Fibonacci Price Modeling Suggests Massive Resistance Range In US Markets

The big selloff in the US markets last week (-1600 pts in the

Dow Jones) on the comments from the US Fed aligns with previous Fibonacci Price

Trigger levels throughout the early portion of 2020 to create a massive

Support/Resistance range in the markets according to our research team. It is very likely that the big selloff bar

from last week will also establish a minor Support/Resistance range within the

price range of that big selloff bar.

One of the key technical components of our Fibonacci Price Modeling system is that it acts as a trend following system, projects key target and reversal levels, and also highlights key trigger levels as price rotates up and down in different time frames. The benefit we derive from this modeling system is that we can interpret the data into various forms of key technical factors for our friends, followers, and members.

Before you continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

YM – DOW JONES

DAILY CHART

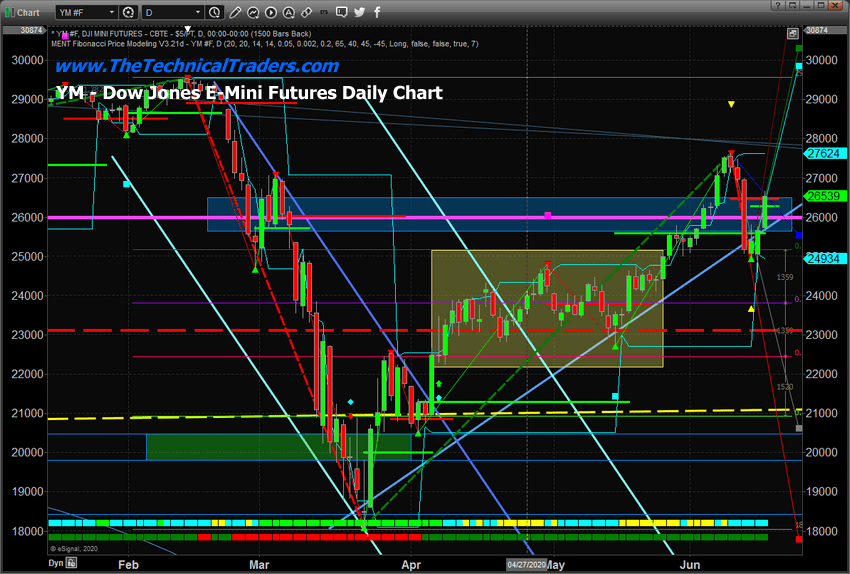

Although this YM Daily chart, below, may be a bit complicated, pay attention to the BLUE SHADED RECTANGLE between 25,600 and 26,500. Additionally, pay attention to the heavy MAGENTA LINE near 26,000. This rectangle and the magenta line are derived from Fibonacci Trigger levels generated by our Fibonacci Price Modeling system.

You can see these Trigger Levels as GREEN and RED horizontal lines drawn just below new price peaks or just above new price bottoms. Fibonacci Price Theory is based on tracking price peaks and troughs in a process as price attempts to trend higher or lower. Our Fibonacci Price Modeling system attempts to adapt to price variances using a modified AI technology and attempts to highlight projected Trigger Levels and future potential Target Levels with each new price rotation.

Our researchers believe the BLUE RECTANGLE range will act as

a major price support/resistance level after the big selloff bar last

week. This price range, totaling almost

1000 points, is likely to prompt volatile price rotation near or within this

range as price attempts to either breakout to the upside or breakdown into a

new Bearish trend.

If the price moves lower, below the 25,500 level, there are very few prior Fibonacci Trigger levels that offer support on the way down. One, near 23,850, and additional deeper Trigger Levels near 20,000 to 20,850 are the only deeper reference points recently. Thus, our researchers believe any price breakdown below 25,500 could prompt a very deep and fast price correction in the markets – setting up a potential double-bottom type of pattern.

YM – DOW JONES 60

MINUTE CHART

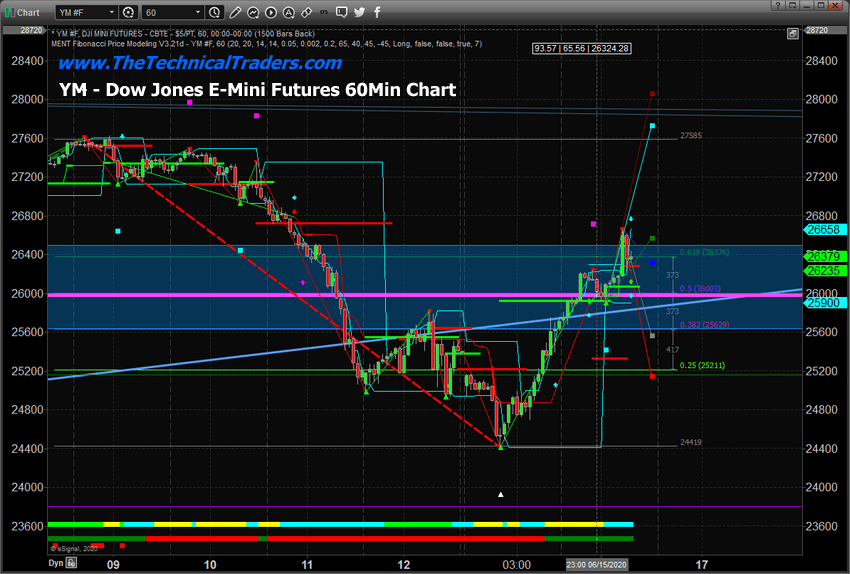

This 60 Minute YM chart, generated about 70 minutes after the Daily chart, above, clearly shows how price reacted near the upper range of the BLUE Fibonacci Price Channel. Almost immediately after attempting to breach the upper range of the support channel, the price collapsed back into the channel and wiped out close to 300+ points very quickly.

Our research team believes the 26,000 will continue to act as

a key price level going forward. The

upward sloping price channel line, drawn as a LIGHT SKY-BLUE LINE through the

recent downside price rotation, is another key price channel supporting the

current market. Once both of these

levels are breached to the downside, there is very little support to be found

before reaching the 23,850 level.

As we’ve been warning our friends and clients, this is the

time to stay very cautious with your trades as volatility will likely continue

to be elevated and bit price rotations are likely as we head into Q2 earnings

season. Everyone wants to see a strong

recovery in the US markets and speculative traders are pushing in that

direction. The reality of the situation

may be that we see a longer-term recovery taking place over the next 6 to 12+

months.

Right now, the YM price is still above the heavy Magenta support level. We need to watch price activity as this level becomes critical for the price to attempt any future upside price moves. If the price falls below this level, then a deeper price breakdown may be initiating.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is an incredible year for traders and investors. Don’t miss all the incredible trends and trade setups.

Subscribers of my Active ETF Swing Trading Newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain. This week we closed out SPY ETF trade taking advantage of this bounce and entered a new trade with our account is at another all-time high value.

Ride my coattails as I navigate these financial markets and build wealth while others watch most of their retirement funds drop another 35-65% during the rest of this financial crisis going into late 2020 and early 2021.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.