Ivan Bebek Shares Two Big Value Creators He’s Aiming to Accomplish for Auryn Shareholders

Auryn Resources’ Executive Chairman Ivan Bebek shares about two big value creators he is aiming to accomplish for shareholders and provides an overall update on the company’s H2 2020 plans. He revealed that this summer will be the company’s busiest summer of activity ever across Auryn’s numerous projects in North and South America. Auryn Resources is a technically-driven, well-financed junior exploration company focused on finding and advancing globally significant precious and base metal deposits. Auryn’s technical and management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates.

0:00 Introduction

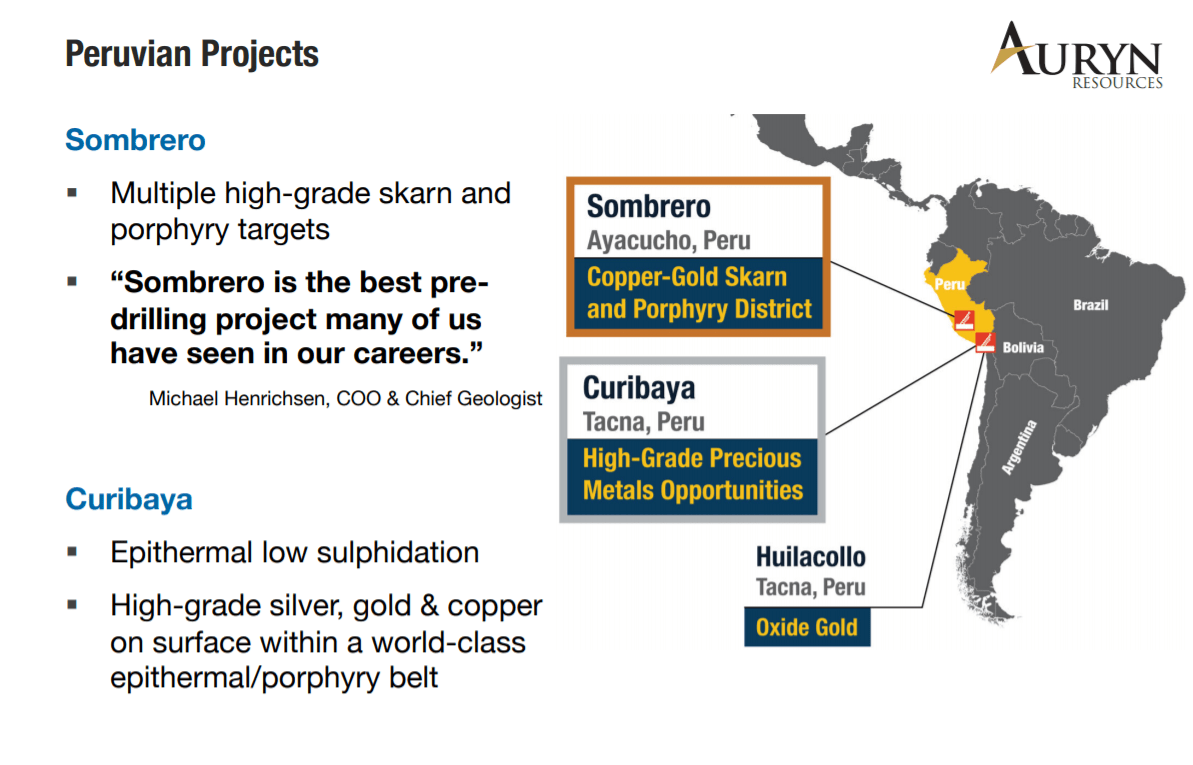

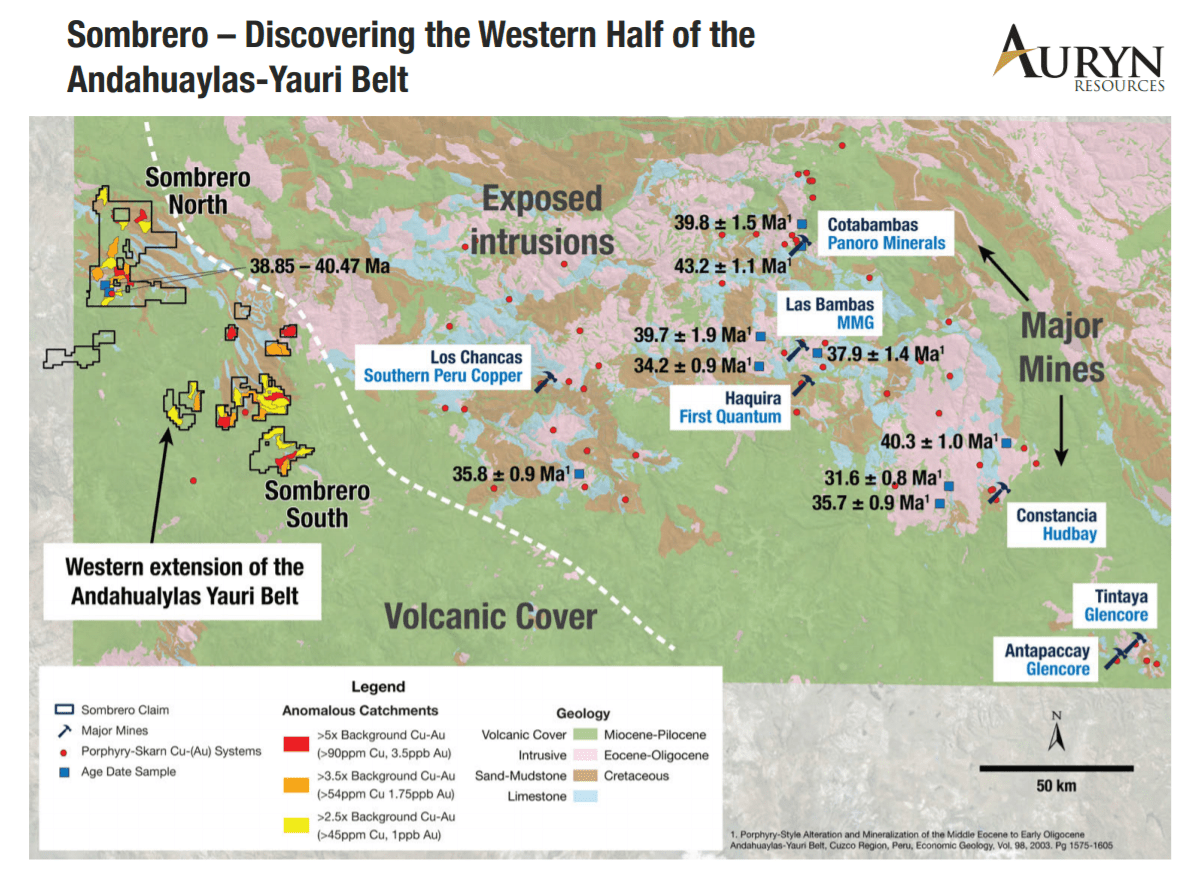

1:15 Update on Auryn’s Peruvian projects

2:51 Timeline for final permitting approval for drilling in Peru

5:30 Catalysts and news flow starting this summer

9:57 Homestake Ridge…will you drill it or sell it?

12:07 Aiming for these two big value creators

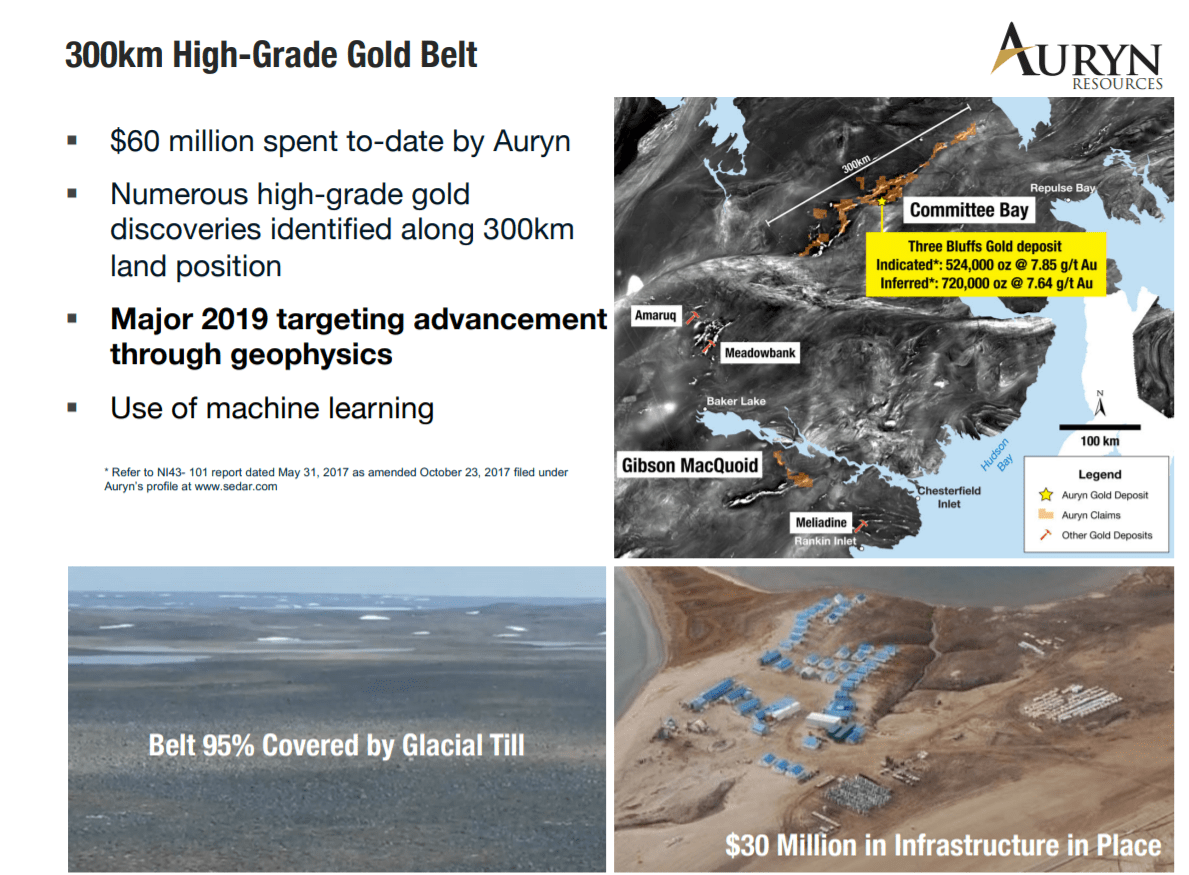

12:58 Committee Bay high-grade gold targets

17:07 Curibaya: high-grade, large-scale silver & gold

18:34 Our busiest summer of activity ever

Ticker: AUG Sign up for Auryn’s email list: https://aurynresources.com/subscribe/

TRANSCRIPT:

Bill: You’re listening to Mining Stock Education. Thanks for tuning in. I’m your host, Bill Powers. We will be getting an update from Auryn Resources and its Executive Chairman, Ivan Bebek. Website is AurynResources.com, and it trades under the same ticker, AUG, in New York and Toronto, on the big boards, not the venture or the OTC. It is a very liquid stock. It’s an explorer and developer in the Americas. Ivan, welcome back on to Mining Stock Education. Thank you for joining me for an update. I’d like to get an update on what’s going on in Peru. I’ve heard you say that 90 to 95% of the value or speculation in your stock could probably be attributed to the speculation regarding the potential you have there at your Peruvian projects. So, could you give us an update of what’s going on in Peru?

Ivan: Sure, absolutely. Well, it’s tough when you have so many good projects in one company to decide where the value is coming from. But the news that’s kind of driven our stock in the last 18 months has most certainly been coming from Peru. Where we are with Peru, it’s been hit hard as everyone knows with COVID. I think it’s the second worst place in South America, and they’re kind of going through their peak COVID kind of outbreak. In a way, it’s good, we’re kind of crossing that hound, but for us, we’re in the stage of applying to get back to work and everyone’s doing this. And there’s multiple phases that will bring people back to work.

We have submitted several health protocols that they’ve asked us to abide by because we’re operating through camps, not within cities, in terms of how we station ourselves and where we live in the field. It’s a lot better chance that we will get a chance to go back to work sooner than most. We had some preliminary approvals of our permits to go back to work. However, we’re waiting for the final official “you guys are good to go back to work.” But we most certainly meet all the health protocols that they’ve required. So we’re kind of in that lineup with probably several other companies looking to get back to work. And our target date would be probably within one to two weeks from, as I speak to you today, so third week of June is probably when you see us back to work sampling and doing geophysics and getting more targets ready for drilling.

Bill: So once the government there in Peru opens back up and they begin to process permits, governments aren’t the most efficient vehicle out there, the private sector is much more efficient. But when can we expect those final approvals for you to drill Sombrero?

Ivan: That’s a great question, and it’s something that’s evolving and it can change a lot quicker. And what we saw the other day was you weren’t allowed as of last year to trench on your project in Peru with an excavator or people doing it, hand dug. You weren’t allowed to trench without getting a DIA. And that’s a substantial process, it took us six and a half months to achieve a DIA. We did channel sampling prior, but I’ve heard as of yesterday, actually, that the Peruvian government is now allowing trenching to happen again. It’s unofficial, it should be official here in the next few weeks, but they’re going to loosen up the restrictions on exploration. And that’s just the start. There’s a bunch of other things that are happening in the background. And what they’re doing I believe is they’re going to make a more concerted effort to allow companies like us to shorten the timeline, to exploration, meaningful exploration, and drilling.

On the drilling side of things, there’s a lot of things that can change there. We don’t know yet if this is going to be something that delays us considerably or accelerates us considerably. But so far, we’re really happy to hear that they loosened the fact that you can now go trenching without an actual DIA, which is an environmental permit, in place.

If I was to estimate based on everything that I know and not to take up too much time and too much details, I’d say we’re still aiming for a Q4 drill program in Peru, and I think that is very viable, but it could also be pushed to next year. So I have to say the one thing that we all say is that we don’t know yet enough to confirm that it’ll be later this year or early next year because we have to wait until the government opens.

What we’re hoping for is that the government moves more nimble or quicker with permitting and drilling due to pause in its economy, the jobs that were lost or put on hold, the mines that were shut down. I think there’s going to be a really big gap in their GDP and their growth from the time that is taken. And I think the country’s going to look back to kind of recover, as most would globally, from the COVID pandemic economically of how they’ve been hit.

So, we’re really optimistic and we’re starting to see signs of things improving already, that things could go a bit quicker and we’re aiming for a Q4 drill program. And once that changes, earlier, hopefully a surprise, or if it’s later, then we will update everybody as it goes. But probably need a good month before we can give some strong clarity of when that’s going to happen.

Bill: Ivan, if you’re speaking to a shareholder who is primarily invested in Auryn because of Sombrero, and now they say to themselves, well, if it’s going to be pushed back, I’ll just sell my Auryn shares and I’ll just buy them back before the drill results come back from Sombrero. What would you say to that person?

Ivan: I would say you’re going to miss all the fun. And what I mean by that is we have a lot of optionality in front of us. We’ve talked about unlocking a lot of value in our share price, that’s not there, specifically through the potential spinning of our company into three, you’re splitting it into three entities, right? If you leave the company now and you come back later when we’re going to drill, there’d be a couple of things you’re going to miss. You’re going to miss the fact, if we do decide to go do spinco, you most certainly would miss that because that would happen well in advance of us drilling in Peru. Secondly, and this is a big one as well, the day that we get to go back and take samples again in Peru, that will be an engine or a catalyst for our share price momentarily after the first results come out of it.

And the reason why is because of my previous comment, we get to go trenching, which are more or less lateral drill holes, but we have a lot of new targets that we haven’t spoken about that are substantial. In the Sombrero district, we have other base metal targets, other copper targets, but a huge precious metal target down South called Ccello. And then Curibaya is about to turn a leaf. And Curibaya is three to four months to get a drill permit once we apply, which would put us in Q4 for drilling. But we’re looking forward to going and trenching the multi-kilo silver over these targets and doing the IP.

When we do the geophysics and see what kind of a target can be underneath Curibaya and/or down at Ccello, and those will happen immediately once we’re allowed to resume work, it’ll take about a month or so to process. But if we come out with really big targets there, plus we have the Sombrero main that everyone’s excited about, plus we have these Canadian assets that are worth way more in this bull market, not only will it be extremely hard to buy our share price, but yes, you can buy it back later, but you’re probably going to buy it at a much substantial higher price. And that’s going to be what we try to deliver for our shareholders.

So, outside of being a holding company waiting to permit, waiting to get back to work, we have that runway and it starts in a couple of weeks and we plan to show people a lot more that we’ve uncovered during this COVID break. And we think that the constant news flow from these new targets, both precious and base metal targets, and some other things I’m not talking about that are pretty substantial going on for us improve.I think people are going to miss a lot of really easy positives for the company and the share price.

And lastly, my original point, the fun part. If we go and split this into three shares, you get a pure Canadian gold share and a high quality, high grade silver-gold target at Curibaya along the coast of those major mines. And you get a Sombrero share. Honestly, you can like Sombrero for what it is and like that better than all the rest in our portfolio, then you could sell the other two and have a free position of things all worked out as planned. But all of what I’m talking about is on the forefront to happen in weeks not months. We’re vigorously working towards trying to get all of the things in place to possibly entertain the idea of a spinco to get it done this summer ahead of drilling in Peru and some other big plans towards Canada.

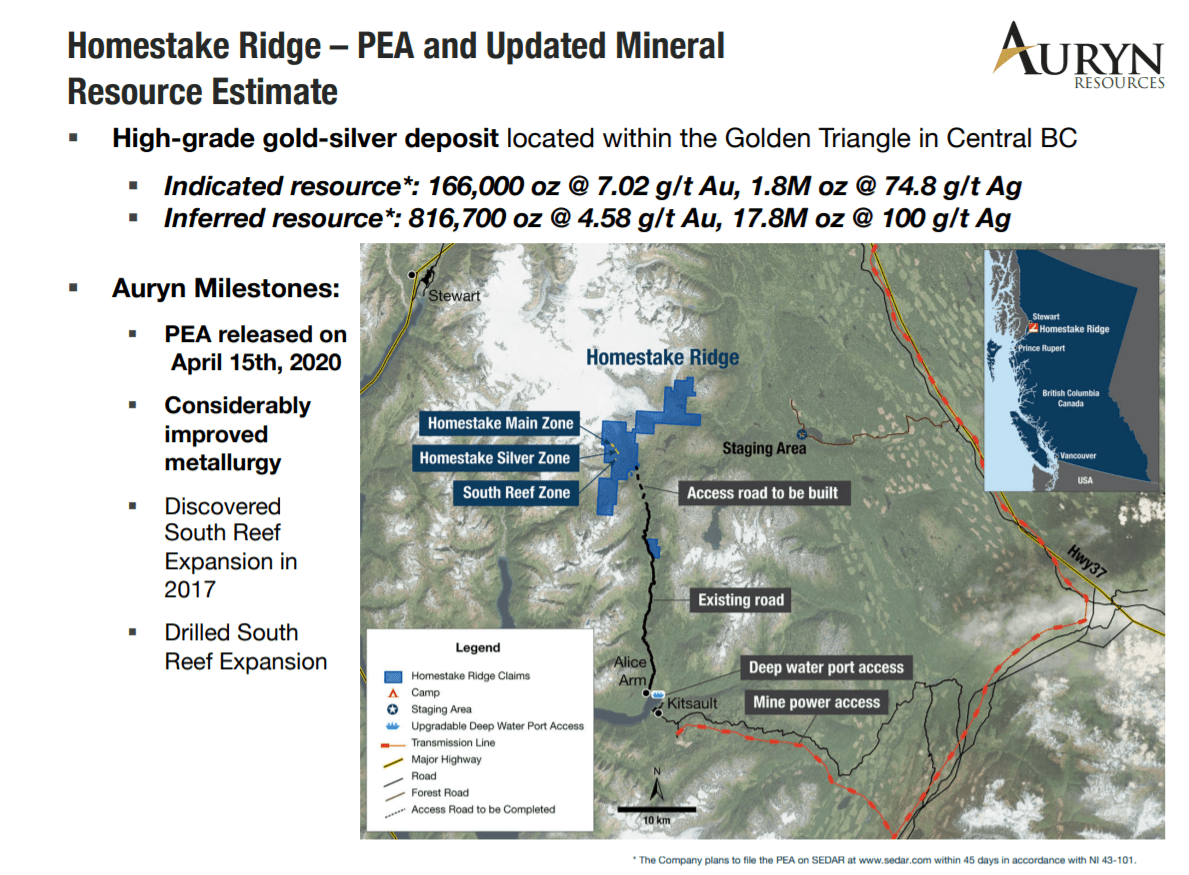

We’re moving ahead quickly. The stock has been quiet in terms of news outside of the PEA we put out on Homestake, which was a great value proposition. It really does support the market cap, whether you own us for Sombrero or Canada. And the breakthrough at Committee Bay, yes, it won’t be drilled this year, but we’re talking about possibly drilling Homestake Ridge later this summer. So there is stuff that can be drilled this year, and we don’t have to wait forever to go drill. There’s a big silver target that we did not follow up on at Homestake Ridge, which would definitely expand the silver zone. I think everyone knows the outlook on silver is very bullish. I’d love to be drilling in two months from now or three months from now, that would be spectacular.

So, I think in terms of that, there’s a lot to miss, a lot going on. The whole reason why you’ve been waiting is not just been Sombrero, it’s been the bigger opportunity we offer. That whole catalyst engine kind of gets revived here in a few weeks once we get back to work in Peru and look forward to possibly drilling Homestake later this summer.

Bill: Ivan, those that follow your story via this show, they send me emails or messages and two of the reoccurring ones over the past year, which I get it less than you, of course, because you’re the Executive Chairman, is when will Auryn split and are they going to sell Homestake. You mentioned Homestake and the PEA you put out. Is there anything more you can share with the market regarding this?

Ivan: Yeah, Homestake became a lot better asset than we thought it was through the PEA. And that’s something that drew a lot more attention and it’s complemented by the gold price. The gold price is $400 higher from when I first said we might sell the asset. And I most certainly think that the gold price is probably going to go a thousand dollars higher from where it is in the next two years. So, as opposed to trying to sell it and monetize it to self-fund, I mean, we’re financed right now, we don’t need any money, not for some time, not till next year sometime. I think there’s more value to unlock at Homestake, and that’s why I’m talking about possibly drilling it later this summer. I think there’s a big silver zone that could add considerably, there’s ways to expand the existing resource, and this is the market we want to do it in.

So, it didn’t work for us at the $1,300 gold price. We couldn’t get what we wanted for the asset. But now the game has changed considerably. So, that’s where we’re at with that. In terms of timing of spinco, as I was kind of alluding to, I would really like to, by opinion and ambition, get the spinco done this summer. And so I’m going to make every effort to try and see if we can organize ourselves and to be in a position to possibly do it sometime this summer. I think it would be a really good catalyst for not just existing shareholders but people that don’t own it.

And if we do spinco properly and we have the right captains behind each entity and people is everything in this business as you’re aware of, if we do this in a good way, we might be able to offer people the entire market who doesn’t own us something they’re not getting somewhere else. And that’s going to be three chances at tier one exploration discoveries that are predominantly mature in their exploration phase, either waiting on drill permits or at the end of $60 million of science kind of pointing towards where the discovery could be up at Committee Bay.

So, I think for me as a shareholder, I’m extremely excited about the opportunities we’re going to be able to create. I’m looking very forward to unlocking the value that we can. I’ve never been a shareholder of a company that did spincos before. I know that I followed what Ross Beaty did in his Lumina Copper days, and it was spectacular for shareholders. And I’ve always dreamed of two things. One is making a tier one discovery, a big one, a 10, 20 million ounce gold discovery or something equivalent in a different metal or bigger. And I think we have enough of those opportunities in the portfolio. But secondly, I’d love to see my share position multiply into three at the forefront of one of the biggest bull markets to commodities that we’ll ever see. And these are what we’re going to get a chance to do as shareholders, but also as executives with our company in the coming months here as we go into this bull market

Bill: Regarding Committee Bay, your gold project up there in Nunavut, Northern Canada in the Arctic, we’ve talked in the past about how you use machine learning to target there. You had a press release out on May 20 talking about advances in high-grade gold targeting there. What was the interaction between your human geological team and machine learning in determining this?

Ivan: So, the machine learning is amazing because it can process and compute a much larger database of information, and the quality of the information and data we’ve put in is extremely high. What it kind of did for us when we went and tested it last summer, it got us to drilling a rock called komatiite. And this rock was being targeted as gold for some reason by the machine learning. But what it revealed to us by accident, I’d say, it revealed to us what our geophysics was showing, and it showed us where the high grade gold was. So a combination of really complex science, data input, drill testing it. It came out with that solution that we’ve had where we saw very distinct signal in our conductivity. And it helped us figure out the geometry of our targets. We thought that we were looking at predominantly steeply dipping structures.

And what this machine learning did, but more importantly, our geologists did, was they reprocessed the data. We’re not going drilling Committee Bay this year, you can’t because of COVID, but that gave us more time without the pressure to scramble a drill program together for the summer. And they realized that we had the geometry vertical when in a lot of cases on the belt, it’s horizontal or slightly horizontal or slightly dipping. And this has changed the targeting.

And when you go back to the 17 targets of high-grade that we drilled back in 2017, and that huge program we did about $30 million program that summer, we came back with all of these targets, we started comparing the new breakthrough from the machine learning on the new geometry. And it showed exactly where we drilled and where we should have been drilling. It started to show it across each target we go back to. So far it’s been extremely exciting because it’s unlocked the geometry, keep it simple. It unlocked the geometry for us. We’ll go drill the proper part of that target next year and I think we’re back to where we were in 2017, where we could have four or five major discoveries on the belt.

It’s real, it’s $60 million worth of really high-quality science, huge amount of really high quality data. The assistance of machine learning and the outcome has been progressing each time. And that’s important because we’re not going up there trying a new target that the machine’s pointing to or that we’re pointing to. We’re going up there and we’re modifying the effort, the science each time with something we’ve learned. And that’s why I’m so excited about it because we’ve come so far, and we’re at the point now where it makes obviously the most sense, that’s usually where it is. But it does and it has a track record of growth into this kind of decision point.

So, I’m excited that we’re going to have a repeat opportunity with Committee Bay that we did when our stock was close to $4 per share Canadian, and we did that big program. I’m excited we’re going to offer that to investors again next year, but with a way better gold price than we had back then. Again, gold price is $400 higher, and if people worry about operating in that part of the world, I know what’s happened with TMAC. A lot of people comment towards Sabina. It’s been a tough go for them. But I kind of look to our neighbors and to the major that’s there that’s operated successfully in Agnico. They’ve done a tremendous job with Amaruq. They’ve done a tremendous job with Meadowbank and Meliadine. These are some of the biggest mines or are the biggest mines in the Arctic and they’re running them really well. And they’re right next to where we are with our belts in the Arctic.

So, I look towards that and the bull market, and I don’t think there’s a better time to go after and drill a project like Committee Bay than the current gold environment we’re in right now. So, it’s exciting and it got to the point of discovery again, where we could make meaningful discoveries, and it’ll be a big program next year that will give us all lots of shots. So very exciting.

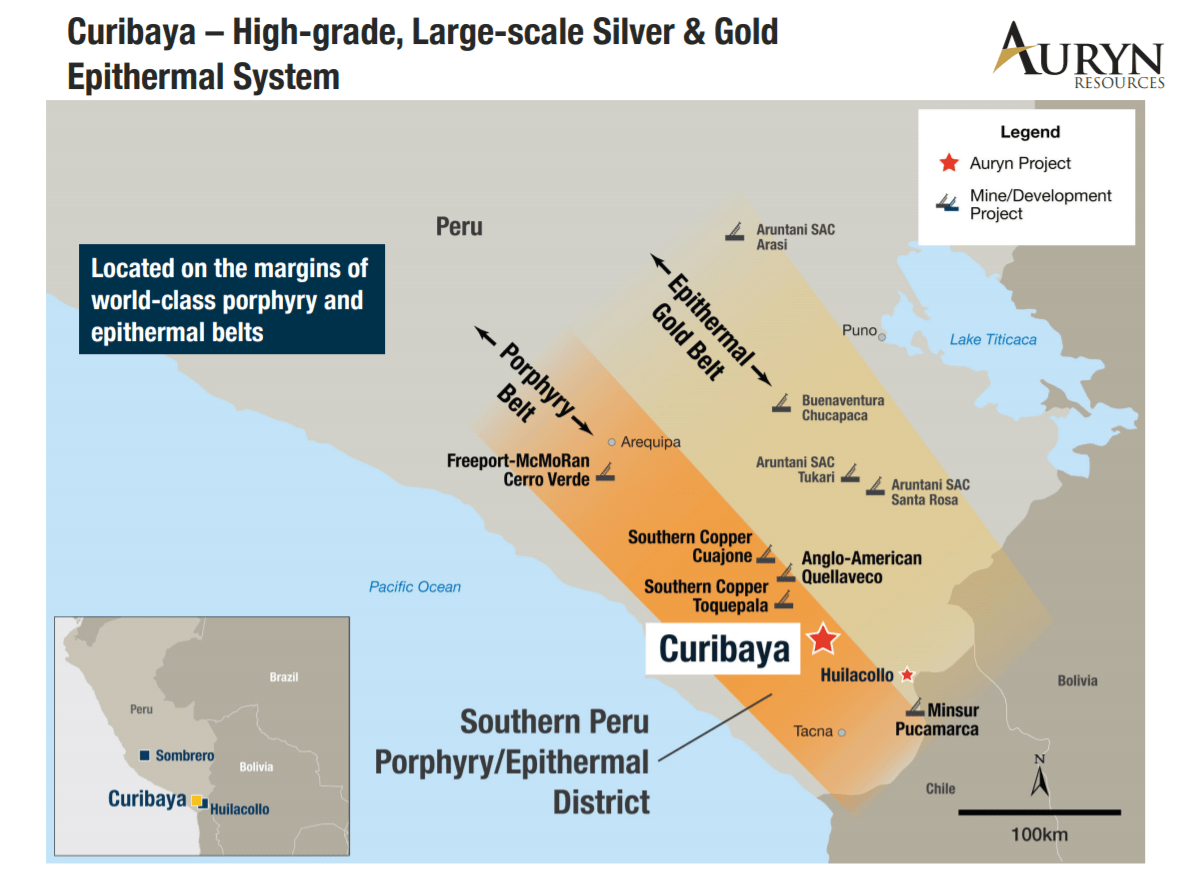

Bill: In Southern Peru, you have your Curibaya project where you’re targeting high-grade, large-scale silver and gold, an epithermal system there. You’ve talked about Peru, but is there anything more you want to address at Curibaya?

Ivan: You know what, there’s more to come out of Curibaya. And for me, we’re going to get back to work there pretty quick. I’m holding my breath a bit for the next round of samples, and I think we’re going to be able to, most certainly be able to go trench some of these areas where there’s several of these veins carrying the high-grade multi-kilo silver, multi-gram gold. I think once we can kind of peel the next layer off, which would be the last layer before we drill it, I think that’s where the fireworks start in the share price.

So far, where Curibaya sits, it’s got the most high-grade silver and gold that I have seen, that we as a group have seen in our careers over 20, 30 years on a project pre-drilling. We’re pointing towards sources now, we have an idea where they could be. The lottery there is how big is the target, how big is the blob and geophysics underneath all of these high-grade banes on the necks of these domes? How big is that? And once we can see that, then either it’s going to be pretty tight but might be very rich, it might be small, or it might be huge. And it’s in the neighborhood of some of the biggest mines in Peru and also in the world. So it’s on the trend for a major deposit to be there.

So, I’m excited. That’ll be one of the first places we get back to work. Samples will follow pretty quickly, and no, there’s so much going on in our company to drive shareholder excitement and the share price forward. It’s been a pause through COVID but that’s about to end here in a few weeks and we’re going to hit the ground running hard. We’re going to have our busiest summer we’ve ever had yet, and we’ve had some very busy summers with a consideration of spinco. But the news out of Curibaya and other parts of Peru, what we’re working on at Sombrero and some things I haven’t mentioned yet, that’s going to be really exciting for shareholders down South.

In Canada, I’m talking about possibly drilling Homestake and expanding the silver zone and possibly the resource come Q3 this year. There’s a real good consideration that we might do that. So, no, I think shareholders can look forward to a lot happening. We don’t need any money to do anything that I’m talking about. We have enough money to drill Homestake if we want to. We have enough money to continue all the work down in Peru. We have enough money to execute on spinco. So, we’re funded and, and that’s important for people to know that. I know the stock’s been volatile. We were down to a CAD$1.00, or US$.75 recently. COVID panic, financial crisis, what have you, pounded the table really hard, even with critics. I’d be shocked that people didn’t take advantage of that in some ways that weren’t afraid of it. But I do understand that people were also apprehensive because of what was going on in the world events with COVID and the financial crisis.

However, I will say the recovery was quick. We’re above our financing price that we recently did. And the fun stuff that we’ve been looking forward to for months, possibly a year and a half or two, is finally in front of us and it’s about to start happening a few weeks away, so we’re really excited.

Bill: You can see that Ivan and the team do not sit on their hands. Ivan’s very ambitious, he’s an entrepreneur’s entrepreneur, that’s why I’m invested in Auryn Resources. He’s going to find a way to try to create shareholder value and move the company forward. Website again is AurynResources.com. Ticker symbol is AUG in New York or Toronto, and make sure you get on the email list also so you get the press releases as they come out. Just go to AurynResources.com to get on that list. Ivan, I really appreciate you coming on today’s show and giving this update. Thank you very much.

Ivan: Thank you so much for having me, appreciate it.