Technical Patterns, Future Expectations and More – Part II

Continuing this multi-part research article, today we are going to explore some more immediate (shorter-term) technical setups. If you missed the first part of this research article, please take a minute to review it before continuing because there is quite a bit of information and related article links that are very important for you to understand this next article. You can view it here.

In the first part of this article, we discussed how our team evaluates a proper market perspective and how we build a consolidated narrative for our subscribers. Some times, it is not easy for us to build a suitable narrative or decide on risk factors as our team may not completely agree with one another. At times like this, we’ll often decide that no action is better than taking any action at all. Generally, though, our team is able to adopt a consensus narrative related to portfolio allocation levels, general market trends and specific target trade setups for the next 5 to 10+ trading days.

The Technical Traders services’ primary objective is to protect assets while attempting to deliver success with trading signals that generate consistent profits. We care, very deeply, about our members and their success. Our team has a combined experience in the markets of over 55+ years, and have lived through various market and economic scenarios going back over 35+ years. We have also had the opportunity to learn from some of the best technicians and analysts on the planet. We publish our public research for two primary reasons: a) to assist our friends and followers, and b) to publically document our future calls and predictions – putting our necks on the line every time we publish anything to the general public.

When we develop a narrative for our members, we internally discuss longer-term and shorter-term expectations as well as to identify concerns or risks that we see as evident in the markets or setups that are present today. As we suggested in Part I of this article, we don’t try to over trade and are very selective in our trades. We also have processes in place to ensure we have found the right risk /reward ratio prior to initiating new trades. If we miss a move – we won’t chase it – there will always be other trades setting up for us to capture new profits for our members. We see some interesting events unfolding that will undoubtedly lead to some fantastic trades.

Be sure to opt-in to our free market trend signals before closing this page so you don’t miss our next special report!

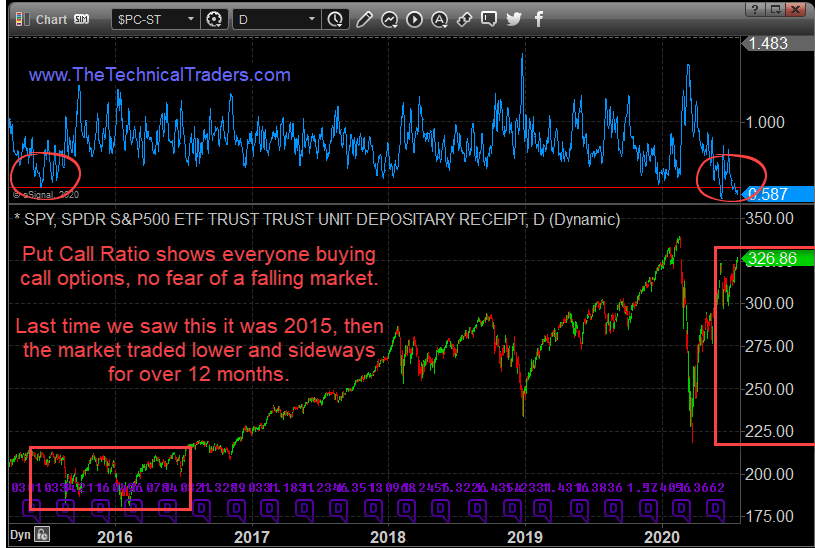

PUT/CALL

RATIO SHOWS SELLERS LINING UP

The chart above highlighting the PUT/CALL ratio suggests sellers are lining up near recent highs, expecting the markets to roll over as the Q2 earnings and data are released. It makes sense that the data could be somewhat bearish in nature given the potential destruction of earnings and revenues in Q2. It also makes sense that near recent highs, as the S&P 500 and Dow Jones have recently rolled into a sideways consolidation, that skilled traders would pull profits near these levels and initiate new Put Options trades to hedge any downside risks in the future.

Gold and Silver recently fired a very large warning shot for anyone paying attention. The US Dollar has continued to weaken and Crude Oil may begin a new downside price trend if the economic data suggests a broader contraction in the US economy. What all this means is that skilled traders and others are losing their bullish bias in the markets and are starting to become protective – expecting some type of new trend to setup.

Our researchers believe a downside price move targeting the $252 level on the SPY is not out of the question. Recall the $252 level is a price level that corresponds with economic expectations as of late 2017. These levels represent a fairly nominal price correction that would still be considered moderate bullish overall. Any deeper price move would indicate the markets are completely disconnected with future expectations for the rest of the year and possibly further out into the future.

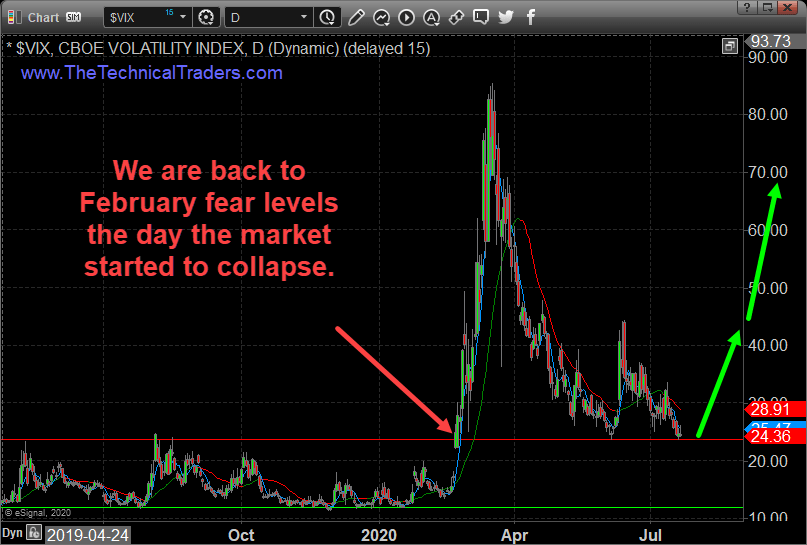

VIX

BACK AT FEBRUARY FEAR LEVELS

The VIX is trading at levels that indicate the level of fear in the markets has recovered to historically moderately high levels (near 25.00) – see the chart below. Volatility is still a major factor in the markets and any change in trend could be aggressive and violent – sending VIX above 40.00 again. We believe this new low level in the VIX is indicative of complacency in the markets and with the current bullish price trend. Complacency in the markets tends to lead to very aggressive price corrections. We believe skilled technical traders should adopt a very cautious stance going forward and protect open long positions exposed to risk.

If the markets begin to breakdown on the Q2 GDP and Consumer data that will be released on Thursday, July 30, 2020, then the VIX will begin to move dramatically higher. In this situation, stop levels just below the current market price levels will begin to become targets. We can also expect to experience a similar event as that of February 2020, a type of flash-crash where a -12 to -18% downside price move could happen over a matter of days – not weeks.

Pay attention to what happens in the

Transportation Index and with Crude Oil and Gold and Silver. Our researchers follow these as early warning

triggers for what may come. Additionally,

our cycle research suggests a bottom in the markets will likely form in 2022 to

2023 – thus we may have quite a bit of sideways or downside price action ahead

of us before a true market bottom completes.

At this point, in order for our cycle research to become valid, we would

need to see a downside price move that substantiates the cycle predictions.

Right now, the advice we continue to provide to our members is to be patient, protect your profits and assets, and prepare for more volatility and risks. This is not the time to play games with your capital and we strongly believe this is not the time to “buy the dips”. A bigger price pattern is setting up in the markets and many traders simply ignore these broader technical patterns. You can read more about these types of patterns in one of our recent research posts that explains the selloff structure. You can also see why we think gold will break out and silver will go ballistic once the stock market bottoms.

We hope you’ve found this multi-part research article helpful and informative. Remember, read our research and determine if you like and agree with our conclusions. Even if you don’t agree, pay attention to what we are suggesting. You never know, it might lead you to make a decision that could help you protect your assets, find a new opportunity or, at the very least, help to keep you better informed – and that is our ultimate goal. We put this effort into publishing these public research articles every day to help you stay ahead of the biggest moves in the markets.

See the articles listed above and read them to learn more about how we see the future unfolding. We believe you won’t find any better research or analysis anywhere on the web than what we offer and we urge you to take advantage of our member/subscriber services when you are ready. The next 24 months are going to be really crazy – get ready for some really great opportunities.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed. Visit our web site (www.thetechnicaltraders.com) to learn how to take advantage of our members-only research and trading signals.