Five Million Gold Ounce Potential Explained by Osino Resources’ CEO Heye Daun

Osino Resources’ (TSXV:OSI – OTC:OSIIF – FSE:R2R1) CEO Heye Daun explains the five million gold ounce potential at the company’s Twin Hills project in Namibia and provides a company update. Heye stated, “We have a true district scale opportunity here, at the center of which is one discovery, Twin Hills Central, which we’ve made. I think Twin Hills Central will ultimately, ultimately, in few years’ time, I have no doubt it’s going to be, I think it will be more than two, three million ounces. It’s going to take some time to get there. That’s not going to be the maiden resource, but around it are the satellite targets which we have only barely scratched the surface of. I think in the next six months, we’ll have exploration results, which will indicate the potential for many more discoveries around Twin Hills Central. So therefore, if you look at those altogether and you ask me to make a statement on potential of resources: it could easily get to three, four, five million ounces, but obviously it will require time and lots of drilling.”

0:00 Introduction

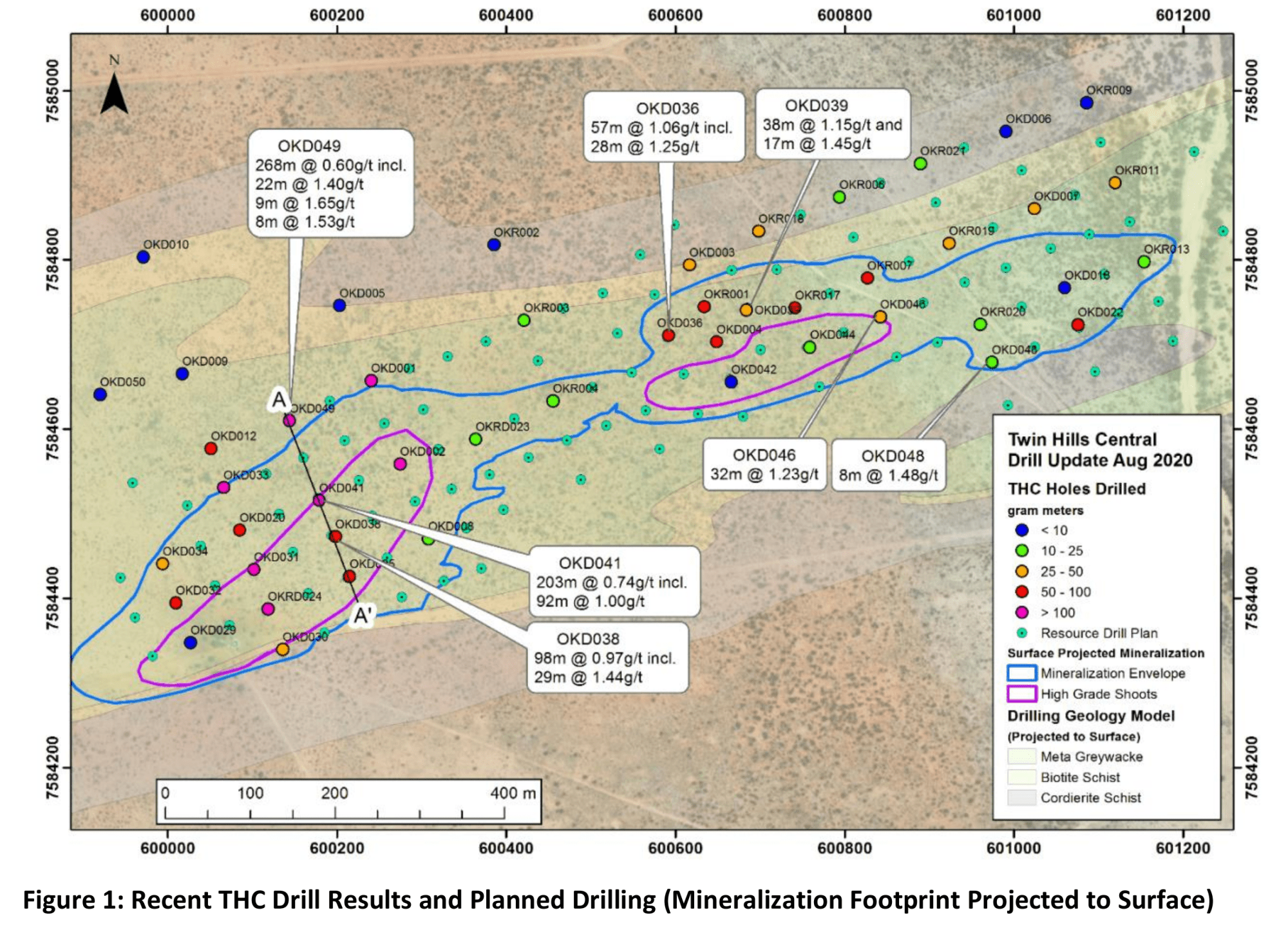

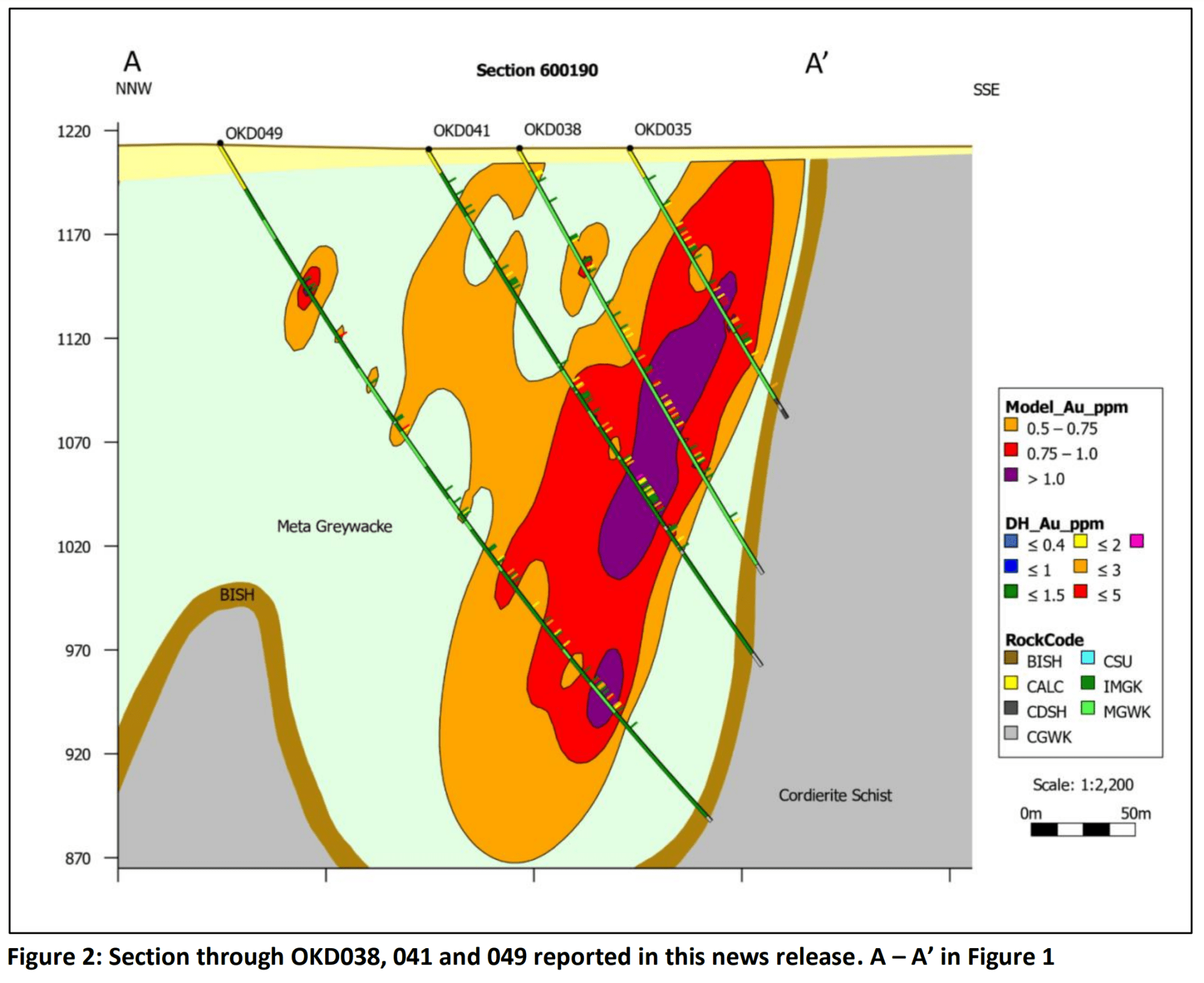

2:01 New positive Twin Hills Central drill results

4:00 Twin Hills Central deposit’s simple and continuous geology

5:43 Twin Hills Central deposit’s simple engineering potential

6:22 Twin Hills Central excellent metallurgy & multimillion-ounce potential

10:24 Navachab: new potential monetization opportunity for Osino

14:23 Twin Hills initial production in best case scenario

16:17 Limited downside risk for new Osino investors

18:28 Commentary on Osino’s share price action

Osino’s Presentation and Stifel Equity Research Osino C$2.60 buy target

TRANSCRIPT:

Bill Powers: Let’s talk about the new drill results that you recently published on August 24th. What was confirmed? What was expanded, and where’s the potential still with the Twin Hills Central deposit?

Heye Daun: We put those results out about a week ago or so, and we were very happy about them. They were, to my mind, confirmatory, so more of the same, which is great. So good stuff. Primarily, you saw that very, very wide zones, which is encouraging and indicates obviously ounce potential. Yes, you may say that the grades looked a little bit low, but you must remember part of that is the way that these drill holes are composited, because it’s basically you throw everything together in one basket, whereas when you mine them, eventually in an open pit, you’ll be able to be selective about it. So the average mineable grade of, say, a 0.6g/t gold probably could end up being a 0.9g/t gold or even a one gram or more. So therefore, not concerned about that.

Also very pleasing has been the down-dip extensions. So you might remember that we’ve only drilled down to about 160 meters vertical depth until recently, but in the last few months, we’ve drilled some deeper holes and that mineralized, wide ore zone extends at depth. So again, it portends probably good ounces growth when we finally put out maiden resources and such like. So yes, we were very happy. But our drilling is slow. So it was only 10 holes, and that’s because until recently we were using diamond rigs only, which is slow, but we have to do that because it provides a much better quality sample. So going forward, we’ve added two RC rigs, and so things are ticking over much better. So yeah, our drilling rate and rate off results and so forth should improve. So I think there’s still a lot out there that hasn’t been announced. So yeah, we are very, very happy.

Bill: One of your larger intercepts was 268 meters at 0.6 grams per ton gold, including a 22 meter intercept of 1.4 grams per ton gold. Now, for newer speculators or speculators that maybe aren’t familiar with the type of deposit you’re developing and exploring here, they may say, “Well, that’s nothing to get excited about.” Maybe they were looking for 20 meters of 8 grams per ton. For those people that are perhaps newer to the Osino story, can you talk about the type of deposit you’re exploring for and why these are good results?

Heye: Thanks, Bill. You should just keep going. You’ve done a good job there. Thanks for reminding me. So this is an orogenic type of deposit, so it’s structurally controlled. Generally speaking, these type of deposits that we have in Namibia are, they tend to be high tonnage and lower grade, as opposed to say the epithermal type of deposits, a lot of which Canadian investors are familiar with, which tend to be a higher grade, but much lower tonnage. So in our case, what’s in our favor though, is that these type of deposits tend to be very continuous disseminated. So the geological risk is much lower.

So these things hang together beautifully. The predictability is higher, and therefore the likelihood of actually turning into a producing gold mine is much higher too. The Otjikoto gold mine, which we sold to B2 Gold, is the best example for that. Now, you mentioned that big 260 meter intercept that we announced. That’s quite astonishing. It really is. That’s very unusual to have that thickness of intercept in these type of terrain. So that’s really, yeah. That’s amazing, and we’re very happy about that.

Bill: And this type of deposit, wouldn’t the engineering be simpler and more assured as well?

Heye: Yeah, I didn’t mention that. So this drilling is up to surface, so it’s an open pit. Easy mining, easy geology, easy metallurgy. I mean, maybe we can talk about the metallurgical results, which we put out about a week earlier.

So as Tyron Breytenbach, one of our biggest champions at Stifel always says, it’s a very simple story. The geology is there, the finance is in place, and now we just have to keep doing what we’re doing, ticking the boxes, crossing the T’s, dotting the I’s. It’s almost a mechanical process of drilling it out, and of course, making new discoveries.

Bill: So you’re preparing the drilling for the resource estimate, which you told us last time would be probably Q1 of next year. On the heels of that, you’re looking at doing your first economic study, PEA, preliminary economic study there. So can you talk to us a little bit about the metallurgy, like you said, and also the footprint. Just with the footprint you have now, not being too speculative or forward-looking, but can you talk to us about some potential numbers here?

Heye: Okay. So metallurgy, thank you. Yes. We did preliminary metallurgical test work, which indicates no problems and conventional process layout and easily treatable ore. We already in the process of following it up with detailed metallurgical test work, so we appointed a very well respected Australian engineering group called Lycopodium. They’re helping us with that. That work will lead into the publication of a PEA sometime let’s say around middle of next year, or maybe a bit earlier.

Building on the maiden resource, you asked me about the maiden resource. The maiden resource is key because most people out there still see us as an exploration company, but of course, we got to put something on the book and show people what the potential is. We’ve always said that Twin Hills has multimillion ounce potential, and I still believe that. So that’s important. you asked about development studies, there are a number of other studies on the way which we’ve alluded to in some of our press releases, but basically all working towards advancing this project to a resource and an economic assessment shortly thereafter. I think I lost your question there. Maybe you just want to ask that-

Bill: In terms of millions of ounces, can you give us a conservative speculation just based on the footprint that you’ve already outlined?

Heye: Wow, you almost cornered me there. I almost said something. So obviously I can’t, Bill. I’d love to. I can tell you about potential. It’s clearly has multimillion ounce potential. So there’s another press release I can refer to, which came out a few weeks ago on an IP study. IP is basically just an alternative to a physical technique that builds on what we’ve done already, and everyone knows IP, but in this case, our IP was very well calibrated because we calibrated it on the existing discovery. So therefore, the strength of these anomalies is better than they traditionally would be. That study has indicated very significant potential of this district.

We have a true district scale opportunity here, at the center of which is one discovery, Twin Hills Central, which we’ve made. I think Twin Hills Central will ultimately, ultimately, in few years time, I have no doubt it’s going to be, I think it will be more than two, three million ounces, whatever. It’s going to take some time to get there. That’s not going to be the maiden resource, but around it are the satellite targets which we have only barely scratched the surface of. I think in the next six months, we’ll have exploration results, which will indicate the potential for many more discoveries around Twin Hills Central. So therefore, if you look at those altogether and you ask me for to make a statement on potential of resources, it could easily get to three, four, five million ounces, but obviously it will require time and lots of drilling.

I mean, one way to back that up is if you look at the Navachab gold mine, which sits 20 kilometers away from us, which Anglo has operated for 20 years, they built it on 800,000 gold ounces. They mined for 10 years and only then realized that they’re actually sitting on more than five million ounces and it got drilled out. Now that they’ve mined more than two or three million ounces, they’re still sitting with three or four million ounces/ So these are very large deposits, and I think Twin Hills is no different. But I should just caution, your listeners and your investors are impatient, as most of us are, so this is obviously not going to be delivered overnight. So the starting point is to put a substantial maiden resource between one and two million ounces on the book, and I think we’ll get there by Q1 next year, and then to grow it from there.

Bill: Heye, I’m glad you brought up Navachab, because that is a mine I believe about 20 kilometers away from Twin Hills. Obviously there’s mineral endowment and ore there, but it’s been poorly run, and I’ve listened to you talk recently in the public forum about the potential to possibly acquire that. That brought me a lot of excitement as a shareholder, because obviously you have the geological team and you’ve already demonstrated geological success. You have the capital markets savviness and ability to raise money, which you’ve demonstrated at least twice this year with two impressive raises. And then now from my vantage point, you’re bringing in the entrepreneurial zeal, or the ability to capitalize on somebody else’s mistakes potentially for the benefit of shareholders. So can you share with my audience what you’re thinking about with Navachab, and how would this impact the valuation at Twin Hill Central and value beyond Twin Hill Central for Osino shareholders?

Heye: Yes, Bill, thank you. I mean, thank you for your generous praise. I appreciate that. From the outset, I’m not here to build a kingdom or a huge Namibian gold champion or so. I’m here to basically create value, but I’m entrepreneurial enough to look at all options of doing so. One set option would be to transition from exploration rapidly into production through organic mergers and acquisitions, through buying an operation. Conventionally, I wouldn’t consider this because we’re an explorer, and I think our sweet spot and our core competence is to be entrepreneurial, to raise money, to draw, make discoveries, think different, and make them big. However, Navachab is so strategically located relative to our assets, it’s basically right next to us. We’ve consolidated all the ground around them. So there are very obvious operational and capital synergies, which would save money and would justify a one plus one is more than two type of scenario.

But more so, as you know in this business, valuation is often about rating, or it is all about rating and about re-rating. So if you think about our evaluation at the moment is reasonable, but it still reflects investors’ views on exploration for us. So if you marry this growth that the Osino opportunity presents with existing production, which the Navachab opportunity next to us presents, there’s potential for a very significant re-rate of the combined entity. I’m talking hundreds of millions of dollars worth of potential re-rate, and obviously that’s an opportunity that couldn’t be sneezed at, or that shouldn’t be sneezed at.

The issue really is that unfortunately, this opportunity is presenting itself in a very strong gold market. So the question is whether we going to be outbid or not, because one thing I can assure you and your listeners is that we’re not going to overpay. We’re not going to put the exciting future of Osino at risk by getting into ill-considered M&A overpay, and then later stumble over. That we are not going to do. But whichever way this M&A in our neighborhood pans out, it can only be positive for us.

So yes, we’ll definitely be part of the process. We’ll look at it very carefully. We’ll assess it. We’ll very likely bid, but from there, we can’t control it. Ultimately, it depends on the price that it ends up going for, and let’s hope that we can do something opportunistic. But even if not, it opens up other opportunities. So I think the whole process, when it starts, or when we don’t know. I mean, we’re making assumptions here. The owners may or may not want to sell that asset, but obviously, I’m just conscious of the fact this is a public forum, so we’ve got to be a bit careful how we speak. But if it was to happen, I would put a big spotlight on us, and I think it’s only going to be positive for us.

Bill: Heye, we’ve talked about the simple geology of the Twin Hills Central deposit. In past interviews, we’ve spoken about how Namibia is a favorable mining jurisdiction. Best case scenario, if geologically your drill results continue to progress, the studies continue to go well, from a permitting standpoint and from a development standpoint, how soon in a best case scenario could Twin Hills be in production?

Heye: Again, as you say, there are many ifs and buts, but let’s say best case scenario. This year, or let’s say early next year, maiden resource and a PEA, which is just an early preliminary economic assessment. Next year, it’s going to be lots of drilling, both exploration and infill drilling, because our maiden resource will be probably mostly inferred resources, and in order to get a PFS, you need to drill it down to closer spacing. So that’s probably a year of drilling, and then in 2022 probably permitting, possibly even commencement of construction and production in 2023. I think in a best case scenario, that’s quite possible and quite doable.

Bill: There’s no environmental issues I guess I want to point out here too. You don’t have local issues or environmental issues like some other deposits do in different locations.

Heye: No, we don’t. It’s got free hold, so the ownership situation is you’ve got local cattle ranches. We’ve got no communities, as you often expect in other parts of Africa. No real environmental issues. We just have to jump through the hoops and especially conclude the long lead items, like environmental and social impact assessments and that sort of thing, and then maybe that’s very much like the rest of the world. These are studies where you have to assess potential impacts and then demonstrate measures to mitigate those impacts. Actually, we’ve initiated that process already, so we’re trying to be as proactive as we can be to accelerate this development process of the Twin Hills project.

Bill: So we’re talking about many potential catalysts, but a new investor to this story would then pull up the share chart, Heye. When we started featuring your company, you were trading at about 35 cents Canadian a share. As we speak today, you’re at a $1.45 Canadian. They may say, “Oh, well, I’ve missed the run here.” What would you say to an investor looking just at your chart, even in light of the catalysts we talked about, and they’re asking themselves, “Well, if I buy here, what is my downside risk?” Could you address that please?

Heye: So I’ll be flippant first and then I’ll go into detail. So I’ll say to your investors, look through the windscreen and not in the rear view mirror. I say that because when we were priced at 35 cents, we were basically a dream with some good money and some good people. We had a great land position, but land position doesn’t mean anything. It could be moose pasture. So we then, over the last year especially, we discovered and advanced a real project, and that’s reflected in the share price. But that project hasn’t fully been delivered yet, and it’s certainly not fully priced, certainly not in the current gold environment. So therefore, going forward, the value that will be unlocked may not be a five bagger from where we are now, which it was for the 35 cent investors, but it comes at significantly lower risk. So I obviously can’t say what return we’re going to deliver over the next year or two.

But it could go still go up substantially from here, and the probability of that happening is a lot higher than it was the probability of turning the 35 cents into a $1.50 back then when you invested. So that’s why I believe that Osino is one of the best risk-return opportunities out there. We are largely de-risked. From a financing perspective, we’ve got the money in the bank. From a technical perspective, we’ve made the discovery. So geological risk is largely gone. We got to go through the mechanics of drilling it out now. And management, we’ve got a bit of track record, and our people have gotten to know me by now, so we do what we say. So I do believe, in many respects, it’s actually a better opportunity to buy the stock now than it was at 35 cents. Then it was risky. Now, far less risky.

Bill: When it was at 35 cents, the stock was illiquid. Now we have hundreds of thousands of dollars worth of shares trading a day. What’s your commentary when you look at the share price action of Osino right now?

Heye: Certainly you can see the diversification of our shareholder base. So we’ve got more hedge funds, generalist investors, institutional investors. So we’ve got about a third of the stock is held by high quality, well-known institutional investors. About a third is still insiders and associates, so like Ross Beaty, my family, Resource Capital Funds, and so forth. And then the last third more or less is retail investors and high networks. The volume is obviously much better. You can see we’re trading a couple of hundred thousand shares a day these days. So that’s very pleasing. I think we’ve got more generalists in there. We also have more hedge funds, which are good, because they’re a better price discovery, more trading. You can see the shorts have gone up, or they go up and down. Also, it’s interesting to watch how the stock is trading more in line with the gold price actually. So that only indicates a much better, more diversified shareholder base.

Bill: Yeah, and when you do begin to trade as a proxy to the gold price, that lets you know that you’ve really got the market’s attention. I can know just from observing different junior gold mining stocks over the past five years. Heye, as we bring this to a close, are there any questions that you’ve been getting from investors that we haven’t addressed in this interview that you’d like to talk about?

Heye: Maybe COVID. I mean, honestly, COVID is not a big issue. We’ve got a great team and maybe a young team that’s able to operate pretty independently, and so as soon as we can travel again internationally, which is probably going to be in a month or two, I would look to try and ramp things up even further in Namibia. So we’re really excited about the future, and we appreciate the time to be on your show again.