The Big Jobs Number and How to Trade It – Part II

In the first part of this research article, we attempting to highlight how the huge jobs number shocked the market into a big upside price move on Friday, June 5, 2020, and how the underlying data continues to suggest we have quite a bit of work to do before the US economy supports current stock market price levels. In this second part of our research article, we’ll continue to share data and charts that we believe paint a very real picture for skilled technical traders.

The huge upside price rally in the US stock market after the 2.5 million jobs number was posted at 8:30 am pushed the stock market higher by 3.5%+. This is an incredible rally in terms of how primed the stock market was for this type of great news. Yet, as we continue to try to suggest, we are still moderately cautious of this rally in terms of sustainability after the destruction to the US and the global economy as a result of the COVID-19 virus event.

Our researchers believe the current numbers may be slightly skewed because of the extreme contraction event that took place over the past 60+ days. Additionally, many of these numbers are calculated using a modeling system that attempts to normalize outlier data. Currently, with the markets pushing well into a bullish territory and the NASDAQ reaching new all-time highs, we can’t argue that the US stock market appears to want to move higher on any news (good or bad).

Before you continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

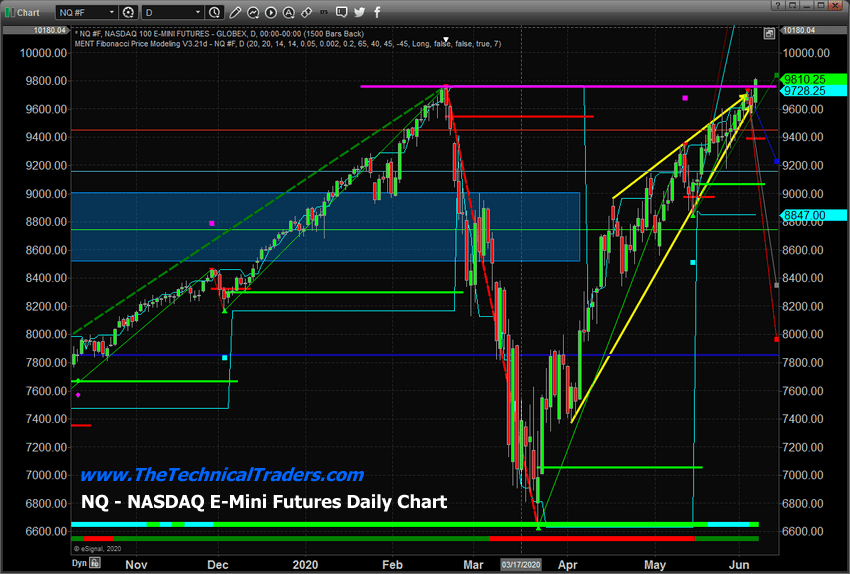

NASDAQ (NQ) E-MINI

FUTURES DAILY

This NQ Daily chart highlights the incredible rally we’ve seen in the tech-heavy NASDAQ. After recovering nearly 50% from the March lows, the NQ began to set up an upward sloping wedge formation near the middle of April. This tightening wedge formation has apex’ed recently just as we got the new jobs number today.

In an unbelievable upside price rally, the NQ is now trading at the highest levels EVER. After 38 million jobs lost, the US economy operating at only a fraction of what it was in January, huge consumer displacement factors, and thousands of pending solvency issues – hey, why not push the NASDAQ up to new all-time highs. This makes no sense to us at the moment.

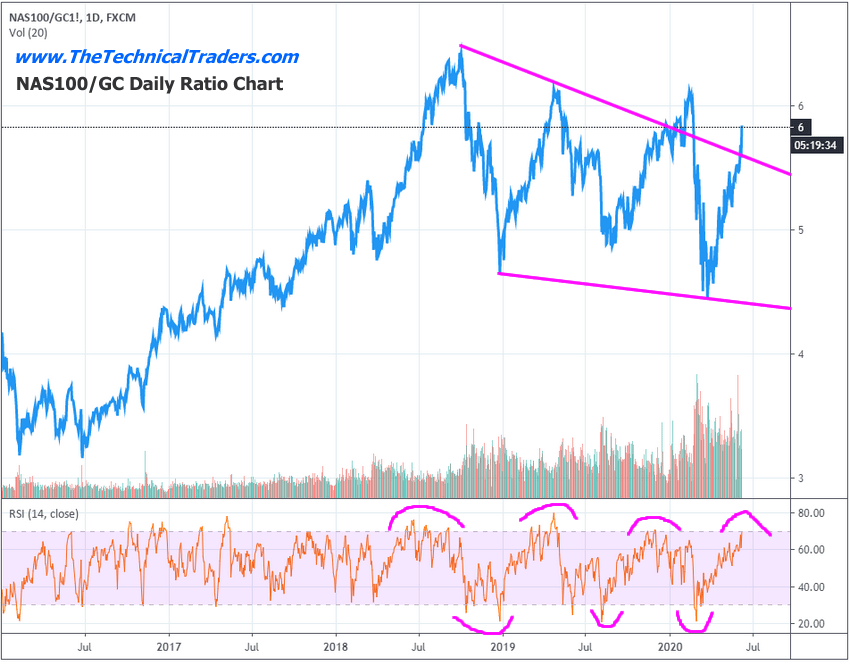

NAS100/GC DAILY

RATIO CHART

The reality is that this incredible rally in the stock market

may have already become a speculator “bubble” – a euphoric over-reaction to the

deep decline related to the COVID-19 virus event. Earnings and future revenues typically drive

valuation growth higher. Take a look at

this NAS100 to Gold ratio chart to understand what has really happened in the

markets over the past 4+ years. The peak

in values in October 2018 coincided with the US Fed action to raise interest

rates which prompted a massive decline in the US stock markets throughout the

end of 2018. Near Christmas, 2018, the

markets bottomed and began to rally higher.

Notice the peak in 2019 was not higher than the peak in 2018? This suggests the real valuation peak in the

market coincided with the peak Fed Funds Rate level in October 2018.

Additionally, the downward price channel that has setup in

this ratio chart suggests the wild trending in the markets while Gold has

pushed moderately higher has prompted a sideways pennant/flag formation. The previous peak, in early 2020, and the

current peak are well above the upper pennant level – this suggests an

over-exaggeration of price advancement.

This type of ratio activity is very reminiscent of 2005 to 2007 – where

the stock market rallied and gold rallied, eventually leading to the breakdown

in the stock market in 2008-09 and a much deeper breakdown in this ratio.

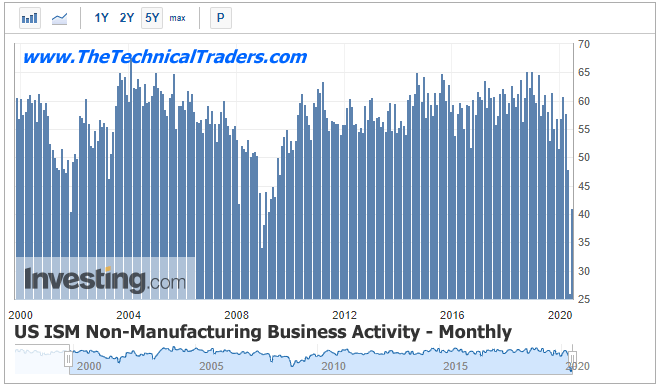

US ISM

NON-MANUFACTURING BUSINESS ACTIVITY INDEX

The current economic data does not support a US stock market rallying to new all-time highs – unless you attempt to account for investor over-enthusiasm and exuberance. The business activity data over the past few months have shown the deepest decline over the past 20+ years. There has never been a print of this indicator below 30, ever, except April 2020. Even at the height of the 2008-09 housing/credit market crisis or the 911 terrorist attacks, US businesses continued to operate at moderate levels.

(Source: https://www.investing.com/economic-calendar/ism-non-manufacturing-business-activity-1484

)

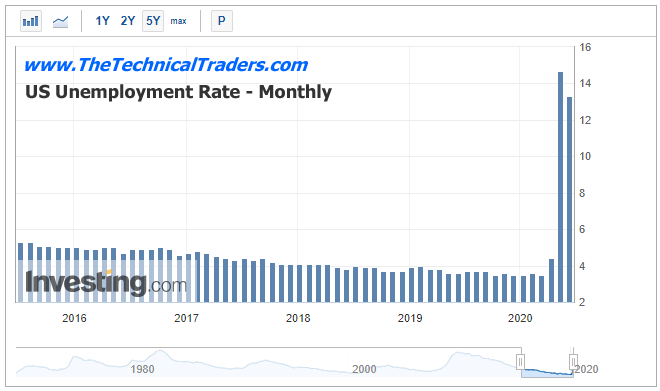

US UNEMPLOYMENT

RATE MONTHLY

The unemployment rates are still far higher than at any time

in over 70+ years – everything is fine.

Why not push the stock market price levels higher by another 20 to 25% –

right? These people will eventually find

work somewhere – sometime?? The

consumers will eventually re-engage in the economy and push income and revenue

levels higher – but not right now.

(Source: https://www.investing.com/economic-calendar/unemployment-rate-300

)

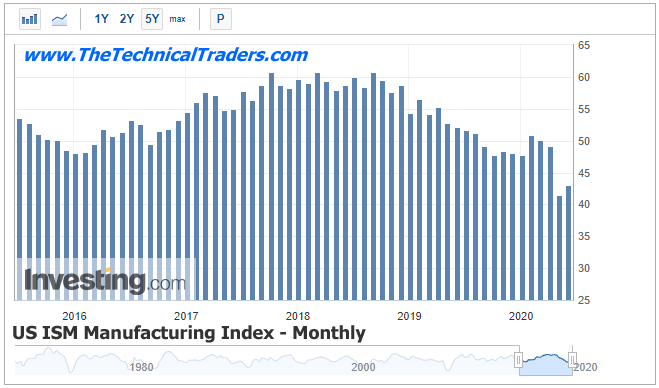

US ISM

MANUFACTURING INDEX MONTHLY

The ISM Manufacturing Index suggests manufacturers are operating 25 to 45% or below capacity levels from early January/February 2020. This will translate into bottom-line revenue data in the near future and likely result in much lower forward earnings guidance.

(Source: https://www.investing.com/economic-calendar/ism-manufacturing-pmi-173

)

Our continued warnings may go unheeded by the masses – and

maybe we are wrong. Yet we continue to

advise our clients to be very cautious of this upside price rally as we believe

the technical factors driving this market are skewed. Speculators and investors are caught up in an

elated buying phase when real data suggests more moderate price valuations. We are still very concerned about the risks

of a breakdown in the markets related to a sudden shift in trader/speculator

thinking.

Very similar to the enthusiasm of 2006 to 2008, traders can

sometimes fall into a trap that expectations do not correlate with real

data/technicals – and this can be dangerous.

If you play these upside moves very cautiously and target the best asset

for your investment objectives, you can do very well while this rally pushes

higher. Yet, you also have to be very

aware of the risks of a breakdown in price related to the tightening economic

conditions and price channels.

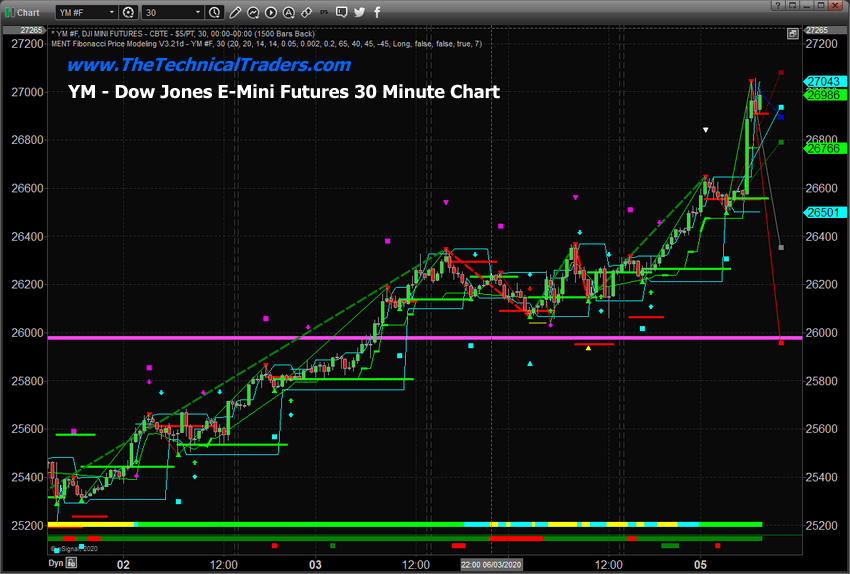

YM – DOW JONES

E-MINI FUTURES 30 MINUTE CHART

This YM 30-minute chart highlights the incredible rally that took place very early in trading on June 5, 2020 – just after the jobs number hit. The traders and speculators want anything that seems positive after months of uncertainty related to the COVID-19 virus event. This bias towards anything positive suggests traders will attempt to push price levels into a feeding frenzy – ignoring all risks and other data. No Fear is an excellent description of what is happening right now in the US stock market – traders have absolutely no fear of any downside risks. We’ve seen this before – and it usually ends badly for some people (remember the DOT COM rally?).

Concluding Thoughts

Our opinion is that traders should stay moderately cautious near these current levels. Even though it appears the markets can do nothing wrong and speculators will likely be telling you “this is the opportunity of a lifetime – just buy anything right now”, our experience is that these types of crazy, euphoric rallies are very dangerous. Price breakdowns come fast and hard in markets like this – they happen quickly.

Cover your open long trades with moderate stop levels. Be picky about what you invest in and target quick gains. Remember the market can act irrationally much longer than many people can stay whole. The shorts are under severe pressure right now, but the data is pointing to a very different outcome in our opinion. We urge you to stay cautious right now – this seems very similar to the exuberance that we saw in 2006-2008 – just before it all fell apart.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is an incredible year for traders and investors. Don’t miss all the incredible trends and trade setups.

Subscribers of my Active ETF Swing Trading Newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain, and we closed out another winning trade on Friday.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.