Technical Patterns, Future Expectations and More – Part I

We get a lot of questions from individuals every week. Our research posts contain a lot of varied examples of Technical Analysis, Economic Data Points, Advanced Price Theory, and other more obscure analysis techniques. Yet, sometimes our readers want to know more – how do we read the tea leaves to try to adopt a consensus approach to trading, investing, and hedging the global markets at times like these?

The easiest answer is that we are a team of technical researchers and analysts. Every day we are watching our proprietary modeling systems, various market symbols, and technical/price setups that occur throughout the globe. Because we specialize in US stocks, ETFs, and Futures, our concern is how the US market will react to these impulses. Having said that, we explore ideas about how capital will flow from one asset class to another over time as various rotations in the global market take place.

Every week, we communicate different points of view and do so across different time frames which provides you with a full view of long and short term expectations and potential moves for stocks and commodities.

Sometimes this can be confusing to follow if you don’t understand the time horizon we are discussing. One article may be about a major double top in the stock market with long term bearish implications, and the next article about more upside potential in stocks as the stock market tries to fill the February price gap window. One is bearish, the other is bullish, both provide a ton of insight for a different type of trader and time horizon looking forward.

The team is able to explore and identify any potential trade setup/trigger we believe is important for our future success. Our team can identify short, intermediate, or longer-term setups in any symbol or market segment. We then discuss the potential for each setup/trigger and attempt to validate the setup/trigger using our proprietary technology. We focus on confirmed trade setups originating from a variety of proprietary technology solutions that are aligned with our researcher’s general analysis.

This keeps our team honed in on what is really happening in the markets as we attempt to identify the “Best Asset Now” related to potential risk and profit. The one thing that many people don’t understand is how much we discuss “RISK”. The first thing any of our researchers accomplish before they suggest a trade setup is a “Risk Analysis” related to the price structure and future expectations. Our researchers may think a certain symbol or asset class is the greatest trade of the year, but risk factors associated with general market conditions, recent support/resistance levels, or volatility may disqualify that trade simply because we won’t allow anything to take excessive risks for our members. Our view is “there will always be another trade setting up in the next two or three days”.

Before you continue, we suggest taking a moment to read some of our other “bigger picture” research posts on silver, gold, and the US markets. Be sure to opt-in to our free market trend signals before closing this page so you don’t miss our next special report!

MARKET PERSPECTIVES

We are sharing some of our most recent research with all of you to help you understand how we view different market perspectives and opportunities as triggers set up in the US stock market. We view some of these longer-term triggers as “bigger waves” that are setting up out in the ocean. When they hit the shore, they have the potential of disrupting things quite extensively and causing quite a bit of damage. But until they hit the shoreline, they are just big waves that are pending in the future.

Our shorter-term systems help us navigate

the smaller price rotations and are often what we fall back onto to confirm

trade triggers. If the bigger wave

suggest greater risk is a factor, then we’ll adjust the targets and stops for

our shorter-term triggers to help eliminate risk and turn the short-term trades

into a “scalping-type” of trade. Quick in and out for 5% to 7% (or more) and

then wait for the next setup.

In a broader sense, we are simply navigating

the seas and tides while attempting to identify the best opportunities for our

members. We write about all types of

technical and price pattern triggers – even economic data. Internally, we focus on technical patterns

and setups that are generated by our proprietary trading/modeling systems. So, when you read any of our public research

posts, remember that internally we may be viewing things quite differently as

the technical and modeling systems are only deployed for subscribers or

members.

MIRRORED

200 DAY MA SETUP

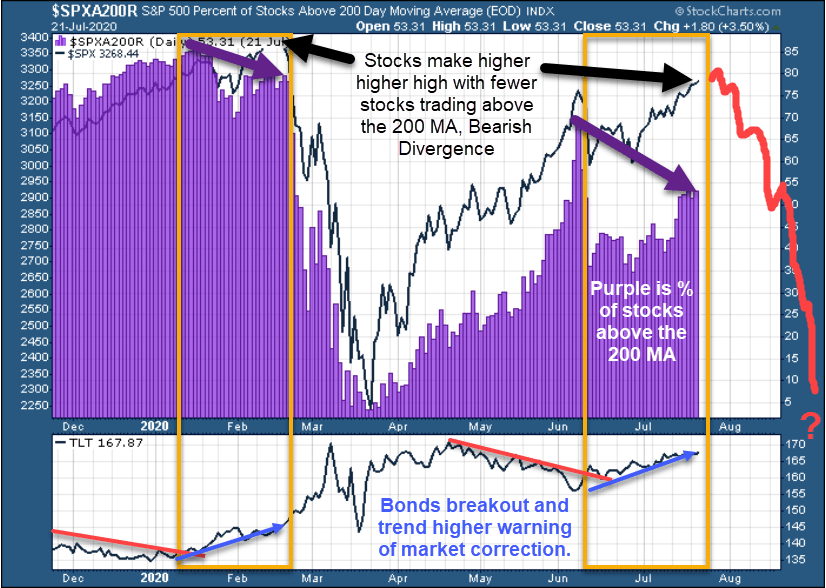

This first example highlights what we believe is a very clear longer-term setup relating to the general market weakness across a broad segment of the US stock market. Back in February 2020, a similar type of pattern set up just before the February 24 collapse. Now, we have a bigger and broader divergence between the number of stocks above their 200 Day Moving Average levels while Bonds (TLT) is climbing higher. This, generally, warns that the markets are stalling and may settle into a downside price trend.

Could the downside price trend be aggressive and volatile? You bet it could. But right now we know this “big wave” is pending and we also know that risks seem rather high for a downside price correction given this technical pattern setup.

BEARISH DIVERGENCE

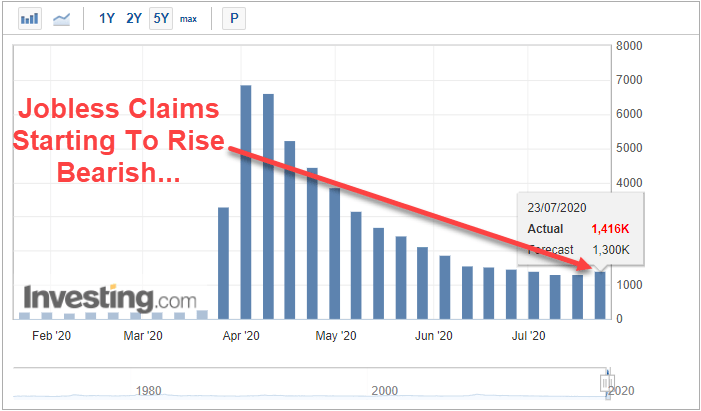

This second chart highlights the Jobless Claims levels over the past 6+ months of 2020. The one thing we want to highlight is the moderate increase in the latest Jobless Claims level and how that may represent a “second wave” of COVID-19 cases prompting additional closures/shut-downs within the US economy in some states. The last thing this recovery effort needs right now is another wave of newly unemployed workers and this data could become a very real problem when you consider the spending, housing, mortgage, credit card, and other factors that are associated with “a loss of income” for any active consumer. There is a domino-process that is likely to take place if these workers are unable to find new jobs quickly.

JOBLESS CLAIMS STARTING TO RISE AGAIN…

Now, as we close out this first part of our Technical Patterns, Trading Perceptions, Future Expectations, and More research post, we want to ask you if you would do anything differently than we currently do to attempt to effectively trade and manage risk levels throughout these incredible times and price swings in the global markets? Remember, we actually called these incredible price moves back in July/August 2019 (and earlier) with our Super-cycle research and other longer-term cycle analysis:

July 24, 2019: THE BLACK HOLE IN GLOBAL BANKING IS BEING EXPOSED

August 14, 2019: GLOBAL CENTRAL BANKS MOVE TO KEEP THE PARTY ROLLING

August 28, 2019: PRECIOUS METALS ABOUT TO PULL A CRAZY IVAN

Over the past 12 months, we’ve effectively

called many of the biggest market moves and trends – in some cases many months

in advance. Our predictions related to

precious metals have been highlighted on many other podcasts and segments. We consider it an honor to be included in

other’s interpretations and presentations – yet we also know the accuracy of

our research is what really counts.

This brings us back to the start of this post – our efforts in generating these free research posts is to help you understand what we are thinking along different time horizons to help you develop your own consensus outcome. We hope you are gaining real value from our efforts because we are not going to stop now – this is when you need us the most. 2020 through 2024 are going to include some of the biggest price swings we’ve seen in decades.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed. Visit our web site (www.thetechnicaltraders.com) to learn how to take advantage of our members-only research and trading signals.