Top-Performing Resource Fund Manager Warren Irwin on Where He Is Investing Now

At the 2019 Beaver Creek Precious Metals Summit, resource fund manager Warren Irwin sat down with Bill Powers and Nick Germain (MiningBookGuy.com). Bill and Nick queried Warren regarding his investments and where he is seeing the best opportunities now. Warren discussed whether investors should even bother speculating in copper and uranium explorers when the developers of those commodities are currently so undervalued in his opinion. He also offered his thoughts on several mining jurisdictions/regions including Argentina, Ecuador and Eastern Europe. Throughout the interview Warren shared numerous resource investing tips and wisdom. This interview is a must-listen for resource investors of all levels of experience.

Warren Irwin’s G-10 Special Situations Fund (US) LP earned the top position in 2016 among the 4,099 hedge funds tracked by BarclayHedge with a 156.32% annual return. Other Rosseau funds also took the second and sixth spots with returns of 155.94% and 128.89% , respectively.

0:05 Introduction

2:22 Cantex Mine Development Corp.

5:49 SolGold and Cornerstone Capital Resources

7:29 NexGen Energy Ltd.

10:42 Will uranium and copper discoveries receive proper valuation in today’s depressed market?

12:20 How much does exchange listing matter?

13:35 Emerging jurisdictions

17:17 Eastern Europe as a mining jurisdiction

20:12 When to buy and sell your mining stocks

23:22 Amazing mining investment opportunities now

25:49 Thoughts on Beaver Creek Precious Metals Summit

27:40 Anything you are shorting now?

29:12 Backing mining superstars…why or why not?

32:17 Thoughts on groups that control several exploration companies

34:55 Final advice

TRANSCRIPT:

Bill: This is Mining Stock Education. I’m your host Bill Powers, and I’m sitting outside at the Beaver Creek Precious Metals Summit with Nick Germain (aka @MiningBookGuy) and Warren Irwin, top-performing fund manager, President and Chief Investment Officer of Rosseau Asset Management. Gentlemen, welcome to the show. Nick, I’m going to pass it over to you. What questions do you have for Warren to kick off the podcast?

Nick Germain (aka @MiningBookGuy) and Warren Irwin, top-performing fund manager, President and Chief Investment Officer of Rosseau Asset Management. Gentlemen, welcome to the show. Nick, I’m going to pass it over to you. What questions do you have for Warren to kick off the podcast?

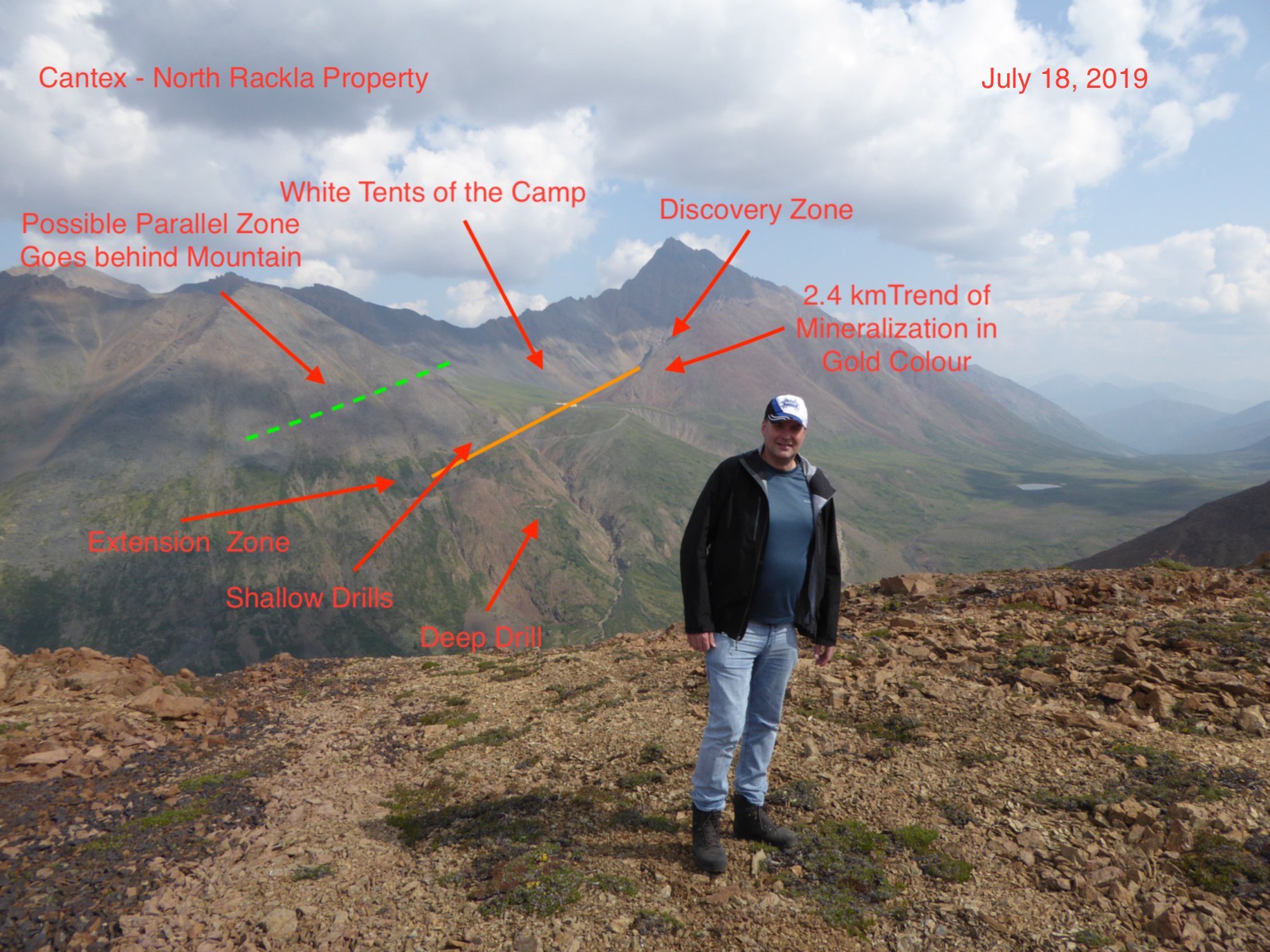

Nick: Warren, I noticed you had an interesting tweet on Cantex Mine Development Corp. with a neat picture and you seemed pretty excited about it. I was wondering if you wanted to add some color to that. What makes Cantex special? It seems maybe it’s like the size potential.

Warren: Well, the first thing is when you take a look at Cantex, you have to look at who’s behind it. The guy behind it is Chuck Fipke who owns a significant portion, just under half of the company. He was the guy responsible for the Ekati discovery, all the pipes at the Ekati Mine, and hence really the founding of the Canadian diamond industry, which basically built a lot of the infrastructure in the Northwest Territories and gave Yellowknife a real new pulse.

He’s a pretty significant player. He made millions and millions of dollars for investors back in the Dia Met Minerals days. When he made that discovery, I was really new to the business when he did that, but I do remember it. So I’ve watched Chuck ever since then, and he’s a very, very serious player. I have backed Chuck in the past. I’ve lost money backing him in the past. So for me, to revisit Chuck after having lost a few million bucks backing some exploration earlier, which between the time of his Ekati discovery today, it says a lot.

Now, what I like about Cantex is I love the scale of it. We’re basically talking about multi-kilometer long gossan with metal showing on surface. Up near the surface, it’s, oxidized a little bit. But as you get deeper it starts getting into a 20% combined zinc-lead for… and there’s quite a bit of silver there, too. And you’re getting metal value of around $500 a ton, which when you take a look at gold terms that’s got third of an ounce gold and they’re getting seem to be getting it around on about a 10 meter wide section.

So what’s interesting about it is when you start with multi-kilometer long structures 10 meters wide with $500 rock. If this thing holds together with drilling, you work out the math and it’s extraordinary. Especially the people on the podcast, you want to just work out with a 3.8 specific gravity and you can work out how many tons you have. And if you multiply the number of times by $500 rock, you have a lot of really, really expensive ore down there. That’s what makes it so exciting is that this could be a massive, massive discovery.

So I’m watching it very, very closely. I bought some shares for my fund at a $1.00 and got a $1.50 half warrant. Today, the stocks in the $4 to $5 range. But you know, this could go way, way higher if it turns out to be continuous and so we’ll see. But it definitely has all the hallmarks I like to look for…continuity, grade, really good pedigree of the people involved. It’s in a good jurisdiction, it’s in the Yukon. There’s a number of things I really like about it. So that’s why I’m watching it very, very closely.

Nick: As a follow-on question regarding a different company, kind of an update on a SolGold and Cornerstone Capital Resources, which you’ve talked about in previous interviews, where do you stand there now?

Warren: Well, the SolGold discovery, which was they basically farmed into the situation that it was from a project generator called Cornerstone and then they went on to grow the initial preliminary discovery into a four billion ton ore body, which is just extraordinary. It’s definitely considered today to be one of probably the top five undeveloped copper deposits in the world.

As a proof of that, we’ve had SolGold has had an both BHP and Newcrest step up and make investments in it. BHP being the largest mining company in the world. Also, the CEO of BHP has said in a press release that they’re very optimistic on their investment in SolGold. At the time, my recollection, it was around 30 plus million dollar investments. So can you imagine the CEO of the largest mining company in the world commenting on a tiny little $35 million investment in a press release? It gives you a sense as to how important this discovery seems to be in the world.

It’s a shame right now that copper is a little on the weak side, but it is a truly an extraordinary discovery and the guys at SolGold and Cornerstone, but mostly SoldGold, they just deserve tremendous amount of credit for taking something initially that showed some promise and really growing it to a world-class deposit.

Bill: You have a very public position in NexGen Energy. What are your thoughts on NexGen right now?

Warren: Yeah. NexGen is in a very interesting time right now. I bought in a NexGen prior to their big discovery around $0.60. The stock went to, I think the higher was around $4.50 with the discovery. The stock drooped down to as low as around $1.50 not that long ago. So when you think about it, I bought in at $0.60 before the discovery really hit and then it went to $1.60 here recently after all that drilling and all that discovery and all those studies.

So it really shows what’s happening here in the case of NexGen. During that period of time too, the price of uranium really hadn’t fluctuated. It’s about 25 bucks at both times. So NexGen seems to be entering into a really unique phase. An example I could give you of that phase was, I remember Aber Diamonds. It had a big run when the big discovery happened. It was just South of Ekati and it ran up, I forget how high it went, but it went quite high. And then as it started to move into development, and when people started doing the resource work, the environmental work, everybody got bored. They blew the stock out.

Remember this is 20 years ago, it was hovering around the $7, $8, and $9 level and I watched really smart guys in the market, just hoovering up stock. That was again 20 some years ago, so I had only been in the business a little over 10 years. I thought it was interesting how they were just… The smart guys were buying and the dumb guys were selling or the impatient guys were selling. And sure enough by the time Aber got into production and started cranking out some cashflow, the stock was $42.

So these guys were stepping up, buying stock at $7 to $9 and a year or so later, $42 bucks. In the case of NexGen, I can see the exact same thing happening where the impatient money is moving on to, whether it be marijuana stocks or Bitcoin or jumping on the recent gold bandwagon and the smart long-term money. Again, there’s not a lot of long-term money out there but the guys are just hoovering up stock, you’re at a $1.60, $1.70, $1.80 and in five, six, seven years or whenever in the future when this thing starts getting closer to some of their big, big cashflow numbers, it’s going to be trading many, many multiples of where it is.

But in the mining sector, what’s interesting about NexGen is it’s not unlike Aber is that the downside risk from here is very, very little. Yet the upside over multi years, if you have a multi-year horizon is pretty extraordinary. It’s one of the biggest and richest uranium discoveries in the world in one of the best mining jurisdiction in the world. Top quality management team, lots of government support, community support like they have got nailed… They checked a lot of the boxes. This is going to be an extraordinary situation but it’s interesting how short-term outlook on some of the players has really created a value opportunity here for the people with a nice long-term horizon.

Bill: So if NexGen’s valuation is so suppressed, when investors look at the uranium explorers, should we expect an explorer with some good results to even get any love from the market?

Warren: You know, maybe, but you’re exactly… A very, very good question. Sometimes when I see a… For example, right now SolGold is super duper cheap and so as Cornerstone and they just made that one of the world’s best discoveries also, like NexGen is definitely one of the worlds best uranium discovery. SolGold is one of the world’s best copper discoveries and they’re all getting killed. And so it’s a very interesting question. Why would somebody go invest in a new copper discovery or a new uranium discovery when we’re seeing when you do find them, you don’t get paid for them?

Now, the only thing I could think of is somebody who’s, if you are investing in, let’s say, an IsoEnergy Ltd. Or other copper exploring, any other explorer, it shows you you have to be reasonably nimble if you’re going to get in it. You may want to just get out of it when the hype is at the max and then try and revisit it at a later date.

But there are risks to that too, because what happens sometimes is with these world-class discoveries out of the blue you’ll get a big takeover bid from one of the major mining companies. You never know. It’s a bit of a risky strategy. But would I invest in copper or uranium juniors right now when I could see SolGold and Cornerstone and NexGen chain trading as cheaply as they are? You know, you kind of think that may not be worth it on a risk-reward basis given how cheap they’re trading is.

Nick: On a global theme, how much does exchange listing matter to you, whether it’s, Canadian, Australia or the UK as the three big ones?

Warren: Yeah, I don’t really care what exchange they’re listed on, although I really do have a very difficult time yelling at Australian management just due to the time change. It’s really tough to get them on the phone. You definitely can’t go over and punch him in the head as easy as you can a Canadian guy who was in Toronto just down the road. Right? So I try not to invest in Australia or even the UK is quite a bit closer and for five hours, but generally the UK mining companies, I find that they’re active in Africa and Canada and they’re active generally in North America and South America.

Those are gross generalizations, but generally, it’s not necessarily the exchange, I just like being close to management and being able to ask them questions, pick up the phone and talk to them. Go on site visits. To go on a site visit to Australia takes, you blown at least a week and tens of thousands of dollars. So I’d much rather jump in a short term, short flight to somewhere in the Americas or in some ways even Africa is reasonably easy, too.

Nick: With emerging jurisdictions, in a previous interview with Bill, you had some interesting comments and I’m just wondering maybe in the last year, can you give at least one example of maybe a jurisdiction that’s on more of a positive path, at least one that’s on more of a negative path and if they’ve affected maybe any of your investments or what you’re looking at?

Warren: Well, Argentina is a good example of a negative one. I may have touched on Argentina before. They’ve done some really bad things to mining companies I’ve had investments in. For instance, when we found an open pit mine in one area, one state of Argentina, what do you know? The governor puts an open pit mining ban on. When we find a gold mine in another state, and it’s an open pit. We’re going to use cyanide to heap leach it. Then there was a cyanide ban in that state. That’s Argentina.

Then Argentina, you know, it gets religion. It realizes that maybe it should have some industry to employ its people and feed his people. Then they get religion and now they’ve got currency controls. My life is too short. I haven’t got much time on the planet left, so I’d just rather just not deal with Argentina. That’s one example.

One on the upswing? Yeah. Well, if you doing South American companies on the upswing, Ecuador is on the upswing. But deep down, it’s South America. They’re on the upswing until they’re on the downswing. So, Ecuador is the flavor of the day today. Ecuador has tremendous geology. It could be a tremendous mining success just like Chile and Peru, their neighbors to the South.

We’ll see how they handle it because they don’t have a long, rich mining history like Peru and Chile does. I hope they embrace it because there’s a tremendous amount of benefit for the country and for the people by embracing mining. Any company operating there will be operating to the highest standards and environmental regulations. The mining companies have come a long way with how they treat the environment, the people, the local community with respect to… You know, I’ve been down to see SolGold’s operations, they’ve done a great job with supporting the community, hiring local people, getting the community engaged and understanding what’s going on. So the people making many of these decisions are indeed local people who have to live in the community. So everybody’s, there’s not going to be any big dumping of toxic water into the stream that everybody… That may have happened decades ago in mining, but with the local people involved in the mining process, everybody’s in it together and everybody wants what’s right for the country, the local people in the environment.

Bill: Do you have an eye on Eastern Europe? I met with some Eastern European companies here over the last two days.

Warren: Yeah, sadly…I was just in an Eastern European country for a week riding my off-road motorcycle and spending a fair amount of time with the locals and talking about corruption. The problem is the level of corruption in Eastern Europe is very, very high. Unless you have the time and energy to deal with corruption and making sure that your partners are not corrupt, make sure that you’re not going to get impacted by corrupt government officials, they’re going to take your project that you just spent $20 million moving forward and giving it to their friends or adding levies or taxes or just outright confiscation.

Remember, a lot of these countries in Eastern Europe were formerly communist, so they have a different mindset when it comes to what the people own and what private enterprise could own. You know, you look at it or let’s say Romania with Rosia Montana, you’ve just got the NGOs in there and everything else. I know people who’ve worked in that project and they’re good, decent people and they tell me, “Warren,” he says, “you know, we would go in there, we would clean up as part of the building this mine. We’d clean up tons of environmental mess from years prior that previous miners have done and are continuing to pollute all the rivers and the country will be better off environmentally by us going in there and mining these ounces and creating these jobs.”

So you see that and you realize that it’s really tricky. I was also riding my motorcycle across Romania was the country I was in. You just see what’s going on environmentally and how the… In my instance, I was riding off road motorcycles, cross country so I saw the environmental degradation of the timber industry and I happened to be riding with, one of the people I was riding with was a Canadian logger who knew all the environmental standards that Canadian loggers have to deal with in British Columbia. He was pointing out environmental infractions for four straight days and just say, “Look at how brown this river is. Well, it’s because they log too close to the river’s edge or they did this or we wouldn’t be allowed to do this or it wouldn’t be allowed to keep create tracks up old riverbeds where they were actually using riverbeds as roadways.

All those things they we’re not allowed to do in Canada, but they do it in Romania. So it’s sad to see that and it’s sad to see some of this environmental mess in Romania won’t get cleaned up because they can’t build Rosia Montana there because of NGOs and a whole bunch of other issues that are blocking the development of that mine.

Nick: Thinking about cash positioning…I think that’s a problem a lot of retail investors have being either too invested or not being invested enough at different parts of the mining cycle. I’m just wondering how much thought you might put into it, whether you have more cash or less cash a few years from now as the market builds up, especially knowing that discovery could happen at any time.

Warren: Why don’t I just give you my own personal advice. This is for advice for retail investors, right? Okay. So I’ve been trading from my own retail account for quite a number of years, right? For decades. Right? So my general rule of thumb is whenever I feel really, really good and think I’m really, really smart, I sell stock and I buy real estate. I remember that’s when I bought my Bre-X house when it was… You know, I was building my Bre-X house. That’s when I sold half my Bre-X stock at $280 a share. The last cycle, I built my last house at the end of the last cycle after I made a big win on, I believe it was Gold Eagle…made a big win. Instead of reinvesting it in the market, I took it out. I set it aside. I said, “I’m going to build my house.” Well, sure enough had I not done that, I may have lost of 80 to 90% of my money invested in juniors as it came off for like five or six straight years down.

The general rule of thumb, if I could give somebody something to think about, in my experience, whenever you feel good, you feel you’re smart, you feel you know what you’re doing, sell your stocks or these good chunk of them and put them into something very safe. Either bank stocks, real estate, and whenever you feel that you’re the dumbest idiot in the world and you can’t believe you put all this stupid money into mining stocks as in today is a good example. Like, for instance, if my parents, my dad’s 85 he comes to me and says, “I’ve got some money to lose. I have no qualms putting them into some NexGen, some SolGold and some other mining names like that,.” Cantex, might be a little speculative at this time for him.

But you know, some of these high value names, like there’s a number of copper producers that are trading quite inexpensively too, right? So when you feel dopey now, that’s the time to invest and when you feel really smart, that’s the time to take something off the table. That’s worked well for me. And it saved my butt quite a number of times. So for retail guys, think about that.

Bill: You said in a previous interview with me that you’ve educated the investors in your fund when they had big wins to take that money off the table to prepare for the bear market.

Warren: What I said, whenever you guys… Well, I told my investors in my quarterly letter, I said, a number of times I’ve said, “Whenever you think I’m really, really smart, that’s when you take money off the table and whenever you think I’m really, really stupid, that’s when you give me money.” So they’ve been really good to take money off the table, but they never give me money when they think I’m stupid. But sometimes they take away money when I’m stupid because you know, it’s tough. It’s a tough cycle. It’s a tough cycle to break. For instance, right now, I believe it is the most fantastic time to invest in a mining fund. We’re floating some trial balloons to start a new mining fund because everything I see out there is super cheap. And on a risk-reward basis, stuff looks fantastic.

Bill: All commodities pretty much?

Warren: Well, gold’s a little bit more expensive recently, but it’s still reasonably cheap. But if you look at copper, you look at, there’s some metallurgical coal deal I’m looking at. They’re cheap. But uranium’s cheap. I don’t know of too many good nickel deals right now, but in general, things are looking quite inexpensive. And if people have an investment horizon of say a decade or… Like we’ve been kind of in the downturn now for five or six years or seven years maybe. Well, it’s not going to last another 10 years hopefully. So if you have a 10 year horizon picking up these these stocks at these levels, you’re going to do very, very well longer term. So that’s an example.

But right now if you looked at I’m down this year in my fund, so one would think, “Well, Warren’s dumb. I would never give him money because he’s down this year.” Well, all I know is I see all my mining stocks. Their fundamentals are fantastic. They’re finding more ounces of gold. They’re finding more pounds of copper. They’re finding more uranium, everything’s going very, very well, yet the stock price just keep dropping. One example too here, we’re looking at, let’s say, SolGold and I don’t own SolGold. I own it through Cornerstone, which owns a minority stake in the project.

The property has an over 50 year mine life on it. And why is this stock weak in the last little while? Well, in part because the price of copper has gone down. Well, price of copper has gone down the last six months. What’s that got to do with the next 50 years as the world makes the transition into copper, into electrification of… Can you imagine how much copper we’re going to need as everybody has an electric car? Not only the copper, extra copper used in the electric car in the motors, but also to run all the electric cables so everybody has a big charger in their garage. Well, that’s a lot of copper and if the whole world does it, copper is going to do very well. And we’re not finding a ton of copper right now. So exciting times for copper.

Nick: Well, I just have one more question mainly about Beaver Creek. Where does this rank for you on the circuit of conferences out there and do you have any examples of some things that make Beaver Creek special?

Warren: Yeah, Beaver Creek is one of my favorites. The other one I really, really like is the BMO conference that happens every late February, just before the PDAC. So that’s really good because BMO does a great job of getting rid of a lot of the trashy companies and the companies you’re going to see there they’re all real people, high quality companies. Whereas if you go sometimes to, let’s say the PDAC, sometimes you’ll see a lot of scammers there because there’s not that control.

Here at Beaver Creek, I quite like Beaver Creek and you catch the buzz of all the latest guys doing some of the latest work. And there’s some interesting names here of companies that are doing some great things and so at least it gets it on my radar screen. So when it does happen if I hear of a good drill hole done by somebody, I’ll say, “Oh, yeah, I met the guy in Beaver Creek, I remember where he is, I know the property a little bit.”

So it gives me a bit of a headstart. Whereas sometimes if you hear of a big discovery and you have not done a little bit of legwork or certainly met management and understood who they are and where they’re from, what experience they have and where they live and stuff like that, it’s a little bit slower to get up to speed on things. For instance, when Cantex hit, well, I’ve known Chuck Fipke for over 20 years. Right? I’ve already lost money with him, so I know quite well. Right? But I’m fortunate I’ve made back that money and some.

Bill: Anything you’re shorting right now, Warren?

Warren: No. Its tough to short at the bottom of the cycle. Actually, there’s one I just don’t want to get into it. I did think about one. I might short it, but I wouldn’t touch it with a 10-foot pole. It’s just an over hyped name, the flavor of the day. And yeah, there’s some, there’s a couple over-hype names, just guys are promoting the heck out of the name and when you roll up your sleeves and, in my case, I’d been involved in that particular mining camp before and I know what’s going to work and what’s not going to work. And I know that, I’m pretty sure it’s not going to work for them. And then there’s another one. Oh geez. Like the PEA is a fantasy PEA.

I think PEA, they should almost change the designation to FEA, “fantasy economic assessment”. Like this one PEA I’ve seen… My God, it is completely and totally ridiculous. And for people who say that following Bre-X, you know, the whole PEAs are really protecting investors, not a chance. This PEA, it’s complete and total utter fantasy and the mine will never be built. It will never be mined and retail investors to this day will fight with me tooth and nail that this is going to be a tremendous project. There’s not a chance it’ll ever get built.

Bill: You’ve said in a previous interview that you don’t always back superstars that have been successful multiple times because maybe they get a little fat with the pleasures of riches, maybe they don’t have the motivation.

Warren: Yeah.

Bill: But if someone’s been successful a couple of times, they’ve been able to assemble maybe a better technical team, a better financial team, they had better financial backing than they did previously. And whereas they may not be motivated with making their first or their few first millions, but you can sense that maybe they’re in it for ego, and they want to build up their reputation for history sake. Would you potentially back that person if you sense something just, the ego drive, maybe if it’s not the money drive?

Warren: I look at it mathematically here. Okay. Let’s say the odds of finding a deposit, a good deposit might be… What? One in a thousand. Let’s say with a good person it would be one in a hundred. Let’s say one in a hundred. That’s being charitable. Well, if the odds, let’s say, of Chuck Fipke finding Ekati was one in a hundred, if you backed them on the next deal, that’d be one in a hundred times one and a hundred which would be one in 10,000 are your odds of him doing back to back discoveries?

Well, I was dumb enough. I backed him on the next one. I lost 2 million bucks, right? You get my drift, right? So the world in mining is littered with…I don’t want to name the names. Some of them are my friends, but the reason I could say Chuck’s name here is Chuck’s onto I think another massive discovery, but it’s been decades since his last one.

What I mean by that is to have back-to-back good discoveries, it’s so tough to do. It really is tough to do. And if you are working the odds out of one in one hundred and one in one hundred or even one in one thousand and one in one thousand. If you multiply the two together, like if it’s one in a thousand for the first, one in a thousand for the second, that’s one in a million that you get two in a row, right?

So the odds of having back-to-back discoveries are very, very tough. So what generally happens and Chuck is a good example. You’ll make a discovery and he’s one of the most determined mine finders I know. But then you’ll fail for a couple of decades and you’ll lose money in Nevada, you’ll lose money in Yemen, you’ll lose money in Northern Ontario. You’ll lose, you know, boom, boom, boom, boom, boom.

And then eventually, boom. It hits you 20 years later. And there’s examples of that where where I’ve learned my lesson. I’ve backed people who just coming off a hot discovery and it’s tough to make two back to back discovery, just tough to make one discovery. So I think what happens sometimes is after a big discovery, people are feeling really, really good and it’s really good, especially about that guy who just found it and they’re willing… “Oh I’ll just throw money for sure back. Oh, I really like that feeling he’s going to… He’s a good guy, he’s hardworking guy and made a ton of money with them.” And then the next thing you know he flops and you’ll lose all that money. So if you’ve rolled all the profits from the first one into the second one you get a zero, you know? So that’s really what I’m getting at it a little bit there. It’s tough to find a mine and to find two back to back, the odds are very, very low.

Bill: Some of these groups form and then they control, let’s say, three to eight different exploration companies and they pool assets, one CFO works for several companies, and they do it to lower G&A. What are your prospective here? Do you think there’s wisdom in this?

Warren: Myself, personally, I stay away from that generally because you know there are some… There’s one group who’s very well-known and we’ve got maybe 20 or 30 companies and they’re stripping off fees off every single one and there’s a flavor of day, “Oh, Lithium’s the hottest name.” Well, they’ll create a lithium company. Well then cobalt is the name of the game. “Well, let’s create a cobalt company.”

Next thing you know, they’ve got flavor of the day, they lithium flavor the cobalt, they load up with tons of penny paper and they’re punting it out through their offshore accounts or whatever else they’re using. So you don’t have to report, and this goes on. Next thing you know, they’ve got a stable of 20 or 30 flavor of the day companies. And then when lithium goes out of favor, that collapses, investors lose all their money. Then when cobalt goes out of favor, that one collapses. Then when vanadium goes out of favor, that one collapses. And then when graphite goes out of favor, that one collapses. Then rare earths. That was the flavor of the day. We’re talking, if you go into some of these groups and they’ve got like, “Oh, you’ve got a flavor of the day companies for the last decade, right?” And guess what? You are charging them fees every year melting down that treasury.

For instance, I’ll give you an example. I remember after Bre-X wiped out the entire mining industry, I’d have idiots come up to me and say, “Warren, Warren, know, you’ve got to invest in this company. They got $1 million in cash and it’s trading at $300,000 market cap. Look at the value there. You’re paying for one-third of the asset.” I said, “What do you think $1 million in the hands of a mining stock promoter is worth? It is worth zero because when the mining cycle turns, that mining stock promoter will immediately cease all operations in the field and he’ll sit there in his office for as long as he could possibly sit in his office and drain that treasury because he knows he can’t get a job in the mining sector because it’s out of favor. He’ll be milking that treasury every which way and he’ll be giving…You know, he’s got a friend who’s out of a job. Well he’ll kick him a $40,000 management contract and next thing you know that million dollars is gone. So never fall for that.

Bill: As we conclude here, for Q4 what advice would you like to leave to the resource investors listening to us?

Warren: Now, is not the dumbest time to buy good quality mining assets. A lot of them have been beat down pretty hard and if you look a little bit deeper behind the share price, you’ll notice the fundamentals have actually improved over the time. If you have the patience to do the work and find these good quality names and hold them into the next cycle, you’re going to do fine.