Second Phase Real Estate Collapse Pending

Real estate, especially commercial real estate, is likely to be the first segment of the real estate market to enter the second phase of an extended collapse. The COVID-19 virus has created an atmosphere where continuing operations for retail, restaurants, and many other business segments is virtually impossible to maintain. Without the ability to earn sufficient income, thousands of restaurants and other retail businesses have already closed or are in the process of closing. This has pushed the commercial real estate market into turmoil. We believe the residential real estate market will follow the commercial market because consumers are going to suffer as commercial real estate collapses. Consumers are an essential part of the consumer marketplace. Thus, the collapse in the commercial market means the consumer market will contract because of the lack of earning and hiring associated with a healthy commercial market.

We’ve authored numerous articles over the past 4+ months

related to the real estate market and how our research team believes the

COVID-19 virus event will process multiple stages of a contraction in the US

markets. First, the shock of the virus

event will take place. Next, the

realization of the economic damage related to the COVID-19 event will take

place. By this time, the second phase

markets should have already entered a stalled market phase.

May 17, 2020: REAL ESTATE SHOWING SIGNS OF COLLATERAL DAMAGE- PART II

April 23, 2020: REAL ESTATE CRASH THE NEXT SHOE TO DROP – PART III

The reality of the real estate market over the next 24+ months is that demand will center around earning capabilities and qualification eligibility. As consumers recoil from the COVID-19 virus event and the economy restructures with new expectations, we believe the real estate market will transition from a low rate opportunity to a low-income selling phase – where fewer consumers are able to afford high priced real estate markets.

The transition in the real estate market will likely take

place as the market shifts into a contraction phase 6 to 10+ months after the

February/March 2020 Covid-19 virus event.

We believe the transitional phase of the real estate market will require

a period of time allowing the opportunistic low rate buyers to push price

levels to a peak before the lack of work/earnings starts to change the market

dynamics. Once the lack of real earnings

takes place, the real estate marketplace will quickly shift into decreasing

price levels and slower demand levels.

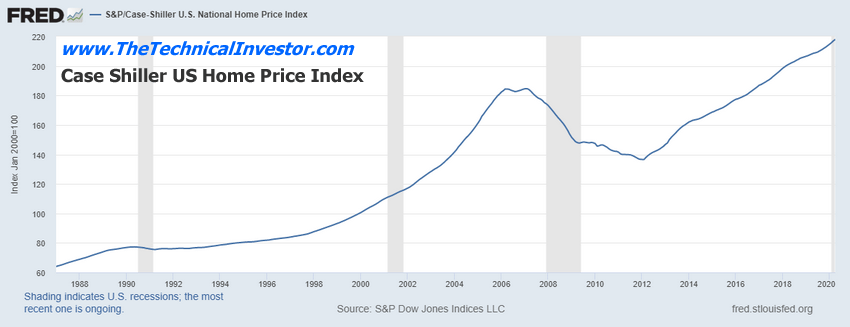

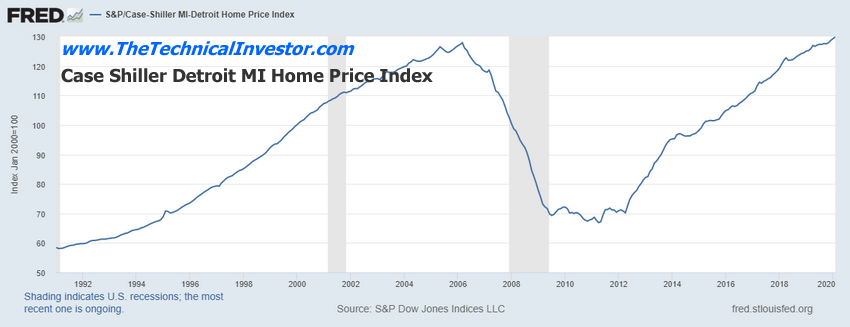

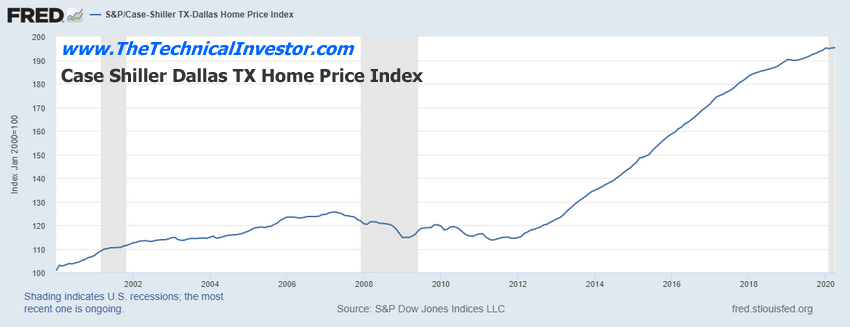

These following Case Shiller Home Index charts clearly illustrate that some of the most depressed and dynamic markets across the US have experienced price level increases that represent very over-extended home valuation levels. Overall, the US Home Price Index is more than 35% higher than the 2006 peak level. The Detroit Michigan Home Price index has recently broken the 2006 peak price level and the Dallas Texas Home Price Index is more than 75% higher than the 2006 peak level. Thus suggests that certain marketplaces have already experienced a dramatic price increase that may not be sustainable after the COVID-19 virus event.

Before you continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

Case Shiller US

Home Price Index

Case Shiller

Detroit Michigan Home Price Index

Case Shiller Dallas

Texas Home Price Index

The Case-Shiller US home price index data suggests the US

housing market has started to flatten out nearly 35%+ above the 2007-08

highs. We believe the past 8+ years of

recovery after the 2008-09 credit crisis has promoted an inflated real estate

market across much of the US. Even areas

that were once quite moderate in terms of price inflation have now seen big

increases in home price levels.

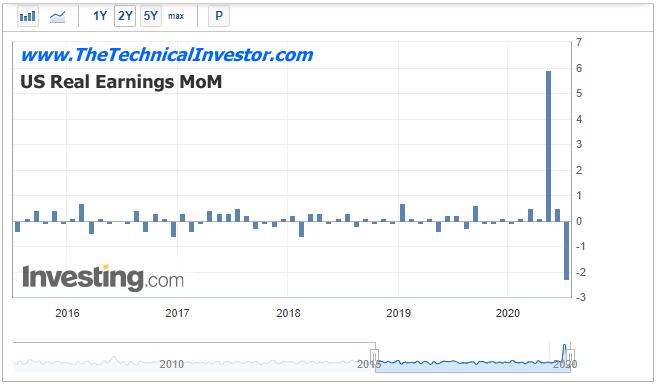

Recently, a Zerohedge article reported real-time US economic statistics that suggest a much deeper second phase economic contraction is likely to take place. Our research team has been suggesting this outcome for many months now.

July 13, 2020: US Recovery Stalls As Pandemic ‘Second Wave’ Threatens To Unleash Double-Dip Recession

Current real estate data from Realtor.Com suggests listing prices have surged over the past 30+ days as inventory levels have decreased dramatically and “days on market” have increased by as much as 25%. The Realtor.com recovery Index is reporting a value of 97.80 for July 4, 2020 – down 2.2% from the basis level on February 1, 2020. The lower interest rates over the past 90+ days have prompted a refinance/purchase phase from consumers that were not at risk from the COVID-19 shutdowns. But as earning capabilities contract, we believe the initial phase of purchasing and refinancing will abate and transition into a more desperate mode of forced selling. Without income/earnings, consumers won’t be able to afford to purchase/maintain mortgages. Everything hinges on the ability for consumers to earn wages that support a healthy housing market.

The newest Real Earnings data (-2.2%) represented the biggest

earnings decline level over the past 12+ years.

Even during the 2007-09 credit market crisis, the earnings level never

fell below -1.0%. We believe this new

earning data level may be the start of even worse levels to come.

US Real Earnings

MoM

As more data is presented, we’ll be able to better estimate

future expectations related to many levels of economic activity. What we do know from experience is that

consumers drive more than 80% of the economy in most cases. If the consumer is unable to earn income at

levels similar to levels prior to the COVID-19 event, then certain segments of

the economy will contract – almost like clockwork. Initially, as the COVID-19 virus event

started, many employers attempted to navigate through the initial expectations

of the shutdowns – expecting some type of moderate recovery fairly

quickly. As the COVID-19 virus event

continues, expectations change and we believe more and more consumers will be

pushed into unemployment and experience decreased levels of income for longer

periods of time.

By the end of 2020, we should know how the real estate market is functioning, and if price levels are stable or not. Our researchers believe a “1-2-3” type of economic collapse is just starting. Consumers lose income while commerce and retail collapse. Renewed state and local shutdowns, similar to the new California shutdown, will continue to disrupt the recovery process and disrupt workers and earnings. Credit tightening will also contract the activity of the real estate market. Overall, these factors should lead to a declining price level in late 2020 and into early 2021.

We’ll go over more data in Part II of this article as we wait for more data to confirm our research hypothesis.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed.