Osino Resources Receives C$1.85 Buy Target (CEO Heye Daun & Exploration Mgr Jon Andrew Interview)

Osino Resources recently received a C$1.85 buy target from Stifel Equity Research (pg 46) which is over double the current share price. In this interview, CEO Heye Daun and Country and Exploration Manager Jon Andrew provide an update on the company’s progress and plans to advance its Twin Hills Central gold discovery. Over 800m of the planned 20,000m 2020 drill program were completed before the lock-down went into effect. Now the Namibian government has lifted the lock-down and Osino can recommence advancing its gold discovery and exploring new targets on its land package.

0:15 Introduction

1:00 Stifel Equity Research issues C$1.85 buy target for Osino

3:12 Namibia’s Covid-19 response’s effect on Osino

4:11 What has Osino accomplished during quarantine?

7:38 20,000m drill program recommencing now

8:45 What resource category will maiden resource primarily be?

9:20 When to expect maiden resource?

10:43 Osino progressing numerous exploration targets

12:06 Planning an exit strategy for Osino to maximize shareholder value

14:19 Maximizing value creation without over-drilling

17:02 Significant investors and institutions entered Osino’s last financing

18:05 Land grab occurring around Osino’s Twin Hills discovery

20:31 Final thoughts

OsinoResources.com TSXV:OSI – OTC:OSIIF – FSE:R2R1

TRANSCRIPT:

Bill Powers: Welcome back to Mining Stock Education. I am your host Bill Powers. I hope that your mining stock portfolios are performing well. One company that I’m excited about in my portfolio that is performing well and that is also a sponsor of the show is Osino Resources. Right now it’s trading in about the Canadian mid-eighty cents range. I was reading a report recently by Stifel Equity Research. They put a speculative buy target on the stock at Canadian $1.85. My personal target, if the company’s successful with the upcoming 20,000 meter program, is higher than that, but nonetheless a successful explorer in a gold bull market I expect to do very well. The website is osinoresources.com.

You can find Osino in Toronto under the ticker OSI and on the OTC in New York under the ticker OSIIF. I’m joined today by Heye Daun. He is the co-founder and CEO of Osino Resources, as well as Jon Andrew, who is the exploration and country manager. Gentlemen, welcome to the show. Heye, if I could start with you, there’s going to be a lot of new listeners to my show that haven’t heard of Osino Resources before. So for those listeners, could you give perhaps a 60 to 90 second overview of why someone might consider investing in Osino Resources?

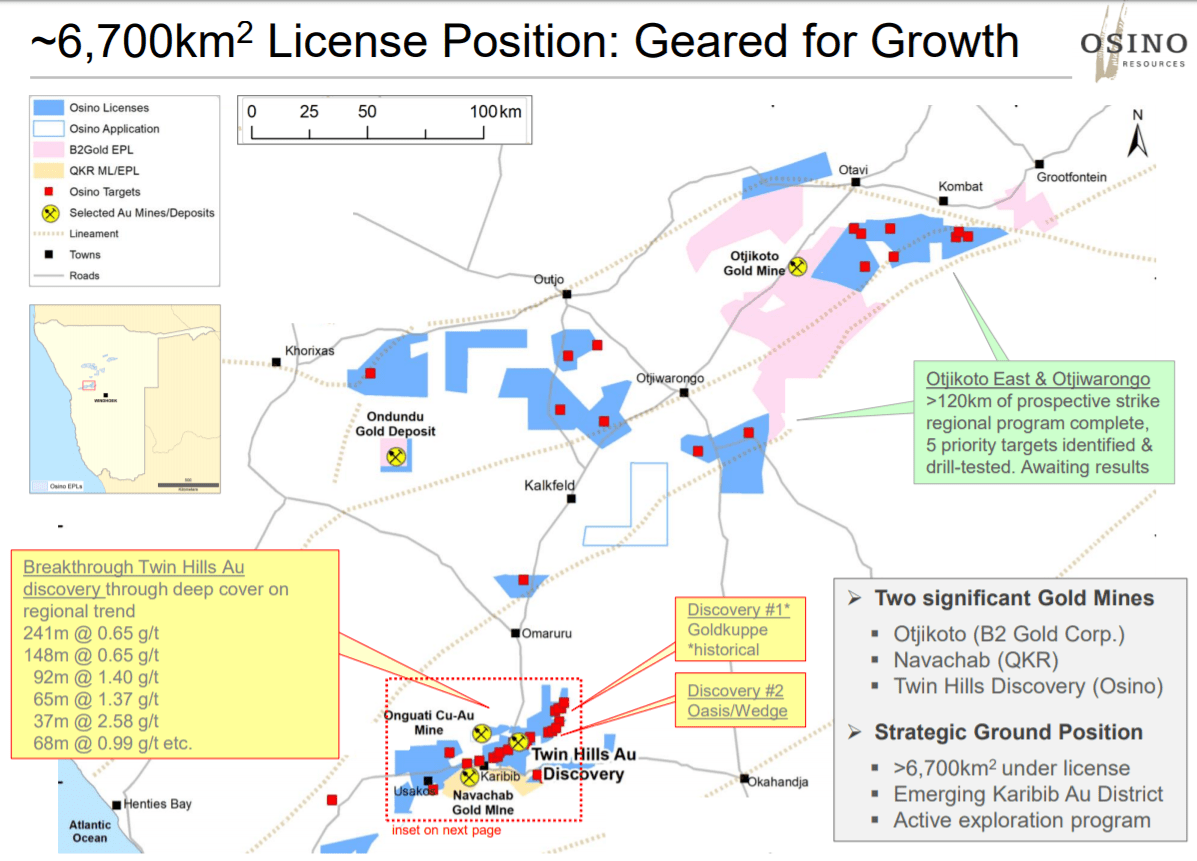

Heye Daun: Yeah, thanks Bill. It’s great to be on the show again. Thanks for having us. So Osino is a Africa-based gold exploration company with activities in Namibia. We recently made an exciting gold discovery in Namibia, which we are now in the process of advancing. I would say there are a couple of key aspects to our company. One of them is management. We of course, we know what we’re doing. We’ve had success before. We’ve delivered value before in gold and in Namibia. I’m in the middle of that myself. We are in a great country. Namibia, you’ve got to think of it like Nevada. It’s very well organized, very good place to be, very easy to operate and it seems to have an emerging gold belt, which we are busy exploring. And lastly we have a blue chip group of shareholders starting with Ross Beaty who’s our biggest shareholder, Resource Capital Funds out of Denver. And after this latest financing we did in January, we’ve got a bunch of other well known institutional investors that are standing behind us and enabling us to do what we’re doing. So that’s really what Osino’s all about.

Bill: So prior to this international virus pandemic that has seen governments give requirements for what businesses have to do if they continue operating or telling certain industries and businesses to shut down, how has Namibia, the jurisdiction you’re in, responded and how has that affected your work program?

Heye: So Namibia has responded similarly to South Africa by instituting a fairly strict lock-down about a month ago. So most companies basically locked down, like us, we’re operating from home, Jon and I. Our technical field staff is at home and we’re not active now. Mining companies in Namibia have continued to operate on a sort of skeleton basis, but the Namibian government made an announcement that there is going to be a partial lifting of the lock-down, so we’re very excited about it because it means that Osino can get going again, can start drilling again and get started becoming very active again.

Bill: So behind the scenes what have you been able to accomplish during this time of working from home?

Heye: I’m going to hand that to Jon because Jon is my exploration manager and I’m only there to raise money, set strategy and make sure that we keep going forward. But in terms of the engine room of the company, that really is Jon. He is employee number one. He is the first guy that I hired. He helped me acquire and consolidate the portfolio in Namibia and he also put the team together, put the entire Namibian infrastructure together and implemented the exploration program that resulted in this discovery that we made. And of course he’s quite preoccupied now again with getting us going and he’s driven a number of technical studies and initiatives over the last couple of weeks that kept us quite busy over the lock-down. So Jon, over to you.

Jon Andrew: Thanks Heye. Thanks Bill. Yeah, we’ve actually been able to keep fairly busy. All our geologists and professional staff, all working from home. But we instigated a few studies before the lock-down in March that have continued through this period, particularly a structural geology review of the drilling that we did last year just to look at our results, our interpretations and give us a different view on those. That is pretty much complete and we’ll be able to use that to refine our drill program when we start up again next week. So that was a very important study that we did. Also, we’ve engaged consultants to look at the drill results from last year with the view to checking all our standard operating procedures and so on. That will ultimately we hope lead to the resource estimate later in this year or early next year. That is 20,000 meters of drilling that we’re going to get going again with will help get us there.

So the consultants, the mineral resource consultants have been looking at our results and have done a check of some of our procedures and so on that we will continue with. When they are allowed to return or at least travel again, we’ll get them to go to Namibia and do a fairly typical site inspection and so on. We’ve also done some interesting work on some of our core from last year where we did some hyperspectral imaging of a few holes, which we’ve received those results now. We’ve been going through them. They’re throwing up some very interesting subtle results, some confirmation of our logging and earlier petrography work, but also some subtle variations in alteration that we think might be playing a role in some of our higher grade mineralization.

So those studies have been ongoing in this period. Then also it became fairly clear, I think maybe a week, two weeks ago, that the lock-down would be lifted and that we probably would be able to proceed with the drilling and other fieldwork. So we’ve been getting things ready, ordering the necessary supplies and PPE that will be needed to make sure we can operate with all the precautions that are needed when this partial lock-down or the lock-down is lifted and we can carry on.

Bill: Jon, I understand that over 800 meters of the plan 20,000 meter program have already been completed. So when you get those drills turning again here shortly, I believe if I recall from my conversation with Dave Underwood last time, about 60% of the holes are going to be step-out or expansion holes and about 40% are infill. Is that correct?

Jon: Yeah, that’s about right. So we managed to get some drilling done before the lock-down in March. Four holes were completed and so we’ll get back to the two diamond rigs continue. Very much the focus is on, as you say, there’s a split between expansion drilling to expand what we know at Twin Hills Central and some of the other prospects along strike and then also the more sort of routine if you like, infill drilling, closing up the drill spacing, the section spacing’s and the drill spacing along the section lines as well, down to 100 by 50 or something like that across the Twin Hills Central body itself.

Bill: With the mineral resource that you hope to have out before the end of this year, what categories do you expect those mineral resources to be in, inferred, indicated, measured?

Jon: I think realistically we probably would aim to have inferred. I’m not sure that we would have enough detail to have anything above that. We will do some fairly detailed drilling in a small area, so potentially we could get something in that area where we might go down to 50 by 50 drill spacing and perhaps we could get more than inferred, but I think realistically most of it would be inferred category.

Bill: Would you like to add something, Heye?

Heye: I just want to have to do some expectation management because I don’t think it’s going to be by the end of this year. Basically the plan that we’ve always communicated was that we will spend the rest of this year doing intensive drilling, but then typically it takes another three months or so to convert that to resource work because you’ve got to wait for results to come in, you’ve got to interpret, you’ve got to a model and so forth. So I always said that internally we targeting, it would be great if we can get something out before PDAC next year. But to some extent it also depends on the success that we get because we’re not hung up about putting out a resource. Of course ultimately exploration needs to end up or leads towards defining a resource.

But the first resource that we will put out needs to be substantial and to some extent with the drilling, by the end of this year if the key number isn’t there yet and then we will just keep on drilling because ultimately we will get there. To me terms of what is the key number, I’ve always said that it’s sort of the respectability threshold is probably between 1.5 to 2 million ounces. Will we get there by the end of this year? I don’t think so. Sometime next year, I think that chance exists, but it depends on the drilling that we’re going to do. So therefore I think a good expectation is to expect a maiden resource sometime in the first half of next year.

Bill: Thank you for clarifying that, Heye. And Jon, I understand that not only will you be expanding the Twin Hills central discovery, but you’re also doing work at various targets throughout your land package.

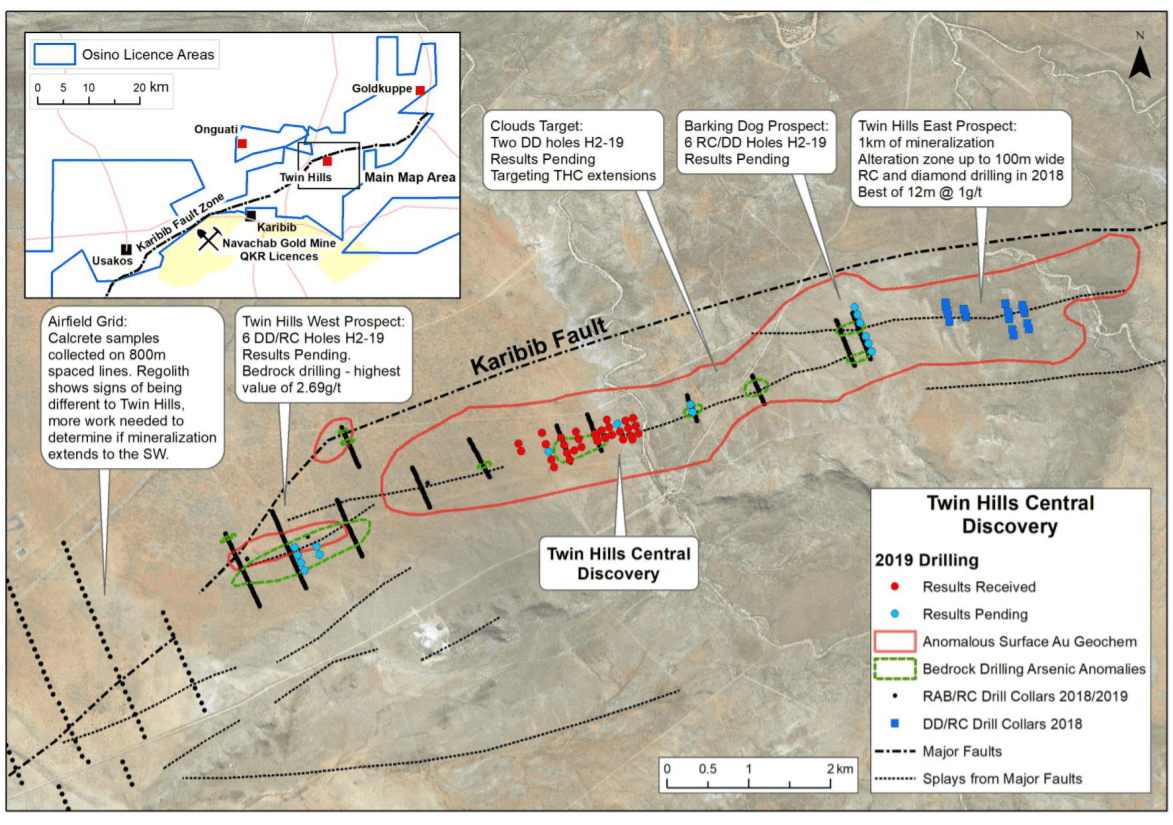

Jon: Yes, very much so. A long strike from Twin Hills Central at Twin Hills Westand Clouds and the Barking Dog prospects that we have, we’ve only put a few holes into those really. There’s a lot more work to be done. That’s partly why we started doing an IP resistivity survey in March as well is to help us refine some of the targeting along strike targets as well. As well as the drilling, there’ll be other work, more regional work going on on the rest of our land package and other projects as well. Yes.

Bill: Heye, is there anything else that you, you would like Jon to emphasize in terms of what the plan program for 2020 is?

Heye: I would just like to say we all internally are very excited. I want to reemphasize also, remember everything we’re doing is undercover. So this IP work and the structural work and some of this technical work that Jon was referring to is very important because our exploration is more difficult than it would typically be in places where you have outcrop. But in a way it’s like for us, to me at least, it feels like we’re about to unwrap some more presents and that makes me very excited.

Bill: Heye, can you talk a little bit about, for those listeners that aren’t familiar with your past success building two companies and selling those companies, share a little bit about your exit strategy when it comes to Osino. I saw a question online; Somebody wondering whether Osino might possibly spin out a project or sell the whole company. How do you maximize shareholder value by determining potentially when to sell? Could you talk a little bit about this please?

Heye: Yeah. The short answer is it will be driven by value but I will give you a longer answer too, and I mean shareholder value. So what makes us successful or what is our core competence I believe and mine and the company’s? And that is we stick to our knitting. So I think junior exploration companies generally are good at raising money, being entrepreneurial, putting packages together, doing exploration. I think Osino has been very good at all of that, but we’re also good I think at raising the risk money to take exploration to resource development. That’s what we’re doing right now. We’re not necessarily the best people at building mines. I have built mines for Anglo Gold in the past so I’m not scared of it, but I think the question of when we will exit, what you asked me about, will be driven by value.

If the market gives us appropriate value at the feasibility stage of this project, then I think that will be a good time to start looking for partners that can help build the mine, i.e., sell the company. But as that internet observer that you mentioned mentions, it could be that we sell the project only. It could be that we split the company and carry on the exploration. It’s hard to say at this stage. I think most importantly right now we need to create shareholder value so that we can continue to raise money, continue to execute our programs and I think with that, by delivering credible quality projects that will bring interest from producers and that’s why I think it’s just a logical conclusion that ultimately it’s probable that a bigger company will end up building the mine so to speak. But it’s too early to give you a definite answer on that.

Bill: When I mentioned at the beginning that my personal target for Osino, if you’re successful in a gold bull market, which I expect gold to continue to rise over the next couple of years, is higher than that equity research firm. I’m assuming we’re successful. It’s a gold bull market and one of the things you of course am aware of is you don’t want to over drill. Because I talked to a successful mining entrepreneur who had a true discovery, multi-million ounces. I talked to him years later and the project still isn’t moving forward in terms of the share price valuation. He told me flat out, he said, “Bill, we over drilled it. The market wanted us to drill, drill, drill, but it wasn’t the wisest thing to do. We spent all this money drilling and now here I have a multi-million ounce deposit, my share price is in the seller and nobody’s asking me to buy it now.” So you of course are mindful of a situation like this, right Heye?

Heye: Sure, yeah. They sometimes refer to it as the Lassonde curve or the value curve and the conventional thinking is that as you move along that value curve, once you go from resource definition where we are now to project development which often involves or which usually involves a lots of infill drilling, basically converting inferred resources to indicated resources. That’s a hard slog because you’re not adding ounces, you’re just making the ounces better. The conventional thinking is that the shareholder value or share prices don’t increase then anymore. That typically you have a period of share price stagnation until you get to production and cash flow and so forth. So the warning is that you shouldn’t get stuck in those doldrums. So yes, we are conscious of that and that’s why for now we are focused on growth, making more discoveries, making Twin Hills bigger, but also focused on certainty, i.e., making it better, improving the quality, making it more certain, reducing the geological uncertainty and basically bringing the answers to book, meaning declaring a real resource on it sometime next year.

I think that is still a key milestone for us, but then there after it’s in the stars. There’s one example, sorry to digress briefly. There’s a very good example for us in Australia. It’s a company called Gold Road. What they did is same like us. They explored through cover and they made a discovery. It very quickly grew to about three and a half million ounces. They then, not JV-ed, but they sold half of it to Goldfields and Goldfields ended up supplying the capital and building the mine, but Gold Road stayed in for 50% of the project. They are now a one and a half billion dollar company, so that’s another model that’s sort of a halfway house. So there are various ways and means how you can achieve an exit, but I think it’s always going to involve M&A in some shape or form.

Bill: Heye, you mentioned in our last interview that during your last financing there were some significant investors and institutions that came into the company. Is there anything more you’d like to share about that at this time?

Heye: Yes. The last financing wasn’t a private placement. It was a more advanced form of financing, similar to a board deal. What that meant is that the stock was immediately free-trading, which is positive for us. So there’s no four-month-hold hang up, which Canadians know that the Americans know about less. I explained that because financial institutions, bigger investors, they don’t like when the stock is held up. So the fact that it was free-trading enabled us to bring those institutions in and they really are the who’s who of the sort of mining investment universe in Europe and in Canada and some of the US. RCF, our cornerstone investor together with Ross Beaty increased their position. So yeah, there’s some well known and very, very high quality names in Canada and the US and Europe that came into that financing.

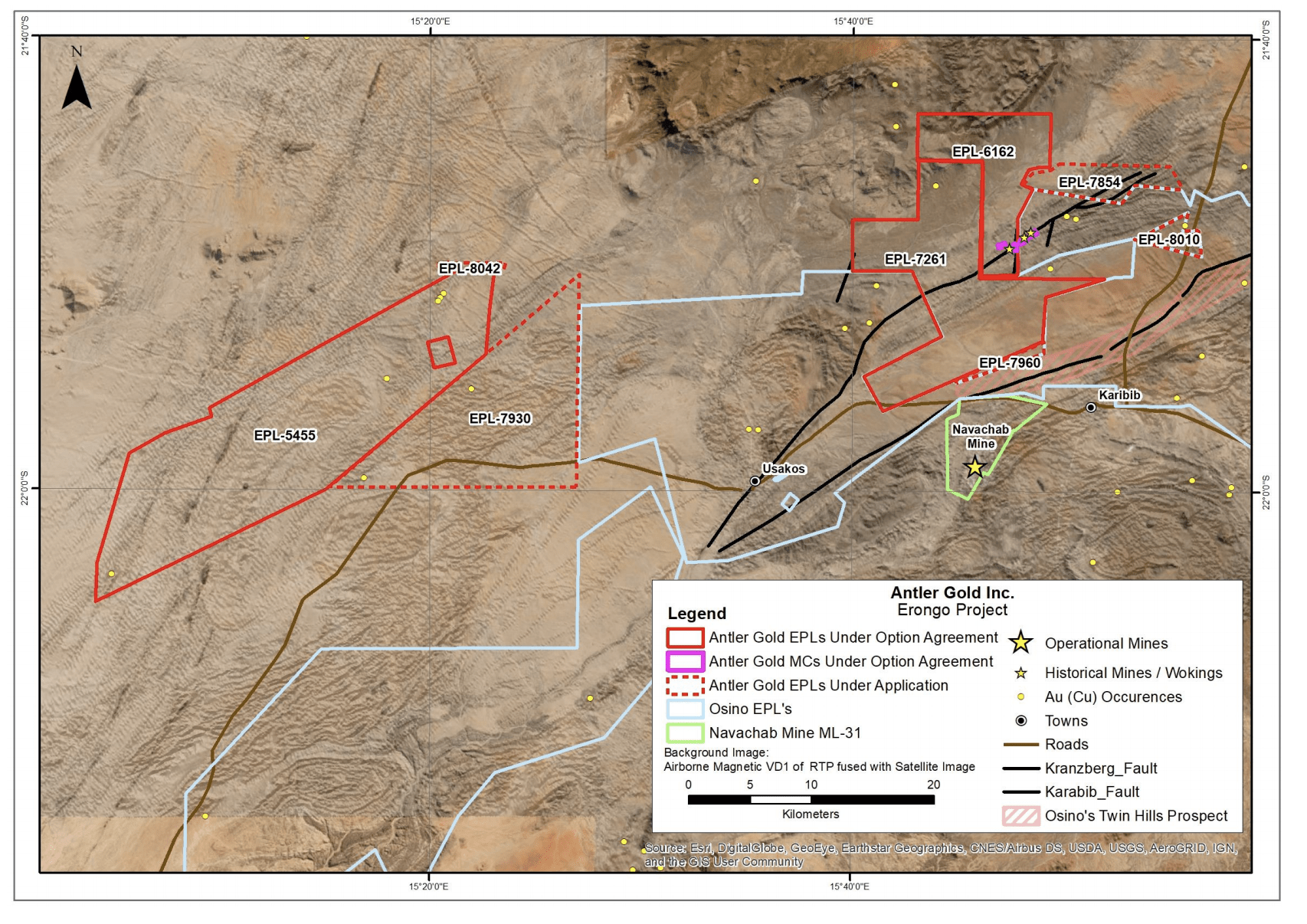

Bill: Jon, I noticed that there have been a couple of explorers that are popping up around your Twin Hills discovery and your land package there. What can you share about this and its significance and what it speaks to what you’re doing? Also, how can investors be assured that you picked up the best land in the area?

Jon: Thanks. It’s an interesting thing. I think first of all, it gives us a bit of indication and it’s nice to see that fellow explorers are recognizing what we’ve achieved. I think it’s a sign that what we started out thinking and saying, which was we believe that Namibia and the Damara part of Namibian geology was under explored for gold resources is true, is right, and our discovery at Twin Hills has shown that. I think we were fortunate. We came in at a good time when not many people were thinking like that and so we were able to pick up what we think are the best pieces of ground. It also gave us an opportunity of getting in quite early to look at a lot of things. I think we looked at a lot of different gold occurrences in Namibia, some of the larger deposits as well and we built up quite a lot of knowledge quickly.

We had some of that knowledge already from experience in Namibia before and gold experience elsewhere, particularly with Dave Underwood. But we managed to build up the Namibian-based knowledge quite quickly, starting off on some of the projects that we acquired in the early days. I think our focus coming in with a very much orogenic gold strategy, focusing on key geological structures has allowed us to focus on what we think are the best pieces of ground and not only in the Karibib area but elsewhere in Namibia as well, in the Damara. So I think it was getting in early, having an approach that maybe hadn’t been applied to Namibia gold exploration by many or any companies in the past, certainly junior explorers. I think it gave us an edge to get what we think are the best ground following the key structures. So I think it was largely that early advantage we had.

Bill: Heye, as we bring our conversation to a close, what final thoughts would you like to share with the investors listening to us?

Heye: Yeah, I just wanted to highlight what Jon said a little bit more because Jon tends to be conservative and humble, and I like him that way, but I have to say that what we’ve done there in Namibia has really been a technical coup. I say that because what Jon described there, going in with our dogma, approaching things with an open mind. So Jon and Dave did that. They excelled at that. They did that very well. At the same time, my role in that is I gave them the funding and I believed in them and I said, “You can do this.” So it took us two or three years of hard work and spending around $10 million of preparatory exploration that ultimately led to this discovery. But that discovery is real, it’s legit, it has size and it’s going to turn into a mine. So I’m very proud of them and very proud of what Jon and David have actually done there. I think increasingly our compatriots in the industry are recognizing this and that’s motivating for us.

Bill: The company again is Osino Resources. Website is OsinoResources.com. If you’re in Toronto, find it under the ticker OSI. On the Frankfurt exchange you can find it under R2R1 or in New York under the ticker OSIIF. Gentlemen, thank you very much for coming on the show and providing an update. I much appreciate it.

Heye: Thank you very much.

Jon: Thank you.