Eric Sprott Funded Gold Explorer Pursues “Billion-Dollar Drill Hole” with Stephen Stewart

Eric Sprott invested in Orefinders (TSXV:ORX OTC:ORFDF) in February 2020 due to the discovery potential at its numerous projects in close proximity to Kirkland Lake Gold’s world-class Macassa Mine. Only after Sprott’s investment did the market begin to awaken to Orefinders’ compelling investment value proposition. Over the last five years, Orefinders operated under-the-radar and quietly assembled a portfolio of assets in the Kirkland Lake area that CEO Stephen Stewart believes could one day deliver “that billion-dollar drill hole.” Orefinders is gold explorer with the third largest land package on the Ontario side of the prolific Cadillac break in Canada and is about to commence six to nine months of non-stop drilling at its projects. In addition to the tremendous discovery potential, the company has an approximately one million gold ounce resource (historic and NI43-101) at its three projects combined as well as three control block positions in three prospective junior miners. In this interview, CEO Stephen Stewart explains the inherent value within Orefinders as well as the blue-sky discovery potential.

0:00 Introduction

2:10 Stephen and his group’s background and past successes

3:53 Compensation and alignment with ORX shareholders

6:03 Acquired assets in down market to drill in bull market

8:39 EV of C$10M w/ 3 projects containing approx. 1M AuOz

9:43 ORX has 3 control block positions in 3 prospective juniors

11:22 Treasury of $4M being deployed into drill programs

14:40 Pursuing “billion-dollar drill hole” near world-class gold mines

16:52 ORX owns the tailing facility of the Kerr Addison mine

18:19 ORX owns 20% of Mistango River Resources which is about to drill right next to Kirkland Lake Gold’s top-tier Macassa Mine

20:15 ORX owns 26% of Nevada gold explorer Pacific Precious (IPO planned Q4)

21:42 Six to Nine months of non-stop drilling

TRANSCRIPT:

Bill: I’d like you to start off by sharing a little more about your background, your group’s background and your past success. I don’t think the market is aware fully of your past success, which you shared with me back in February when we were originally chatting about your company. Please share a little more about your background.

Stephen: Sure, happy to. So, I grew up in the mining industry. My father was a mining lawyer and I always worked side by side with him and I still do. He’s still involved in all of our companies. In a sense, I grew up discussing and thinking about this industry at the breakfast table and the dinner table. Formally speaking, my background is in finance. So I understand how money works and how things are valued. That’s really been my focus and I apply that towards the junior mining industry, which isn’t really high finance, but certainly in dollars and cents matters. And in terms of my past successes, our group, I guess largely is known for being the assembler of what became the Cote Lake project, and we drilled a discovery hole and we were significant shareholders in Trelawney when it was sold back in 2012 to IAMGOLD for over $600, almost $700 million. So, that was one of our big wins. And we were also involved with the early days of what’s now called the Ring of Fire in Northern Ontario, which is a phenomenal world-class deposit up there that sadly has fallen on hard times due to infrastructure and issues. But that has been our background, but ever since 2015, we have been involved with Orefinders and other companies, which are in its portfolio.

Bill: When a new speculator or investor is looking at a potential exploration and development company, one of the things, as you know, we need to look at is the management’s perspective. Can we trust them with our money? And one of the first things you look at to see is how do they compensate themselves. Share a little bit about your perspective on the whole idea of founder shares, options, how have you bought your shares? When do you plan to sell your shares?

Stephen: Okay, good question. Firstly, I pay myself $10,000 a month. Very simple. In terms of founders’ shares, there are zero founders’ shares that I have received from Orefinders or actually from any of the companies I’m involved with, and I’m involved with a few. So I have bought, with cash, every single share that I own, vis a vis on market or in a private placement. And I typically participate in every single private placement I’m involved with, not everyone, but most. So I am directly aligned with shareholders, in that sense.

Bill: If someone sees you selling in the open market, what should they think?

Stephen: They should sell too. Frankly, unless we have a tremendous success and we are multi-dollar stock, I don’t believe that anybody sitting in my seat should be selling their shares while trying to convince the public that they should be buying those very same shares. That sends the wrong message. We are in this to make a discovery. We are in this to sell this company and make money just like the rest of our shareholders do. And I’ll note that I do pay myself of course, a salary, I think I earn every penny of it. But I will also note that in the last number of years, I put more money into this company than my salary by quite a distance, I would imagine. I own about 5 million shares Orefinders.

Bill: So you’re an investor even more so than an employee?

Stephen: Well, that’s the only way I’m going to make money. I mean, nobody got rich off a salary. I’m in this business to make substantial money. And I think with Orefinders, we’re in a good position to do that. So, $10,000 a month pays the rent, so to speak, but I’m here to make 10, 20, 50 times my money.

Bill: Stephen when we spoke 18 months ago I remember you sharing with me that your approach was to acquire assets. And at that time you weren’t particularly focused on drilling because you just didn’t feel like the market would reward that. And that would, at that time, it wouldn’t be in the best interest of shareholders. However, when we spoke in February this year, your mentality and your outlook seem to change, can you talk to us now about what you’ve done in the last few years with Orefinders to set yourself up for what you’re about to do right now?

Stephen: Sure. Well, you’re absolutely right from 2015 to December 2019, Orefinders had a very clear philosophy, which we were very forthright with investors. And we said, “We refuse to drill, all else equal.” It just didn’t provide the appropriate return on investment, which we seek, which starts at 10 times your money. And also the cost of capital was too high. Meaning we had to give away 25%, 30% of our company to do any drill program of significance. So our share price was too low. And if you met or exceeded expectations, it was often met with the liquidity event. Now, if you made a world-class discovery like a Hemlo or a Voisey’s Bay, that would have been superseded, but that’s not really an investment proposition that we were interested in, but we’re most interested in mitigating the risk.

And so we saw the opportunity to take advantage of the market. The market was a downmarket and we could buy other people’s projects that they were having a hard time raising money for. And so, Orefinder’s really developed this portfolio, we now have six assets. We accumulated them in a down market and perhaps more importantly, we accumulated them largely out of distressed or call it unique situations. So we bought problems, that we believe we can sell. And now we announce if people go to our news release, December 30th, we announced before the gold really started to move. We felt that the pivot was in place. And what I mean by that, it was time to go back to the drill bit. We feel, and felt, that investors are going to start to pay for quality results and discovery. And so we’ve developed this portfolio, we bought it cheap and now we’re cashing ourselves up. We’ve got $2 million in the treasury. We’ve got another, probably 8 million in marketable securities. And we just announced a $2 million financing that’s closing in a few weeks, that’s going to give us a great position. And now it’s all about putting the money into the ground and looking for that billion-dollar drill hole that we seek.

Bill: Great, and I want to talk about the fundamental value in your company. So if I do just some quick back of the napkin math, your market cap, as we speak is about $20 million and your enterprise value would be about $10 million. Is that correct?

Stephen: That’s fair to say with our cash. And if you strip out our cash and marketable securities, yes.

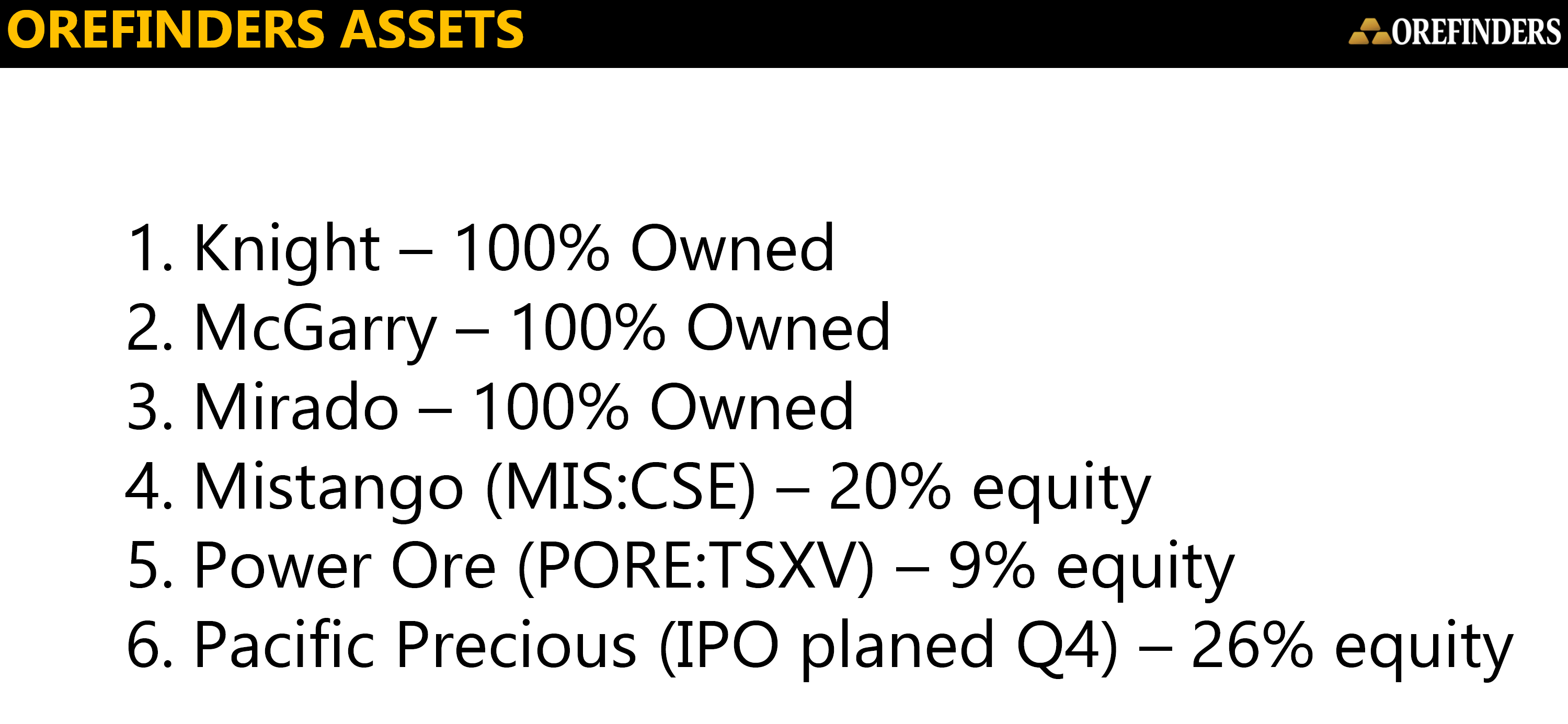

Bill: Okay. So with a $10 million enterprise value, let’s first talk about your projects, your three projects, Knight, McGarry, and Mirado, where’s the value currently before you begin to drill these projects?

Stephen: Well, I guess you could say the value is retained in the ounces in the ground and not all ounces are created equal, as we should know. However, each of those projects has either 43-101 historical ounces in the neighborhood collectively, of about a million ounces. And you can attribute all sorts of different multiples on a per ounce basis. But if you’re going to attribute a million dollars relative or a million ounces relative to our market cap, that’s $10 an ounce, which is extremely low. So I think our enterprise value is quite attractive, at this point in time.

Bill: Then you also have three equity stakes in companies. Talk to us about this please.

Stephen: That’s correct, we own three positions. I would say control block positions, one in Mistango River Resources, which we acquired vis-a-vis a hostile proxy battle that ended last year. And we’ve got a very exciting project in Kirkland Lake that we’re going to be drilling extensively very soon, it’s right beside all of Orefinders assets as well, so that’s why we got attracted to that project. As well we have about an 9% position in a company called Power Ore P-O-R-E on the Toronto Venture Exchange. It owns a very sexy copper-gold, very large scale mine that was operated by Falconbridge. They took out 1.5 billion pounds of copper, a million ounces of gold out of that. And we spun that off in 2018 because it … we had a non core asset that we weren’t getting any value for. It was not a gold asset and then went on to create that company.

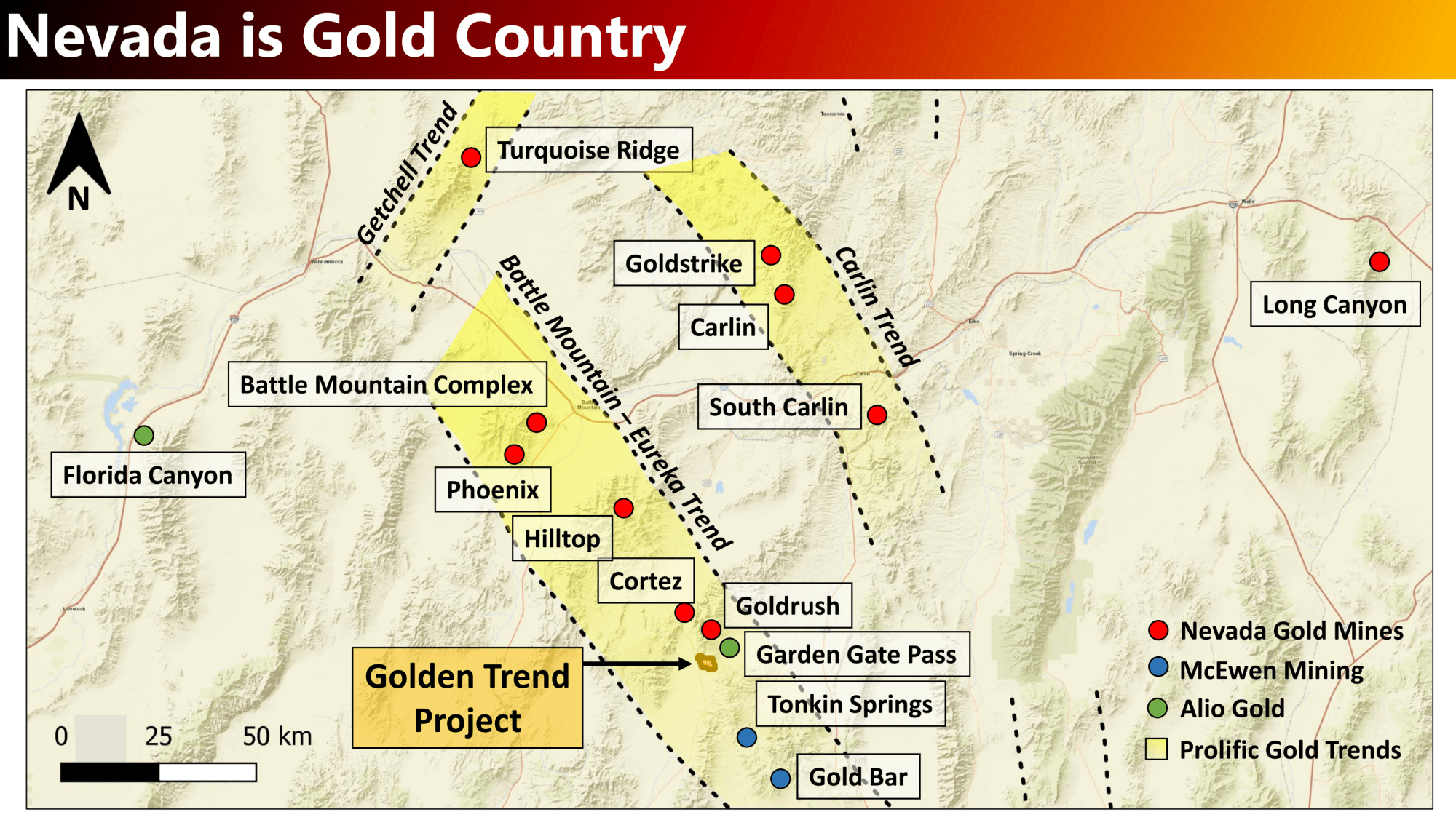

And then last we’ve got a 26% interest in a company called Pacific Precious. Pacific Precious is a private company, and its planned IPO is later this year in Q4. It’s led by a gentleman by the name of Ron Stewart. Ron is not related, we just happen to be from the same clan in Scotland, if you go back far enough, I suppose. But that focus is going to be in Nevada. It controls a project, right beside Barrick’s Goldrush, which is a monster deposit. And I think investors can anticipate that company to grow in terms of its portfolio in Nevada as well.

Bill: Okay, so you’re raising $2 million. You’ll have about 4 million in the treasury. How are you going to spend that to advance these projects?

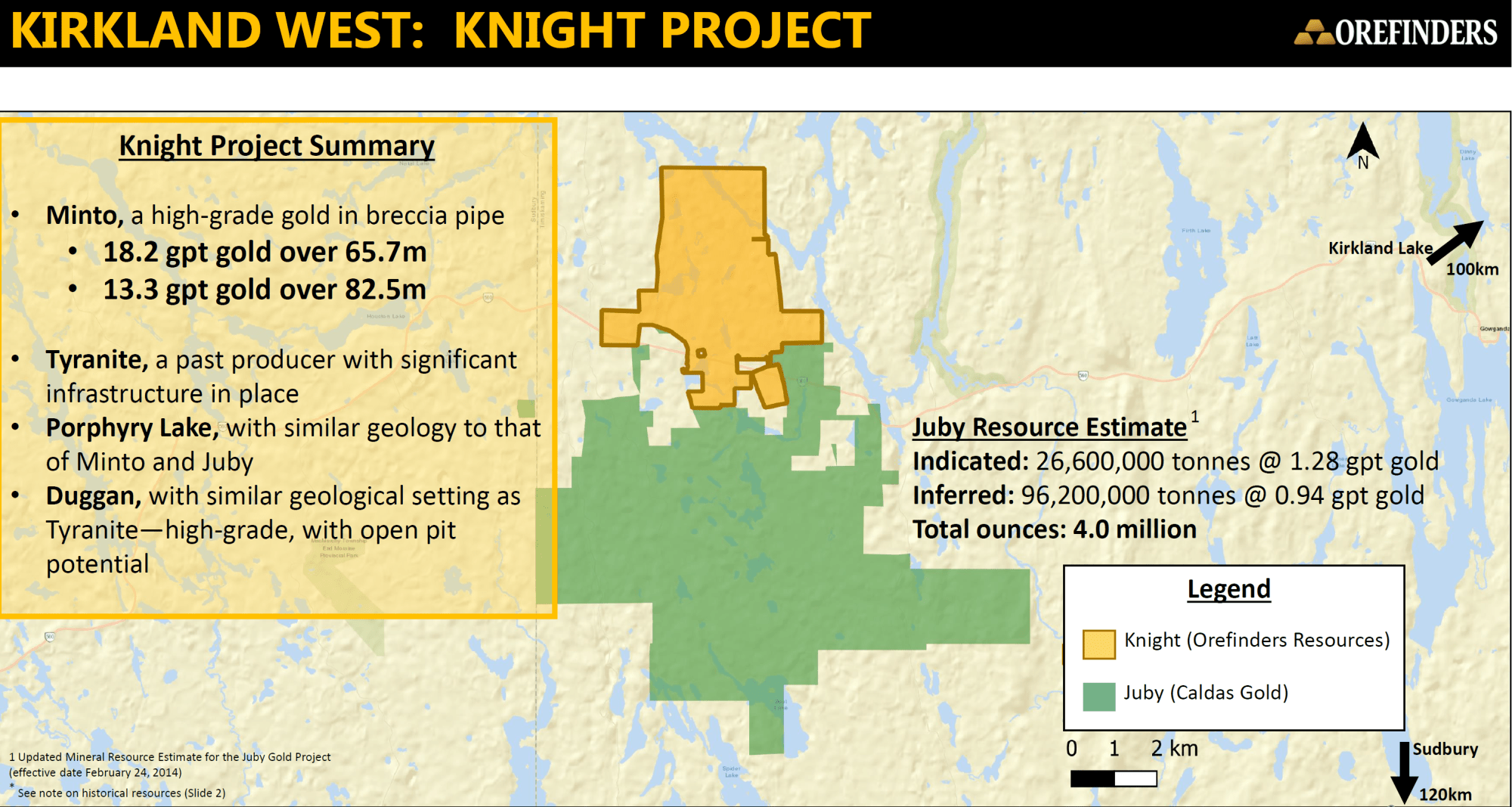

Stephen: We’re going to put as much of that into the ground as possible, as I said before, and as we said in December. We believe the time is now to put it into the ground and make a discovery. The accumulation of these assets was phase one. Now phase two is to drill. And so a couple of weeks ago, we put out a news release that we’re going to be drilling our Knight project, which is just 60 kilometers West of Kirkland Lake. We’ve got 5,000 meters planned. I think investors can expect us to probably double that when we close this financing. So that’ll be our first drill program. It’s got a very attractive discovery drill target on it. We’re going to put about 10% of those meters into a, as I said, a discovery target. It’s sort of binary. If we hit it, it’s going to be very interesting, potentially game-changing if we miss it, it’s no big deal.

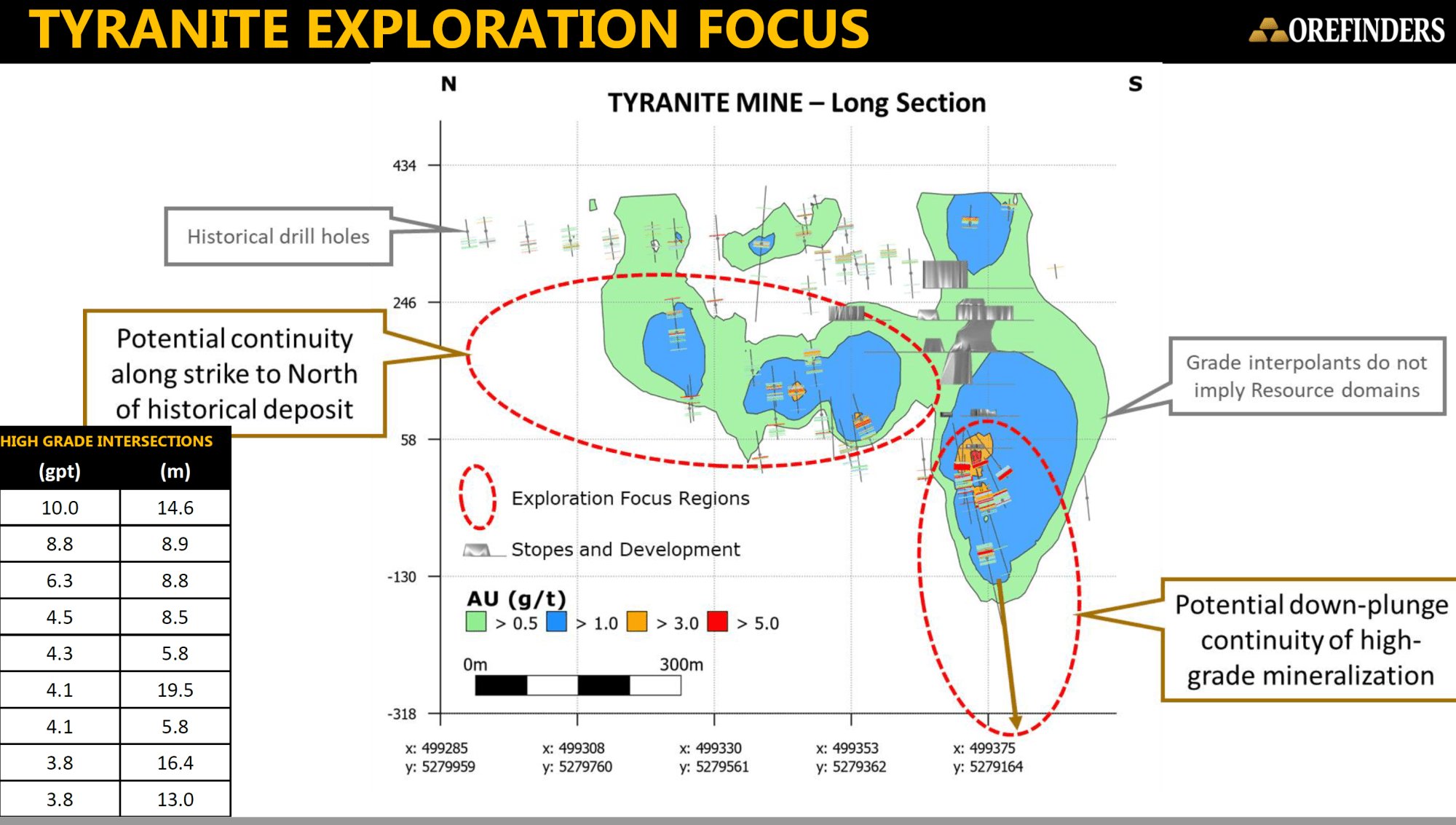

The vast majority of those meters are going to go towards our Tyranite project, which is an existing, high-grade mine, more traditional style. It’s got very good historical intersects. Now we’re going deeper and we’re going laterally. So we’re going to be expanding those resources. So, that’s our first drill program on the Knight.

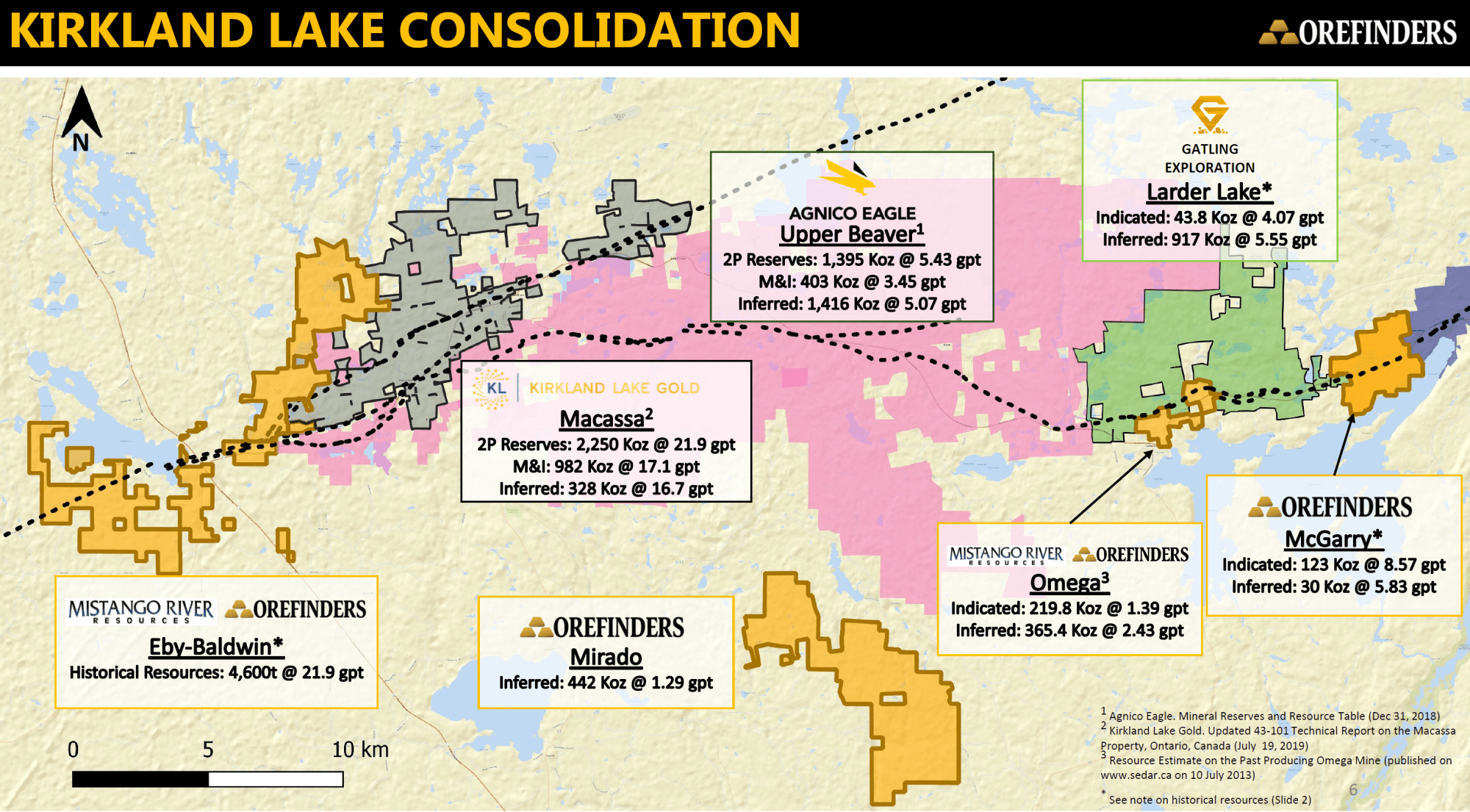

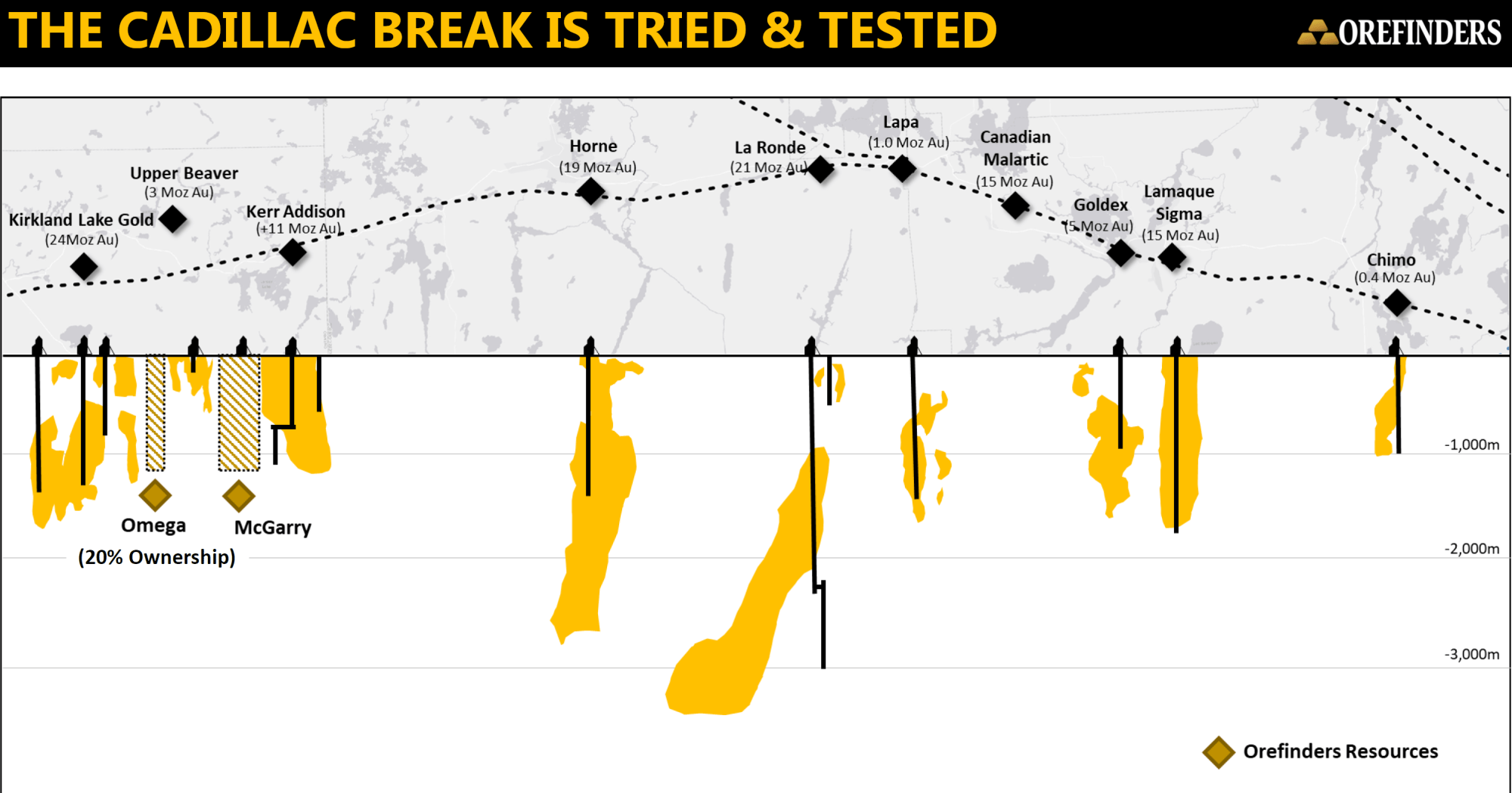

Then we’ll subsequently pull the drill over to our McGarry project, which is about 20 kilometers West of Kirkland Lake. And it’s beside the Kerr-Addison which was a world-class 12 million ounce high-grade producer. We have the same style of mineralization on there. Again, we’ll have a sort of a two pronged drill program approach. One is some, call it lower hanging fruit on known mineralization, which is right beside the Kerr-Addison, we’ll look to expand our existing resource there, which we have an eight gram per ton resource there. But also there’s on the McGarry there’s about a kilometer and a half of strike length on the Cadillac Break, which is a world-class fault where all this gold in Kirkland Lake came from. It’s really never been drilled. And so that’s going to be the discovery aspect and investors can expect us to come out with probably 7,000 or 8,000 meter drill program towards the end of this year on that one as well. So details to come forth on the McGarry.

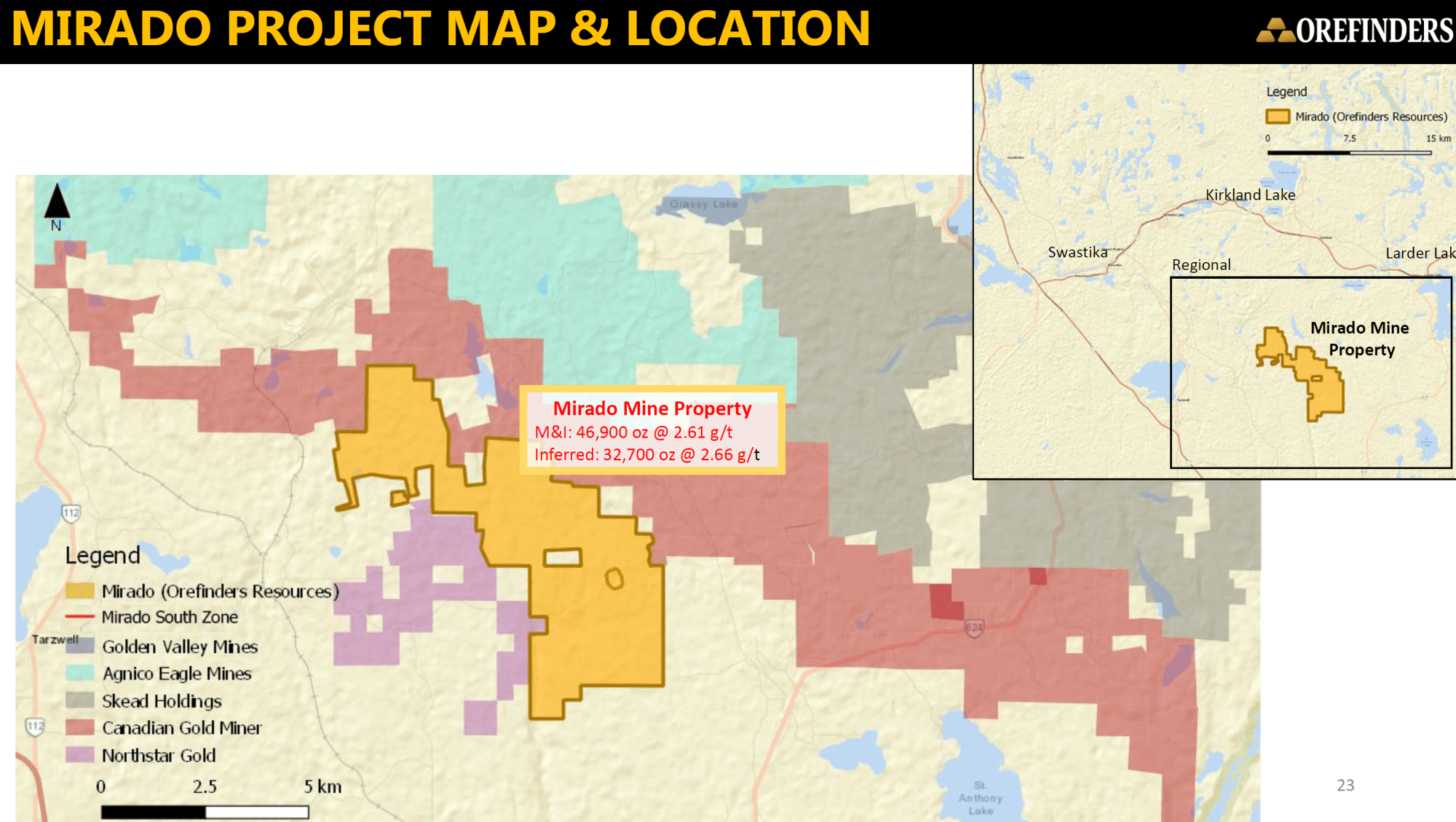

And our last projects called Mirado. We’ve got about 450,000 ounces in an open pit there. We view that as having multimillion ounce potential, but it’s really just a function of drilling it out, without getting too technical, and it’s just step out drilling, but there’s definitely potential to grow that. And, all these assets I’ll note that on our McGarry, our Knight, and our Mirado, and of course the assets that are also, we have direct exposure to in Mistango are all very proximal. They’re all next door neighbors. And that was by design, certainly not by accident.

I do believe that, and I’ve been vocal about this, that mergers and acquisitions are inevitable in this industry and Orefinders, Mistango and all of our properties have really put ourselves in front of what we see as a coming wave of mergers and acquisitions, not that we’re waiting on being bought out, far from it. We’re going to go and drill our own properties and see what happens. But, we plan to make ourselves so attractive that the big guys, the guys that build mines and operate mines just can’t resist.

Bill: Stephen, speculators that focus on Canadian mining stocks will understand the significance, geologically and location-wise, of your projects and why it’s so good. But perhaps those that don’t pay as much attention to Canada, or maybe they’re newer to investing and speculating in mining stocks. You mentioned Kirkland Lake, can you elaborate a little more on the grade and the resource at Kirkland Lake and why, where your projects are located are, is excellent.

Stephen: Sure. Well, Kirkland Lake can be defined as the third largest gold ore body in the history of the world. Not many people know that, but Kirkland Lake or Kirkland Lake Gold, the corporation, now mines the highest grade mine in the world. It’s called the Macassa and the Macassa next year is going to be pulling out 400,000 gold ounces at nearly 20 grams per ton, which is just phenomenal. And they’ve just made a new discovery there called the South Mine Complex, which they think is going to be putting that mine in operation for the next 30, 40 years. I mean, so who said mining is not sustainable? And so that is, I guess the big dog in Kirkland Lake town is the Kirkland Lake mine. Now, just about 20 kilometers to the East of that is something called the Kerr-Addison, and I mentioned that before, we’re right beside that on the McGarry, that mine was also in its day world-class.

And these two mines really are the goalposts of the Cadillac Break on the Ontario side, which is by no exaggeration is a world-class fault system, which is just a crack in the earth where these hydro-thermal fluid carrying the gold can seep into and deposit these gold over millions of years. There is another ore body lurking in between those two world-class monsters. And we are the third largest land owner collectively in that region between those two projects, aside from Kirkland Lake Gold, themselves multi-billion dollar company, as well as Agnico Eagle, the other major in the area. So those are the two big dogs and then it’s us. So we think we are phenomenally well positioned.

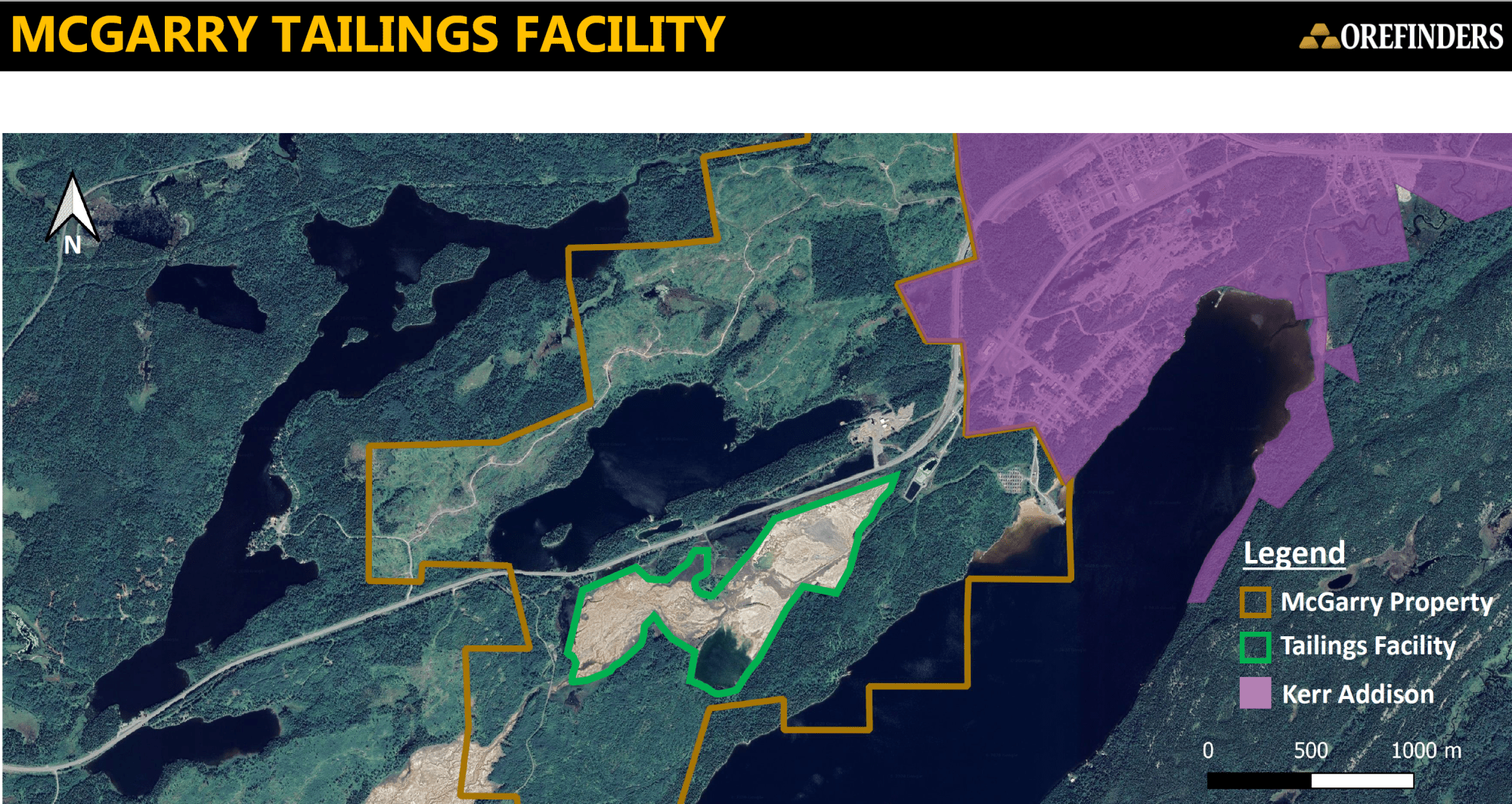

Bill: I also think it’s unique that at your McGarry projects, you own a tailings facility right next to the Kerr-Addison. So as I was going through your presentation, the word that came to mind was ‘ransom.’ It’s almost like you have a ransom on that project, don’t you?

Stephen: Well, I don’t know if I’d use that word, but certainly strategic would be the word that would come to mind. The Kerr-Addison itself right now, as I said, it’s shut down. It was a high-grade underground mine in 1996, but it has been reinterpreted into a open pit type of a deposit. And that’s going to get, … It’s a big deposit too. So that’s going to get a lot of attention. And as you know I owned the tailings facility, or I should say, Orefinders owns the tailings facility on its McGarry project. That is not an insignificant fact. So it is my belief that whoever buys the Kerr-Addison, and somebody is going to buy the Kerr-Addison, somebody large I think, they are going to require our property because they need to put that waste material somewhere. Now, again, that’s not our strategy, but that’s a nice card to have in our back pocket. However the McGarry, I think, offers the potential to discover its own Kerr-Addison 2.0 on it. And that’s ultimately why we’re there. We’re not there to be in a blocking position. We’re there to discover an ore body and sell it to the highest bidder. But if having the tailings facility is a plus, well, then we have that plus.

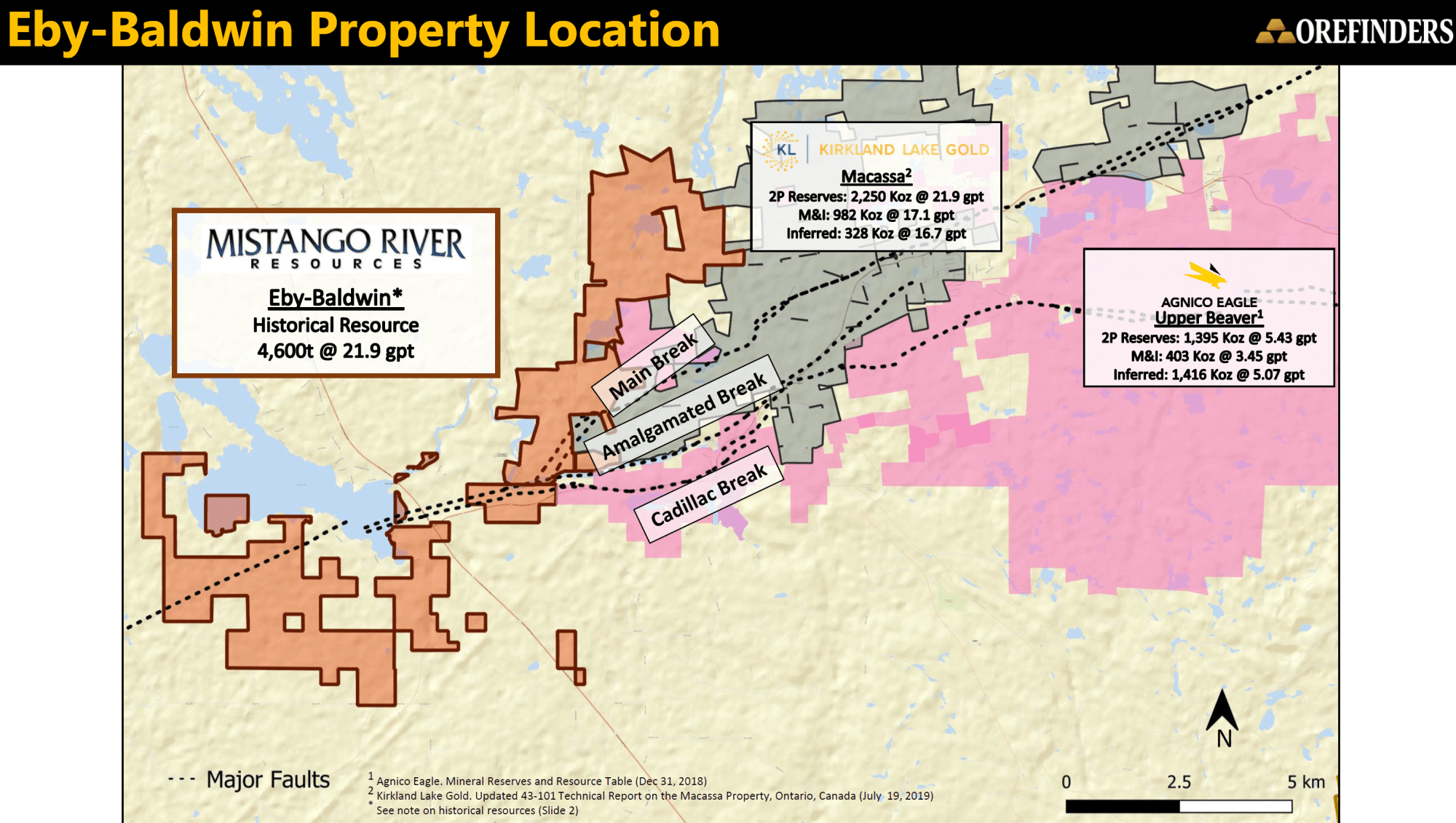

Bill: What about Mistango River Resources, one of your equity positions. Eric Sprott invested in this company as well. Talk to us about the prospectivity that the Orefinders investors would get through the stake in Mistango.

Stephen: Orefinders owns 20% of Mistango, and you’re right, Mr. Sprott came in. Actually, he came in on four separate occasions this year, two times into Orefinders and two times into Mistango. And Mistango has $4 million in his treasury right now. It announced a $3 million financing, contemporaneously. It announced the same day as the Orefinders. It’s a broker deal done by Echelon and we’ve got large institutional names coming in. And I certainly hope Mr. Sprott is going to come in again, we’ll make that announcement at close. And it is going to be drilling. It is in the process of defining a very substantial drill program on its Eby-Baldwin project, which is directly beside the Macassa mine, which I told you about that 400,000 ounce per year, 20 gram per ton gold deposit that Kirkland Lake Gold owns, the Eby-Baldwin owned by Mistango 100% it’s right there.

We believe it’s the same geologic setting and it’s well financed to go and find a discovery on its own. What Mistango is seeking is a couple of intersections to prove that that Kirkland Lake ore body, which I mentioned, which has been mined for nearly a 100 years, and is the third largest gold ore body in the world. We are trying to prove that it continues to go West onto our property. And when I say continue, I mean, the Macassa is one of seven mines in history which have extracted from this ore body. We believe that Mistango has the eighth, and we will, come closing this financing, have $7 million worth of drilling to go out there and prove it. If we do then, Oh boy, is that 20% that Orefinders owns is going to be worth an awful lot.

Bill: And Pacific Precious, if you could give us your commentary on the speculative upside.

Stephen: What’s going to happen there is that Orefinders owns 10 million shares. It’s going to dividend out at least 5 million of those directly to our shareholders as a part of the IPO process. So Orefinders shareholders can expect a zero cost basis dividend coming to them by the end of the year. It owns a project called the Golden Trend, which is again, contiguous…I guess we like contiguous projects, but this project is contiguous to Gold Rush, which is nearly a 15 million gold ounce, 10 gram per ton, monster deposit owned by Nevada Gold Mines, which is the JV between Barrick and Newmont. This is a monster mine. We believe we are in the same geological context, this is in the Cortez Trend. It is really the Beverly Hills 90210 zip code to be in for gold mining.

So, that is a very prospective project that Pacific Precious is going to raise money for in the very near term, and put some holes in there and trying to find a deposit. In addition to that, you can expect the leadership led by Ron Stewart to go out and acquire additional projects. We love Nevada. Well we love … First all I love Ontario, I love Quebec. There’s no better place to do business. If we’re going to do business anywhere else, it would be in Nevada. And so that’s giving us, and Orefinders shareholders, direct exposure to Nevada.

Bill: With an enterprise value of about CAD$10 million, just with the fundamental value within the company, I find that compelling before the speculative blue sky potential. And then Stephen, just to recap here with your position in Pacific Precious, Mistango, and the three projects, how many projects will be drilled, let’s say within the next six months and potentially more value created?

Stephen: I think, once we close this financing, we’re going to be drilling in just a matter of days. I don’t anticipate we’ll stop drilling for the next six to nine months. That’s my plan. So we’re going to start drilling on the Knight. We’re probably going to double that to 10,000 meters. We’re going to have at least 6,000 to 8,000 meters on McGarry. And then last we’re going to drill our Mirado project, which was our first project we had, but certainly doesn’t deserve to be mentioned last. Those three projects are going to get an awful lot of attention. As I said off the top, we spent an awful lot of work putting together this portfolio, with the idea that when the time is right, we’re going to raise money and put it into the ground and the time is now. And so our shareholders can expect us to do exactly what we said we’re going to do. And we’ll see if Mother Nature cooperates.

[…] TSXV:ORX OTC:ORFDF Orefinders’ company profile interview with CEO Stephen Stewart: https://www.miningstockeducation.com/2020/09/eric-sprott-funded-gold-explorer-pursues-billion-dollar… Northern Miner issue about Eric Sprott’s investment in Orefinders: […]