The Truth About Gold’s Golden Cross | The Daily Gold

JANUARY 27, 2019 JORDAN ROY-BYRNE CMT, MFTA

A golden cross occurs when the 50-day moving average crosses above the 200-day moving average. Its supposed to be a bullish signal and it just happened in Gold.

In order to know if this is meaningful, we should check the history and assess the results.

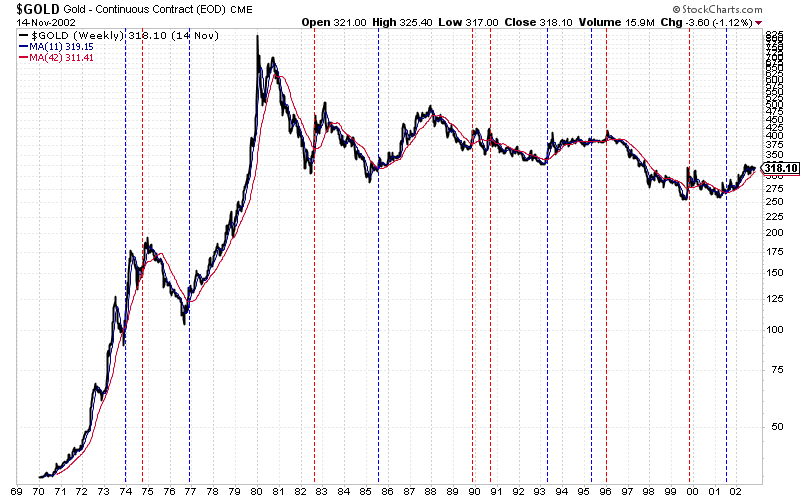

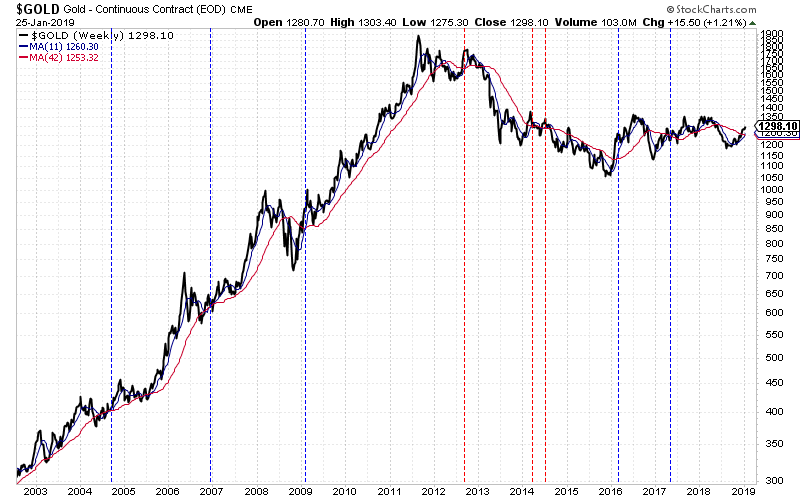

We used weekly charts (with equivalent moving averages) so you can see the history in two charts. Blue lines were bullish while red lines were bearish.

First, we show 1970 through 2002.

Next, is 2002 through today.

There have been 20 golden crosses and 11 have been bullish with 9 being bearish.

When the primary trend is higher the golden crosses tend to work as a bullish signal. When the primary trend is lower or sideways, the golden crosses can serve as a warning for bulls.

However, there are times when the cross can happen as it precedes a change in the primary trend. The best examples of this are the crosses in June 2001 and September 2012.

One turned out to be a massive buy signal while the other was a massive sell signal.

In effect, the signal for Gold is not important or especially useful. It has a mixed track record and because of that its useless as a leading indicator.

(As an aside, I’m guessing its probably more effective for equities).

Interestingly, there will be a golden cross before Gold makes a major breakout. It’s a mathematical certainty. I’m just not sure it’s going to be this one.

Rather than focusing on something with a mixed record, you should focus on the pending shift in Fed policy. The historical data (as I’ve shared numerous times over the past year) shows that is when rebounds and bull markets usually begin in gold stocks.

Going back 65 years, I count 13 times when the Fed went from rate hikes to rate cuts. The average gain in gold stocks during 11 of those periods was 172%.

The moves higher began an average and median of three to four months after the last hike.

When it’s clear the Fed is shifting policy, that is when we want to be aggressive buyers. It’s not clear yet so there’s no need to chase anything now. There will be plenty of time for you to get into cheap stocks that can triple and quadruple once the Fed is cutting rates and the new bull market is confirmed. Recall that many juniors began huge moves months after epic sector lows in January 2016, October 2008, May 2005 and November 2000. Don’t chase the wrong stocks now. To prepare yourself for some epic buying opportunities in junior gold and silver stocks, consider learning more about our premium service.