Maximizing Wealth Creation through Discovery with Ivan Bebek of Auryn Resources

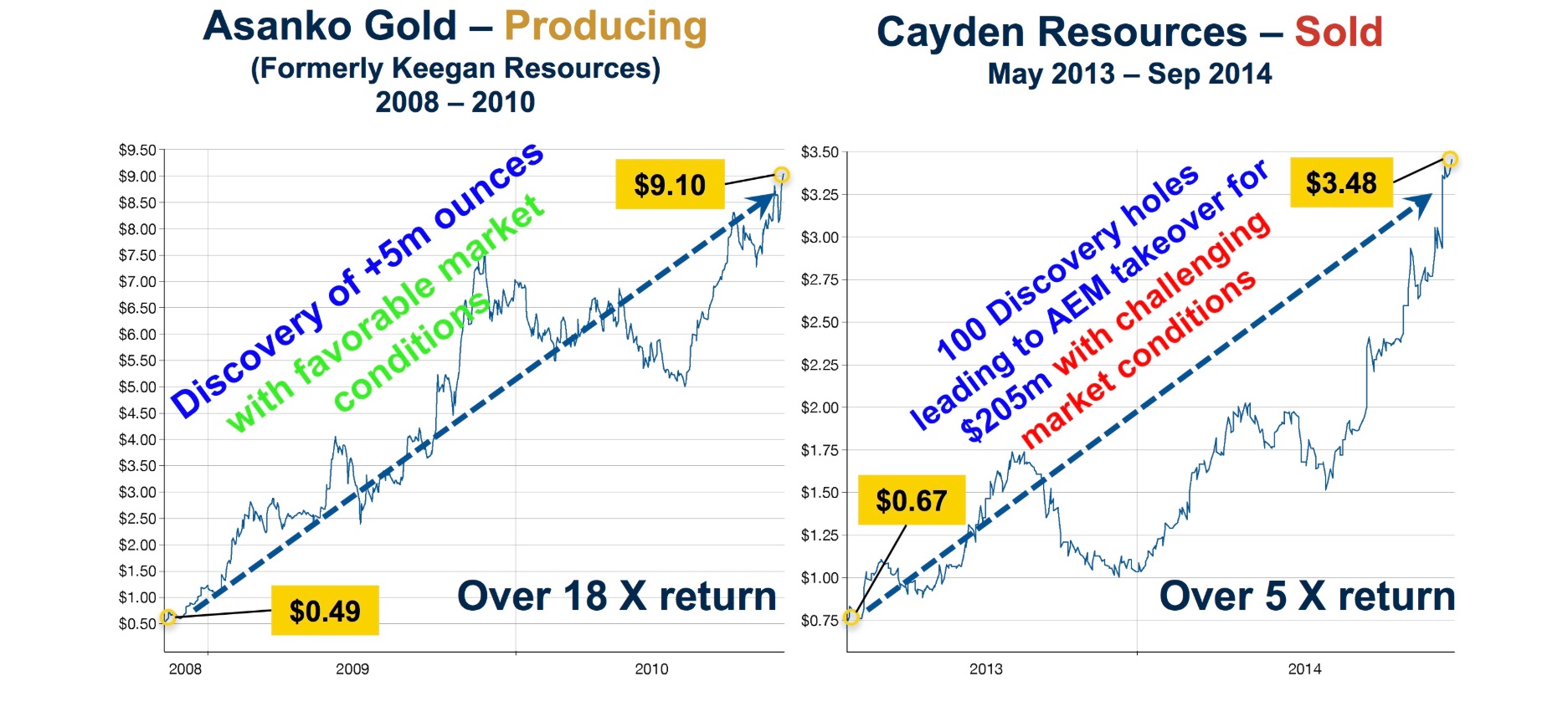

Auryn Resources’ Executive Chairman Ivan Bebek, while only in his young 40’s, is not a rookie when it comes to creating massive wealth for shareholders through mineral discovery. Ivan’s previous two companies Keegan Resources (over 18x return) and Cayden Resources (over 5x return) both saw significant discoveries which resulted in lucrative buyouts. Now Ivan and his team at Auryn Resources are building upon their prior successes to pursue even bigger potential world-class discoveries which they are on the verge of drilling.

In this interview, Ivan talks about why and how he and his team pursue value-creation through discovery. As he shares, “I’ve always erred on the side of an earlier-stage project because you get paid as an investor for finding something more often than for having something. If you have a substantial asset, the general market picks up, you’re going to do well. But if you make a new discovery like we did in Keegan, where we found 5 million ounces of gold from zero, the stock went from 49 cents to $9 per share, you’re going to get rich. So I’ve got a pretty serious, unhealthy appetite, I describe, for really big exploration projects that have really big swings. Because that’s, the return that gets us all excited here in our office.”

Auryn Resources is a technically-driven, well-financed junior exploration company focused on finding and advancing globally significant precious and base metal deposits. Auryn’s technical and management teams have an impressive track record of successfully monetizing assets for all stakeholders and local communities in which it operates. Auryn conducts itself to the highest standards of corporate governance and sustainability.

0:15 Introduction

1:35 Testimony of how Cayden Resources in 2014 saved a speculator’s portfolio

3:15 How Ivan maximizes wealth creation for shareholders

5:32 Courageously and effectively sharing the speculative opportunity is key to value creation

6:54 What’s more important…the money or the metal?

8:49 Handling criticism

15:43 Responding to Ross Beaty’s endorsement of Ivan and Auryn

18:47 Significance of Sombrero project’s age-dating confirmation

23:52 Auryn raises CAD$10M from core investors

26:58 Discussing the short position on Auryn

Ticker: AUG ~ Sign up for Auryn’s email list: https://aurynresources.com/subscribe/

TRANSCRIPT:

Bill: Welcome back to Mining Stock Education and thank you for tuning in ladies and gentlemen. If you’ve been listening to the last few episodes, you know that I just returned back from Vancouver after attending the Vancouver Resource Investment Conference. And with the long plane rides and such back to Detroit, Michigan, have a lot of time to reflect. And as I reflect I take notes, mental notes as well as writing on my notepad. And as I categorize the different reflections that I have, kind of goes into three categories.

One, interesting companies that I met that I think have a unique and compelling value proposition. Two, interesting people that I met in the industry, whether it’s an executive or a geologist or a fellow investor. And then three, memorable stories. And one memorable story or impactful thing that I recall was after the first night of the conference, going out to Chinese with a high net worth private investor who invests his own money. We were talking about the past decade of mining stock investing and he was sharing his experience. And he shared, in 2014, he said, “Boy, that was a tough year, 2014 in the bear market.” He said, “But there was one company that saved my portfolio that year.” He said it was Cayden Resources. He said if it wasn’t for Cayden Resources, it would have been an absolutely devastating year for him.

And in that bear market, he said a hundred drill holes turned into a $200 million buyout and that saved his portfolio. Well, the executive at the helm of Cayden Resources in 2014 is my guest today. He’s also a sponsor of the show, Ivan Bebek, the executive chairman of Auryn Resources. Ivan, welcome back to the show. And when you hear a story like that, what do you think?

Ivan: Well, it reminds me what it did for myself and all the rest of the shareholders as well. It was an amazing accomplishment by us and we had all the world in front of us to go find something substantial. Somebody recognized that in the exploration phase. And I won’t say it was a surprise. Because if you listen to me a year before that transaction took place, well before we even got our letter that it was going to happen, I had prepared to market that that was a strong possibility. I’ve been a good speculator over my career. And that was something that really, it put the money where the mouth was and the success was huge. From that, I think outside of being proud of an accomplishment like that, reinvesting a lot of that capital and going to try and find something bigger has been a really fun road. And that’s kind of what got us here today.

Bill: Can you talk about how you, as a mining entrepreneur, look at maximizing monetizing assets? Because as a private investor, when I’ve researched companies, there’s executives out there that are in charge of five million ounces plus gold deposits that seem to have been stagnant for a decade or decades on end. But then there’s the cases of Cayden Resources where you monetize a hundred drill holes and create tremendous amount of value quickly. How do you look at monetizing these assets?

Ivan: Well, I think it’s a great point. And we are always looking at more projects and a lot of things come across the desk. Some have multi-million ounces, some have nothing, right? And they’re early stage. And I’ve always erred on the side of an earlier-stage project because you get paid as an investor for finding something more often than for having something. If you have a substantial asset, the general market picks up, you’re going to do well. But if you make a new discovery like we did in Keegan, where we found 5 million ounces of gold from zero, the stock went from 49 cents to $9 per share, you’re going to get rich.

So I’ve got a pretty serious, unhealthy appetite, I describe, for really big exploration projects that have really big swings. Because that’s, the return that gets us all excited here in our office and the companies we build, right? Would we like to have a few billion tons of copper? Would we like to have five or 10 million ounces of gold to start with that could become 20 or 30 million ounces of gold? Absolutely, but those don’t exist anymore. You don’t find those, and if you do, generally, you’re finding them with a lot of hair on them. There’s either metallurgical issues, community issues, or variability issues in the grade.

It’s a lot easier to get paid for something new if you can find something new where you don’t know any of that. And that’s where the joy comes. So when we talk about monetizing investments for investors, and we’re large investors in our own company, we’re big shareholders and we’ve bought a lot of our, I personally have bought a lot of our own stock in the open market. What we look at is how could we find something big enough to move the needle much further than we have previously? And discovery is the true way there. And is frankly going to be the future of all major resource returns and resource investments. It’s going to be through discovery. So that’s what really gets us excited.

Bill: What is the key determining factor from a management perspective, though? And as I’ve analyzed this, is it entrepreneurial zeal where you don’t have all the skills yourself but you bring together the money and the people to make it happen?

Ivan: Those two elements are most certainly the key ingredients of anything that we do this way. But the third element besides putting those together is you have to be able to share the opportunity in generalist terms. And I think a lot of guys have the science figured out and the facts figured out, but a lot of guys or companies are missing the communication skills to really show the opportunity and tell the story.

And I think that there’s two ways to win in this business and they both resolve in a major discovery. But if you tell the world what you’re excited about and you show everybody why you’re so excited about it, I think you’re going to get a lot more of an audience and you might have a better share price following. In terms of if you go out there and make the best discovery as a very scientific person, but you haven’t told many people about it because you’re waiting till the discovery is there, you’re probably not going to get nowhere near the performance of the person that shared his speculation.

So having the courage to share your speculations on a world stage because you know you’re going to get judged by them, the ones that work or don’t work, is something that we carry as well. A good friend of mine and a fund manager I sat with during this conference here, and there’s always a debate of what’s more important. Is it the money or is it the metal? And if we look at that equation, it comes right down the middle. I mean the money has to come before the metal or else you can’t find the metal. But in any good team that you see around the industry, you need to have a balance. It’s a 50/50, because the money guys and the market side of it, it cannot promote something if it’s not there. And the geologists cannot drill and find something if they don’t have money.

So I think balance is the most important word out of our group, out of what we achieve. And you know looking at Auryn specifically now in what we’re doing here, we offer something that nobody’s offering investors in this entire business. And that’s a high degree of optionality. If you listen to my presentation at the conference, we talked about potentially spinning our company into three different companies. That’s something we, we need some more validation from one of our projects before we’ll pull the trigger on that.

But imagine that as a shareholder we’re about to go into a bull market. We have some really exciting opportunities both north and south of the equator. And if we can divide one share into three shares, somehow, going into a bull market, and make one or two or possibly three major discoveries or monetizing events, I don’t hear of any other juniors in the entire marketplace that has that kind of opportunity in front of them with the quality and depth of technical team that’s behind it or the maturity in the projects.

And when I refer to maturity, we’ve spent a lot of money getting to where we are now. And these are mature projects, the final stages of drill permitting at Sombrero, we will have drill permits we anticipate by the end of the year for Curibaya. These two projects are really taking shape. Outside of them just being some great area to go explore, they sit on two of the most prolific mining belts arguably in the world, but in Peru for sure.

Bill: Ivan, you articulate the potential so well, like you said. And that’s one of the key things that’s missing from a lot of the executives that do present at these conferences. But when you articulate so well and you lay out the potential so well, you kind of do put a target on your own chest. Because we can’t control everything. And sometimes timelines don’t work out or things don’t progress the way we would want. So when you get to that place, and maybe there’s internal conflicts as any organization has, and then you have to deal with not only what’s going on internally, but you have externally the investors giving you a call, too, and asking questions and questioning when will this point be reached? How do you handle criticism and how does that make you better? And what’s your response to it?

Ivan: Well, there’s a few things. Everyone who’s doing well picks up a lot of critics. And whether it’s envy-driven or whether it’s an unfairness felt in the valuation or the attention we get, the one thing I will say is, more specifically, is if we’re this good at valuing our opportunity and eloquently presenting it to investors, imagine when we do make the discovery how we’re going to perform? I want everybody who’s worried about our timelines or listening to critics and hearing about the negativities. Well what’s going to answer everyone’s questions or comments is going to be the drill bit. And we live by that same drill bit, as well, right? I’m not too worried about people being negative. I’m more worried about what we’re going to do well and how we’re going to reward investors for being positive. And our ability to articulate our opportunities and to capture the attention of not only investors but major mining companies, major financiers in the business, this is something that’s going to pay us extremely well when we do get a discovery.

Lastly, being critical towards what we do and stuff, I think it’s the easiest business in the world to be critical towards because it’s the hardest business in the world to succeed in. And if you want to be critical on what we’re doing today, you have to look back at when we made the discovery at Keegan and how that performed during the discovery phase. You have to look back at Cayden and what we pulled off there for investors. The track record is what defines us with who we are today. And it’s something that we can improve on going forward because of any good business venture that you’ve tried and succeeded, there’s always something you can do better.

The one thing that I said at the end of my speech, if you want to go and be critical about our marketing or abilities to market ourselves and create value, well I’ll argue that our ambition as a company is defined by our aggressive nature towards creating substantial shareholder wealth for not only our shareholders, but also our stakeholders. And if we’re to be criticized for trying to make our shareholders wealthy, then I don’t understand that as something that I would take offense from. That’s just a misguided criticism.

But aside from all that, I have to come back to this. And I laugh a little bit. When everyone has a different view, and you can look at the coin two ways, where the glass of a cup of water is either half full or half empty. If Sombrero turns out to be half as much as we think it is, the return, I’m under-promoting it drastically and I haven’t done a good job. And people have criticized me that in my previous companies when they succeeded. Specifically, major financial personalities came to me and said, “Ivan, you under-promoted me on Keegan in the early days. You should have been way more aggressive. You under-promoted me on Cayden when it was 70 cents before it got bought at $3.50 the following year.” There’s a limit.

And then I have to go back to this. I bought about three and a half million dollars worth Auryn in the open market. I bought it up to $3.75 per share. I’m proud of every single purchase that I bought and I would buy every single share again if I was given the opportunity to do it. Because I think that we’re going to win on one of these three major opportunities, potentially in all three. So I come back to this, the power of being able to articulate a really, really high quality opportunity and being backed by guys that are from Newmont, guys that have worked for Newmont for 10s and 20s or 30 years, including their former chief exploration geologist, we’re not just coming up with these random speculations. There is a tremendous amount of fact behind what we do.

But I don’t think it’s just the articulating that has really got people to separate us from the herd. It’s also been the strategizing. We have timed our financings. We have built one of the best registries. We’ve been overly-patient on fundings to get the right investors that we want in our registry. We’ve been very specific about the timing of raising capital. We bridged ourselves in August at a time we would have been crushed on a funding and then done at a much more dilutive pricing. So it worked out extremely well and now we get to raise money here on the forefront of a lot of really good events to come and take place.

I think in hindsight when you look at everything you’ve done, you have to come back with your own report card and be self-critical where you can be. The only thing I haven’t done well is I haven’t been a bit more aggressive in earlier stages of opportunities. Maybe Auryn at $1.20 early last year when it was down at its lows. But at the same time, at the risk of losing credibility, you don’t want to just be too much rah, rah, rah. People attack us recently, a lot of investors, and I get the texts and the emails daily about our permits.

We gave guidance that we would potentially have in November, we didn’t make that guidance up. We get it from a source that is very reliable and we’re in the general bureaucracies of Peru government to try and get permits in Peru. Right now, we sit here on this call, and we’re anticipating to get our DIA, which is the major environmental aspect of our permit, sometime this month, which is January. This would be month seven…inside seven months we would achieve it. And what a lot of people don’t realize is the fastest DIA achieved in Peru in the last two years happen in nine months. A company just got there as the other day and it was the 14th month that they got it. We’re talking about getting it within seven months.

So I’m really anxious to turn the drill probably more than any critic or any long investor in our company because I’m at the forefront of everybody’s investment, including my own. But I’m also patient because the big discoveries take time. And you’re not going to come and buy Auryn or any company an hour before it goes to $20 or wherever it ends up going if a discovery’s made. So that’s where we are today. And I welcome the critics because I stand behind science. That’s how we’re led. And there’s so much fact and strategy behind everything we do. I think that’s, the transparency that I exude in all of my podcasts, is something that I think is really fair for investors. If we turn this company into three shares versus one, eventually, imagine what your price per share is going to be at the end of the day if you choose to hold one or two out of the three, or if you hold all three and they all work out.

Bill: Ivan, as a shareholder of Auryn, I’m very happy that you’re effective at communicating the value proposition. When I was in Vancouver a couple of days ago, I spoke with an executive of a silver company in South America, which happened to be my worst loss about two or three years ago, 65% loss, which I wasn’t happy about. And I just told them in a matter of fact, said, “Hey, good to see you. You were my biggest loser a few years ago.” And during that time period, as the share price kept going down and down, I kept calling him. And I called him probably four times over three months. And what I kept telling him was, “Listen, you are doing a terrible job communicating to the market. So I don’t care what you’re doing geologically, it’s not going to make any difference here. I’m telling you as an outsider who owns your company, you have to do a better job communicating to the market because the market doesn’t understand what you have here and what you’re trying to accomplish.” So that was a learning issue for me. But not only do I see that in you, but I was at the opening conference, opening session at the conference, and Ross Beaty specifically mentioned you as an up and coming mining entrepreneur. What was your reaction to that?

Ivan: Ross Beaty is someone who I have obviously a ton of respect for, I think the whole industry does. I think he sold 14 companies. And I’ve had the luxury to be a shareholder in some of them. I started to get to know Ross right before the sale of Cayden to Agnico. Ross gave me some incredible advice. And since then he’s been a shareholder, but he’s always been very generous with his time when I have real serious questions to ask.

The first thing I do when I step into the next plan for our company, I put on the humble hat and I go look to people who’ve done this at a capacity much larger than me, much smarter than I would know without the experience. And I listen. And Ross is someone that I’ve been trying to earn his respect for some time because he is one of the most humble billionaires in space and he’s done it right as many or more times than everyone else.

And getting his accolade was truly, not only is it inspiring for me as an executive to get it from somebody like that, but I do know his filter is really, really harsh. He picks very few people to perform that way. But it makes me want to work harder, makes me want to work 10 times harder than I was working yesterday. And if you know me well, I really don’t stop. I kind of go 14, 16 hours a day. I get text messages at two in the morning that I somehow respond to in Europe or overseas.

So it just doesn’t stop. But it’s, it’s awesome to get it. And I’m very, very appreciative. Ross is a mentor of sorts and he’s been incredibly great and generous with his advice. So to get that kind of respect for him, I think not only for me personally, but more importantly, I know he mentioned Auryn in that comment. I think that’s a really big accolade for what we’re up to. And it kind of validates what we talked about at the beginning of this interview. The multiple opportunities that could come out of a portfolio like this where some real money was spent and it’s led by really good science. So hopefully Ross continues to be an investor, becomes a bigger one, and we can go and deliver a huge win. There’s nothing more I’d want to do for somebody like that in our company.

Bill: And your big target now is the Sombrero project in Peru. You had a press release about that on the 17th of January stating that you confirmed the age of the mineralizing intrusives at Sombrero. Now this was a more geologically-dense press release, so some of us non-geologically trained investors might not have grasped the full meaning of this, but I understand you had a very positive response from the majors?

Ivan: It’s something that, when you’re in the science business, exploration is science, right? You’re going to have to have some science press releases once in a while. And we put this press release out on Friday. The reaction was incredibly positive. Several people reached out to us in the technical world with impressive reactions. They were shocked. And you have to ask yourself, from a non-technical perspective I’ll try and summarize it real simple. Sombrero’s called Sombrero, which means hat in Spanish, because most of Sombrero’s covered by a thin layer of volcanic rock. A volcano erupted ashes on the rocks. You can’t see a lot of the rocks underneath it. And the success we’ve had to date and the kind of, we’ll call it the tip of the iceberg, has been these erosional windows where you get to go and sample 109 meters of 0.7 on a surface or 232 meters of 0.5 and a half percent copper equivalent.

Those kind of samples are rare to see in most systems. And you’re getting small windows, you’re not sampling where you want to sample, just where mother nature has eroded some small windows. But these are all created by an event scientifically. And that event and when it occurred is very paramount in not only just this part of Peru, but several parts of Peru or South America where these events occurred. And it’s the Eocene age date that we’ve announced we discovered that we have. All of the intrusions we can’t see, the 80% of the ground that we can’t sample on surface, now it falls into the category of being in the same event that made all those major mines next door. So it’s the most paramount reason of why Sombrero exists as an opportunity. A lot of people said, I’d mentioned it in interviews previously, that the age is the same. And a lot of people on the generalist side were like, “We knew that.”

But putting out the science when you have a tremendous amount of corporates or majors looking at your opportunity, having them all being aware of that at the same time, is I think something paramount. Because it’s a very important factor and it has the actual science and facts versus an executive going out there and talking about it. So the outcome was incredibly positive from what happened from that press release. The market may have missed it, they may have been frustrated by it. We’re all waiting for the DIA. The DIA is imminent. I mean, it could be this week, it could be next week, but it’s in the final stages. And it’s still on track to come pretty quickly. Everything that we’ve done, every press release that we make besides reporting the news of what’s happened that we’re excited about, comes with great strategy.

And that’s all I want everyone to think about. We are being extremely strategic, not only with the accommodation of potential corporate interests down the road, or the accommodation of major shareholders, but most importantly everything has been set up so that we could perform aggressively well with massive premiums if we make these world-class discoveries.

Something that I haven’t talked too much about, and I’m surprised, and maybe you have more questions in this interview to ask about it, is Curibaya. We put out these amazing silver numbers that we don’t still know what to make of them, or we’re learning quickly, but the world didn’t know what to make of them. A couple of guys familiar with the silver world have approached me and said they’re even better than other silver things that are getting a lot of attention right now. Eight kilo silver, three kilo silver, 14 kilo silver, numerous samples that are running in the multi-kilo silver over a big area. What we’re doing and what we have been doing is we’ve been sampling and working on the ground and mapping continuously since the middle of January. We started a few weeks ago. And a lot of news to come out of Curibaya. I think that the system’s a lot bigger. There are a lot more aspects to it that are a lot more fundamentally key and critical towards it being a pretty robust, big system that I think the market’s going to see. We’re waiting on a bunch of samples. I don’t know the results, I wouldn’t forward-shadow those results. But seeing a lot of diatrims, boiling points, a lot of textures that are major factors in a lot of major deposits.

We’re finding more and more and it’s expanding. So I think that Curibaya is going to come out in the next few weeks, probably between now and PDAC you’ll probably see some more news on it. And it’s going to be really standalone. It’s going to be comparatively exciting as Sombrero is. And it’s on a world-class epithermal porphyry belt. So again, the address is right. The grade is astounding. And I think getting it to where it is now, we’re so lucky as a company to have that as another potential tier-one swing in our portfolio. But expect a lot more out of us at Curibaya. I most certainly do based on what I’m hearing from the field.

Bill: To advance Curibaya as well as your other projects, you need money. And you just announced that you raised C$10 million. Can you tell anything more that’s not in the press release to us regarding this?

Ivan: The financing was, we were very specific, and we raised 10 million of our own money last year. When I say our own money, close shareholders and/or family members have done the financings. We’re apprehensive about bringing a lot of shareholders into the larger transactions that we’re not aware of, we don’t know, because we’re trying to maintain a certain level of core investors that would allow us to execute on various parts of our strategy going forward. Which include the consideration a spin-co, or if we do make a big discovery, if there’s a major mining company that wants to bid it early, we want to be able to hold onto it to make sure we monetize it well. This funding was fully placed when we announced it. It gives us 18 months of working capital, which is pretty substantial.

It doesn’t include a specific drilling budget in it, but we’re not too worried about that because once we have the drill permit in hand, I mean that’s the easiest money to get and it’s the easiest to get a better premium for that as you’re about to turn drills. So a lot of marquee investors is what I told the world we were looking for to put in this placement. I’m not going to comment on who’s buying it, but we did achieve somebody that we were very, very ambitious towards getting larger into our shareholder registry. So on closing, I’ll be a bit more public, obviously with permission. But it’s gone to the best people we could have possibly put this funding with and sets us up for tremendous success for the rest of the year.

Bill: And if I read the press release correctly, there were no US investors in it, is that correct?

Ivan: That’s correct. In this financing it was just Canadian or off seas, overseas investors. The second thing we did, Bill, we had that a bridge loan. And that now is convertible. That is a very specific adjustment to the loan that will remove the debt burden that was on the company that might’ve been giving us a bit of a discount. And so we think the bridge loan will likely convert here in the near future. And then we’re off to drilling on a few things.

And if we do decide to split the company in a few months once we get some more information out of Curibaya, we most certainly have enough capital for each entity to survive for 12 to 18 months with this raise. So the optionality it’s given us on a corporate basis is substantial. But also the work we’re going to be able to deliver to the market and the fact that it takes us kind of away from the needing money kind of category. So I anticipate there to be a much different reaction to our share price on the back of the funding as well as the receiving of more permitting news, specifically the DIA, hopefully imminently. And more news out of Curibaya. So look forward to a lot of news. And the funding’s out of the way. We got a really good group of investors. I think that we’ll reflect in our share price going forward.

Bill: Ivan, in our last interview, we talked about shorting junior mining stocks and specifically how shorting has affected Auryn. I’m curious, if you do split the company into three, how would that affect those that short the stock?

Ivan: Well, I’ve never shorted a company before, Bill, and I’m an optimist and I always look for how companies can succeed. So I don’t know the exact mechanics, but I think a few things. We’ve needed money for some time. It’s been communicated to me that there’s a heavy short position on the company. When does it cover? What’s going to trigger it? I most certainly don’t know, but at some point it will have to be covered. If we do make the decision to go ahead with the spin-co and do that, I don’t think you can deliver the spin co shares. You would be forced probably to cover prior. But I don’t know too much about it. All I know is that we’re going to perform incredibly well with our projects. And I think the financing being out of the way, it takes away the potential shorting that people would do looking for a funding. And where and when did they cover, I think we’ll all see it in the share price at some given time.

The only thing I’ll say that’s changed considerably is the catalysts that will drive our share price have become a lot closer to us now. And I think you’ll see steady news resume in our company. Lastly, and I want to make this point very clear, a lot of people, they will comment on my enthusiasm and my marketability and how much I market the company. I’ve been to one mining conference outside of the Vancouver conference a few days ago since Beaver Creek and I have not done any marketing outside of that. Two things. One, there wasn’t much new, but the share price Canadian was in the dollar, mid dollar eighties. It was performing extremely well.

I’ve done a series of podcasts to try to communicate with investors, but I haven’t been on the road at all. And the stock has performed extremely well. So what happens for me is when the catalysts start happening, the DIA comes together, more news out of Curibaya. I’m on a plane, and to be honest I’m going to be on a plane a lot in the next three months because there’s going to be a lot of news behind what I’m going to talk about. Now it’s going to be worthwhile. The story is changing dramatically. And for those of you who have waited for this Sombrero for a year and a half or since we first started talking about it and seven months for the permit, we delivered Curibaya in the meantime. Which is another Sombrero-potential-esque opportunity based on what kind of reward we could get. And both of them are going to be drilled this year. So there’s a lot of news to come in front of us.

There’s a lot of things I have not even mentioned myself because we are so busy. And I think a lot of people don’t realize that when we’re not putting out press releases, when we’re not marketing, we’re strategizing, we’re advancing programs, we’re setting up more access in different parts of our projects in Peru. We’re setting up drill permits and whatnot. So there’s a lot of stuff that we’ve been doing, which I like to call project staging, or advancing things towards discovery. And instead of talking about permitting for seven months and torturing people with that word, which I’m really beginning to hate, because it takes forever in South America sometimes, but we’re going to be talking about drilling.

And I know the risks of of exploration. I know the risks of drilling. The fact that there is a few drill holes in Sombrero on the edge of the system before we got there gives me a lot more confidence that we’re going to start drilling something pretty spectacular pretty quick. Maybe it’s not on drill hole one, but within the first program that we do, I think there’s a good chance that get into one of these discoveries.

And lastly, if you paid attention to us in the last few years and how long it took us to put this together, a bit of luck, but a lot of planning and some coincidence, we finally see the turn in the commodity prices, or the treatment towards commodity or equities. And we saw that at the Vancouver show with the turnout of way more people with meaningful interest to listen to way more stories and way more companies now starting to put projects and swings together on the exploration side.

So if you’re going to make a big discovery, it’s going to take you a few years to get drill-ready. We’ve spent those years. It’s going to take you some time to get permits. We spent that time. Now we get to look forward to drilling for 18 months across Peru in these two projects and then monetizing our portfolio into this bull market. So truly an exciting time for us.

The long wait to get to this point, we think, will be more than worth it with at least one or possibly two of these events that get monetized. And I’m referring to events of projects, Sombrero and/or Curibaya. Canada has some surprises to come. I think the opportunity in Canada is as good as it’s ever been. And it’s obviously very well suited with a gold bull market, which I think if you listen to half the people in the industry, the more conservative ones, you’re getting a new wave of confidence toward the metal price performing. But if you listen to all of them, I think that we’ll all soon be believers that the gold market’s coming back.