and technical information contained in this news release was prepared and approved by Paul Teniere, M.Sc., P.Geo., CEO of Lido Minerals Ltd. who is a Qualified Person as defined in NI 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS

Paul Teniere, M.Sc., P.Geo.

Chief Executive Officer

Lido Minerals Ltd.

(604) 687-2038

For more information about Lido, please visit the Company’s SEDAR profile at: https://www.sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00045337

THE CANADIAN SECURITIES EXCHANGE (CSE) HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE.

Forward-looking Information Cautionary Statement

This news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. In particular, forward-looking information in this press release includes, but is not limited to, statements with respect to the Company’s proposed acquisition, exploration program and the expectations for the mining industry. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation and environmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; liabilities inherent in water disposal facility operations; competition for, among other things, skilled personnel and supplies; incorrect assessments of the value of acquisitions; geological, technical, processing and transportation problems; changes in tax laws and incentive programs; failure to realize the anticipated benefits of acquisitions and dispositions; and the other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2020 TheNewswire – All rights reserved.