Gold Is Flagging Out – Breakout Rally Targeting $1,950 Or Higher Is Next

RESEARCH HIGHLIGHTS:

- Gold Found Support Near $1,945- Right Where We Expected

- Gold Setting Up A Pennant/Flag And Is Nearing The Apex

- Another Measured Move Is Setting Up – Targeting $2250 Or Higher

- Silver Should Rally To $36 Or Higher When Gold Breaks

Nearly every Precious Metals/Gold enthusiast that follows our work has been emailing or messaging us asking about the next rally phase for Gold. Thank you for all of your messages and supportive comments. If you have not been following along, please review our recent research on gold and silver price moves, the rally in platinum, and detailed 2020/2021 price forecasts for gold and silver.

After watching the VIX start to move higher last week while the S&P and Dow Jones pushed to new all-time highs, our research team has been actively studying the Pennant/Flag formation in Gold that has been setting up. Our “Measured Move” article suggests support near $1,945 will act as a launchpad for an upward price advance to levels near $2,150 or higher. As the momentum of this upside price move continues to build, as we’ve recently seen with the last upside price leg, we believe the $2,200~$2,250 could be the next real upside price target for Gold.

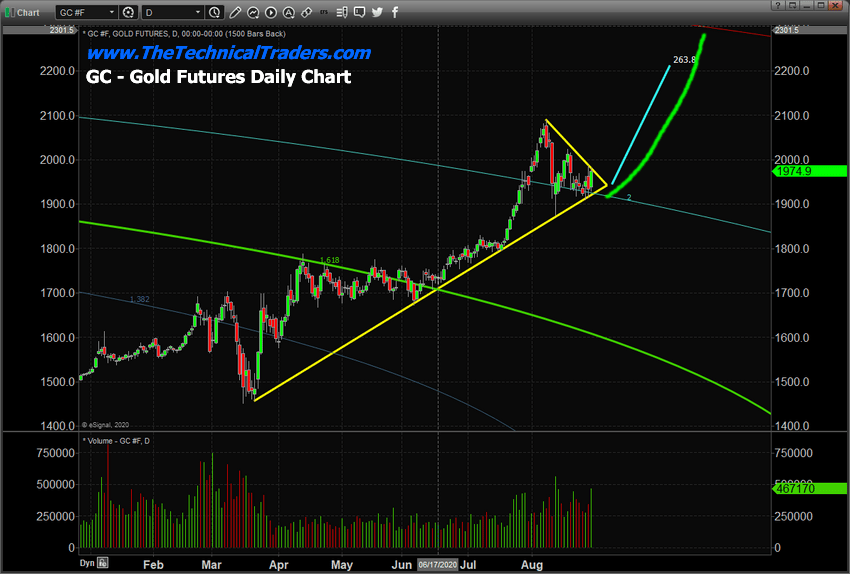

Over the past few weeks, Gold has confirmed our projected $1,945 support level by closing out near this level for multiple weeks (8/10: $1.949.80, 8/17: $1,947). We believe the ability of price to close above the $1,945 level, even though price traded below this level, shows how strong this support level really is. Now that Gold has started to rally near the Apex of the Pennant/Flag pattern, we believe the next upside leg could be starting.

This Daily Gold Futures chart, above, highlights the extended upward price trend and the recent downward FLAG/Pennant setup – flagging out near $1945. We believe the next upside price move could prompt a move to levels well above $2,200 to $2,250 as the momentum behind this move continues to build. Once Gold clears $2,200 on an upside price advance, we’ll clearly be in “new high price” territory and it will shock many investors that Gold continues to rally in the face of the US stock market rally. Something does not settle when one considers Gold suggesting massive fear underlies US stock market price levels near all-time highs. You may want to review our Dow Theory article to attempt to better understand what we believe is driving fear.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

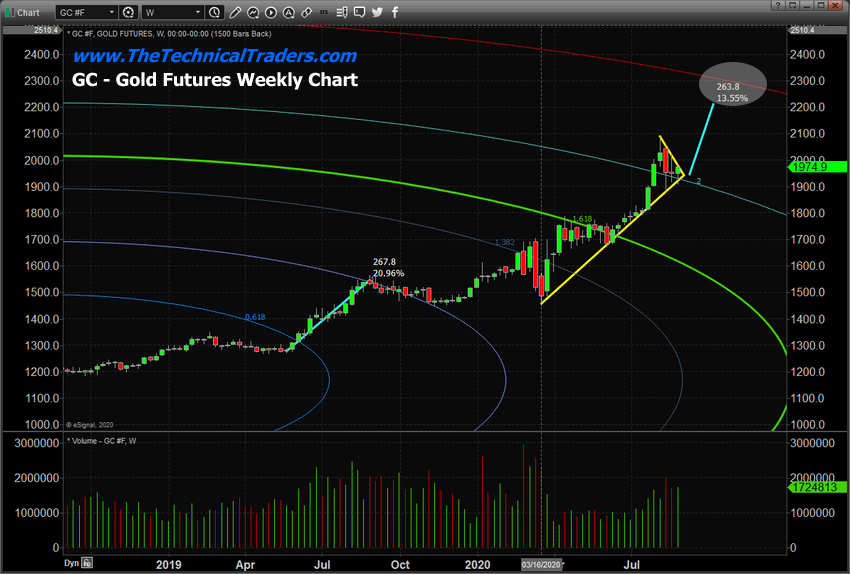

The Weekly Gold Futures chart below helps to pinpoint the upper price target range assuming momentum continues to build as the next breakout move takes place. Our research team believes this next leg may push up to levels just below $2,400 before stalling out again, then likely retrace to levels near $2,250~$2,275 where another sideways/flag pattern may setup. This time, the sideways/flag setup may be very quick in terms of completing, possibly only visible on intra-day charts.

We believe the next upside price rally will have begun once Gold closes above $1,985~$1,990 (near the Flag Apex). Get ready, this should be a very solid upside price move targeting $2,250 or higher.

Please pay attention to our research and how accurately our research team has deployed technical analysis over the past 3+ years tracking this move in Gold. Isn’t it time you learned how I and my research team can help you find and execute better trades? Our incredible technical analysis tools have just shown you what to expect 6+ months into the future. Do you want to learn how to profit from these huge moves? Sign up for my Active ETF Swing Trade Signals today!

If you have a buy-and-hold or retirement account and are looking for long-term technical signals as to when to buy and sell equities, bonds, precious metals,or cash then be sure to subscribe to my Passive Long-Term ETF Investing Signals to stay ahead of wild market gyrations!

Stay healthy, safe and strong!

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Read our FULL DISCLAIMER here and visit www.thetechnicaltraders.com to learn how to take advantage of our members-only research and trading signals.