Wild Volatility Continues As US Markets Attempt To Establish New Trend

We’ve continued to attempt to warn investors of the risks

ahead for the US and global markets by generating these research posts and by

providing very clear data supporting our conclusions. Throughout the entire months of May and June,

we’ve seen various economic data points report very mixed results – and in some

cases, surprise numbers as a result of the deep economic collapse related to

the COVID-19 virus event. This research

post should help to clear things up going forward for most traders/investors.

As technical traders, we attempt to digest these economic data factors into technical and price analysis while determining where and what to trade. We attempt to identify the “Best Asset Now” (BAN) for trading based on our proprietary technical analysis and predictive modeling tools. We also attempt to stay away from excessive risks in the markets. The reason we adopt this strategy is to help protect assets and to attempt to assist our clients and followers in avoiding sometimes foolish trading decisions that can destroy your account and future.

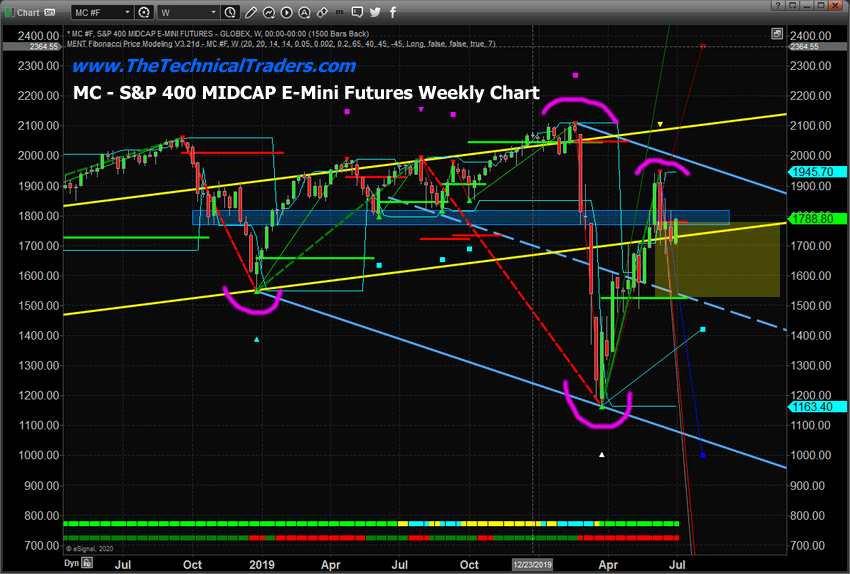

S&P 400 MIDCAP E-Mini Futures – Weekly

We are focusing on the MC, S&P 400 MIDCAP E-Mini Futures,

charts today while attempting to illustrate the technical factors that are

currently present in the longer-term Weekly and Monthly charts. Our researchers believe the month of June

presented a very clear “high price peak” that suggests the US stock markets may

have established a “recovery price high” in June 2020. This high price level reached just above the

midpoint of the YELLOW price channel level that originated from the market

bottom in 2009. This price channel is

very important for technical traders because it relates the high-low price

range that was established over the past 8+ years as a “trend barrier” for

price.

When that channel was broken in March 2020, this became the first time since the low (bottom) was established in 2009 that we witnessed any significant breach of the lower YELLOW price channel. It also indicated a substantial disruption in the markets was taking place – the COVID-19 virus event that disrupted the entire globe. Currently, the price has rallied back into this YELLOW price channel and stalled near the midpoint of the YELLOW price channel.

There is very strong support between 1775~1815 on the MC chart originating from the 2018 and 2019 low price levels (see the LIGHT BLUE Rectangle on this chart). Additionally, our Adaptive Fibonacci price modeling system is suggesting a “Price Trend Void” exists between 1525 and 1780 (between the two Fibonacci “Trigger Levels” – highlighted by the LIGHT YELLOW Rectangle on this chart. This price void represents a wide range between the Bullish and Bearish trigger levels on this weekly chart. Currently, the price is very near the Bearish Fibonacci Trigger level @ $1780 (the RED line on this chart near the right edge). Once price falls below this level (again), it will confirm a potential Bearish price trend is likely.

The lower Bullish Fibonacci price trigger level, near $1524, was confirmed in late April by price. Technically, this level now becomes “support” for the market as we wait for the price to confirm or deny the new Bearish Trigger level. If the price fails to confirm the new Bearish Trigger level (close below that level), then the previous Bullish trend is intact.

Our researchers believe the wild rotation in price near the middle/end of June, where the markets reached a peak level, then experienced a deeper downside price correction, suggests the markets have reached a strong resistance point near the middle of the YELLOW trend channel – and rebounded lower. If our research is correct, this suggests price has already reached an upper resistance level and rotated into a new Bearish trend. We would now want to see how price reacts to the lower YELLOW channel and the new Bearish Fibonacci Trigger Level – these act as an intermediate support. The price must fall below these levels to confirm the Bearish price trend – where the price will enter the “void” between the Fibonacci trigger levels.

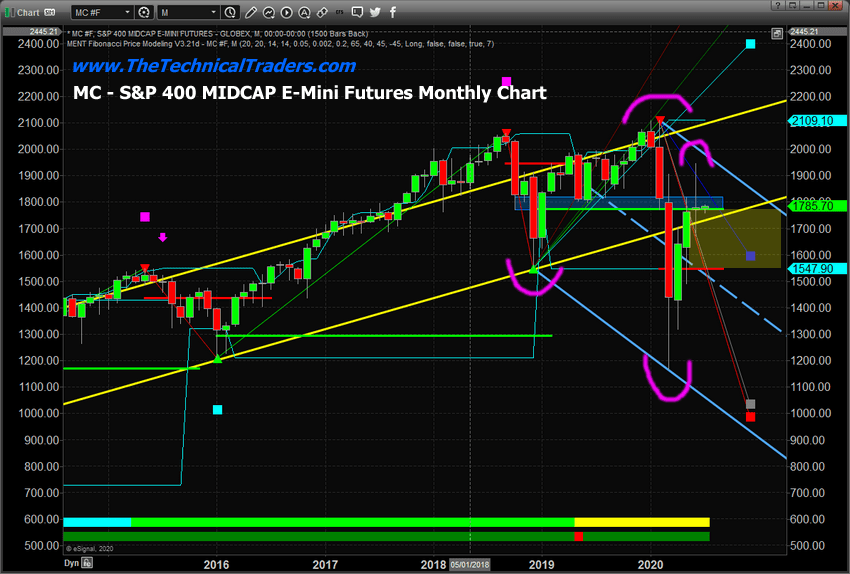

S&P 400 MIDCAP E-Mini Futures – Monthly

This Monthly MC chart highlights the broader market technical research supporting our analysis (below). The same type of Fibonacci Trigger levels exists on this Monthly chart as we see on the Weekly chart. In fact, they are almost exactly the same levels (1545 and 1780). The alignment of these levels on both the Weekly and Monthly charts suggest these trigger levels are critical for future price activity/trends.

If the MC price level fails to establish a new upward price

trend and close above $1780, then the Bearish Fibonacci trigger level has been

“confirmed” and we can determine that the current price trend is Bearish. This would likely lead to a breakdown in

price levels targeting the midpoint of the LIGHT BLUE price channel midpoint

level, near $1525 – possibly much lower.

Recently, we posted a number of research posts suggesting

this market setup is somewhat similar to previous market peaks throughout

history.

June 25, 2020: US Stock Market Enters Parabolic Price Move – Be Prepared, Part II

June 21, 2020: A Stealth Double Dip or Bear Market Has Started

June 14, 2020: Revisiting Our ADL Predictions For S&P 500

A variety of our technical analysis models have continued to warn of future price weakness and the very real potential for a deeper downside price move in the near future. As the US continues to battle the COVID-19 virus, social unrest and riots, the pending US Presidential Elections and Q2/Q3 economic data – the one thing we are certain of is “uncertainty”. We believe the current price levels of the US stock markets are overextended to the upside and our technical modeling systems continue to suggest a downside price move is setting up. It is likely that after July 4th, the Q2 data will shock the markets into a sense of reality as the world struggles to regain some sense of where we bottom and what’s next.

Please heed our suggestions related to the risks in the markets and prepare for more extreme volatility going forward. As you are likely well aware, Gold and Silver continue to move higher which is a very clear indication that global traders believe extreme risks are growing in the global markets. Now is not the time to become overly confident related to future bullish or bearish price trends. The markets will decide where it will trend in the near future. Our technical models suggest a breakdown in price is setting up after this massive recovery peak.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.